Investment Thesis

Chesapeake Energy Corporation (NASDAQ:CHK) EPS prospects are expected to deliver negative figures until summer 2024. Despite these lackluster prospects, I find this stock highly compelling.

Personally, I’ve invested in Antero Resources (AR). Yes, there are some minor differences between the two companies, but these are insignificant in the grand scheme.

In fact, I argue that this narrative revolves around a substantial and sustainable increase in natural U.S.-based gas demand in 2024. Presently, investors show little interest in this sector, but now is a really great time to engage with natural gas stocks like Chesapeake Energy.

The Massive Electrification Movement

The global landscape is witnessing a monumental shift as we progress further into the electrification of diverse sectors.

While the conversation surrounding this movement might not be as prevalent as it deserves, its impact is bound to significantly reshape our energy requirements in the years to come.

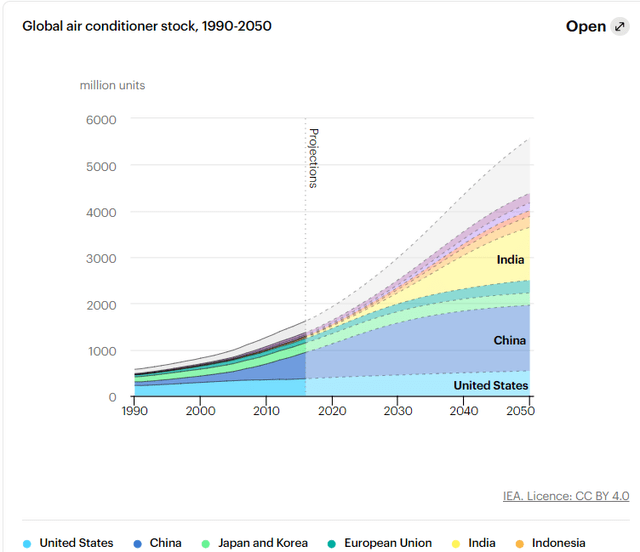

From the surge in demand for electric-powered appliances like air conditioners and heat pumps to the growing popularity of electric vehicles (“EVs”), the strain on our electricity grids is undeniable. Additionally, the proliferation of massive data centers, crucial for the digital infrastructure, further amplifies the demand for reliable and substantial energy sources.

EIA report

However, it’s crucial to recognize that despite the widespread perception of a balanced energy production system, the reality is more complex. Energy sources vary significantly in their applicability and efficiency for generating electricity. The practicality of using diesel for electricity production, for instance, is fraught with numerous challenges, including environmental concerns and inefficiencies.

Consequently, I argue that this leaves only nuclear and natural gas production to meet this increase in demand. I’ve already discussed nuclear energy here, so I won’t repeat myself (disclosure, I’m long Uranium Energy Corp. (UEC)).

These energy sources offer a dependable and robust means of generating electricity, providing what I believe to be the main viable solution to the challenges posed by the electrification of various industries.

Natural gas serves as a cleaner alternative to other fossil fuels, emitting fewer pollutants and greenhouse gases. Furthermore, it’s flexible, affordable, scalable, and lower in carbon emissions than coal.

Why Investing in Renewables is For Now Impractical

Now, let’s discuss renewable energy.

The electrification of everything movement cannot solely rely on renewable energy sources due to the current limitations of the electrical grid.

The primary challenge lies in the lack of an efficient energy storage system within the grid infrastructure, specifically lithium-ion batteries. The demand for electricity needs to be carefully balanced with its production, a balance often disrupted by the intermittent nature of renewable energy sources.

Although renewables generate a substantial amount of energy during the day, the peak consumption period typically occurs in the evening, after working hours. This mismatch underscores the critical need for a massive energy storage solution to bridge the gap between renewable energy production and demand, ensuring a more stable and reliable power supply for the electrification movement.

Why Invest in CHK?

Investors look at natural gas prices headed into yet another warm winter and presume that natural gas prices will not reach $4 MMBtu in 2024.

Trading Economics

I argue that this is a faulty assumption. The demand for U.S.-based natural gas is going to dramatically increase in 2024. Why? Because it doesn’t make sense for prices for this coveted commodity to be so cheap in the U.S., while the rest of the world is paying more than 5x the price for this commodity.

The feedback I get to this argument is that Europe’s energy demands for this winter are already sorted out. And whilst this is true, everything that we’ve discussed here is about a short-, medium-, and long-term demand for natural gas.

Furthermore, it’s not only Europe that seeks U.S.-based natural gas, but Asia too. Consequently, I argue that natural gas prices will find a floor at around $3 MMBtu and steadily climb from this figure over the next several months.

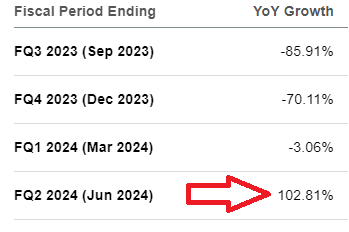

The other argument I’ve heard from investors is that CHK’s EPS comparables look horrible and unpalatable.

SA Premium

As it stands right now, analysts are not expecting CHK’s EPS to stabilize and return to grow until summer 2024. Why would investors get involved now, for a stock that may not stabilize for another 6 months or more?

Because the market is always looking ahead by 6 months. The market isn’t very forward-looking, but you can rest assured that right now, investors are starting to price in summer 2024.

The Bottom Line

Despite projections of negative EPS for Chesapeake Energy until summer 2024, the stock presents a compelling investment opportunity.

Anticipated growth in U.S.-based natural gas demand in 2024 underscores its potential. Presently overlooked by investors, the current market conditions offer an opportune moment to consider natural gas stocks like CHK.

Further potential lies in the expected stabilization of natural gas prices beyond $3 MMBtu, with a gradual increase in the upcoming months.

This positive outlook for natural gas, coupled with the growing demand, suggests CHK’s long-term profitability.

While challenges exist, including the complexities of the energy market and current EPS comparables, market trends are already reflecting expectations for CHK’s future stability and growth. With a promising narrative underpinning its potential, Chesapeake Energy emerges as a favorable option as natural gas prices head higher.

Read the full article here