The Eaton Vance Floating-Rate Income Trust (NYSE:EFT) is a closed-end fund (“CEF”) that can be employed by income-focused investors to help them achieve their goals. The fund’s current 11.15% yield stands as a testament to this, as this yield is substantially higher than that provided by many junk bond funds or indeed most other funds that invest in fixed-income securities. This comes from the fact that short-term interest rates are substantially higher than long-term interest rates right now. The yield curve has been inverted since July 2022, which is due to investors expecting that interest rates will be lower in the future than they are right now. The Federal Reserve has suggested as much, although it is guiding for higher interest rates than the market currently expects. This still creates an interesting opportunity right now for investors who are willing to focus on the short end of the yield curve as these investors can obtain a much higher yield with less risk than investors who are buying long bonds. That could be a selling point for this fund.

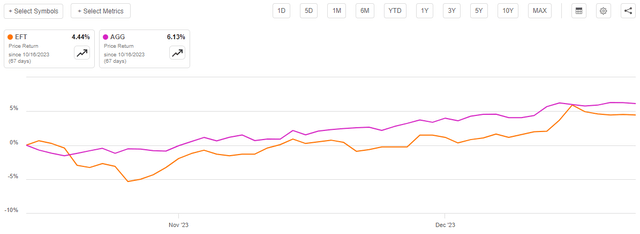

As regular readers can no doubt remember, we last discussed the Eaton Vance Floating-Rate Income Trust in the middle of October. The fund’s share price performance since that time has admittedly not been particularly impressive. The fund’s shares have appreciated by 4.44% compared to a 6.13% increase in the Bloomberg U.S. Aggregate Bond Index (AGG):

Seeking Alpha

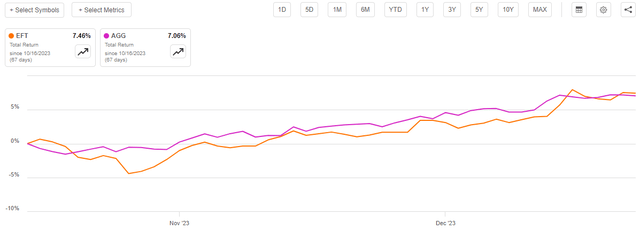

This is certainly a bit disappointing, but it does not tell the whole story. After all, as I pointed out in my previous article on this fund, floating-rate securities tend to be fairly stable in the market and deliver essentially all of their returns in the form of direct payments to the shareholders. In contrast, fixed-rate bond prices move inversely to interest rates despite the fact that they deliver no net capital gains when held to maturity. As such, we should consider the distributions paid out by both the Eaton Vance Floating-Rate Income Trust and the Bloomberg U.S. Aggregate Bond Index in any performance comparison. When we do that, we see that the fund beat the index since the date that my prior article was published:

Seeking Alpha

There is no guarantee that the fund will continue to outperform going forward as it depends somewhat on interest rate movements. However, as I have pointed out in a few recent articles, there could be some reasons to believe that fixed-rate bond prices are too high right now and could be poised for a correction. The Eaton Vance Floating-Rate Income Trust should prove to be quite resistant to such a correction and as such it could deserve a place in your portfolio as a hedge against any volatility in the bond market. This is something that risk-averse investors, such as retirees who need to preserve their principal, might appreciate.

About The Fund

According to the fund’s website, the Eaton Vance Floating-Rate Income Trust has the primary objective of providing its investors with a very high level of current income. This is not especially surprising considering that the fund invests primarily in floating-rate debt securities. As the fund’s fact sheet explains:

[The fund] Provides broad exposure to the floating-rate loan market, providing diversified exposure to the asset class. Provides exposure to the loan market’s many sectors, credit tiers, and issuers.

One of the defining characteristics of floating-rate loans is that they tend to be remarkably stable in price regardless of movements in interest rates. We can see this quite simply by looking at the performance of the BBG US Floating Rate Notes 5 Yrs. And Less Index, tracked by iShares Floating Rate Bond ETF (FLOT). Here is the ten-year price chart of the index:

Seeking Alpha

As we can see, the floating rate note index has been almost perfectly flat over the trailing ten-year period. This is in spite of the fact that there were some changes in interest rates during the period. In particular, the Federal Reserve tried to raise the federal funds rate in 2018 and again in 2022. These were naturally both attempts to cool off an overheating economy. In the latter case, there was also a substantial amount of inflation due to all the newly printed pandemic-era cash sloshing through the economy. The Federal Reserve also cut interest rates severely in 2020 in an effort to support the economy through the COVID-19 lockdowns that put many people into unemployment and shut down the majority of small businesses in the United States. None of these interest rate changes had any effect on the price of floating-rate debt securities, as we can clearly see from the fact that the price chart of the asset class is almost perfectly flat over the period. In fact, we can clearly see that the only event over the period that had any significant impact on the price of these securities was the outbreak of the COVID-19 pandemic which prompted investors to simply dump everything and move to cash. That was a very short-lived event though and the price quickly recovered.

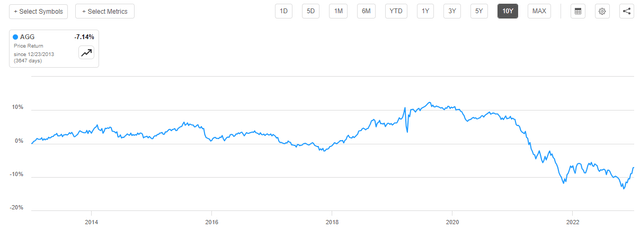

This is a very different performance than ordinary fixed-rate bonds. Here is the performance chart for fixed-rate bonds, as measured by the Bloomberg U.S. Aggregate Bond Index, over the same ten-year period:

Seeking Alpha

We can obviously see significantly more volatility here. This comes from the fact that these securities move inversely to interest rates. After all, when interest rates move up, brand-new bonds will have a higher yield than existing bonds based on their face values. Thus, nobody will buy an existing bond over a brand-new one with identical characteristics in such an environment because the existing bond has a lower yield but is otherwise the same. The price of the existing bond therefore needs to decline in order to offer a competitive yield in the environment. The reverse is true when interest rates are declining, as investors bid up the price of existing bonds with high coupon bonds until they are competitive with the lower yield available on brand-new bonds.

This dynamic does not occur with floating-rate securities, however. This is because the coupon adjusts so that they always deliver a competitive yield with new similar securities. As such, their price does not need to change in order to deliver an acceptable yield in any interest-rate environment.

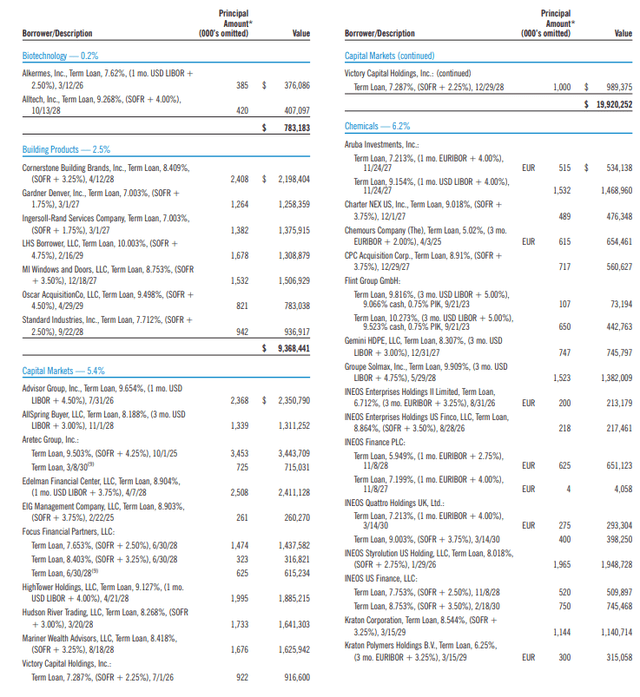

Unlike many bonds, the yield on floating-rate securities is typically a function of short-term interest rates as opposed to long-term interest rates. It is typically expressed as a spread over some benchmark, such as LIBOR or SOFR. For example, here is page 21 from the fund’s most recent annual report that shows some of the securities that are currently held by the fund:

Fund Annual Report

As we can see, the yield of the debt securities typically is based on SOFR, LIBOR, EURIBOR, or something similar. It adjusts on a regular basis, typically right around the coupon payment date. This is why the fact that the inverted yield curve is so important right now. Over the past two months or so, long-term interest rates have gone down as investors have begun to price in the expectation that the Federal Reserve will slash interest rates next year. However, this has had no impact on short-term rates as the short-term rate is typically based on the federal funds rate or its equivalent in other nations. These rates have not gone down along with long-term rates. This chart shows the Secured Overnight Financing Rate over the past year:

Federal Reserve Bank of St. Louis

As the coupon rate paid by the securities in the fund’s portfolio is based on short-term rates, we basically have a situation where the securities that are held by this fund have a much higher yield than most ordinary bonds. This is one of the factors that allows the Eaton Vance Floating-Rate Income Trust to boast a higher yield than even junk bond closed-end funds right now. Income-focused investors might appreciate this higher yield, especially when combined with the fact that the price of these securities is relatively unaffected by interest rates.

The downside to this price stability is that most of the securities that are held by this fund do not appreciate when interest rates decline. The Federal Reserve recently guided for three 25-basis point cuts in the federal funds rate in 2024. We can see this in the fact that the median estimate of the year-end exit rate by the members of the Federal Open Market Committee is 4.6%:

Federal Reserve Bank of St. Louis

That suggests a total of 75 basis points of cuts over the next twelve months. This is the reason why the stock and bond markets have both been rallying since the middle of October. However, the market may have overshot. As of right now, the market has priced 150 basis points of cuts into securities prices.

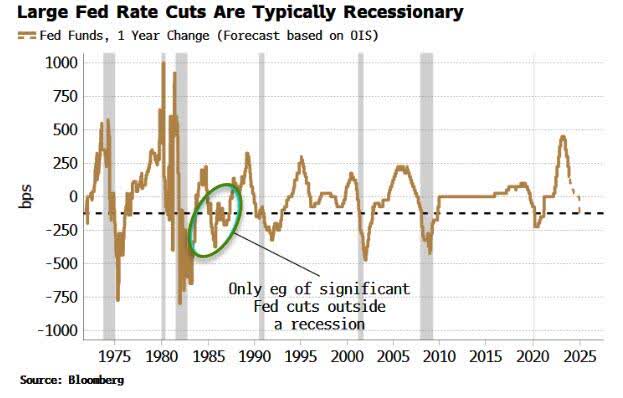

It is very unlikely that the Federal Reserve will cut the federal funds rate by 150 basis points next year. According to Simon White, Bloomberg’s macro strategist, there has only been one time in history when the Federal Reserve has cut interest rates to that degree outside of a recession:

Zero Hedge/Data from Bloomberg

Thus, if there actually is a “soft landing” in 2024, then fixed-rate bonds are substantially overpriced today. If the economy goes into the recession as needed to justify the market’s rate cut projections, then stocks are also almost certainly overpriced. In other words, if the economy avoids a recession, then bonds will probably correct when the Federal Reserve cuts rates by less than is currently priced in. If the economy does enter into a recession in 2024, providing a justification for the market’s rate cut expectations, then stocks will almost certainly decline.

It may be a good idea to include a fund like the Eaton Vance Floating-Rate Income Trust in your portfolio considering the risks surrounding the rate cut and soft-landing narrative on both sides. The securities that are held by this fund should hold their value pretty well regardless of what actually happens in 2024. The shares of the fund might admittedly still get sold off in a correction, but they should regain their value fairly quickly as investors see the enormous discount that would result from such a sell-off and try to take advantage of the situation. The fact that the market tends to close outsized discounts on net asset value in the closed-end fund space is the basic thesis behind some of Saba Capital’s funds, such as the Saba Closed-End Funds ETF (CEFS). Thus, the Eaton Vance Floating-Rate Income Trust should overall provide investors with a degree of principal protection in what could be an uncertain market in 2024.

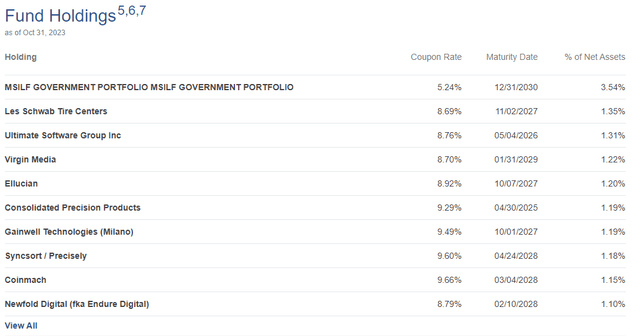

In addition to the fact that most of the fund’s securities should not see price changes in the face of interest rate movements or other market volatility, the fund also achieves a certain level of safety by maintaining a very diverse portfolio. As we can see here, there is no single position that accounts for an outsized proportion of the fund:

Eaton Vance

The MSILF Government Portfolio is a government money market fund, so it does not really count as an outsized position due to the fact that the risk of loss is incredibly low. Other than that one position, the largest position is a debt issue from Les Schwab Tire Centers, and that position only accounts for 1.35% of the portfolio. This is not a large enough position to have a noticeable impact on the fund. In short, even in the event of a default, there is nothing in the portfolio that accounts for enough of its assets for any of the fund’s shareholders to even notice. The current yield of all of these securities is more than sufficient to quickly erase even a total loss from any individual issuer.

For the most part, our overall thesis about this fund being a safe haven to ride through any potential volatility over the next year appears to hold true. The only real downside to this fund is that its income will decline if the Federal Reserve cuts rates. That is certainly a possibility over the next twelve months, and the central bank itself has stated that it probably will reduce the federal funds rate. As such, we certainly do not want this fund to be our sole source of income. It does deserve a place in your portfolio, though, as its ability to act as a hedge should prove valuable.

Leverage

As is the case with most closed-end funds, the Eaton Vance Floating-Rate Income Trust employs leverage as a method of boosting the effective yield of its portfolio beyond that of any of the underlying assets in the fund. I explained how this works in my previous article on this fund:

In short, the fund borrows money and then uses that borrowed money to purchase floating-rate debt securities. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, so this will usually be the case. Unfortunately, this strategy is not as effective at boosting yields today as it once was. This is because the difference between the yield of the purchased securities and the interest rate of the borrowed money is a lot less than it was back when interest rates were at 0%.

The use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund does not employ too much leverage since this would expose us to an excessive amount of risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the Eaton Vance Floating-Rate Income Trust has leveraged assets comprising 36.21% of its assets. This is quite a bit higher than the 34.09% leverage that the fund had the last time that we discussed it, which makes this one of the only funds that we have discussed in recent weeks that increased its leverage over the past few months. This increase in the fund’s leverage came despite the fact that its net asset value is up 1.14% since the last time that we discussed the fund:

Seeking Alpha

This is the exact opposite of what we would expect. Typically, an increase in the net asset value reduces a fund’s leverage. This is because the fund will normally keep its leverage stable, so it ends up being a smaller percentage of the portfolio as the size of the fund’s portfolio increases. The fact that this fund’s leverage went up despite the increase in net asset value suggests that the fund actually increased its outstanding borrowings over the period.

In this case, the increase in borrowings is probably not a big deal. As I pointed out numerous times throughout this article, floating-rate securities do not typically exhibit any significant amount of volatility. It is volatility that causes problems for a leveraged fund because it may force the fund to sell its assets following a market crash. It is exactly the same thing as borrowing on the margin in an ordinary brokerage account. The fact that this fund is not holding volatile securities suggests that it can carry more leverage than most other funds. As such, the balance between the risk and the reward is probably still reasonable here, but we do want to keep an eye on the fund to ensure that it does not increase its leverage further.

Distribution Analysis

As mentioned earlier in this article, the Eaton Vance Floating-Rate Income Trust has the primary objective of providing its investors with a very high level of current income. The fund accomplishes this goal by investing primarily in a portfolio of floating-rate debt securities and similar income-producing assets. As we saw earlier, many of these assets pay a coupon rate that is a few hundred basis points higher than LIBOR or SOFR. In today’s environment, these benchmark rates are higher than they have been for more than twenty years so we can expect that this situation would result in the fund receiving a very high yield from the assets in its portfolio. The fund even employs a layer of leverage to allow it to collect payments from more securities than it could ordinarily afford to purchase, which has the effect of boosting the effective yield that it receives based on the value of its net assets. The fund pools all of these payments together and then pays the money out to its shareholders, net of its own expenses. We can probably expect that this would result in the fund boasting a very high current yield.

This is certainly the case. The Eaton Vance Floating-Rate Income Trust currently pays a monthly distribution of $0.1180 per share, which gives the fund a distribution yield of 11.15% at the current price. The fund also recently declared a special distribution of $0.0396 per share, which will be paid in January. This special distribution is naturally a one-time thing, but it does reflect positively on the fund’s performance over the past year. The fund’s yield is higher than many fixed-income funds right now, although other floating-rate debt funds have yields in the same ballpark.

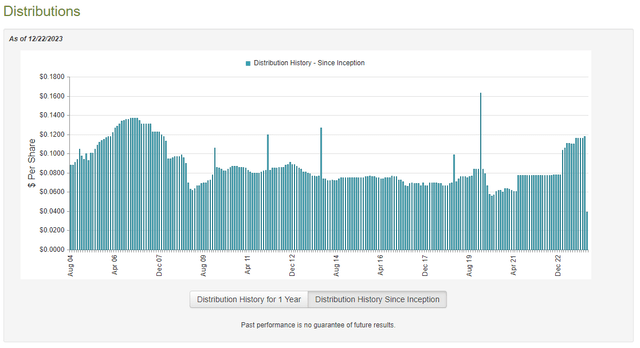

It seems likely that the fund’s current yield will be appealing to any investor who is seeking to earn a high level of income from the assets in their portfolios to assist in covering bills or other lifestyle expenses. Unfortunately, the fund has not been especially consistent with respect to its distribution over the years. As we can see here, the fund has both raised and lowered its distribution numerous times over its lifetime:

CEF Connect

This variable distribution could prove to be a turn-off for any investor who is seeking to earn a safe and consistent level of income from the assets in their portfolios. However, it is not especially surprising considering the assets that are held by this fund. Floating-rate securities are very stable in price, so nearly all of their total returns are directly dependent on interest rates. As such, the fund’s income will go up when interest rates rise and down when interest rates fall. It only makes sense that the fund will need to adjust its distributions to correspond with its income in order to avoid underpaying the shareholders or destroying its net asset value.

We should still have a look at the fund’s finances, though. After all, despite the variable distribution, there is always a risk that it is not properly distributing its income and causing problems that could affect it in the future. As such, let us have a look at its financial statements.

Unfortunately, we do not have an especially recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report is its annual report which corresponds to the full-year period that ended on May 31, 2023. This report was linked to earlier in this article. This report will naturally not include information about anything that occurred over the past seven months. That is disappointing because there were quite a few things that occurred over the period. For example, interest rates rose over the summer as the market began to come to terms with the possibility that high interest rates could be with us for a while. We also saw a period of market strength beginning in October in which investors began to buy up assets in an attempt to front-run the 2024 interest rate cuts. That period continues today. This fund was probably less affected by this than most debt funds, but the Federal Reserve’s interest rate increase in July might have still had an impact on its finances. This report will give us no information about that impact, and unfortunately, we probably have to wait another month or so for the semi-annual report that will detail that information.

During the full-year period, the Eaton Vance Floating-Rate Income Trust received $1,072,827 in dividends along with $48,224,702 in interest from the assets in its portfolio. This gives the fund a total investment income of $49,297,529 during the period. The fund paid its expenses out of this amount, which left it with $33,572,147 available for the shareholders. That was more than sufficient to cover the $30,661,298 that the fund paid out to its owners. Thus, it appears that this fund is simply paying out its net investment income. That should be sustainable as long as the fund’s net investment income remains around its current level. This is likely to be the case if interest rates stay high, but the fund may be cut once the Federal Reserve starts reducing interest rates next year.

Valuation

As of December 22, 2023 (the most recent date for which data is currently available), the Eaton Vance Floating-Rate Income Trust has a net asset value of $13.32 per share. However, the fund’s shares only trade for $12.70 each. This gives the fund’s shares a 4.66% discount on net asset value at the current price. That is a lot worse than the 6.20% discount that the shares have had on average over the past month. While the current price is a discount and therefore acceptable, investors might be able to get a better price by waiting for a little bit.

Conclusion

In conclusion, the Eaton Vance Floating-Rate Income Trust is a closed-end fund that could deserve a place in an investor’s portfolio right now. There are some signs that both the stock and bond markets might be volatile next year, as both are arguably overpriced and could be due to a correction if the Federal Reserve sticks to its own guidance instead of satisfying the market. This fund should prove to be resistant to such an event, which could prove to be quite valuable in protecting your assets. The fund’s distribution yield is also quite high, befitting a floating-rate fund in today’s environment. Unfortunately, Eaton Vance Floating-Rate Income Trust’s share price is more expensive than normal, but it is not obviously overpriced.

Read the full article here