Investment Thesis

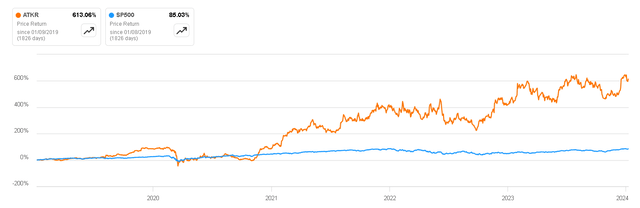

Atkore (NYSE:ATKR) has delivered an exceptional return over the past five years, outperforming the S&P500 index by a substantial margin. This robust performance serves as a strong indicator of the company’s quality and resilience.

While the business exhibits some cyclical characteristics, it benefits from various macro trends that are expected to provide significant tailwinds in the coming years. Coupled with a track record of successful acquisitions and a demonstrated pricing power, the company stands poised for double-digit growth in the top line in the foreseeable future. Even with a conservative outlook, I believe that the current price positions the company as a ‘buy’.

Price Return vs S&P500 (Seeking Alpha)

Business Overview

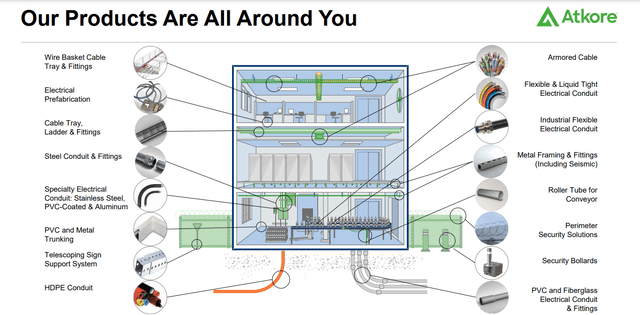

Atkore operates in the electrical raceway and cable management industry. The company manufactures and distributes a wide range of products used in the construction and infrastructure sectors, such as electrical conduits, armored cables, cable trays, and other solutions that facilitate the safe and efficient installation of electrical systems. According to the company itself, these products are ubiquitous and indispensable for the development of cities, making them mission-critical problem solvers

Atkore FY2023 Investor Presentation

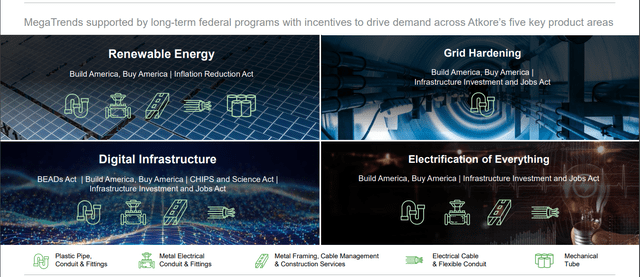

These products, although not entirely recurring and dependent on industrial and residential investments, have tailwinds in the coming years thanks to certain macro trends supported by long-term federal programs. We can mention some of them to clarify how the company can benefit in the coming years.

- Infrastructure Development: Electrification often requires the development and upgrading of electrical infrastructure, including the installation of conduits, cable management systems, and other components. Atkore, as a manufacturer of electrical raceway products, stands to benefit from the increased demand for these infrastructure solutions.

- Renewable Energy Integration: The shift towards renewable energy sources like wind and solar power involves the generation and distribution of electricity. Again, Atkore’s products may be essential in creating the necessary infrastructure to transmit and manage this renewable energy efficiently.

- Electric Vehicles: The growing popularity of electric vehicles contributes to increased demand for charging infrastructure. Atkore’s products may be used in the installation of charging stations and related electrical systems, supporting the expansion of EV infrastructure.

- Smart Cities and IoT: The development of smart cities and the Internet of Things (IOT) often relies on extensive electrical infrastructure.

- Data Centers: Data centers are facilities that house servers and other computing equipment. Atkore’s products play a crucial role in creating a structured and organized environment for the complex network of cables that connect servers, storage devices, and networking equipment with products such as cable trays, conduits, and other cable management solutions.

- Fiber Optic Networks: This is crucial for high-speed data transmission. They are used for telecommunications, internet connectivity, and various applications where fast and reliable data transfer is essential, and Atkore provides solutions for protecting and managing fiber optic cables.

Basically, in practically all current macro trends, Atkore products have a place and are entirely necessary. Whether in electrification, the Internet of Things, artificial intelligence, or digitalization, making it an extremely attractive investment case.

Atkore FY2023 Investor Presentation

Key Ratios

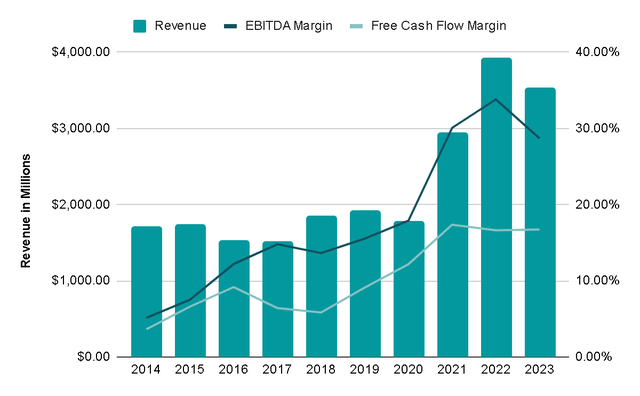

In the last decade the company’s revenue has grown 8% annually and I find it quite remarkable to mention that the company has shown extraordinary pricing power added to constant M&A activity thanks to fragmentation.

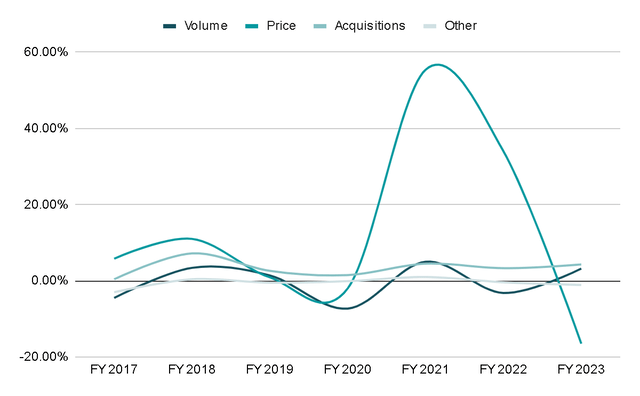

For instance, during the period from FY 2017 to FY 2023, the company achieved an average annual revenue growth of 15%. This growth was attributed to a substantial 12.7% from price increases and a further 3.4% from strategic acquisitions. These gains effectively offset a slight -0.3% decrease in volume and other factors negatively impacting growth, such as fluctuations in foreign currency exchange rates and variations in the number of business days within the fiscal year.

Thus far, we have observed that acquisitions can contribute to a steady low to mid-single-digit growth over extended periods. If volume persists, propelled by favorable macro trends benefiting the company, coupled with ongoing price increases, the growth trajectory appears promising. The prospect of achieving double-digit growth in the next decade, while initially surprising, seem feasible.

Author’s Representation

Net Sales Growth (Author’s Representation)

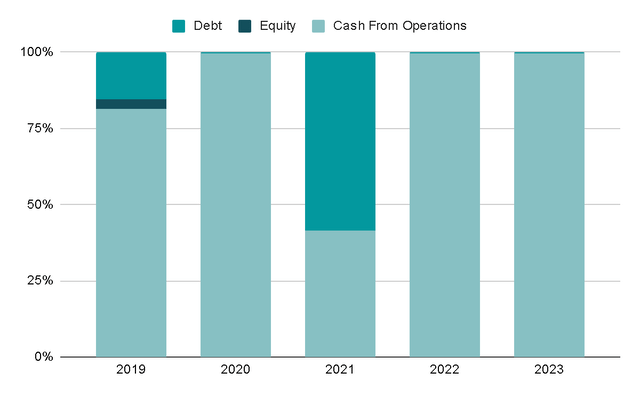

One of the aspects I appreciate most about the company is its prudent capital allocation strategy. Over the past five years, 76% of the capital has been financed through internally generated cash, with the remaining 24% primarily sourced from debt, a significant portion of which was promptly repaid. Consequently, the Net Debt/EBITDA ratio has consistently decreased, declining from 7.5x in 2014 to 0.5x today.

Author’s Representation

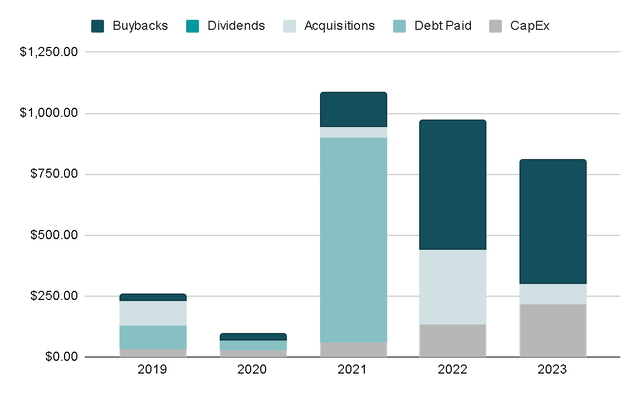

The allocation of this capital has been strategic, with 15% dedicated to cash-funded acquisitions, 26% reinvested in the business through CapEx and Working Capital, and 33% directed towards rewarding shareholders through share buybacks. Notably, the company has allocated $1.2 billion to buybacks in the last five years, resulting in the repurchase of nearly 18% of outstanding shares during this period.

Author’s Representation

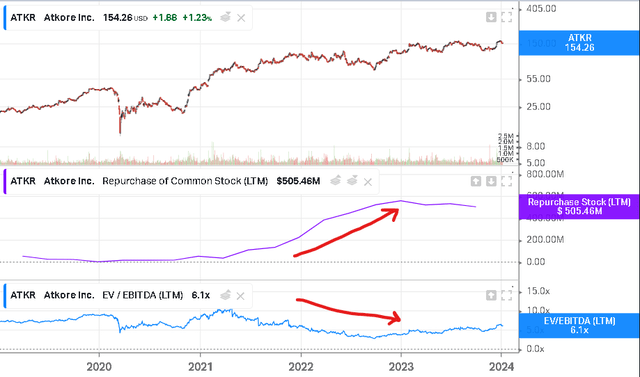

And if we take a look at how these share repurchases have been carried out, we can notice that since 2021, the more the valuation fell, the more they were allocating to repurchasing shares. This makes perfect sense to me since many companies that grow through M&A sometimes make the mistake of continuing to acquire businesses at, let’s say, 6x EV/EBITDA, when they could “buy themselves” at 4x EV/EBITDA through buybacks, which generates much greater value for shareholders.

Koyfin

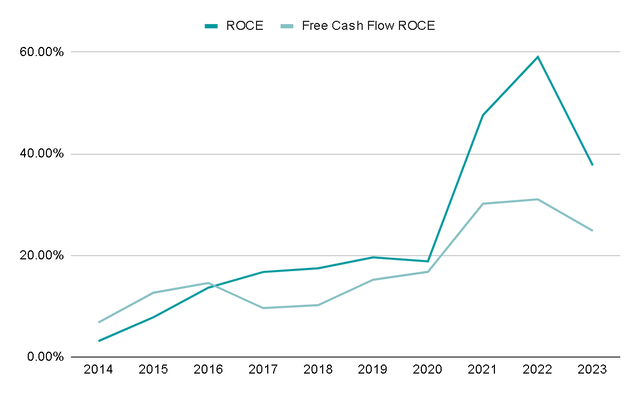

Lastly, given the company’s significant reliance on acquisitions for growth, assessing the returns generated from these transactions is crucial. One key metric for this analysis is Return on Capital Employed (ROCE), which has averaged an impressive 24% over the last decade. Notably, this metric appears to be improving each year, indicating more profitability and value creation for shareholders.

Author’s Representation

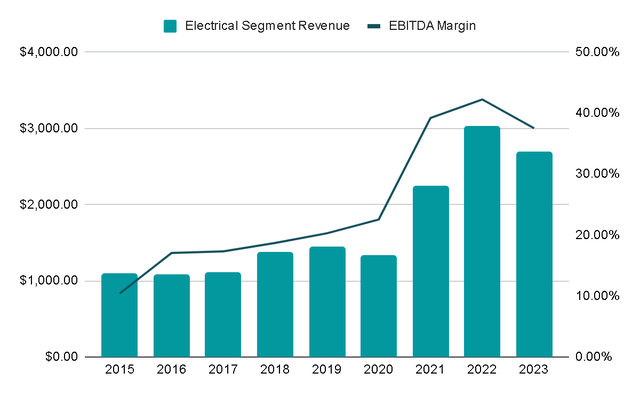

A significant portion of the increase in ROCE and margins can be attributed to the strategic acquisitions undertaken between 2020 and 2021, prompting a slight restructuring of the business. Until FY2020, the business was categorized into ‘Electrical Raceway’ and ‘Mechanical Products & Solutions,’ with average EBITDA margins of 18% and 14%, respectively. Following these acquisitions, the current structure emerged, consisting of ‘Electrical’ and ‘Safety & Infrastructure’ segments. This restructuring led to Electrical achieving average margins of almost 40%, which have proven to be sustainable since 2021, while Safety & Infrastructure experienced a modest decrease to 13%.

In essence, the company effectively enhanced profit margins through these acquisitions, showcasing that the management’s focus extends beyond mere growth for the sake of expansion. Instead, they have successfully elevated the overall business quality through strategic decisions and acquisitions

Author’s Representation

Valuation

To project potential returns following a current price purchase, I will assess revenue growth, margins, and exit multiples.

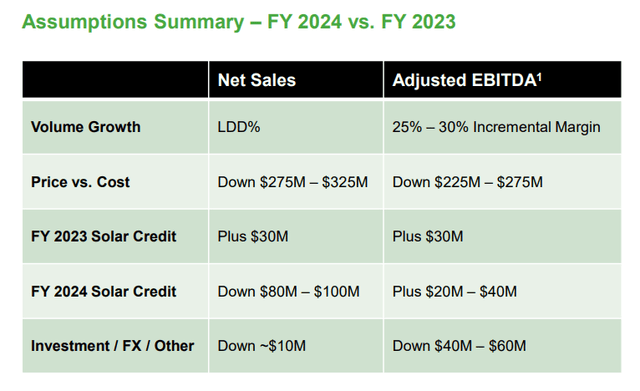

Management’s FY2024 guidance anticipates a revenue growth of approximately 2%. While this may seem modest, a closer look reveals that the growth composition includes low double-digit volume expansion, offset by price reductions and other one-off detractors. Assuming stable prices and the resolution of these one-offs, an increase of 3-4% for acquisitions, and at least 5% for volume seems realistic. However, to be conservative I will estimate 5% annual revenue growth for the next 5 years.

Atkore FY2023 Investor Presentation

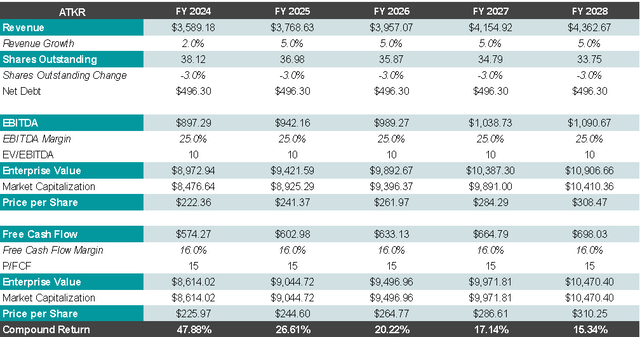

If these assumptions hold, maintaining current margins, and applying exit multiples of 10x EV/EBITDA and 15x Free Cash Flow, a projected price per share of approximately $300 USD could be expected. This projection implies an attractive annual return of 15% over the next five years.

Author’s Representation

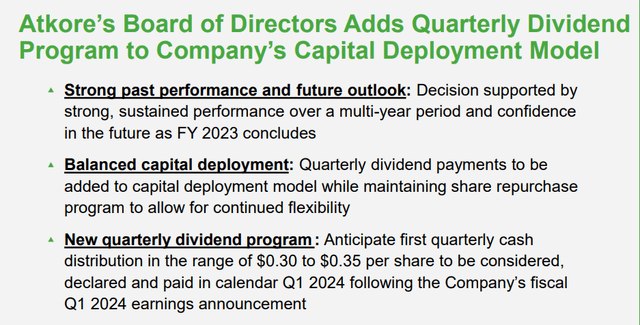

Additionally, management’s plans to initiate dividend distribution in FY2024 add further value. For Q1 2024, they anticipate distributing between $0.30 and $0.35 per share, resulting in a modest dividend yield of around 0.8% when annualized. This distribution represents around 10% of the Free Cash Flow generated in the last year.

Atkore FY2023 Investor Presentation

Risks

While the investment thesis for Atkore appears compelling, it’s essential to acknowledge the potential risks that the company faces.

Firstly, Atkore’s financial performance is inherently tied to overall economic conditions. Economic downturns can lead to delays or reductions in construction and infrastructure projects, impacting the demand for Atkore’s products. Despite the company having tailwinds for future growth, it remains susceptible to economic cycles.

Moreover, Atkore operates in a competitive market where competition from other manufacturers of electrical raceway and cable management products could influence market share and pricing dynamics. While factors like reputation and reliability play a fundamental role in customers’ choices, it’s also true that there is limited differentiation among products offered by Atkore and competitors such as nVent. This competitive landscape adds an additional layer of consideration when assessing potential risks for the company.

Final Thoughts

When I first encountered Atkore, the company had not yet reported results for FY2023, and uncertainties lingered regarding the trajectory of its performance in the coming years, particularly amid a decline in revenue. The landscape has since evolved, and it appears that the downturn has bottomed out, with gradual signs of growth emerging.

Notably, the company had demonstrated robust growth through price increases and strategic acquisitions, yet volume remained a challenge. However, there are indications that this aspect is also undergoing positive changes. Coupled with a proactive capital allocation strategy and an attractive valuation, the current outlook positions Atkore as a promising investment.

Considering the company’s positive attributes and the mitigated risks, I have decided to assign Atkore a ‘buy’ rating.

Read the full article here