Thesis Summary

Enphase Energy, Inc. (NASDAQ:ENPH) just reported its Q3 earnings and the stock is down over 15% in the last five trading days.

The manufacturer of solar energy solutions has seen revenue stall and issued poor guidance for the next quarter due to the oversupply of their existing products.

While the company benefited from COVID demand pull-forward and very low rates, today’s environment is very different, with rates now much higher than before.

Nonetheless, ENPH is a solid and profitable company, and at some point, the shares could become a compelling buy.

$60 would be a good spot to buy from both a fundamental and technical perspective.

Company Overview

Enphase has made a name for itself in the solar energy industry thanks to its microinverter technology, which allows it to deliver end-to-end solar storage solutions. The company essentially sells microinverters and batteries.

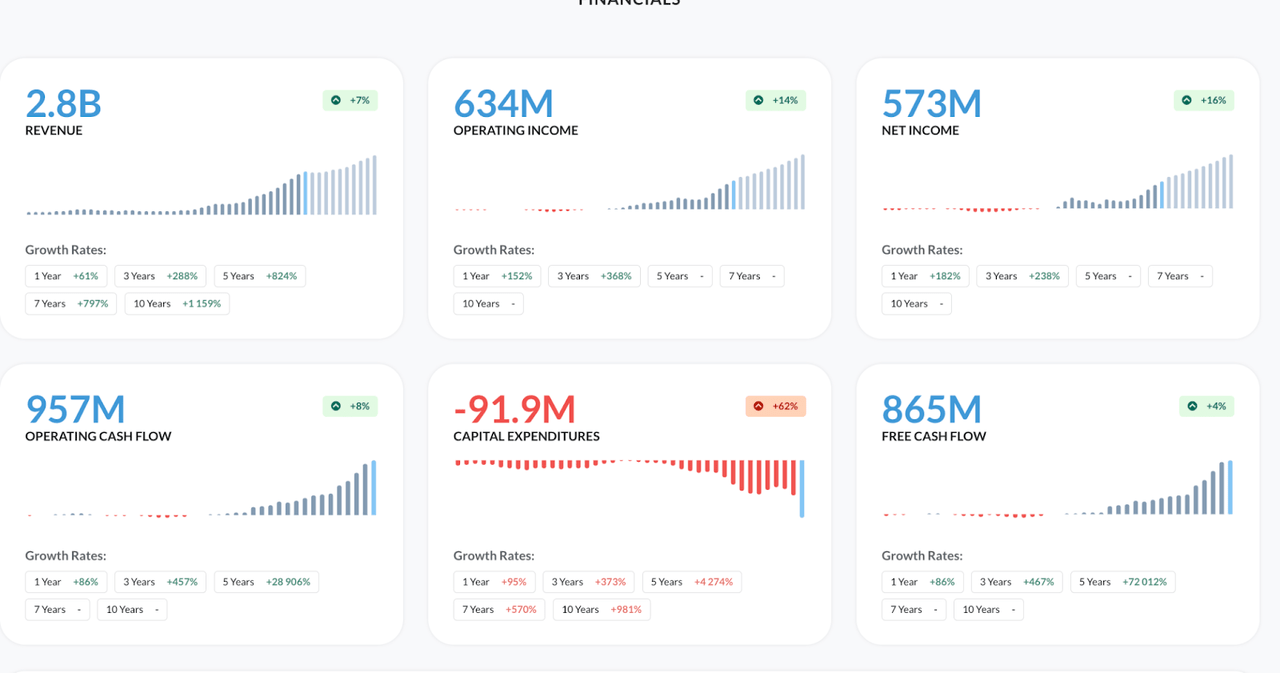

As we can see in the panels below, ENPH enjoyed strong growth during the last five years, but this has begun to slow down:

ENPH metrics (Alpha Spread)

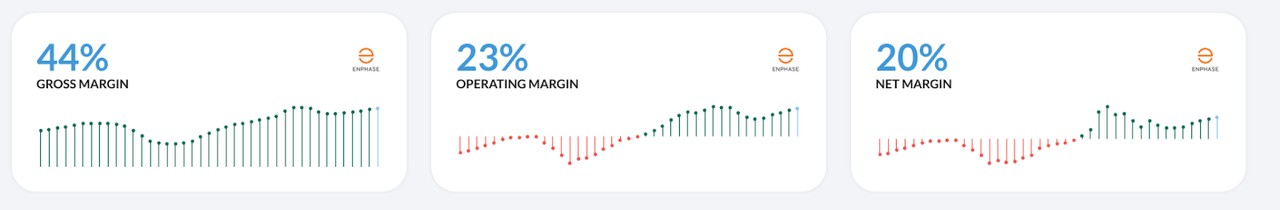

Not only did revenues increase by over 800% in five years, but operating income and margins especially really began to take off since 2019:

ENPH margins (Alpha Spread)

The company began turning a profit in 2019, and investors began to pile into these stocks as Enphase boasted both revenue growth and profitability.

The stock actually went from $7 in January 2019 to over $340 at its peak in December 2022.

But the glut for solar, brought about by the uncertainties of the Ukraine-Russia war and fueled by low interest rates, has now turned into an oversupply, and the evidence of this is now undeniable following the latest quarterly results.

Latest Results

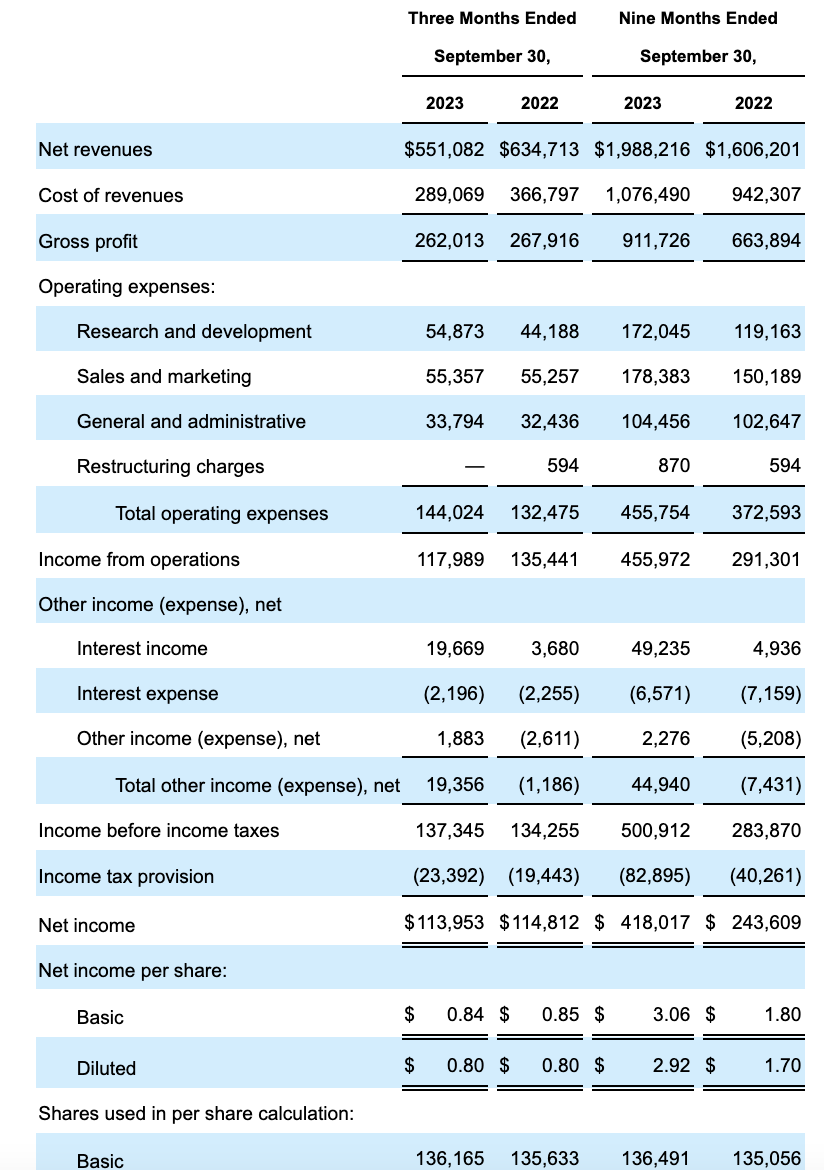

ENPH Q3 (10-Q)

To-line revenue missed estimates by $15 million and decreased 13.2% YoY. EPS came in line with expectations at precisely the same level they were a year ago.

But most striking of all was the incredibly poor guidance for the next quarter:

We are guiding revenue for Q4 in the range of $300 to $350 million. This reflects approximately $150 million of channel inventory correction in the U.S. and Europe. In other words, we are undershipping to the end market demand for our products by approximately $150 million. We anticipate under shipment will continue in Q1 and expect our channel inventory to normalize in Q2.

Source: Earnings Call.

This means revenues are projected to come down by $200 million the following quarter. This dynamic should normalize in Q2, but I don’t see solid evidence of this.

Future outlook

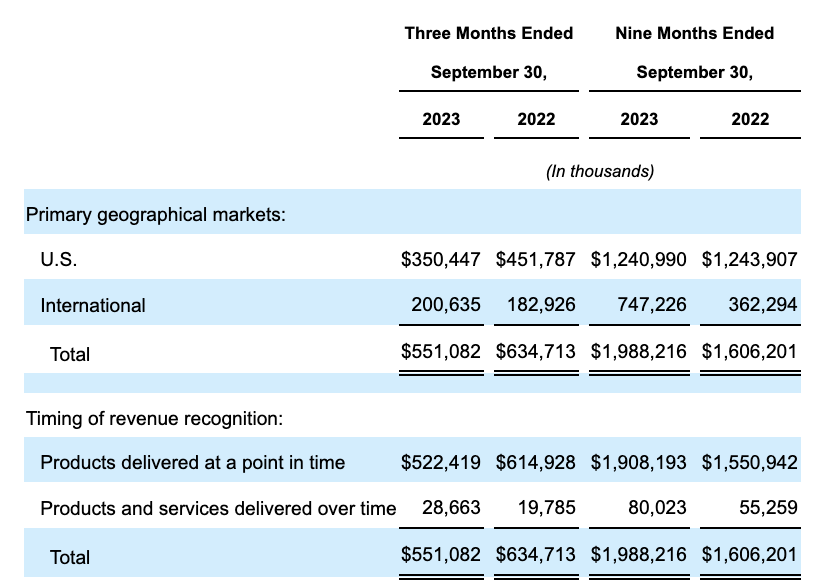

Enphase has two main markets, the US and International, which are mostly Europe.

ENPH geographies (10-Q)

In order to analyze the future outlook of Enphase, it is best to do so through the lens of how each of these geographies is set to perform in the future.

In terms of the US market, sales were down 25% sequentially in California, which the company attributed to the switch from to NEM 3.0, a new system by which solar customers will be remunerated for their excess energy.

Over in Europe, weakness was widespread. Enphase’s top market, the Netherlands was down 40% sequentially

We saw a much weaker demand recovery from summer. We also see a lot of distributors facing an oversupply of solar equipment, particularly panels, leading to much more aggressive destocking. Despite this temporary weakness, we think that the pullback in Europe will be temporary as the fundamentals remain strong. And we are relatively underpenetrated in the U.S. We are entering lots of new geographies with our IQ8 microinverters and batteries. So we remain very bullish about Europe.”

Source: Earnings Call

Moving forward, as mentioned in the paragraph above, I believe the IQ8 family of microinverters will play a key role in determining the success of the company.

This is the IQ8P microinverter, our highest power microinverter till date, 480 watts of AC power. That can support solar panels up to 650 watts DC for Brazil, India, South Africa, Mexico, Spain, and other emerging markets.

Source: Earnings Call

Overall, it’s clear that the solar industry had gotten ahead of itself, and this sell-off was warranted. With that said, Enphase remains a profitable company with a superior product and a reasonable valuation.

Although I am not one to believe that solar is a definitive solution to our energy problems, the solar energy market is expected to grow by 12.3% in the next ten years, and Enphase is very well positioned within it.

Valuation

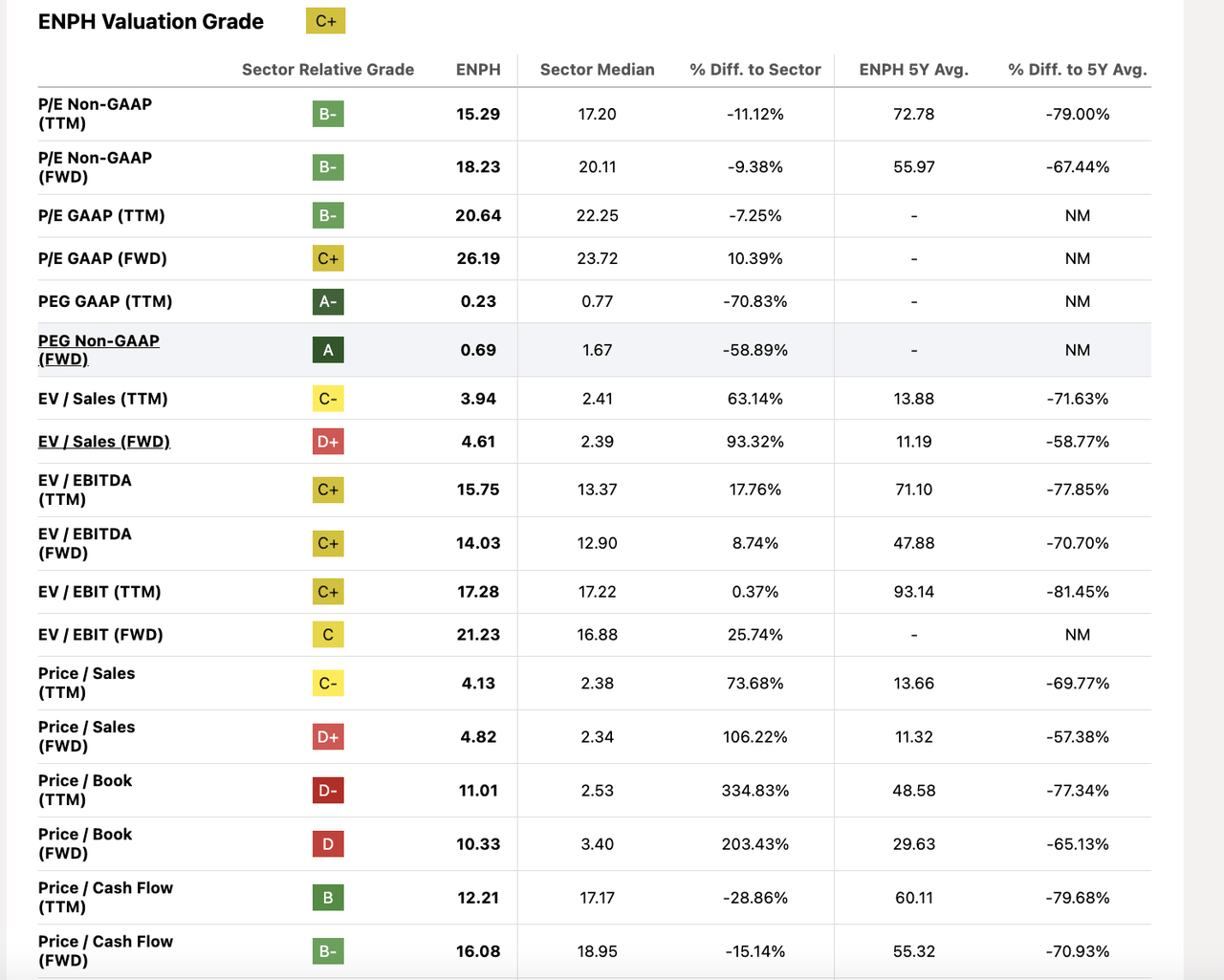

ENPH still has a pretty compelling valuation.

ENPH valuation ratios (SA)

Even adjusting for weaker future cash flows, the company trades at 18x cash flow and has a PEG of under 1.

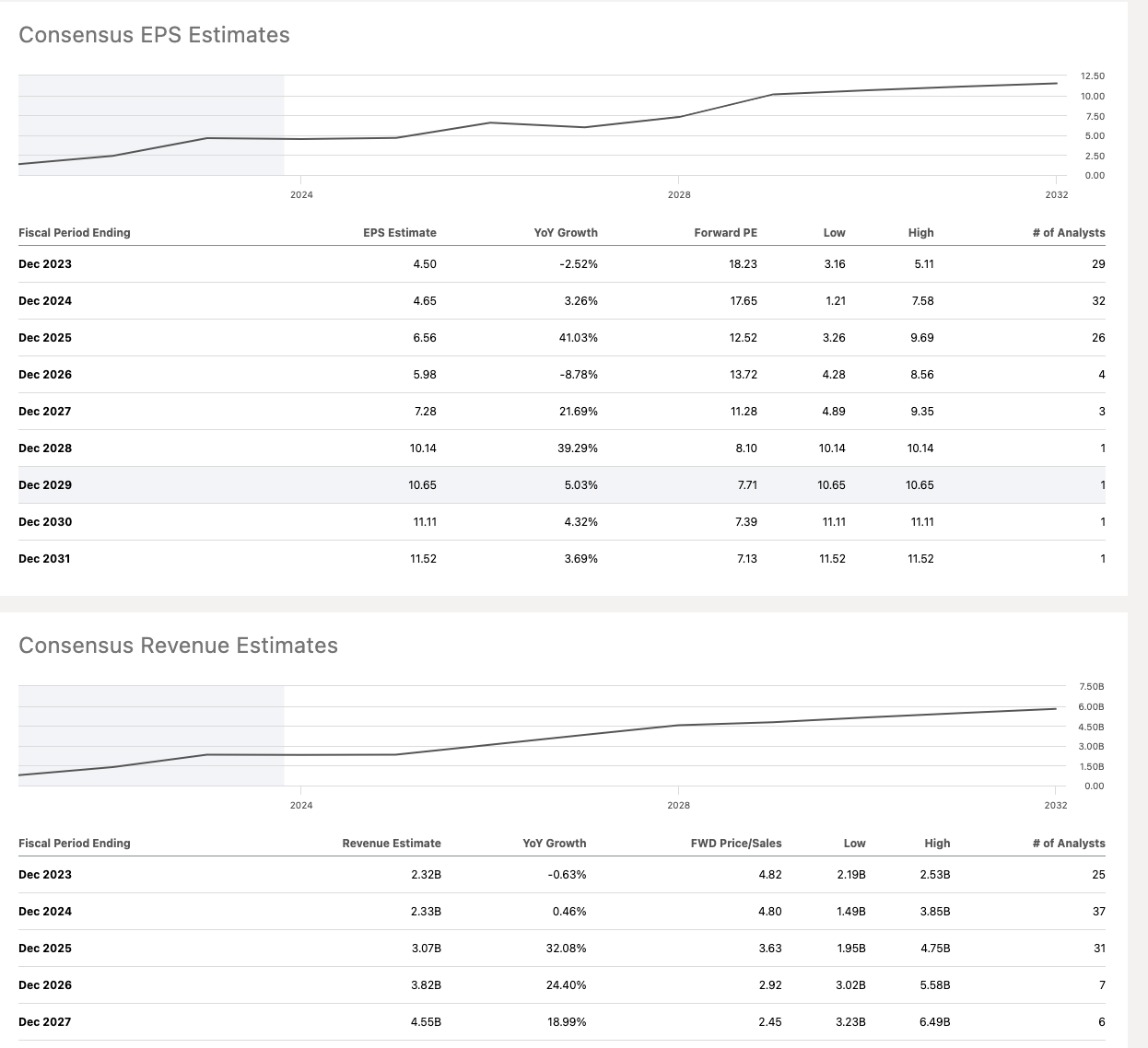

Despite the weakness in the coming year, analysts are still quite bullish on the long-term.

EPS and Revenue Estimates (SA)

EPS is expected to grow by 40% in 2024, while revenue growth is expected to return to double digits after 2024.

The way I see it, even if we take a more conservative view than these estimates, ENPH is at most, slightly overvalued.

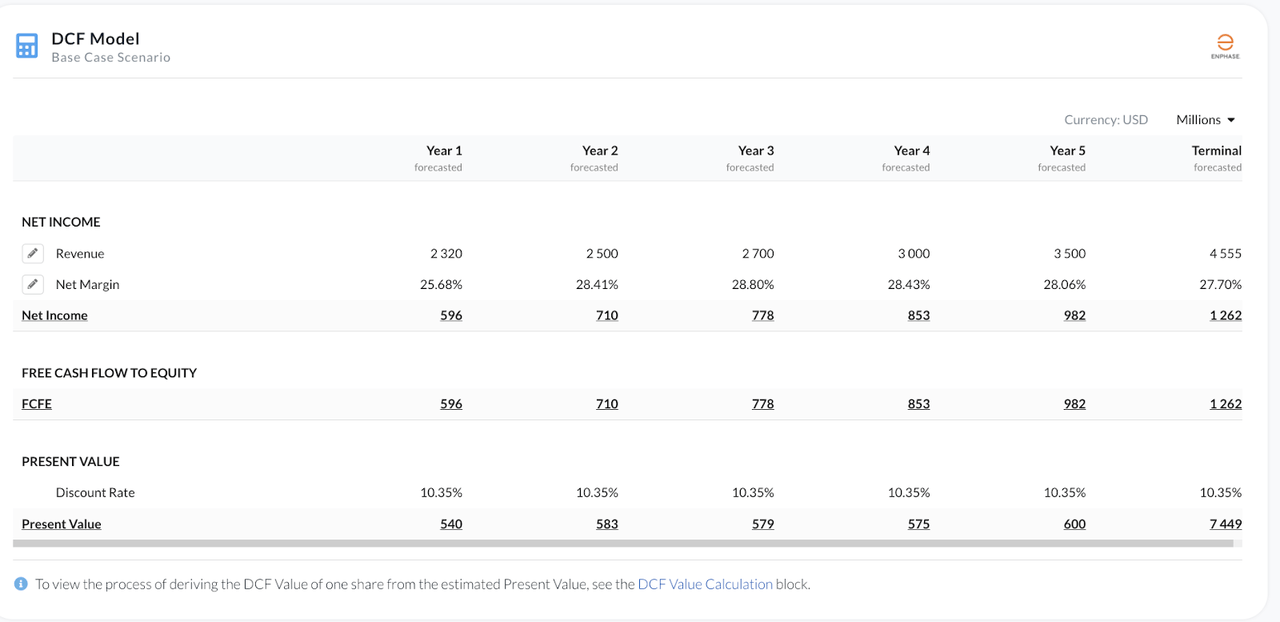

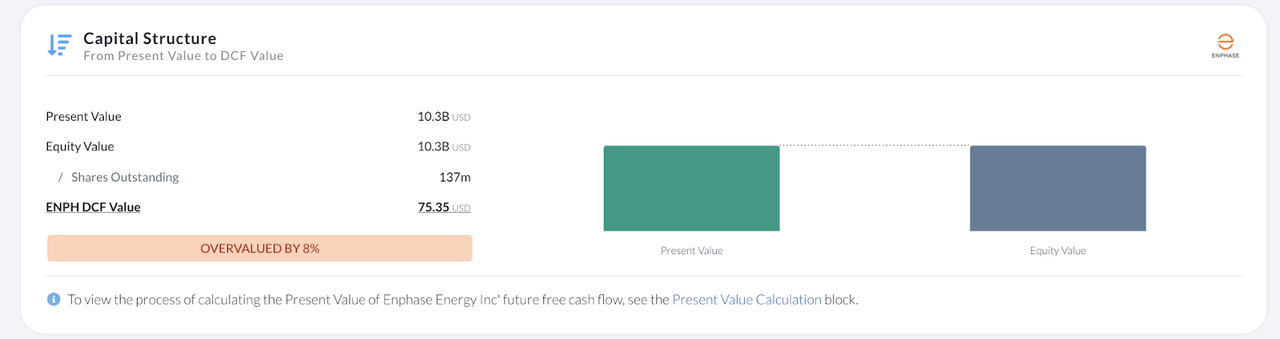

DCF model (Alpha Spread) DCF valuation (Alpha Spread)

Assuming the company can grow a CAGR of 14.4% in the next five years while maintaining a similar Net Income and applying a generous discount rate of 10.25%, my calculations tell me ENPH is 8% overvalued.

Technical Analysis

With that said, I’d be happy to buy ENPH if we could fall another 10% from here.

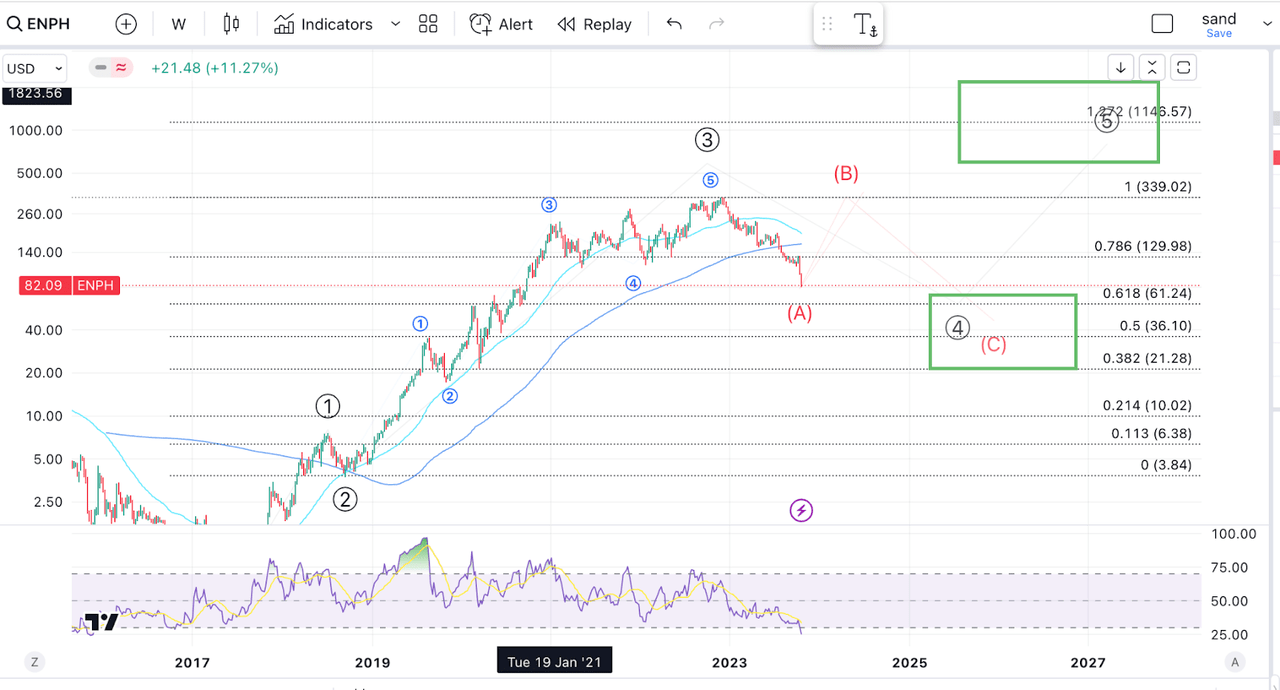

ENPH TA (Author’s work)

From a technical perspective, ENPH is now fast approaching the 38.2% retracement of what I see as wave 3. This could be a good place for a reversal and given how oversold the RSI is, it’s a nice spot to add.

Takeaway

ENPH is a high-risk, high-reward type of stock. The solar energy business is cyclical, and I would expect weakness in the coming year. However, this weakness might offer us a great chance to buy ENPH at a cheaper price. Once growth returns, and perhaps also with the help of lower interest rates, ENPH should easily outshine the market.

Read the full article here