It happened… and it’ll happen again. The market dropped roughly -10% in only four weeks. That’s pretty fast! I mean… it’s not “COVID fast” (the market dropped -34% in only 22 days back then).

Oh, and it’s not “Black Monday fast,” either (the market dropped -22.6% in one day back in 1987). You’re starting to get the point… we’ve seen this before – but just how often do we see market pullbacks, corrections, and crashes?

This Wasn’t a “Crash”

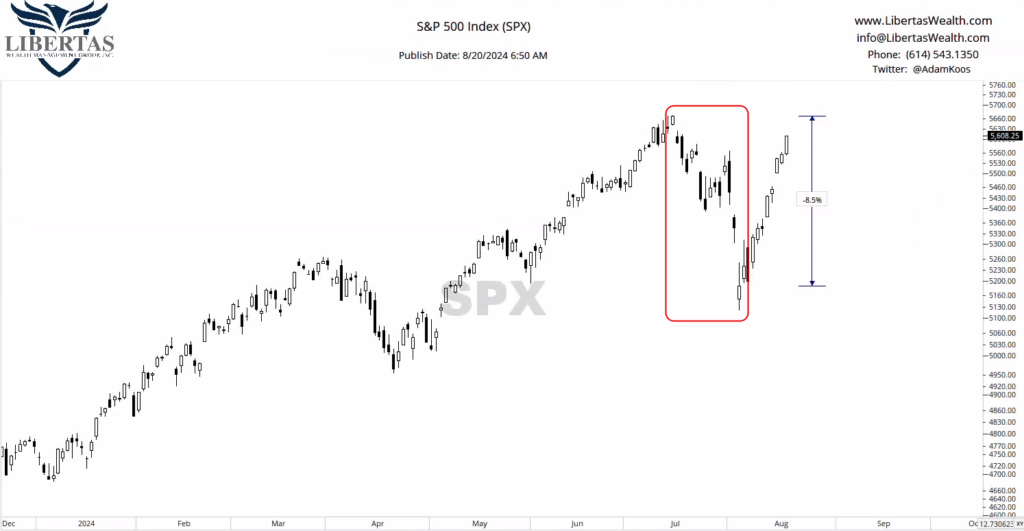

What we just experienced in the four weeks that followed July 15th was most certainly not a market crash. As you can see below, the S&P 500 (SPX) was down right around -8.5%, and the Nasdaq composite was down more than -13% (not shown).

You can blame the Yen carry trade or A.I. stocks – whichever blows up your skirt – but the bottom line is that the market took a breather after going up too long and perhaps even “too fast” without taking a metaphorical breath.

Do we all deserve a t-shirt, now that the market has re-captured roughly 60% of its losses in only (wait for it…) two weeks?

Meh… probably want to hold off on that. In fact, with September historically being the worst month of the year for the stock market and the election coming up right behind it, I wouldn’t be surprised to see another drop before we get a resumption in the uptrend that currently exists.

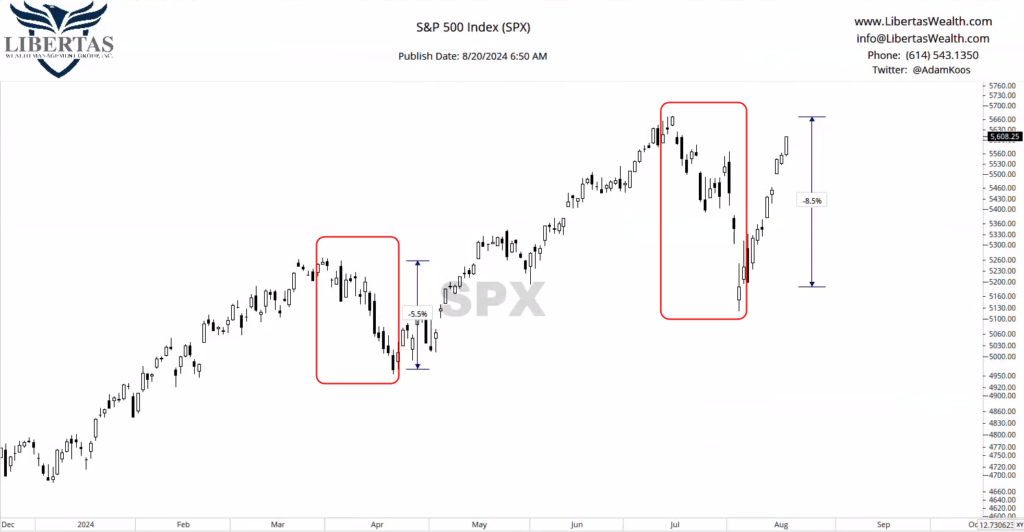

Meanwhile, did you notice something on the chart above? There was another market pullback that occurred this year, back in spring. Did you see it? Here… I’ll annotate it:

So, not as bad as the one we saw in July, but still… a pretty quick, 15-day, -5.5% drop in the market that had people worried that the sky was surely falling “this time.”

It Happens More Than You Think

“But that’s not all!” …says the infomercial.

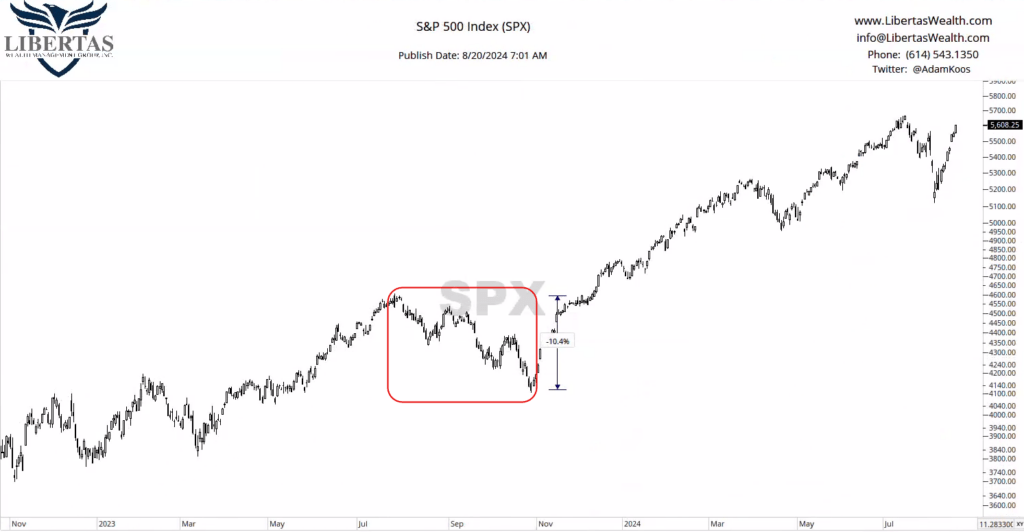

You probably don’t remember, but back in the summer of last year (2023), the market peaked in July and went through a pretty long, three-month correction of more than -10%.

Again, I say “you probably don’t remember” because that’s the whole point of this month’s “Coach’s Corner” article. To point out that these things happen way more than you think, and it’s because we humans suffer from this psychological heuristic called Recency Bias. We tend to remember the most recent past and forget things that are further out in time and history.

Just How Often Does the Market Do This?

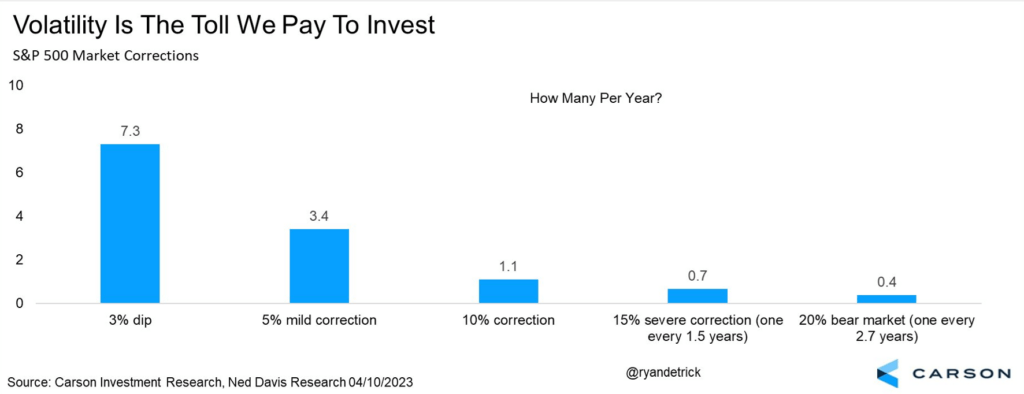

Again, it happens more thank you think. Check out the table below and I’ll walk you through it…

- The S&P 500 drops -3% roughly seven times-per-year

- It experiences what I call a “pullback” of -5% more than 3 times-a-year

- Once per year, on average, the market drops -10% (this is what we call a “correction”)

- Every 18 months or so, a “severe” correction takes place, where the market falls -15%

- Once in every 2 ½ to 3 years, the market heads into “crash” territory, which is a drop of -20% or more

Think about that for a minute… the market drops -10% once-per-year, on average. That means a $1 million retirement portfolio invested in stocks would lose $100,000, once per year, on average, at some point throughout each and every year!

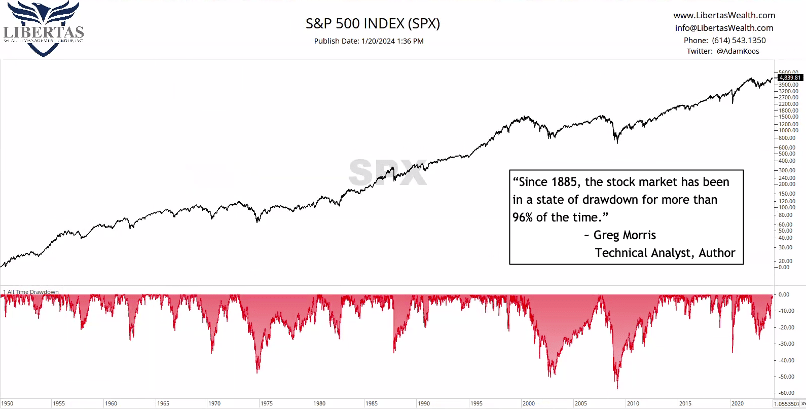

I’ll leave you with one more visual to close out this month’s article. It’s a study performed by one of my many mentors in Greg Morris.

Greg found that the market spends most of its time going down! To be specific, since 1885, the market has been in a state of drawdown more than 96% of the time. Let that sink in for a second.

I personally think the “trick” is to know whether the market is in an uptrend, downtrend, or if it’s “trendless” …and yes, there is such a thing as “no trend at all,” or in other words, times when the market is setting up for its next big, long-term move (up or down).

What Should You Do Now?

I personally think the market is in an uptrend, so I believe that what we saw in the four weeks that followed July 15th was a buying opportunity for those who had cash sitting on the sidelines (and by the way, it’s still “on sale” as I type these words).

I’ll reiterate that we could see some downside and even a re-test of the August lows as we walk into the seasonally weak month of September, and depending on how wild and emotional this election cycle gets, we could see some additional volatility as we head into early November.

In the end, however, I don’t believe the market will crash if one party (or the other) wins the presidency. Contrary to what the political media would like you to think, the market likes “certainty,” and we don’t have a whole lot of that going on right now. Rather, these next 2 ½ months will almost certainly be filled with uncertainty!

So with that, buckle up, don’t freak out, and just know that, for the next 12 weeks or so, we’ll be going through a rough patch on your journey toward and/or through retirement, and that everything will be okay on the other side of this rocky road.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here