Introduction

The energy transition from CO2-emitting coal/gas to “clean” energy has sparked a nuclear rebirth as the most efficient clean electricity source and has driven uranium prices in the last two years, with expectations of long-term deficits prompting higher price expectations. To invest in this theme, I researched two uranium ETFs, Global X Uranium (URA) and Sprott Uranium Miners (URNM) where Cameco (NYSE:CCJ) (TSX:CCO:CA) was the top holding and thus decided to analyze the company and found it more compelling.

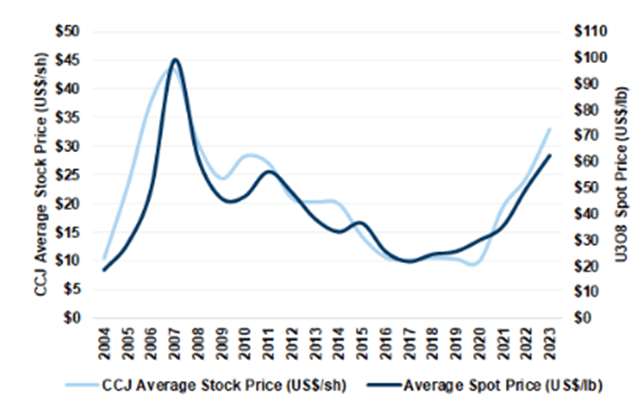

Performance

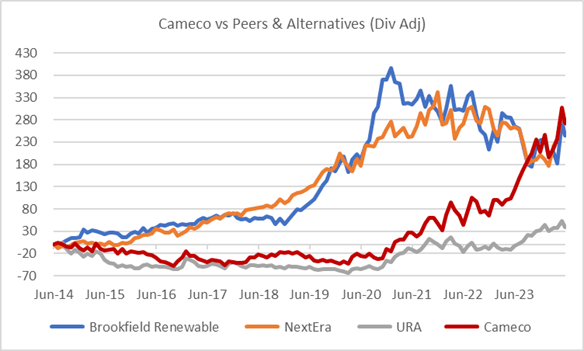

Cameco’s share price performance mirrors uranium spot prices and has been a terrible long-term investment given the resistance to nuclear energy in the last 20 years. However, vs a portfolio of uranium stocks via the URA ETF, Cameco has done far better at capturing uranium prices. I was also curious to see how the stock faired vs clean energy companies. I compared it to Brookfield Renewable Partners (BEP), which is in a JV with Cameco that co-owns Westinghouse, and versus a large utility such as NextEra Energy (NEE). Using prices adjusted for dividends (total return) one can see that Cameco recuperated from 10 years of losses in 2023.

FactSet Created by author with data from Capital IQ

What is Cameco

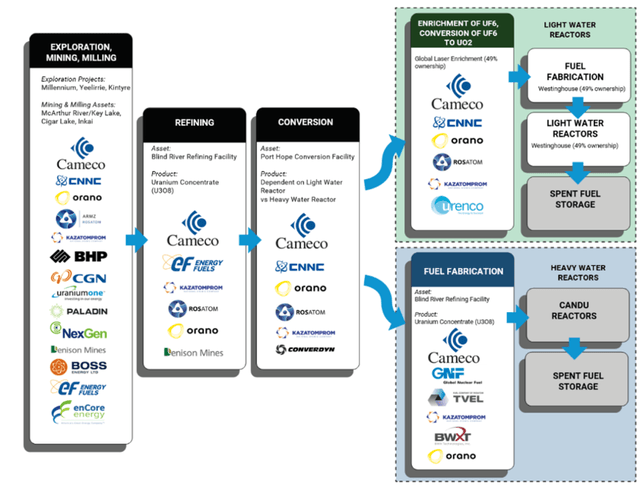

Cameco, based in Canada, is the second-largest uranium miner in the world with 15% capacity, behind National Atomic Company Kazatomprom (OTC:NATKY). It also refines and produces fuel rods for nuclear power plants that represent 16% of revenue. In late 2024 Cameco acquired 49% of Westinghouse (51% Brookfield Renewable Partners), further extending its integration and exposure in the value chain to nuclear power plant maintenance and new builds.

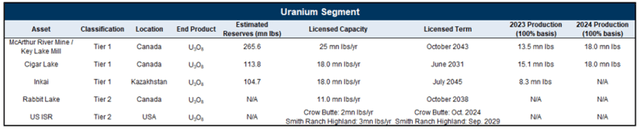

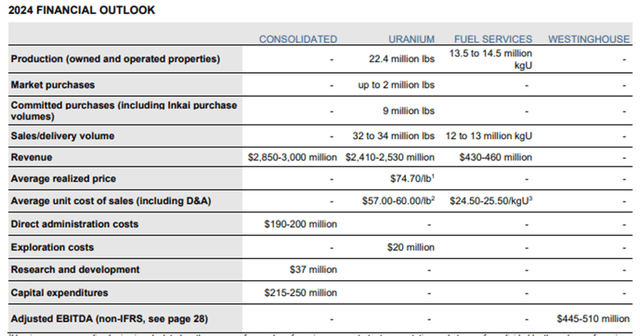

The company has three main mining operations with McArthur River (70% stake) and Cigar Lake (55% stake) in Canada that have 43m lbs. capacity and should run at 83% utilization in 2024 up from 66% in 2023. The third, Inkai (40% stake), is in Kazakhstan with 18m lbs. capacity and is not consolidated, i.e., reported as equity income. The fuel service operation refines uranium and produces fuel rods, mostly for the Canadian nuclear fleet.

Cameco Mining Assets (Cameco)

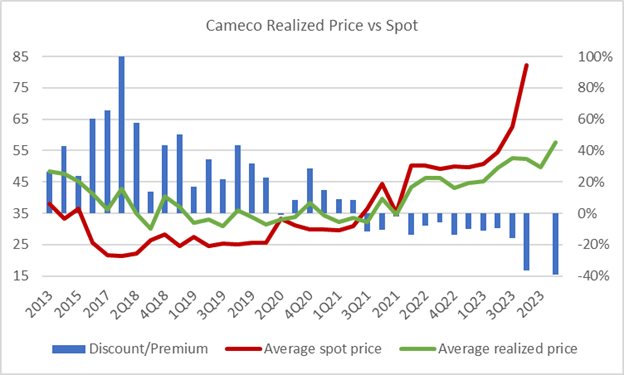

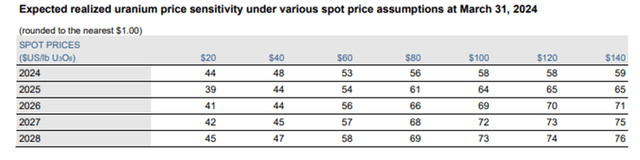

Contracted Prices vs. Spot Market

Cameco´s realized uranium price (revenue/volume) does not directly track the spot price due to the company’s commercial strategy which, utilizes a 40/60% fixed/variable price mix for long-term contacts. However, at present, about 20% of reserves or 200m lbs are in this contract terms, which means that higher prices and volumes should produce a gradual and sustainable price catch-up.

The company provided a sensitivity guideline where the realized price climbs from US$56 to US$69lb if spot prices are flat at US$80lb.

Created by author with data from Cameco Uranium Price Guidance (Cameco)

Westinghouse Nuclear

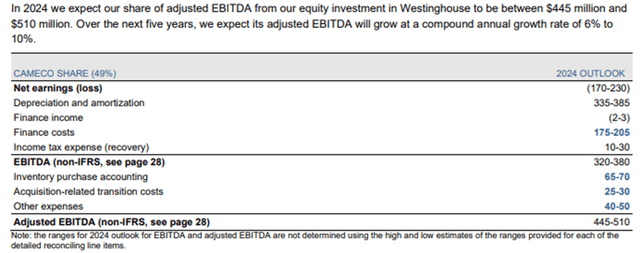

What is a new factor in the Cameco investment case is the 49% stake in Westinghouse Nuclear, a leader in nuclear plant design, construction, and maintenance. This was acquired in 4Q23 for US$2.3bn in partnership with Brookfield Renewable Partners. This provides Cameco with further integration in the nuclear value chain and may be a very positive source of earnings growth and diversification, reducing the dependence on uranium prices. According to Cameco´s 2024 guidance for Westinghouse they expect to report a net loss of $200m and from one report by Goldman Sachs (GS) earnings recovery to $500m in 2025.

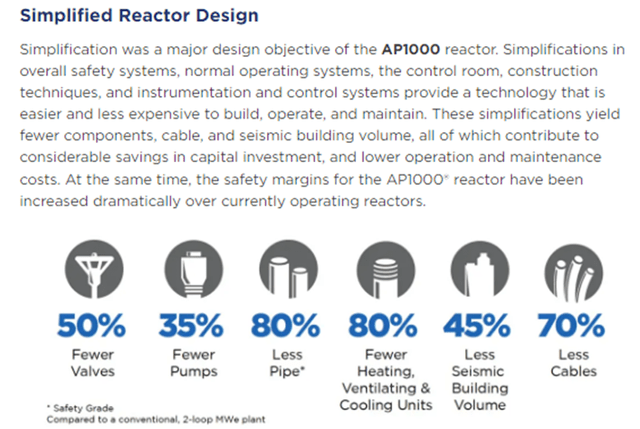

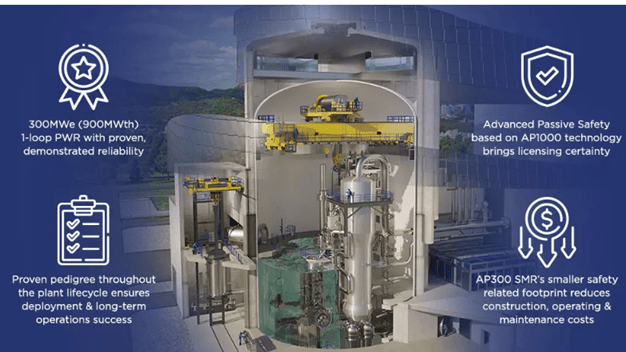

Westinghouse has built 430 reactors and has developed the AP1000, with 4 in operation with 26 in construction or contracted. It has also developed an SMR (Small Modular Rector) and a Microreactor that may provide additional upside if deployed.

Cameco Cameco SMR (Cameco) Westinghouse Guidance (Cameco)

Equity Income Increasingly Relevant

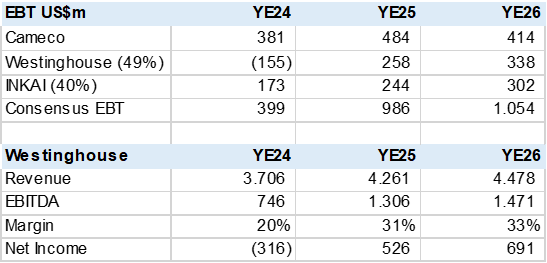

As mentioned earlier, Westinghouse results are reported as equity income, i.e. the earnings proportional to the equity stake. These results are not added to revenue or EBITDA and unless the JVs pay dividends, equity income does not provide cash flow. Nonetheless, it is a clear indication of the JV’s growth and value to Cameco. Many analysts will add equity income to EBITDA in their EV/EBITDA valuation metric, which, in my view, is not the best way to capture a JVs contribution. Below, I break down EBT (Earnings before Tax) for Cameco and its JVs to illustrate their importance.

Created by author with data from Capital IQ & Bloomberg

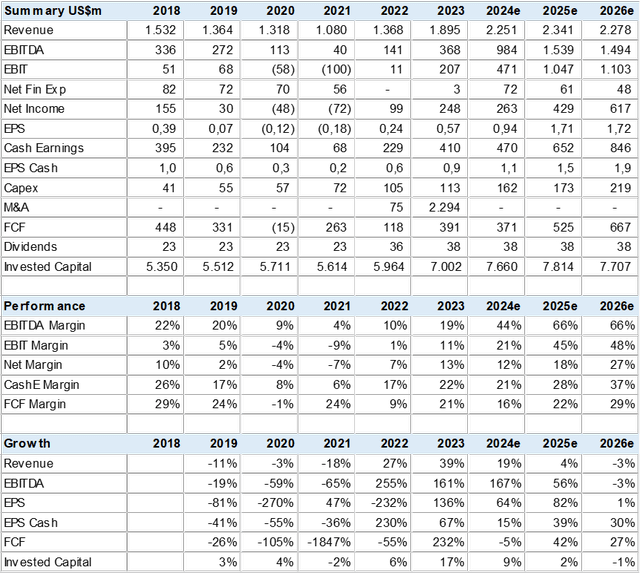

Consensus Estimates over 30% Earnings Growth

I gathered consensus data from 14 analysts to measure Cameco’s growth and profitability metrics, which for the most part factor in the company guidance for 2024, which assumes more than doubling EBITDA margin on stronger uranium prices. For 2025 and 2026 the market expects margins to increase to 60% on higher volumes and prices as discussed earlier on Cameco´s contract commercial terms. Earnings get a further boost from Westinghouse equity income contribution where analysts have less clarity, but some are forecasting over US$500m or US$250m to Cameco which seems under-estimated and may provide for earnings upgrades.

Cameco Consensus Estimates (Created by author with data from Capital IQ)

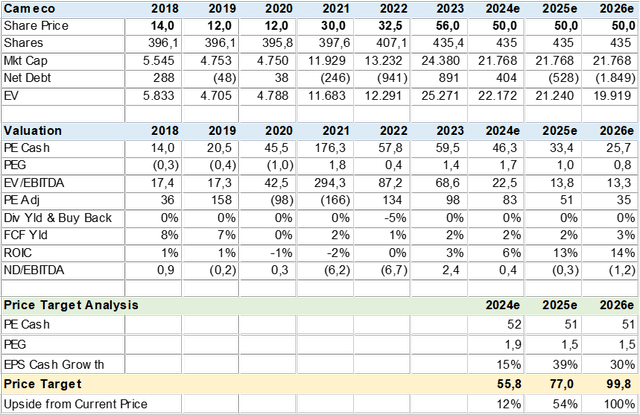

Valuation

The consensus has a US$56 price target that backs into an implied PE (cash) of 52x and a PEG of 1.9 which are premium valuations but not out of context with historic ranges. Note that I use cash earnings for capital-intensive companies, which is calculated with net income plus depreciation. In the case of Cameco this metric includes its substantial equity income, the earnings from Westinghouse and Inkai mine in Kazakhstan.

The 2025 price target of US$77 is based on a 1.5x PEG that, given the increasing earnings growth, translates into a 51x cash PE ratio. The same methodology points to a US$100 price target for YE26 on the company’s continuing growth and profitability drivers.

Consensus Valuation (Created by author with data from Capital IQ )

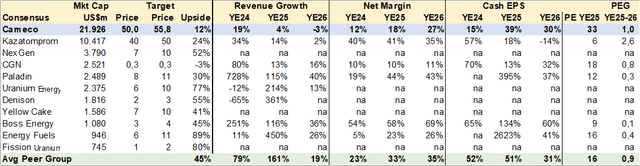

Peers

I gathered consensus data for some of the top uranium producers to compare to Cameco’s growth and valuation metrics. As can be seen in the table below, quality is scarce in the sector with Kazatomprom’s production and geopolitical issues, the rest are junior miners initiating production with substantial execution risk. The more adventurous investor may find Paladin Energy (OTCQX:PALAF) and Boss Energy (OTCQX:BQSSF) an interesting option, judging from consensus data. CGN is a Chinese-listed company.

Created by author with data from Capital IQ & Bloomberg

Risk

The primary risk is a declining uranium price, which may occur if the nuclear reactor expansion stops and even reverses. That scenario seems unlikely given the energy transition, and climate change action to reduce carbon emissions but could be driven by new energy technologies. The other factor that could lead to lower uranium prices in the long term is oversupply as dormant mines and then new mines come into production, i.e., a classic commodity cycle. Cameco´s valuation premium vs Kazatomprom could decline in that scenario.

Conclusion

I rate CCJ a BUY. The company is at the center of the nuclear rebirth that has favorable short and long-term growth expectations that should provide support for uranium prices, if not drive them higher. At the same time, the 49% stake in Westinghouse provides additional integration in the nuclear value chain via the design, construction, and services of nuclear power plants. The combination points to over 30% earnings growth through 2026.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here