Beazer Homes USA, Inc. (NYSE:BZH) reported the company’s fiscal Q3 results on the 1st of August in post-market hours, sending the stock down -13% the following day. While the Q3 financials came in as expected, the fiscal Q4 expectations were pushed down considerably from previously incredibly ambitious levels.

In my previous article on the stock, “Beazer Homes Has Significant Mid-Term Targets As Revenues Gradually Improve,” I remained with a Buy rating for Beazer Homes, calling the company’s prospects undervalued by a good margin. Since the article was published on the 17th of June, Beazer Homes has now returned 11% compared to the S&P 500’s (SP500) return of 3% in the same period, despite the initially negative reaction to the Q3 results.

My Rating History on BZH (Seeking Alpha)

Q3 Results Came In As Expected

Beazer Homes’ fiscal Q3 results came in at a fair level, continuing the company’s recovery from macroeconomic weakness. Revenues came in at $595.7 million, up 4.0% year-on-year and finally growing again after three weaker quarters. The revenue recovery came in as expected, missing Wall Street’s estimates by an insignificant $2.0 million, and came within Beazer Homes’ own home building revenue guidance range of $581-606 million for the quarter.

The reported EPS of $0.88 beat Wall Street’s estimates by $0.05, but still declined $0.54 year-on-year – Beazer Homes’ profitability, which I’ve previously outlined as a risk, is still worryingly declining. Underneath, the home building gross margin contracted 310 basis points to 20.3%, in part due to a -1.1% decline in the average selling price, but also due to continued cost inflation. The higher revenues weren’t able to offset the underlying weakening gross margin trend with enough operating leverage.

Altogether, the Q3 financial results still came in as expected. While I believe that the growth in closed home sales is great and shows good improvements in the macro-challenged industry, the underlying profitability trend is pushing margins back closer to a weaker pre-pandemic level. The current uncertain macroeconomic environment likely also plays a key part in margin declines. However, Beazer Homes’ ability to push margins back up through transferring inflation into prices is still cloudy and is a major risk to note in the investment.

The Implied Q4 Outlook Was Pushed Down Amid Persisting Macro Uncertainty

More notably in the report, Beazer Homes pushed the implied Q4 outlook down by a considerable margin. I already previously noted the previous FY2024 guidance’s ambitious expectations for the last quarter, though, making a guidance cut understandable in my opinion.

Beazer Homes now anticipates ~1500 closings in Q4 at an average $520 thousand selling price, creating an expected adjusted EBITDA of >$80 million in the quarter. Previously, the Q4 outlook was at an implied 1788 closing mid-point and around $113.2 million adjusted EBITDA, showing a significant push downwards with the Q3 report. The Q4 average selling price is now expected at $520 thousand though, being a great improvement from the FY2024 guidance and previous quarters’ actualized selling prices – it seems like Beazer Homes is now increasing its focus on protecting margins.

While orders had improved in both Q1 and Q2, orders in Q3 abruptly declined. They were -10.8% to 1070, likely also contributing to a worse short-term sales outlook. Quarterly orders have significant short-term turbulence, and the decline in orders seems like a bad sign, as cancellations rose and the sales pace per community declined even more dramatically by -23.9%. In the Q3 earnings call, Beazer Homes’ CEO Allan Merrill related the sales environment to have been poor. Potential buyers struggled to qualify for a mortgage, and as many homebuyers pushed back the purchasing decision, anticipating lower interest rates. As the factors seem to be macro-related, I believe that the order decline is a sign of likely short-term turbulence but not a sign of long-term issues.

The macroeconomic background still stands uncertain. While interest rates have begun declining, being critical for home sales, Fannie Mae still sees weak home buying demand ahead as the average consumer is still cautious, also shown by the US consumer sentiment’s weakening from May forward. Fannie Mae only foresees notable improvements far into the 2025 calendar year, as lower interest rates cement and as potential buyers’ real income improves after the period of high inflation.

Beazer Homes still communicated in the Q3 earnings call that it is quite optimistic on new home sales in 2025 and beyond. It is expecting to grow revenues by around 20% in the next fiscal year. There could still be short-term turbulence ahead due to an uncertain demand picture. This will potentially cause a miss of the ambitious 20% growth target if the recovery only comes in late 2025 as Fannie Mae anticipates. However, the midterm outlook stands good with declining interest rates. The company also expects profitability to improve in the next fiscal year, but I believe that some caution is still required with the bad recent gross margin development.

Updated Valuation

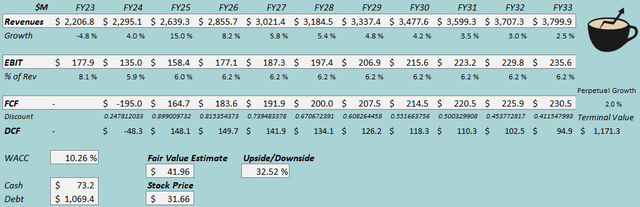

I updated my discounted cash flow [DCF] model. I now estimate better growth to be pushed back to FY2025 with just a 4.0% FY2024 growth, improving the FY2025 revenue growth outlook to 15.0% near Beazer Homes’ 20% target, still adding a margin of safety. Afterward, I estimate similar growth as previously.

With weakness in the underlying gross margin, I have adjusted my long-term EBIT margin level to 6.2% from 6.5% previously. The sustained margin level should see improvements from a good selling price, but I believe that high caution is again required in anticipating margins. I have weakened the short-term margin outlook more considerably due to the uncertain macroeconomic environment.

The cash flow conversion outlook stands similar as previously, and I again subtract capitalized interest from cash flows as I estimate unlevered cash flows.

DCF Model (Author’s Calculation)

The estimates put Beazer Homes’ fair value estimate at $41.96, 33% above the stock price at the time of writing – the stock still seems to have a good undervaluation with the outstanding community growth expectation and with a stable margin outlook. The fair value estimate is up slightly from $38.98 previously.

Also speaking for an undervaluation, the company also trades at a notable discount to its tangible book value and peers’ respective tangible P/B ratios.

Peer Tangible P/B Comparison (Seeking Alpha)

CAPM

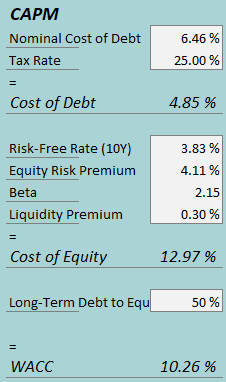

A weighted average cost of capital of 10.26% is used in the DCF model, down from 11.58% previously. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q3, Beazer Homes had $17.3 million in capitalized interest expenses, making the company’s interest rate 6.46% with the current amount of interest-bearing debt. I again estimate a 50% long-term debt-to-equity ratio.

To estimate the cost of equity, I use the 10-year bond yield of 3.83% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. I have kept the beta estimate at a high 2.15. With a liquidity premium of 0.3%, the cost of equity stands at 12.97% and the WACC at 10.26%.

Takeaway

Beazer Homes’ Q3 results came in as expected, showing a recovery into positive revenue growth but still showing a bad profitability trend. The implied Q4 outlook was cut considerably with persisting macroeconomic uncertainties, but Beazer Homes still sees better times ahead in FY2025 with growth in active communities and as the macroeconomic background starts to improve from lower interest rates.

With the mid- to long-term earnings outlook, Beazer Homes USA, Inc. stock still seems undervalued by a good margin, with the expectation that margins can at least sustain at near the current level. As such, I remain with a Buy rating for Beazer Homes.

Read the full article here