Thesis

The Canadian oil and gas space is highly fragmented. As such, there are laundry lists of small oil and gas producers that are growing their operations in Western Canada. Land in the region is extremely cheap and located in generally young basins that have not gone through any meaningful amount of consolidation. I have begun digging through the crop of companies in this sector to help identify the strongest candidates for long-term survival. Today I’ll be highlighting Bonterra Energy Corp. (OTCPK:BNEFF).

Bonterra Energy is a microcap Canadian oil and gas producer that is capable of free cash flow generation even at its small scale. The company participates in the Pembina Cardium oil play in Alberta Canada. In addition to this play, the company has an exploratory play in the Montney Basin slightly further West on the British Columbia border.

The company has been walking the tightrope to balance multiple company priorities. Bonterra is focusing on generating free cash flow, growing production, and reducing its net debt below 1.0x. Since 2021, the company has been able to reduce its debt profile by $200 million while increasing production to over 14,000 BOE/d.

Given this progress, BNEFF is on the cusp of the next step in its maturation process. Upon reaching management’s debt threshold of $135 – $145 million in net debt, the company plans to initiate a dividend that accounts for 25% free cash flow. I view this as instrumental for a long-term investor that will reap some reward while the company continues to build out its Montney assets. This growth platform will be fueled by the cashflows from the predictable Cardium play. It’s not sexy, but it works.

I recommend Bonterra as a long-term organic dividend growth play with the ultimate goal of benefiting from M&A activity as this small player potentially gets absorbed into a bigger entity.

NOTE: Canadian dollars are used in this article unless specified.

Introduction

Bonterra operates in a relatively untapped oil play in Western Canada. The Pembina Cardium field is the company’s bread and butter where it owns 312 sections (roughly 312 square miles). This acreage is fairly blocky as well, aiding in drilling longer laterals for capital efficiency. These wells don’t produce eye-popping volumetric numbers but have a reasonably quick payoff thanks to low drilling costs and a high oil cut.

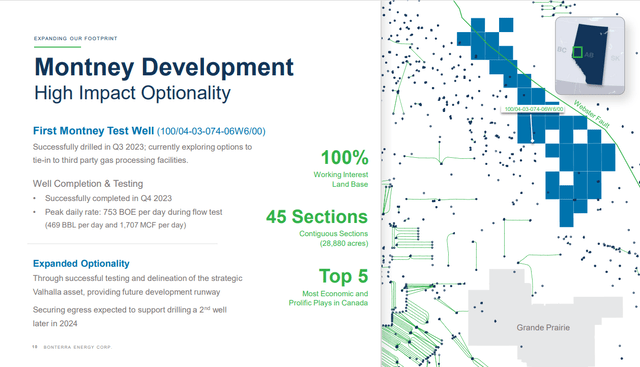

The company has also assembled a separate 45 square mile (28,880 acres) block slightly northwest of its Cardium play. This small block resides in the Montney formation and was assembled for approximately $2 million, or $70/acre. This incredibly low land purchase is the first step in keeping operating costs low in this developing fairway.

Company Goals

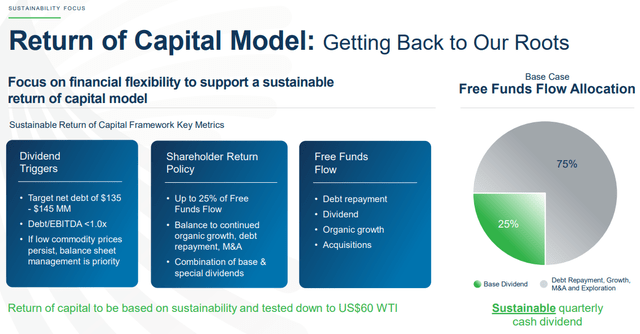

Bonterra has publicly laid out its priorities as it plans to move forward. The company plans to focus on a step-by-step process to grow the company while also rewarding shareholders.

1. Achieve target debt of $135 to $145 million. This will reduce the leverage ratio to less than 1.0x while also reducing interest expenses.

2. After the target debt is achieved, the company plans to initiate a dividend program at 25% of free cash flow.

3. The remaining 75% of FCF will be allocated to growth, debt reduction, M&A, or special dividends.

This plan is more of a slow burn and is supportive of a buy and hold ownership strategy. Since October, Bonterra’s share price has declined 38% making this narrative even more compelling.

Bonterra Energy Investor Presentation

Free Cash Flow Analysis

As always, the numbers must be able to support the narrative. Given the small scale of Bonterra, the narrative has to also be robust enough to withstand the occasional stressor in the commodity markets.

For Q4, I have modeled a slight reduction in revenues from Q3, mainly attributed to a 5% reduction in crude prices for the quarter. The quarter is strengthened however by significantly reduced capital spending to aid in FCF generation. This will allow Bonterra to generate significant FCF to drive the company toward its debt reduction goal.

|

Q4 Cash Flow Analysis |

Average Strip |

|

|

Light Oil Revenue |

$69.6 Million |

$60.8 Million |

|

NGL Revenue |

$6.4 Million |

$5.6 Million |

|

Natural Gas Revenue |

$10.8 Million |

$7.2 Million |

|

Operating Expense |

($34.5 Million) |

($32.5 Million) |

|

Admin + Interest + Tax Expense |

($11.0 million) |

($9.8 Million) |

|

Free Cash Flow |

$39.6 Million |

$31.1 Million |

|

CAPEX |

($15 Million) |

($25.0 Million) |

|

Distributable Cash Flow |

$26.3Million |

$6.3 Million |

With $26.3 million in DCF in Q4, the company should have sufficient financial resources to meet its net debt goal. Using these projections, Bonterra should end 2023 with $141.2 million in net debt. Therefore, the financial threshold to initiate a dividend will be met.

The second threshold is, can the company afford to pay a dividend over the long term? The company has been guided to payout 25% of FCF. Using a long-term model based on $75 WTI and $2/MCF Henry Hub pricing, the average DCF column was calculated. In this model, the company generates $0.17/share of DCF, thus translating into a quarterly dividend of $0.04/share. At the current share price, this translates into a yield of approximately 3.3%. This also assumes a CAPEX spend rate at the upper end of CAPEX guidance, approximately $25 million per quarter.

For the defensive investor, I ran the model to determine the minimum WTI price that would sustain this level of dividend spend. A cash flow breakeven scenario produced itself using a strip of $67.5 WTI and $2/MCF Henry Hub, giving a fair amount of margin to the dividend. As the debt profile improves, the breakeven price should continue to move lower.

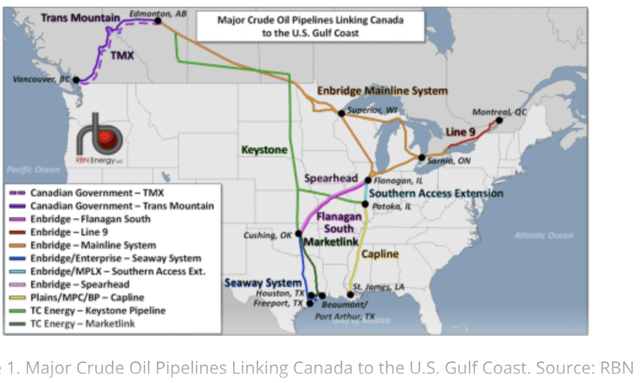

Opening of the TMX Pipeline provides some upside

Historically, Canadian producers had few options to move their products out of Canada. The Keystone Pipeline and the Enbridge Mainline were the two main ways out of the country. As a result, producers have been forced to sell their products at a decreased price to work their product through the pipeline bottleneck.

In the coming weeks, the Canadian government is expected to open the expansion project on the Trans Mountain Pipeline, dubbed TMX.

TMX is a 590,000 barrel per day pipeline that will nearly triple the capacity of the original 300,000 bpd pipeline. The net impact will result in producers no longer being forced to take a discount to transport their product.

Through the first nine months of 2023, Bonterra recorded an average discount of $2.55/barrel to WTI pricing (‘USD’). The opening of the TMX pipeline could result in significant cost savings if even half of this discount is eliminated. By reducing the discount to $1.30/barrel, the company stands to realize $4.32 million (‘CAD’) in additional revenue annually.

This factor alone will cover approximately 72.5% of the dividend expense as projected in the FCF analysis. This may be a little over-optimistic, but it drives home the fact that even a small improvement can have a large impact on Canadian producers.

RBN Energy

Growth Basin

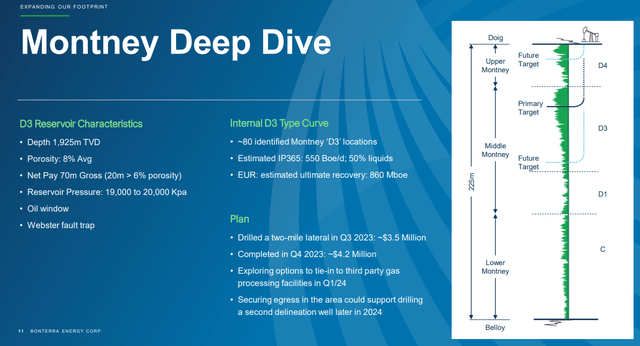

Bonterra continues to invest in the Cardium oil play as it generates predictable returns. The company has taken steps to utilize a small portion of that free cash flow to diversify its asset base and stake a claim in the liquids rich window of the Montney basin. The company spent $8 million developing a prototype well along the Webster fault.

Bonterra Energy Investor Presentation

Wells in this location are expected to have a low decline rate and have a comparable oil content to that of the Cardium wells. Initial production data showed an oil percentage of 62% with the remainder being natural gas. These wells stand to be very profitable over the long term as a result of both the shallow depth, and multiple target windows in the play. The company projects that two additional secondary targets are available to harvest additional inventories. These secondary targets benefit from increased capital efficiency by re-using the initial well bore.

Bonterra Energy Investor Presentation

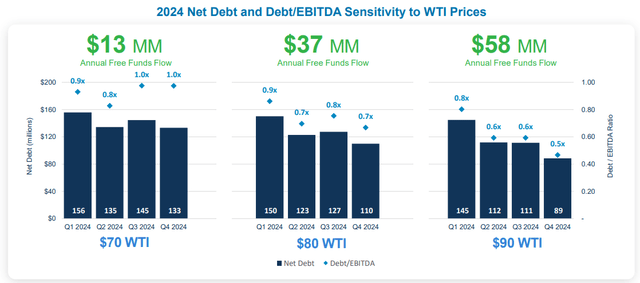

The company will evaluate drilling a second well in this window during 2024 depending on commodity and rig prices. The company’s FCF sensitivity analysis indicates that adequate FCF to fund a second well would require sustained crude prices north of $80 WTI (US dollars).

Bonterra Energy Investor Presentation

Valuation

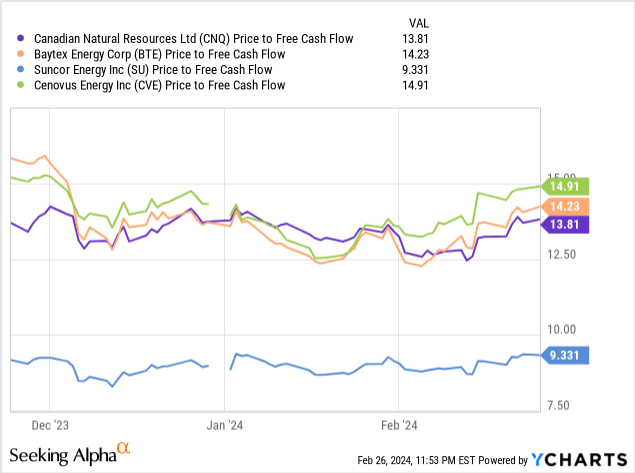

Using the “Average Strip financial model, BNEFF generates approximately $25.2 million in FCF annually. This equates to $0.677/share. At the current price of $4.85/share the price to FCF ratio yields a multiple of approximately 7.15x. This is several turns lower than the bigger names in Canada. It is fair to conclude that BNEFF’s shares are cheaply valued in comparison to the general Canadian field.

Risks

Bonterra is obviously a riskier play based on its microcap status. 2023 saw a 333 BOE/d impact as a result of well shut-ins related to wildfires in central Alberta. In practical terms, this accounts for the production of one well, maybe two. However, due to the company’s small size, this translates into a not so insignificant, 2.4% reduction in total production.

Other external events, such as a Canadian winter storm or a more intense wildfire, could have a larger impact on Bonterra’s total production. Depending on the severity, an event such as this could temporarily drive Bonterra into negative FCF.

Summary

In this article, I introduced a microcap Canadian producer Bonterra Energy. This company produces oil-weighted, low-capital wells in the Cardium oil play. These wells have relatively short payback windows that are less than a year and produce reasonable amounts of FCF. The company has been using this FCF to retire over $200 million of debt over the last three years.

As a result of this improved financial condition, the company is approaching financial performance metrics that will allow it to start paying a quarterly dividend. The FCF analysis performed showed that a $0.04/share dividend can be supported with a margin at $75WTI and $2/MCF Henry Hub prices. The stress test showed that the dividend breakeven was $67.50/barrel.

This analysis did not take into account any favorable pricing that Bonterra could receive as a result of the opening of the TMX pipeline. A benefit of $1.25/barrel was shown to have sufficient financial impact to cover approximately 54% of the projected dividend.

In addition to progressing through its debt reduction program, Bonterra has accumulated a small secondary play in the Montney window in western Alberta. The initial economics of these wells appear favorable due to shallow depth and multiple zones available for development.

I like Bonterra as a slow organic growth story that may eventually be acquired by a bigger entity. The company’s priorities are fiscally responsible and conservatively grounded. Purchasing this company below $5/share gives an adequate risk-adjusted opportunity for a long-term shareholder in my view.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here