Almost four years ago, I recommended purchasing DTE Energy (NYSE:DTE) for its promising growth prospects and its attractive dividend yield. After that article, the stock rallied up to 30%, until it peaked in the spring of 2022. Since then, the stock has pared all its gains due to the surge of interest rates to a 16-year high level, which has compressed the valuation of the stock. Many investors may be considering to sell the stock after its dramatic underperformance vs. the broad market. The stock has gained just 2.5% over the last five years, whereas the S&P 500 has rallied 57% over the same period.

However, investors should realize that DTE Energy exhibits solid business performance. The only reason behind the underperformance of its stock is the surge of interest rates, which has nothing to do with the business of the company. In fact, all the utilities have vastly underperformed the S&P 500 over the last five years. The Utilities Select Sector SPDR Fund ETF (XLU) has gained only 11% over the last five years, much less than the 57% rally of the S&P 500.

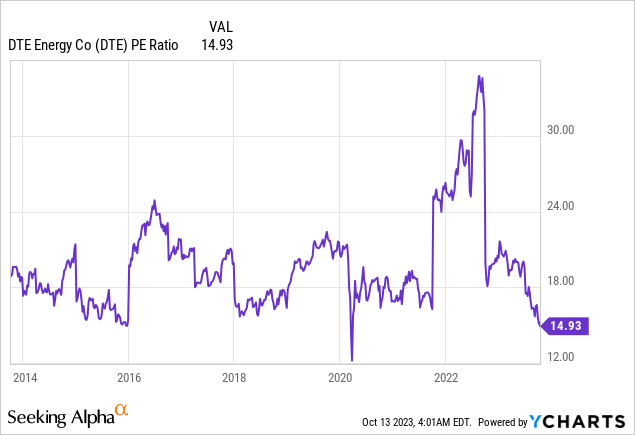

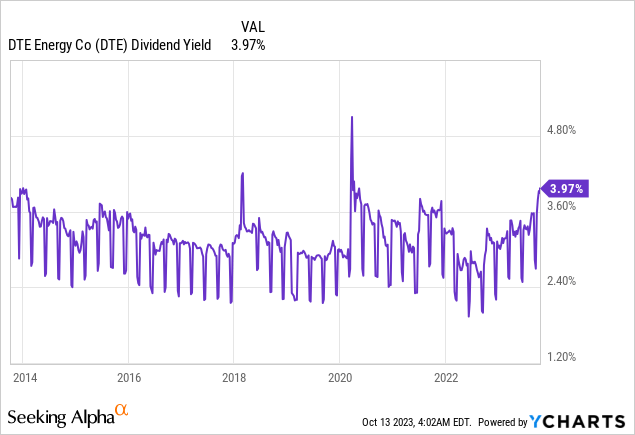

Due to the compression of its valuation caused by the surge of interest rates to a 16-year high, DTE Energy has become extremely cheap. It is trading at a nearly 10-year low price-to-earnings ratio of 15.5x and is offering a nearly 10-year high dividend yield of 3.9%. Even better, the company has pledged to keep raising its dividend by 6%-8% per year in the upcoming years. Whenever interest rates begin to moderate, the stock is likely to enjoy a steep rally. Therefore, investors who can wait patiently for the economy to cool and interest rates to revert to normal levels are likely to be highly rewarded by this high-quality utility stock.

Business overview

DTE Energy was founded in 1903 and is based in Detroit. It generates, buys, distributes, and sells electricity to about 2.3 million residential, commercial, and industrial customers in southeastern Michigan.

As a regulated utility, DTE Energy is characterized by highly reliable and predictable performance, without major surprises. In the latest quarter, the company grew its earnings per share 12.5% over the prior year’s quarter, from $0.88 to $0.99, mostly thanks to increased profits from energy trading. Management reaffirmed its guidance for earnings per share of $6.09-$6.40 in the full year. At the mid-point, this guidance implies 7% growth vs. the initial guidance of management for this year.

The global energy market is transitioning from fossil fuels to clean energy sources at an unprecedented pace. According to a report of the International Energy Agency [IEA], the global investment in green energy projects has surpassed the investment in fossil fuels by an impressive 70% this year. For every $1 spent on investment in fossil fuels, $1.7 is now invested in clean energy projects.

DTE Energy is ideally positioned to benefit from this trend. As shown in the chart below, the utility has greatly improved its energy mix since 2005.

DTE Energy – Energy Transition (Investor Presentation)

Source: Investor Presentation

Even better, DTE Energy intends to accelerate its energy transition in the upcoming years. It plans to cease the use of coal at one Belle River unit in 2025 and reduce its carbon emissions by 85% until 2032. As the cost of generating energy from solar and wind power has been decreasing at a fast pace, the increased use of clean energy is likely to somewhat enhance the operating margin of DTE Energy.

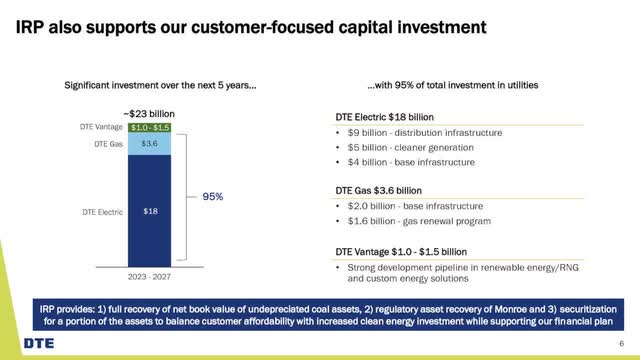

Moreover, DTE Energy has a promising growth plan in place. The company intends to invest approximately $23 billion in its business over the next five years.

DTE Energy – Growth Plan (Investor Presentation)

Source: Investor Presentation

This amount exceeds the current market capitalization of the stock by $3 billion or 15%. It is thus evident that the company is investing in its future growth at full throttle. Indeed, management has repeatedly stated that it expects the earnings per share to grow by 6%-8% per year on average in the upcoming years. This is an attractive growth rate for a utility, as it is combined with the reliable and predictable nature of the earnings of the company and its proven resilience to recessions.

Analysts agree on the outlook of management. They expect DTE Energy to grow its earnings per share by about 7% per year on average, from $6.21 this year to $8.26 in 2027.

Valuation – Expected return

Due to its 19% decline this year, the stock of DTE Energy is currently trading at a nearly 10-year low price-to-earnings ratio of 15.5x. This earnings multiple is much lower than the 10-year average of 18.2x of the stock.

The cheap valuation has resulted from the surge of interest rates to a 16-year high. The Fed has raised interest rates so much in order to restore inflation to its long-term target of 2.0%-2.5%. Inflation has cooled since it peaked at 9.2% last summer but it is still standing at 3.7%. Nevertheless, the Fed is likely to accomplish its goal sooner or later. About 60% of current inflation is attributed to rising home prices. Given that mortgage rates have climbed above 7%, they are likely to finally reduce the demand for houses at some point in the future and thus help drive inflation to the target zone of the central bank.

It is also important to realize that utilities are among the most sensitive securities to interest rates. High interest rates enable investors to identify attractive yields in many bonds and stocks and thus they render the dividends of utilities less attractive. This explains the aforementioned underperformance of the entire utility sector vs. the S&P 500 over the last five years.

However, as soon as the Fed achieves its goal of reducing inflation to comfortable levels, it is likely to begin reducing interest rates towards normal levels. When that happens, the stock of DTE Energy will probably revert towards its historical valuation level and thus it will enjoy a steep rally.

Given the reliable and predictable nature of the earnings of a regulated utility, it is reasonable to expect DTE Energy to achieve earnings per share of about $8.26 by 2027, in line with the above mentioned analysts’ expectations. If the stock trades at its average price-to-earnings ratio of 18.2 in that year, it will trade at $150 (=18.2 * 8.26). Therefore, the stock has 56% upside potential over the next four years or 11.8% per year on average. If one adds the 3.9% dividend, the total annual return becomes even more attractive.

Dividend

DTE Energy has paid uninterrupted dividends every single quarter for more than a century. It has also raised its dividend for 14 consecutive years. Moreover, thanks to its exceptionally cheap valuation, the stock is currently offering a nearly 10-year high dividend yield of 3.9%.

The stock has a forward payout ratio of 62%, which is undoubtedly healthy for a utility. In addition, the company has an investment grade credit rating of BBB from S&P and Fitch and a Baa2 rating from Moody’s. Given also that net interest expense consumes only 33% of operating income, the company can easily continue raising its dividend for many more years.

DTE Energy has grown its dividend by 5.8% per year on average over the last decade and by 4.9% per year on average over the last five years. The company raised its dividend by 7.6% this year and provided guidance for dividend growth of 6%-8% per year in the upcoming years, in line with earnings growth. Overall, DTE Energy is offering a nearly 10-year high dividend yield of 3.9% and is likely to grow its dividend by 6%-8% per year in the upcoming years.

Risk

Just like most regulated utilities, DTE Energy has proved essentially immune to recessions. In fact, the stock would probably benefit from a recession, as interest rates would decrease and the earnings multiple of the stock would most likely expand in such a case. Therefore, while a recession is a risk factor for most stocks, it is not a risk factor for DTE Energy.

The main risk factor for DTE Energy is the adverse scenario of persistently high inflation for many years. In such a scenario, the Fed would probably maintain high interest rates for years, and thus the valuation of DTE Energy would probably remain compressed for much longer than currently expected. Investors should be aware of this risk factor but the odds favor that the Fed will drive inflation to its target range at some point next year thanks to its aggressive policy.

Final thoughts

The surge of interest rates to a 16-year high is an abnormal condition, which has exerted extreme pressure on the valuation of the stock of DTE Energy. Those who purchase the stock at a nearly 10-year low valuation level and at a nearly 10-year high dividend yield are likely to be highly rewarded as long as they can maintain a long-term perspective.

Read the full article here