Investment Thesis

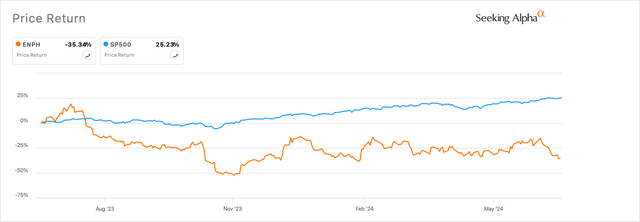

Residential solar equipment manufacturers have seen sales fall off a cliff in the past 12–15 months, marred by slowdowns in solar projects, elevated financing costs, and an uncertain macroeconomic environment that has made it difficult for companies such as Enphase (NASDAQ:ENPH) and SolarEdge Technologies (NASDAQ:SEDG).

Exhibit A: Enphase & SolarEdge trail the markets so far in 2024. (SA)

SolarEdge is a completely different story with a few major risks, such as its liquidity profile and margins that are inherently tied to the company. On the other hand, Enphase has a cleaner approach to profitably growing and returning shareholder capital to investors. At the same time, Enphase’s intrinsic inventory levels as well as channel inventory levels show some promise that continues to shape my optimistic view of the company.

Based on my analysis of Enphase’s performance so far and my forecasts and outlook for the industry, I recommend a Buy on Enphase’s shares.

Quick recap of Enphase’s business model

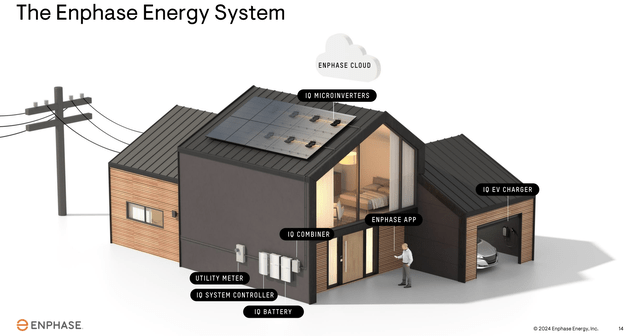

Enphase manufactures solar energy generation and storage equipment for the residential housing sector. The Fremont, CA-based company designs, develops, and manufactures components for residential solar-energy powered solutions. Enphase is currently shipping IQ8™ versions of microinverters (used in solar panels), the 5P versions of their IQ batteries, EV chargers, Solar Kits as well as apps and software solutions to manage the end-end process of installing, generating, and managing aspects of solar energy, as shown in Exhibit B below.

Exhibit B: Enphase’s products in a residential house setting (Investor Presentation)

While most research notes will cover the usual product notes and peer comparisons, I believe the most important factor in understanding Enphase lies in how it operates its business.

The company mostly operates in a distributor model, where Enphase ships products to its distributors, who in turn ship products to solar installers, who eventually end up installing Enphase’s products at residential home locations.

Hence, in addition to tracking the usual energy capacity, utilization, and profitability metrics, I believe, tracking the company’s inventory levels and revenue growth will help in the visibility of the outlook and growth prospects of the company.

#1: Inventory levels improve amid stabilizing market volatility

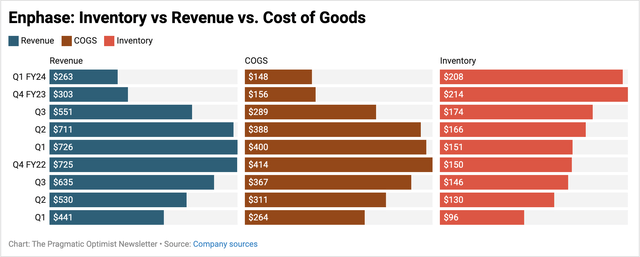

As Enphase wraps up the last month of its Q2 FY24 quarter, it will be lapping a torrid trail of four quarters of revenue decline after demand plunged since Q3 of last year, as indicated in Exhibit C below.

Exhibit B: Enphase Revenue trends versus the cost of goods sold and inventory build up (Company sources)

The convergence of several headwinds at the time contributed to killing the demand momentum that the company had started to see at the onset of CY23. The launch of California’s updated version of solar energy metering tariffs, NEM 3.0, increased the payback period for solar energy customers in California, as pointed out by energy research firm Wood MacKenzie. At the same time, the U.S. Feds made their final 25 b.p. hike of 2023, while Enphase’s European region saw strong slowdowns as well after lapping a strong 2022. The culmination of these factors led to severe demand drops, leading to higher levels of factory inventory and channel inventory levels of Enphase’s product.

In my opinion, the first task for management will be to drive down inventory levels in their factory as well as in their distribution channels, which management appears to be focused on at the moment. On previous earnings calls, I noted that management has strived to improve the sell-through and sell-in metrics of their product while also undershipping at the same time. From the previous two earnings calls, I see that management has improved inventory levels in their distribution channels by ~$130 million per quarter, on average. At the same time, their factory levels also marked their first drop on a sequential basis, as noted in Exhibit B above.

Management is also working on new initiatives to onboard as many distributors and installers on their Solargraf observability & proposal tool, which should give more insight on inventory movement through the distributor and installer channels. Plus, management has also changed processes at their factories in China, allowing them to easily scale up or scale down manufacturing and production to better align capacity with their end demand levels.

With the company lapping a year of demand distortion from NEM 3.0 policies, interest rate hikes, and cyclical sales in Europe, I expect demand for Enphase’s product to normalize in the back half of the year. I am also encouraged by management’s focus to bring inventory turnover levels back to the 2-3x range from the <1x where they sit today.

#2: Strong management focusing on profitable growth

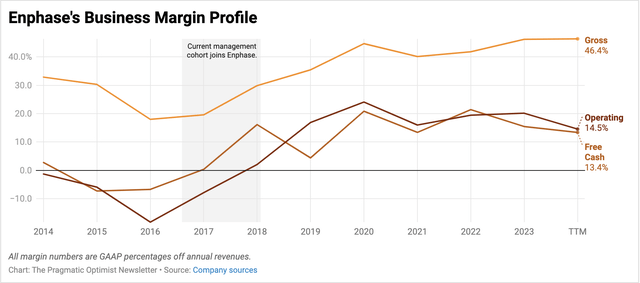

In my view, the current cohort of management executives is best-in-class with industry experience, a solid fundamental understanding of Enphase’s business model, and a keen focus to continually increase operating leverage and deliver shareholder value. As can be seen in Exhibit C below, since the current cohort of management executives joined Enphase in 2017–2018, the company has delivered robust operating leverage.

Exhibit C: Enphase margins have been improving on a secular-cycle basis since management joined in 2017-2018 period (Company sources)

Despite the broader market seeing some declines in the past 3–4 quarters, management has been able to keep COGS under control, as seen by the stable gross margins in a volatile market, as noted in Exhibit C above.

In the Q1 FY24 earnings call, management revealed that they continue to expect GAAP gross margins to be in the 42–45% range in the upcoming Q2. This points to strong execution, in my opinion, setting the company up for success in the back half of the year.

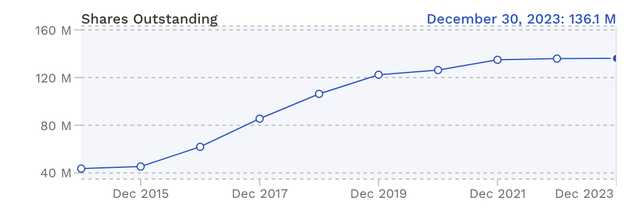

Management also demonstrated tighter share dilution rates in the last few years, as noted in Exhibit D below, while maintaining a favorable capital structure. The company holds ~$1.32 billion in debt with about $253 million in cash and ~1.4 billion in short-term investments.

Exhibit D: Enphase’s share dilution rates are under 1% since 2021. (Company sources via finbox)

#3: Significant upside from current levels

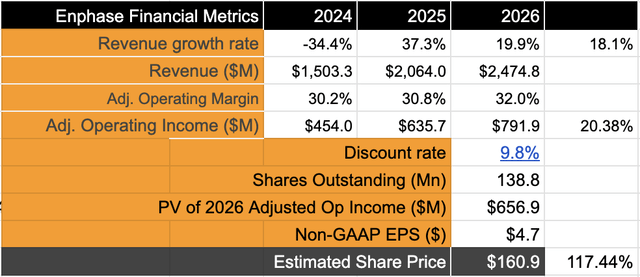

Management is guiding Q2 revenues to ~$310 million. The company will be lapping the severe declines in demand last year seen by the demand dilution due to NEM 3.0 and softness in European regions. Management also expects H2 FY24 to be stronger than last year, an assessment with which I agree given the easier comps in the prior year. Assuming the demand environment stabilizes, I expect the company to grow ~18% CAGR.

On the other hand, I expect adjusted EBITDA to be growing at a much faster rate, relative to revenue, given their focus on profitability. I believe operational efficiencies demonstrated by management as well as a much cleaner-looking inventory portfolio over time will help scale their margins, supported by strong high-teen revenue growth.

My model also assumes a fairly low share dilution rate, under 1%, while the discount rate will be ~9.85 based on assumptions.

Exhibit E: Enphase’s valuation (Author)

Based on my model, I believe the company should be valued at 34x forward earnings since I expect Enphase to grow earnings at ~20% CAGR, faster than the S&P 500.

If not for certain risks that must be understood, I would have recommended a Strong Buy for Enphase. However, for now, I will rate this as a Buy.

Risks & other factors to consider

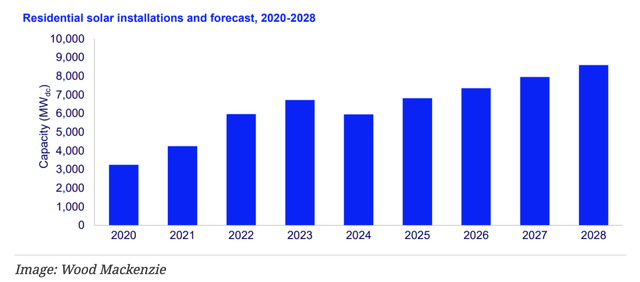

It is possible that the demand environment may not reverse higher as per my expectations, and it may take longer for the company to lap the demand dilution it witnessed last year. I have stated earlier that management as well expects demand to stabilize, citing movement in their inventory levels among their distribution channels. Long-term trends still hold intact, according to energy research firm Wood Mackenzie, as seen below in Exhibit F.

Exhibit F: Residential solar installations forecast (Wood Mackenzie)

In addition to Wood MacKenzie, research by S&P Global also indicates long-term trends remaining stable from the perspective of projected residential solar installations and manufacturing capacity. Therefore, I am optimistic about my outlook for Enphase for the back half of the year while still being cognizant of demand risks.

The other risk to consider is a surprise uptick in interest rates. The residential solar energy industry is sensitive to elevated interest rate levels since most solar projects are financed using debt. Currently, expectations are for one rate cut this year, but if interest rates were suddenly raised, it could severely dent the prospects of Enphase and its network of distributors and installers. With inflation rates easing, especially after the latest May PCE Report, I believe the probability of further rate hikes for this year are close to zero and Enphase should benefit from that rates outlook.

Takeaway

Enphase is currently set up for success as we move into the second half of this year, in my view. I do expect some level of volatility, but with management confident of the demand environment stabilizing after a rough two quarters last year and the continued efficiency being demonstrated in the company’s business & inventory levels, I believe Enphase is well-poised for greater returns.

I recommend a Buy on Enphase.

Read the full article here