The last time I wrote about Bitcoin (BTC-USD) was on October 21, 2021. It was the day that the first exchange-traded fund (ETF) for cryptocurrency made its debut in the form of the ProShares Bitcoin Strategy ETF (BITO), and I placed a resounding “SELL” rating on this vehicle, preferring to hold gold (GLD) when it comes to the need for a store of value.

CNBC

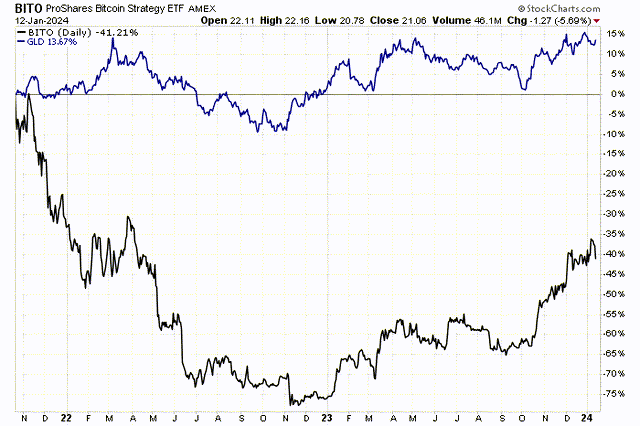

More than two years later that looks to have been a prescient call, as BITO has collapsed 40%, while gold (GLD) has risen more than 13%. Therefore, I am going to update my outlook for the cryptocurrency space now that the first exchange-traded funds that invest directly into Bitcoin started trading last week with the long-awaited approval coming from the Securities and Exchange Commission.

StockCharts

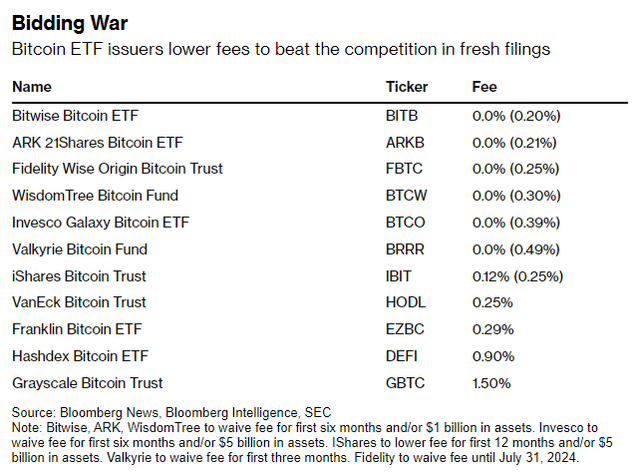

Oddly enough, that approval seems to be the centerpiece of the new investment thesis on the basis that the birth of numerous regulated ETFs that can now invest directly into Bitcoin will be very bullish for its price in the medium-to-long term. The assumption is that these new products will make it far easier for investors and financial advisors to allocate funds to the new asset class, widening the investor base dramatically and significantly increasing the inflow of funds.

Bloomberg

The more recent performance of Bitcoin suggests the introduction of these 11 new securities was a “sell the news” event. After peaking above $49,000 on the first day of trading, the digital coin cratered under $42,000, as though it was a technology stock that just fell short of earnings expectations. The difference is that a technology stock represents a company with profits, assets, and a fundamental value. Bitcoin does not.

Finviz

Proponents of the digital coin claim that it serves as an inflation hedge, as well as a store of value, which can improve the risk-adjusted performance of a diversified portfolio. I have not seen it exhibit any of those characteristics over the past two years. Therefore, I am reiterating my SELL rating on Bitcoin after the coin surged in price over the past month in anticipation of the launch of these new ETFs.

While I can’t ignore the industry completely, as there are technologies behind it like the blockchain, which have real productive value, the 23,000 coins in existence today, led by Bitcoin, do not. I see them all as solutions to a problem that never existed, born out of years of speculation that was fueled by an unprecedented amount of free money and near-zero interest rates.

Bitcoin proponents claim that its value lies in the fact that there is a limited supply of them, but there are limited supplies of most everything and they are not worth $49,000 each.

As for a store of value, how can an asset that loses 10% of its value in a day, much less half its value in a year, be considered a store of value? Consumers can’t use it as a currency when they have no idea what its value will be tomorrow, or in a month, much less a year from now.

When I have asked highly regarded investment professionals why they own Bitcoin, they all say the same thing. They don’t want to miss out on something they don’t fully understand and be criticized for doing so. That is not a compelling investment thesis. They can’t explain why the price rises or falls other than speculative investment flows.

Lastly, the emergence of this asset class had far less competition in a world of negative real yields. Bonds were not attractive, but now real yields are positive across the curve and money market accounts pay more than 5%. That is stiff competition for digital currencies, and I think their popularity will slowly whither over time. Bitcoin has no determinable fundamental value, and its appreciation is dependent on an increasing number of investors participating in the craze, which reminds me more of tulips than a legitimate new investment class. I will continue to avoid it.

Read the full article here