Assurant (NYSE:AIZ) is a relatively unknown insurer that operates in niche markets with recurring revenue. The firm has translated its focus and good operational execution into consistent long-term growth. It has returned cash to shareholders through share buybacks and dividends. Although the yield is low, the 20-year streak of annual increases and excellent safety is appealing. Even with the current runup in share price, it is trading at a reasonable earnings multiple. I view Assurant as a long-term buy for dividend growth investors.

Overview of Artesian Resources

Assurant, Inc. traces its history to 132 years ago. In its present form, it was spun off from Fortis, the Dutch financial conglomerate, in 2004 and renamed Assurant. Currently, the company is headquartered in Atlanta.

After a series of acquisitions and divestments, the insurance company operates two main segments: Global Housing and Global Lifestyle. Global Housing offers lender-placed homeowners, multi-family and condominium, and manufactured housing insurance. Global Lifestyle sells insurance for mobile devices, consumer electronics and appliances, credit and other insurance products, and vehicles.

Total revenue was more than $11,131.6 million in 2023 and $11,562.2 million in the last twelve months (“LTM”).

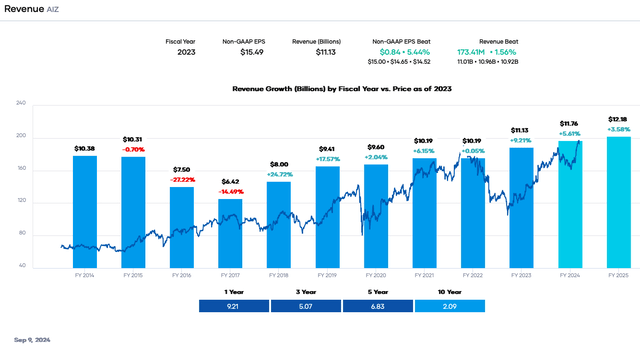

Revenue and Earnings Growth

Assurant’s revenue and earnings per share (“EPS”) have grown consistently since 2017, when they were at a low point in the past decade. I last covered Assurant in September 2020 with a buy rating. Since then, the insurer has sold its Global Preneed segment in 2021 and focused on Global Housing and Lifestyle. Preneed was not a large segment compared to the other two, so it did not materially change the overall business.

The firm reported second quarter results on August 6, 2024, that beat top and bottom-line estimates. The share price surged in response, reaching a peak of $199.50 before dropping to its current value. Assurant expects further growth in 2024 because of the Global Housing segment’s growth and small acquisitions like iSmash in Global Lifestyle.

However, the revenue growth rate has been volatile because of acquisitions and divestments over the past several years. It has varied from as little as low single digits to as high as about 25%. However, the insurer’s two main business lines are capital light with recurring revenue. Most of the risk-based insurance lines were sold. Hence, looking forward, we expect low single-digit growth rates because of organic customer addition and price increases.

Portfolio Insight

Global Lifestyle sells subscription-like insurance that generates a recurring stream of revenue. Also, losses tend to be smaller. Items like mobile phones, electronics, and appliances only have a replacement cost of hundreds to a few thousand dollars.

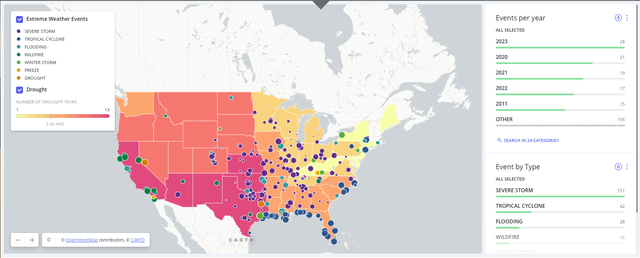

That said, housing insurance revenue is more volatile. Revenue should climb in parallel with housing unit growth, which grows slowly but consistently each year. Even during the subprime mortgage crisis, the number of units rose, albeit at a slower rate. However, this segment can potentially experience catastrophic losses due to weather-related events. Storms, hail, tornados, and hurricanes will damage housing resulting in claims.

St. Louis Fed

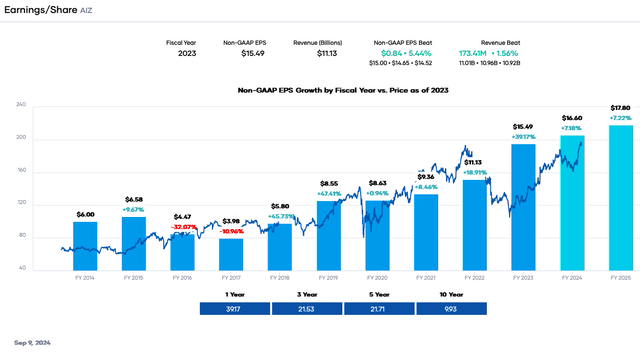

Similarly, EPS has grown consistently since 2017 because of recurring revenue streams, beneficial acquisitions offsetting divestments, and greater operating margins. Additionally, higher interest rates have benefitted investment income since the COVID-19 pandemic. Earnings per share have also been boosted by consistent share repurchases that have lowered the share count.

Portfolio Insight

Because of the positive trends, the share price continues to rise over time. However, the COVID-19 pandemic pressured the share price. In addition, 2023 was a difficult year for home insurers because of natural disasters and severe weather. That said, positive top and bottom-line trends have caused investors to bid up the share price. It is up ~14.7% year-to-date and ~38.6% in the past twelve months.

Recent Challenges and Risks

Assurant’s challenges are related to the slow growth of insuring mobile phones, electronics, and appliances. These categories are cyclical, and growth will be based on product releases. Moreover, these markets are saturated, and most people have all the products they need. This will likely keep a cap on growth rates.

The greater risk is catastrophic losses related to severe weather and other events. High housing growth is occurring in areas that are prone to weather-related catastrophes. For instance, Florida is prone to hurricanes, severe storms, and flooding. Texas also experiences hurricanes, hail, wildfires, and tornados. They are unpredictable but will affect revenue and EPS. The chart clearly shows that the number of billion-dollar extreme weather events has increased from 2011 to 2023. In addition, many are concentrated in higher population growth states.

Center for Climate and Energy Solutions

Lastly, investment returns and interest rates influence the insurance company’s results. The probability of losses exists if investments are too risky or interest rates change quickly.

Competitive Advantages

Assurant’s competitive advantage is its focus on niche markets with fewer players. Also, the firm’s two insurance lines are capital-light and less risk-based, with recurring revenue streams.

Dividend Analysis

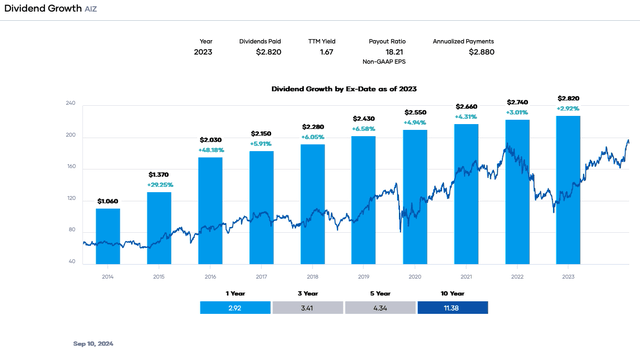

Assurant’s share price increase has caused the dividend yield to drop below its 5-year average of 1.8%. The forward yield is now only ~1.5%. The yield occasionally rises over 3%, but it is rare.

Additionally, Assurant is a Dividend Contender with a 20-year streak of increases. The annual growth rate has been about 4% to 4.5% in the past five years. It was higher before that, and the 10-year rate is over 11%. However, the annual increases are slowing even though the payout ratio is modest at around 18% because of a focus on share buybacks. We expect low single-digit dividend distribution increases over the next few years.

Portfolio Insight

The dividend is supported by solid safety. The payout ratio is ~18% based on an estimated fiscal year 2024 EPS of $16.60. This value is well under our threshold of 65%. Free cash flow (“FCF”) of $935.6 million easily supported the dividend requirement of $152.3 million in 2023. The dividend-to-FCF ratio of 16.3% is well below our desired value of 70% or better. The firm has an A+ (Superior) rating from A.M. Best, and the credit rating agencies give it an A/A2, upper medium investment grade rating.

Lastly, Assurant receives an ‘A+’ dividend quality grade from Portfolio Insight, a measure of earnings performance, revenue performance, dividend performance, profitability, and financial strength. The net result should be investor confidence about dividend safety.

Valuation

The rising share price has benefitted extant owners. That said, the decline in 2022 – 2023 was severe, and the valuation is still reasonable and below the long-term averages. The forward price-to-earnings (P/E) ratio is 11.6X below the trailing five- and ten-year ranges.

Analysts estimate the insurance company will earn $16.60 per share in fiscal 2024, roughly 7% more than in 2023 and much higher than in 2022 because of higher investment income and lower losses. We will use 14X as the fair value multiple near the long-term average. As a result, our fair value estimate is $215.80. The present share price is ~$193.26, suggesting that Assurant is undervalued.

Applying a sensitivity calculation using P/E ratios between 13X and 15X, we obtain a fair value range from $215.80 to $249.00. Hence, the stock price is approximately 78% to 90% of the fair value estimate.

Estimated Current Valuation Based On P/E Ratio

|

P/E Ratio |

|||

|

13 |

14 |

15 |

|

|

Estimated Value |

$215.80 |

$232.40 |

$249.00 |

|

% of Estimated Value at Current Stock Price |

90% |

83% |

78% |

Source: Dividend Power Calculations

How does this calculation compare to other valuation models? Portfolio Insight’s blended fair value model, combining the P/E ratio and dividend yield, estimates a fair value of $276.61 per share. The two-model average is ~$254.51, indicating that Assurant is very undervalued at the current price.

Final Thoughts

Insurance companies can make decent investments provided they are managed conservatively and do not take too much risk. Mispricing insurance lines and risky investments will usually lead to losses. That said, Assurant is capital-light and focuses on recurring revenue. It is not immune to catastrophic losses but has executed well, resulting in consistent long-term growth. Even with a climbing share price, the equity is still undervalued based on historical metrics, and Seeking Alpha’s analysts’ and quantitative ratings are optimistic. Also, the dividend growth streak and safety are attractive. I view Assurant as a long-term buy.

Read the full article here