Written by Nick Ackerman.

For some background on this monthly publication, here is my view on dividend growth stocks:

Dividend growth stocks aren’t always the most exciting investments out there. They often aren’t grabbing the headlines, and they aren’t the stocks running up hundreds of percentages in a year. In fact, they are often some of the least exciting stocks. And that is precisely their strongest selling point. With such a vast world of dividend growth stocks available out there, it is important to screen through to see if there are any worthwhile investments to explore.

They are stocks that provide growing wealth over time to income investors. Dividend growers are often larger (not always), more financially stable companies that can pay out reliable cash flows to investors. Some are slower growers than others. Some are going to be cyclical that require a strong economy. Some are going to be secular, which doesn’t generally rely on a more robust economy.

Dividend growth can promote share price appreciation. Of course, that is if these companies are growing their earnings to support such dividend growth in the first place. Trust me. There are yield traps out there – I’ve owned a few that I’m not particularly proud of.

I like to think of investing in dividend stocks as a perpetual loan of sorts. Essentially, every dividend is a repayment of your original capital. Eventually, holding long enough, you have the position “paid off.” It is all returned back into your pocket from that point forward.

All of this being said, it is important to understand my approach to dividend stocks and why screening dividend stocks can be important for income investors. As with any initial screening, this is just an initial dive – more due diligence would be necessary before pulling the trigger.

The Parameters For Screening

I’ll be using some handy features that Seeking Alpha provides right here on their website for this screen. In particular, I will be screening utilizing their quant grades in dividend safety, dividend growth and dividend consistency.

Dividend Safety is relatively self-explanatory. These will be stocks that SA quants show reasonable safety compared to the rest of their various sectors. The grade considers many different factors, but earnings payout ratios, debt and free cash flow are among these. This category will be stocks with A+ to B- ratings.

For the dividend growth category, we have factors such as the CAGR of various periods relative to other stocks in the same sector. Additionally, the quants also look at earnings, revenue and EBITDA growth. As we will see, this doesn’t mean that every stock with a higher grade has the growth we are looking for. This just factors in that the dividend has grown or earnings are growing to support dividend growth possibly. For these, the grades will also be A+ through B- grades.

Finally, for dividend consistency, we want stocks that will be paying reliable dividends to us for a very long time. In particular, hopefully, they are raising yearly, though that isn’t an explicit requirement. We will also include stocks with a general uptrend in dividend payments, which means there could have been periods where they paused increases for a year or two.

After looking at those factors alone, we are left with 414 stocks at this time from the 397 listed last month. I’ll link the screen here, though it is a dynamic list that constantly updates regularly. When viewing this article, there could be more or less when going to the link.

From there, I wanted to narrow down the list a lot more. I then sorted the list by forward dividend yield, from highest to lowest. Since these will be safer dividend stocks in the first place, screening for those among the higher payers shouldn’t hurt.

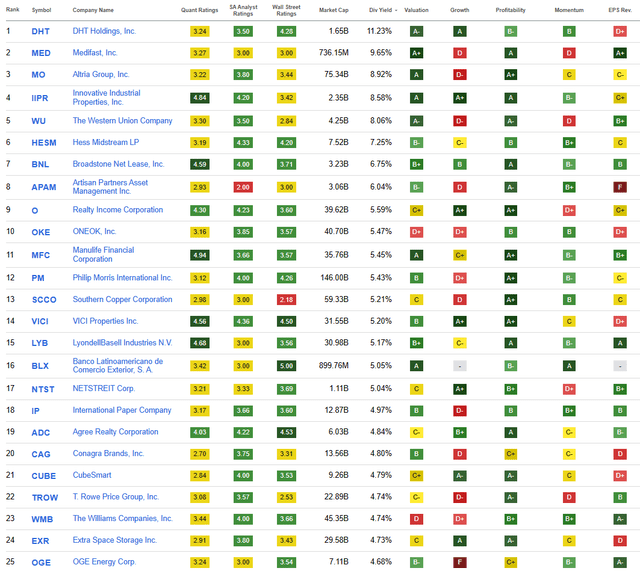

I will share the top 25 that showed up as of 12/04/2023.

Top 25 Screen (Seeking Alpha)

DHT Holdings (DHT) is an unfamiliar name to me, and it comes in at the top of the list this month. However, the dividend policy there looks variable. While it has been growing year-over-year, it isn’t the type of consistency that I’m looking for in this monthly piece. Likewise, that is why we haven’t touched on Artisan Partners Asset Management (APAM) in previous iterations of this article. Southern Copper Corporation (SCCO) also appeared to have a variable dividend policy, but it has been stable in the last few quarters.

Medifast (MED), Innovative Industrial Properties (IIPR), Hess Midstream LP (HESM), Broadstone Net Lease (BNL), Realty Income (O), ONEOK (OKE) and VICI Properties (VICI) were all names we touched on recently, so we will skip over them for this month. We generally have a fair number of returnees each month, as there is only so much volatility from month to month. However, this month, it seemed there were even fewer changes than usual.

Additionally, The Western Union Company (WU) was a name that I had previously covered in this piece on several occasions. However, after holding its dividend flat for nearly three years now due to significant competitive pressures hitting earnings, it also doesn’t meet the spirit of what this piece is trying to highlight. Similar to DHT, APAM and SCCO, they could be great companies and perform amazingly in the future, but that is not what this piece is looking to highlight.

With all that being said, here are the five names we are going to take a look at today that could be worth exploring further: Altria (MO), Manulife Financial Corp. (MFC), Philip Morris International (PM), LyondellBasell Industries N.V. (LYB) and NETSTREIT (NTST).

Altria 9.20% Yield

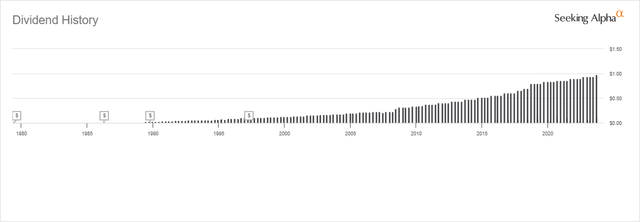

Altria is sporting a monster 9%+ yield with an envious track record of 53 years of increasing its dividend. Soon to be 54 years, given they raised their payout once again in the past quarter. That’s a streak that provides it the crown of the “dividend king” title.

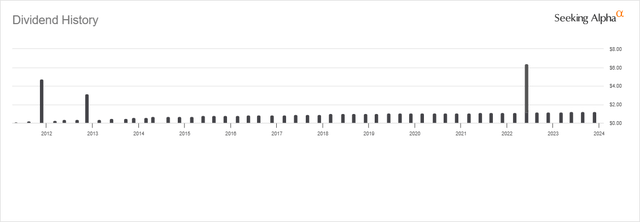

MO Dividend History (Seeking Alpha)

This is a name that is no stranger to this monthly dividend growth screening piece, and the last time we touched on the name was in August 2023. The company delivered earnings that disappointed in mid-October. The shares dropped quite promptly upon both the miss of the top and bottom lines. That being said, the earnings miss was essentially in-line with the results missed by only a hair.

As usual, cigarette shipment volume fell, and this time, so did net revenues as it gets harder to replace those lower shipments with simply increasing prices. I believe this remains the key risk for MO going forward, which is what other categories they can move into. While I am a shareholder, they have failed to impress me on what will drive this company forward into the future.

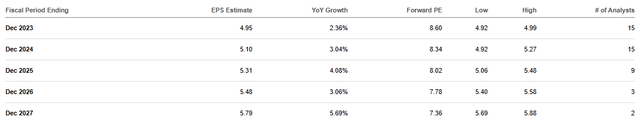

That being said, through November’s rally, MO recovered nearly the entire drop that it experienced post-earnings. Analysts are also still anticipating some earnings growth going forward, even with flat to slightly down revenues.

MO Earnings Estimates (Seeking Alpha)

Additionally, MO isn’t priced to perfection either, with its forward P/E at 8.6x. According to the company’s historical fair value range, it is trading on the cheaper end. However, there is an admittedly wide range here, one of the widest I’ve seen.

MO Fair Value Range (Portfolio Insight)

Manulife Financial Corporation 5.45% Yield

After moving down the above list quite a few names, we finally arrived at the 11th ranked name on the list, and that is MFC. This is a new name that shows up for the first time this month. New names are always exciting for this list, but this isn’t an unfamiliar name. This is a life and health insurance giant out of Canada. With a market cap of nearly $36 billion, this is no small operation.

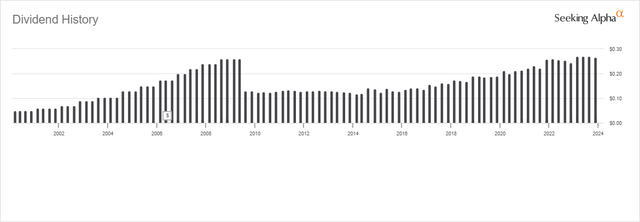

MFC has delivered dividend growth for the last decade and paid dividends for 23 consecutive years. While it may appear that the dividend is variable, it is actually the CAD to USD exchange rate that is making it seem that way. We covered a number of Canadian companies previously, primarily in the pipeline space and a couple of banks, so it isn’t that unusual.

As fluctuations in the currencies happen between the two, there are naturally going to be different exchanges. It goes both ways; sometimes, it is a helpful exchange, and sometimes it hurts what one is receiving. However, in the end, it seems to balance out as both the U.S. and Canadian currencies are fairly stable.

MFC Dividend History (Seeking Alpha)

They cut their dividend during the global financial crisis, as many financial companies had done. They then maintained their payout for several years before raising it starting in 2014 and have been raising it ever since. With the latest dividend representing the fourth quarter in a row of CAD$0.365, we anticipate another bump soon. Given the strong core EPS dividend coverage and analysts expecting earnings to continue to grow, it seems all the more likely.

MFC is trading on the lower end of its fair value range as well, though that seems to have been the case from about 2019 onward. This company also has a fairly wide range, but not as wide as MO, that we highlighted above.

MFC Fair Value Range (Portfolio Insight)

Philip Morris International 5.43% Yield

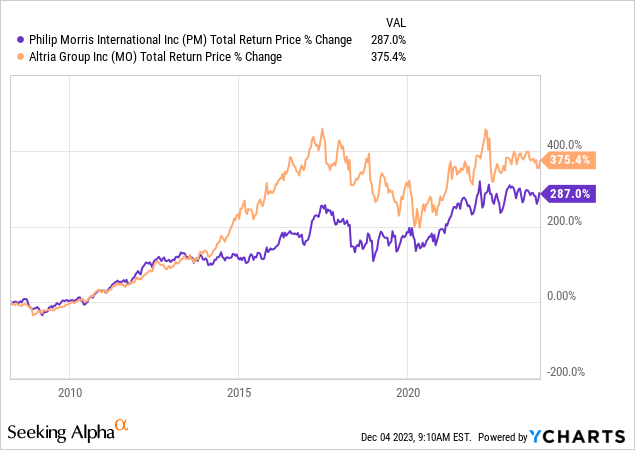

With PM on this list, we come into the second big tobacco play for this month, which also needs little introduction. In fact, at one point in civilization’s history, these two were one. The divorce took place in 2008, and PM was given the world while MO focused on the U.S. It Turns out MO seemed to benefit the most in terms of total return since that split.

YCharts

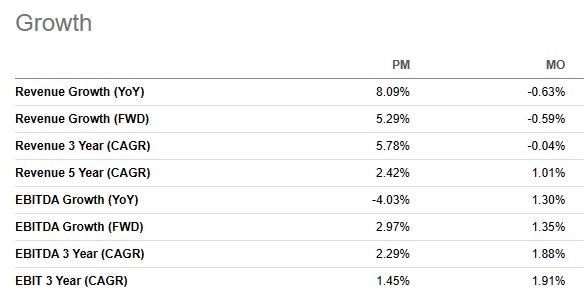

However, more resilient smoking rates in certain countries relative to the U.S. could be cause for concern. The U.S. is more middle-of-the-road in terms of smoking rates. Growth in terms of revenue and EBITDA seem to favor PM going forward, which should put them in a potentially better spot in terms of potential appreciation.

PM Vs. MO Growth Metrics (Seeking Alpha)

With MO, you get a higher dividend, but with a lack of growth prospects at some point, even the yield could be suspect in the future. However, well covered at this point and growing faster, relatively speaking.

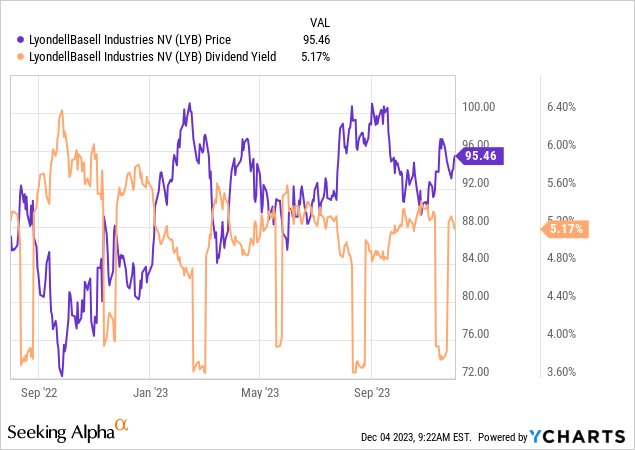

On the other hand, on the valuation front, MO would be the cheaper of the two on most P/E measurements. This means that PM is also relatively the richer priced of the two tobacco giants and, therefore, is priced accordingly to its better growth prospects.

PM Vs. MO Valuation Metrics (Seeking Alpha)

LyondellBasell Industries N.V. 5.24% Yield

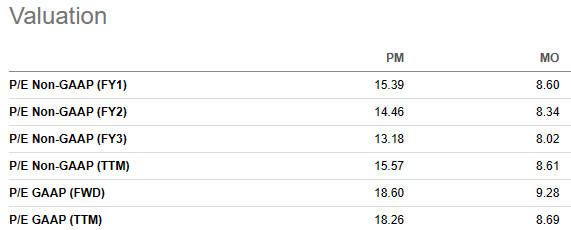

This is not the first time that LYB has made the list for discussion in this monthly article. However, it had been quite some time since we touched on it; we’d have to go back to August 2022 – well over a year ago as we are getting close to closing the 2023 chapter. It isn’t that it hasn’t popped up on this screening, but it’s been toward the lower side of the screening as the yield itself has stayed relatively low compared to the other names that have populated the list.

This isn’t all bad news, and it’s mostly because the stock’s share price has remained fairly elevated after taking a swift drop lower toward the latter parts of 2022. Of course, that drop was simply the overall market taking a nosedive as it moved deeper into bear territory at that time.

YCharts

Today, we are covering it primarily because we ran into so many of the same names higher on this list. This is number 15 on this screening today; for some context, it came in at number 11 last month when its yield then was a similar 5.26%.

LYB remains on my own personal watchlist, and they’ve delivered dividend growth for going on a decade now. Last year, they even paid out a giant special dividend to investors.

LYB Dividend History (Seeking Alpha)

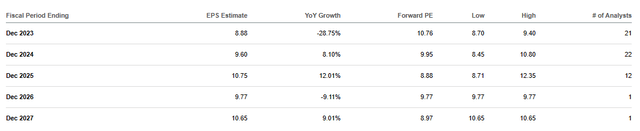

With a manageable dividend payout ratio and expectations for earnings to return to a growth trend after 2023, they could be set to grow dividends for the next decade as well. They’re a chemical company, and cyclicality comes with the nature of their global operations; earnings gyrations are to be expected.

LYB Earnings Estimates (Seeking Alpha)

Given the forward P/E of 10.76x, the company isn’t richly priced either making it for a rather fair entry level for investors that want to take a long-term position. I have a personal buy target of $85, but I’m being greedy, and that would take the forward P/E buying target to around 9.5x.

NETSTREIT Corp. 5.10% Yield

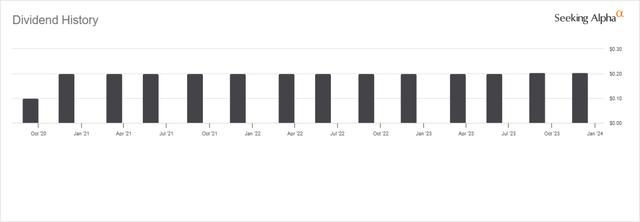

NTST is another new name this month that we’ve never covered before. In fact, it’s a relatively new REIT overall, being founded in 2019. I’ve also made somewhat of an exception to including this name this month because the history here isn’t exactly that long. They also only had a modest dividend boost, probably to simply say they did.

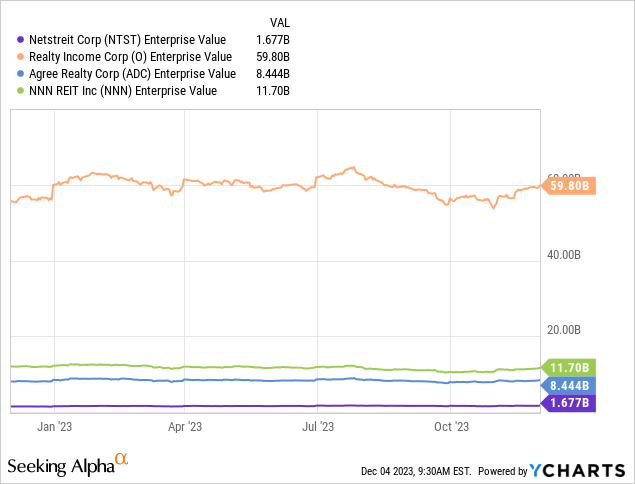

This is a retail REIT that is quite small, relatively speaking. Some of its larger peers would include Realty Income (O), Agree Realty Corp (ADC) and NNN REIT (NNN). For some context on just how small the company is, here is a comparison of the enterprise value of each. NTST comes in as the smallest, with ADC the second smallest, but is 5x larger. Despite being so small, they are still internally managed.

YCharts

NTST’s latest earnings report showed AFFO coming in at $0.31, a 3% increase from the prior year. For the nine months that ended September 30, growth was a touch better at 5%. Analysts are expecting earnings to grow over the next four years, but fairly modestly at an average of 3%.

Therefore, seeing only a modest increase in the dividend here makes sense when they took it from $0.20 to $0.205 or an increase of 2.5%. That being said, the dividend payout is quite low, at only around 66%. They could raise by $0.005 for years if they were able to simply maintain AFFO.

NTST Dividend History (Seeking Alpha)

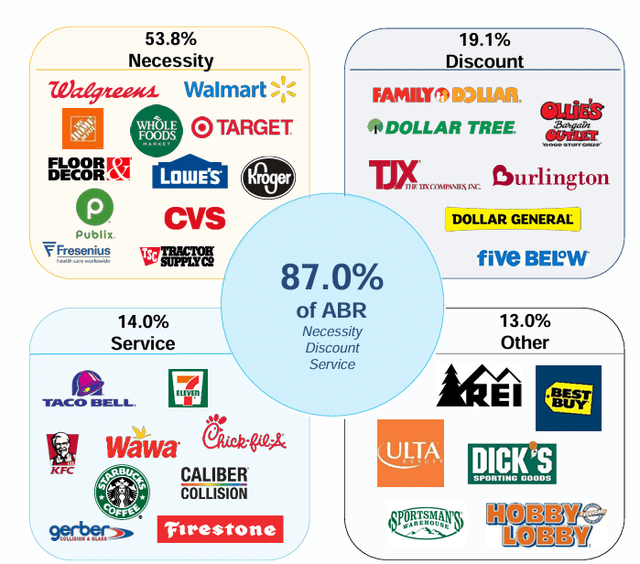

They have a diverse basket of tenants with 100% occupancy. They operate properties in 45 different states with 85 different tenants in 26 different retail sectors. Nearly 69% of their tenants are also considered investment-grade, which bodes well for making sure rents are paid. Additionally, they also list that a larger portion of their properties are either necessity or discount retailers.

NTST Tenants (NTST)

Those are tenants that are going to be significantly more resilient in times of economic hardship. They are either at or near the bottom in terms of consumers wanting to trade down; there basically is nowhere else to trade down from several of these retailers. While pharmacy chains could struggle, they are also generally essential or “necessity,” as listed by NETSTREIT.

Overall, as an income investor, I’m a fan of REITs, and this one will certainly be one to watch going forward. That said, the reservation here is that it trades at a forward P/FFO of 13.8x. O currently is trading at 13.25x, and NNN is at 12.87x. So, these larger and more well-established names offering similar valuations reduces some of the appeal at this time.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here