Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the last week of May.

Market Action

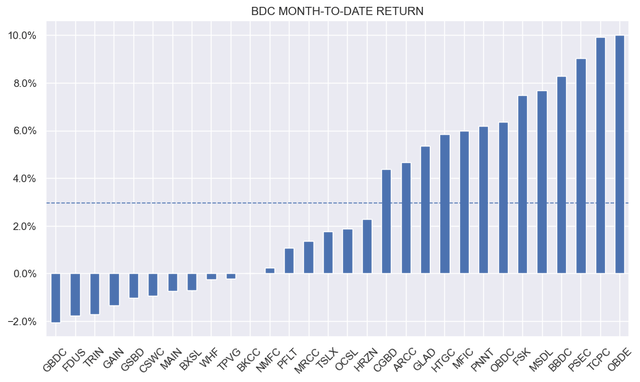

BDCs posted a good week, outperforming the broader income space. Over the month of May, BDCs in our coverage posted a 3% gain on average. The combination of higher-for-longer short-term rates and a risk-on environment helped the sector. OBDE finished in the lead in May – a stock that we added at the end of April.

Systematic Income

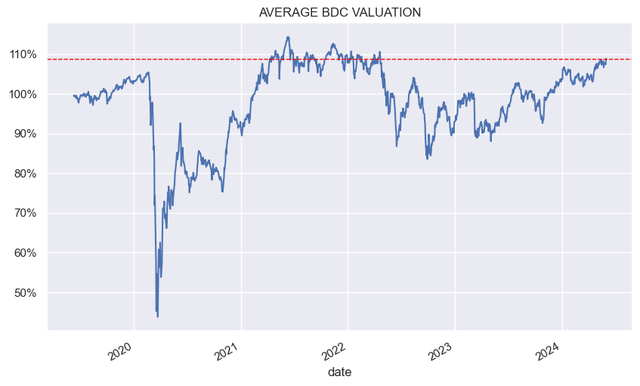

The average BDC valuation in our coverage moved to a new 2024-high – the highest level in more than 2 years.

Systematic Income

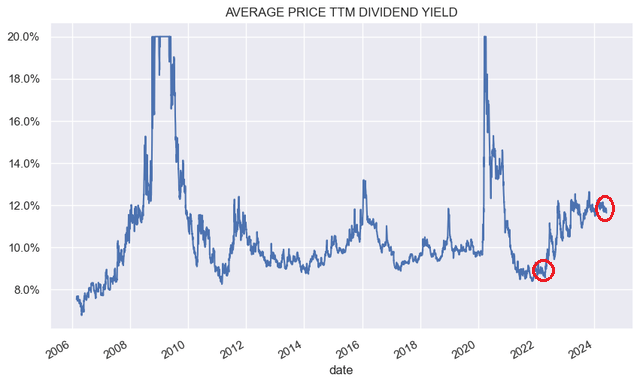

What’s interesting about this is that the last time valuation was this high, net income was significantly lower. Outside of market shocks (e.g. GFC, COVID, Energy crash), BDCs are trading at elevated yields, despite the high level of valuation.

Systematic Income

Market Themes

The Barings BDC (BBDC) team had a number of resignations earlier in the year. The issue seems to be friction between the insurance company owner MassMutual and the private credit lending team. BDCs are typically owned by alternative asset managers rather than insurance companies which mitigates any cultural issues.

There were complaints that the Barings BDC team did not get sufficient support from the parent with regard to operations, recruitment and compensation as well as the fact that MassMutual also invested in outside private debt funds. Another key factor was apparently that the company the BBDC people left for – Corinthia Global Management, which seems to be a start-up – was offering equity for new hires, pretty unusual for an asset management firm.

There were 22 resignations originally, however, on the call the company implied that only 6 people left with the remaining having been successfully retained. BBDC management did acknowledge they are looking to hire new people.

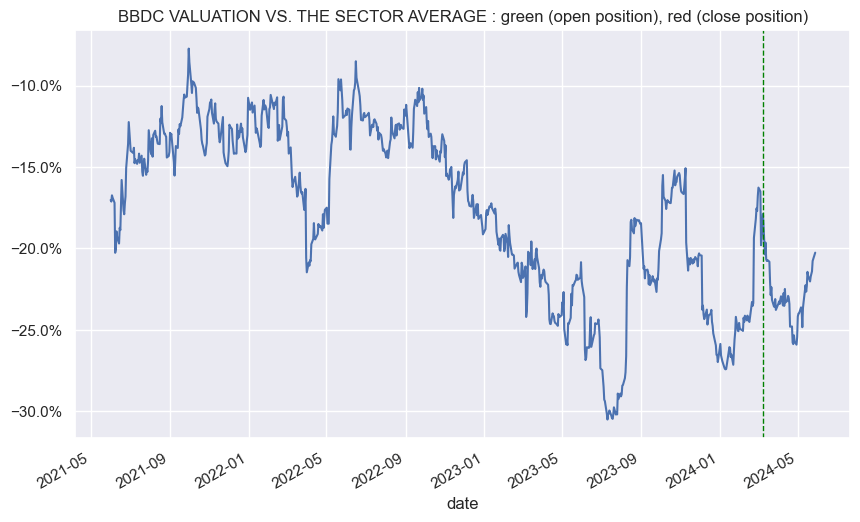

Obviously, there is some risk that the best people have left, however if it pushes MassMutual to sweeten the pot for the private lending team that could be a good outcome. Overall, BBDC has been performing in line with the sector but continues to trade at a significant discount to the average valuation.

The stock’s valuation fell sharply on the news however it has since retraced much of the drop. We recently added BBDC to our High Income Portfolio given the significant margin of safety in its valuation relative to its performance.

Systematic Income

Market Commentary

MidCap Financial (MFIC) announced an adjournment of special meetings of stockholders to allow the Apollo CEFs AIF and AFT holders additional time to vote on the merger. Recall, the company (which remains part of the Apollo umbrella) wants to absorb the capital inside the loan CEFs AIF and AFT.

From their perspective this certainly makes sense. The same capital will generate significantly more fees and will be less liable to a CEF activist takeover. From the perspective of AIF and AFT shareholders however it’s not at all obvious this is a good deal. This is particularly since both funds already have a slug of private debt but at lower fees.

It’s very likely MFIC will get the shareholder approval in the end. However, MFIC shareholders (both current and future ones coming from the CEFs) need to consider whether they want the BDC to put a lot of new capital to work at what could be the peak of the macro cycle when spreads are very tight and covenants are relatively loose.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!

Read the full article here