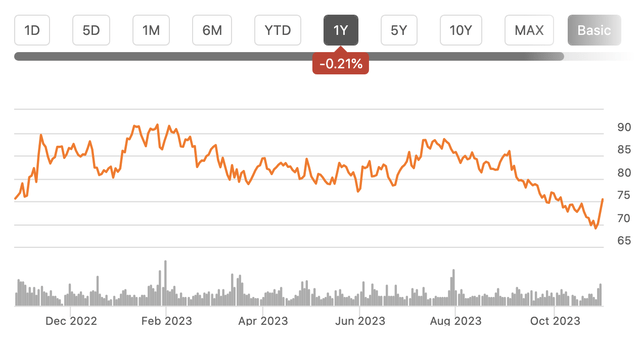

Shares of Eastman Chemical (NYSE:EMN) have been essentially flat over the past year, though they had been steadily declining prior to reporting Q3 results last week. Last October, I recommended investors sell the stock, seeing downside to the mid-$60’s with limited upside. Since then, shares are up slightly but have lagged the S&P 500. Given where shares are today, it is worth revisiting the stock, particularly as results have actually been a bit worse than I forecast. While the business may be bottoming, this appears priced into the stock. Recent optimism appears overdone

Seeking Alpha

In the company’s third quarter, Eastman earned $1.47 in adjusted EPS, besting estimates by $0.02 even as revenue fell by 16% to $2.27 billion. The company has done a good job of destocking inventory to generate cash flow, and avoid being saddled with excess product to sell at a loss. In fact, it has reduced inventory by $147 million this year. By reducing its plants’ utilization rate and running below end-market demand, EMN has been saddled with a $100 million cost headwind.

Chemical plants obviously have substantial fixed cost, so reducing volumes increases per unit cost. As a consequence, adjusted EBIT margins are down 100bp from last year, which would have been 40bp worse if not for favorable timing on energy pass through costs in some units. To be clear, Eastman has made the right decision in reducing volumes into a market that has customers running down their own inventory, but it is the nature of a cyclical business that margins come under pressure during downturns.

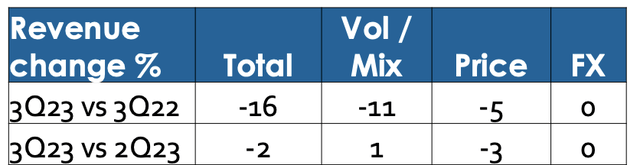

On a consolidated basis, revenue was down 16% from last year due to 11% lower volumes and 5% lower prices. Relative to Q2, revenue was down 2%. Volumes actually rose by 1% while pricing was down 3%, as you can see in the table below. The company is seeing strength in auto, which echoes Dow’s (DOW) quarter. With customer inventories also down substantially, volume pressure may be subsidizing. This has fueled some of the optimism in shares since reporting earnings.

Eastman Chemical

Drilling deeper into results, Advanced materials, its primary unit, provides plastics and chemicals for consumer goods, autos, and construction. Revenue rose 1% sequentially but was still down 16% from last year. Prices are holding in, up 1% from last year but down 1% sequentially. It sees inventory destocking largely complete, which should enable rising asset utilization going forward and help the company regain some margin.

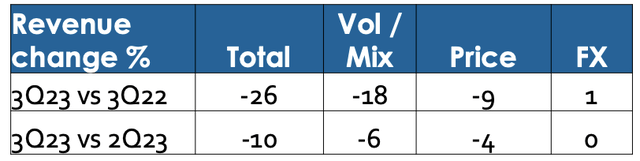

AFP (additives and functional products) is a bit more concerning. As you can see, there was a meaningful sequential decline with revenue down to $670 million. Both volume and pricing are continuing to be headwinds, and we do not appear as close to a bottom here. Management sees ongoing trouble in Asian construction, a key end-market. This is primarily tied to China’s real estate market, which is facing ongoing pressure. On the earnings call, management specifically highlighted that it has not seen the growth it anticipated in China occur yet.

Management also sees ongoing challenges in the agriculture sector where inventories have not destocked like they have elsewhere. But outside of these two major end markets, inventories are low and volumes should be stabilizing. Due to these pressures, EBIT fell to $105 million from $150 million last quarter. One other challenge is that the unit is seeing declines in LNG fills after a strong H1 with that decline continuing into Q4. I do think long-term with Europe pivoting away from Russian gas, the LNG business is a strong one, and this should prove to be a timing issue more than anything else.

Eastman Chemical

Fibers revenue was flat at $323 million sequentially—this was up 29% from last year. I would note volumes were up a smaller 2%. This business has energy pass-throughs, and in Europe, natural gas prices and electricity rose substantially last year. These pass-throughs occurred with a lag and are now being reflected in results to the point where it is now back on a normal footing. As seen by the sequential flat result, this tailwind to revenue has played out.

Looking ahead, Eastman expects $6.30-$6.50 in adjusted EPS during calendar 2023. It has earned $5.09 in adjusted EPS so far this year. This implies $1.21-$1.41 in earnings in Q4, or down about 10% sequentially. Ongoing destocking in agriculture and medical goods will continue to be headwinds, and energy prices remain elevated, reducing margins outside of fibers. Moreover, while demand may be stabilizing outside of these trouble spots, there really is not much growth to speak of, outside of autos.

Based on this level of earnings and further destocking of its own inventory, management expects $250 million in free cash flow during the fourth quarter. That is after generating $242 million in free cash flow so far this year–$163 million after adjusting for changes in working capital. For the year, the company will deliver about $400 million in free cash flow, ex-working capital. I had originally thought the business could do $600-650 million, but agriculture and Chinese construction demand have been even worse than feared.

Looking to next year, it should be able to recapture some utilization, helping to support margins. Additionally, its polyester recycling plant should be up and running this quarter and contribute $75 million in 2024 EBITDA. Against this, management did note that pricing is “starting to moderate in a few places.” While volumes rose in Q3, that 3% sequential decline in prices is something to monitor further, and it likely is to keep a lid on margin recapture.

Right now, the company pays $370 million in dividends, for a 4.35% yield, so even as this lower free cash flow, it is covered sufficiently, though there is no scope for material share repurchase activities. Assuming a 33% incremental margin, recognizing the benefits of operating leverage as utilizations rise, EMN would need to generate about 6-7% revenue growth from its Q4 run-rate to get back to my $600-650 million free cash flow level next year.

Shares today have just a 5% free cash flow yield, which is pricey for a cyclical commodities company like EMN and indicates to me the market is forecasting a substantial rise in cash flow to grow into that yield. At a $75 share price, it would have a 7.2% free cash flow yield using my $625 million level, which I view as a fairly full but reasonable multiple.

Now, EMN can achieve this, aided by the new plant coming online, but 6-7% revenue growth does mean the market is pricing in not just the avoidance of recession but also expansion. Given the Chinese construction sector is a key consumer of its chemical products, to justify its share price we will likely need to see China resume growth next year. This is possible, particularly if there is government stimulus, but all else equal, I view the outlook there as highly uncertain and prefer investment opportunities not tied to this risk. For instance, I prefer a company like Steel Dynamics (STLD), more directly tied to US construction.

Investors in EMN should be glad at how well the stock has held up given the cash flow declines in the business as agriculture and Chinese end markets have come under pressure. While volumes may be bottoming, this seems fully reflected in the stock. Just as shares did not fall that much as the business softened, I am not sure, given the current valuation, they will rally much as the business strengthens, if it does. I suspect in a year’s time, we will again see the stock between $70-75, and I would sell for better opportunities elsewhere.

Read the full article here