In mid-June, I called out Ascend Wellness (OTCQX:AAWH) as the cheapest cannabis MSO. The stock has rallied 43% since then, but this rally was mainly due to the pending potential rescheduling of cannabis that would wipe out the punitive 280E tax that impacts the entire group of operators. I reviewed the stock in mid-September after the news had broken and called it still very cheap. It has declined 10% since then, but its peers have fallen a lot more.

Today, I review what has happened in the 8 weeks since I last wrote about the company, including their Q3 pre-announcement, and I assess the outlook, the chart and the valuation. I also explain why I recently reduced my exposure significantly in my model portfolios that I run.

Q3

On 10/25, the company announced that its Q3 revenue will be approximately $140 million, which is ahead of the expectation at the time of $127 million. Adjusted EBITDA had been expected to be $22 million, but the company shared that it will be $27-29 million. The company will host a call this week on the 7th to discuss it more, but it didn’t really explain the strength. In addition to the pre-announcement, the company revealed that it has a new CFO and some other new members to its leadership team. A few days after the pre-announcement, AFC Gamma (AFCG), a REIT, revealed that the former AAWH CFO is now its CEO.

The Outlook

While the strength in revenue, adjusted EBITDA and free cash flow during the quarter was good to see, the company didn’t provide any sort of outlook in the press release. The analyst estimates didn’t rise substantially after the positive pre-announcement. Two months ago, the analysts were projecting revenue for 2023 of $496 million, according to Sentieo. Now, they expect it to increase 25% from 2022 to $507 million. Adjusted EBITDA was previously expected to be $94 million, and now they project that it will increase 5% to $97 million. This jump is less than the amount by which it exceeded the Q3 estimates.

For 2024, analysts were looking for revenue to be $565 million with adjusted EBITDA of $124 million. Now they project revenue will grow 13% to $571 million with adjusted EBITDA growing 28% to $125 million.

For 2025, there are just two analysts providing estimates currently. They anticipate that the company will generate slightly higher revenue at $573 million. The adjusted EBITDA is projected to be 9% higher at $139 million, a 23.6% margin.

The Chart

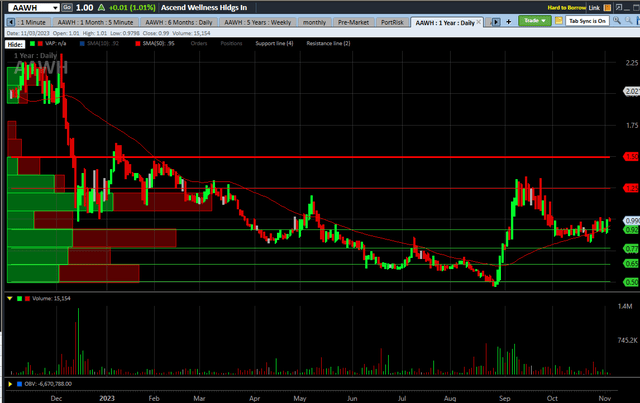

Ascend dropped almost 82% in 2022, and it is down 13% in 2023. Here is the action over the past year:

Charles Schwab

In my September write-up, when the stock was $1.11, I suggested that $1.25 could be resistance. It closed above there just one day and then pulled back to $0.82. I still see resistance at $1.25 and then $1.50. I also see support in the $0.75-0.95 area.

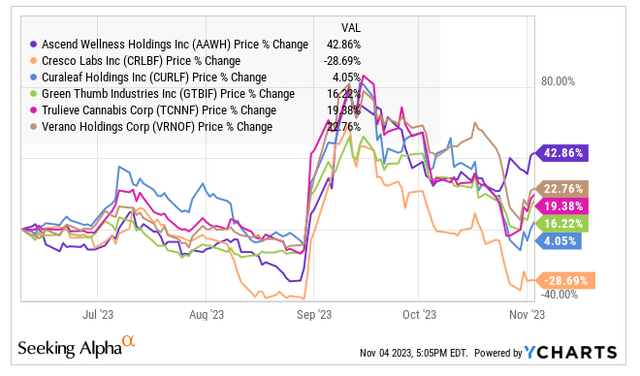

Since my June write-up, the stock has outpaced its peers. I consider Ascend as one of the Tier 2 names, and the three others are Ayr Wellness (OTCQX:AYRWF), Cannabist (OTCQX:CBSTF) and TerrAscend (OTCQX:TSNDF). Ascend, up 43%, has rallied slightly more than Ayr, up 42%, while TerrAscend has declined a bit and Cannabist has dropped a lot. It has outpaced all of the Tier 1 names:

YCharts

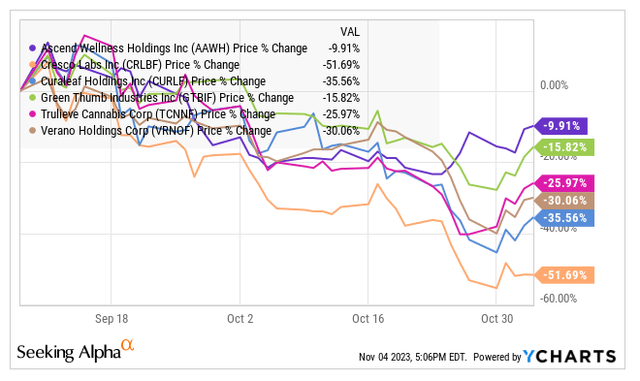

Ascend has outpaced all of the Tier 1 names since the September article too:

YCharts

The performance relative to the Tier 2 names has been more outstanding, as the others have declined substantially more. TerrAscend has dropped 26%, Ayr Wellness has plunged 55% and Cannabist has fallen 65%.

Valuation

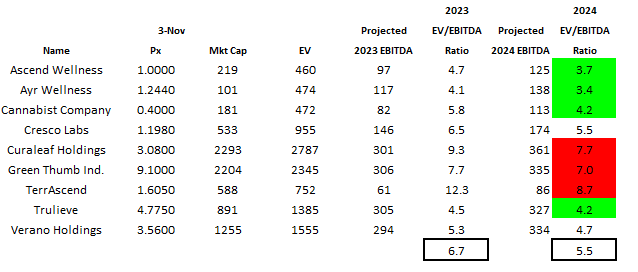

Ascend is cheap, but its cheapness no longer stands out like it did in the past. Here are the Tier 1 and Tier 2 names with their enterprise values compared to their projected 2024 adjusted EBITDA:

Alan Brochstein using Sentieo data

Trulieve (OTCQX:TCNNF) is the cheapest Tier 1 name by far. Ascend is below the average of the 9 companies but now valued more highly than Ayr. Two months ago, it was valued below Ayr.

Where Ascend trades in the future depends highly upon whether 280E gets wiped out. If it remains, I expect that the price could fall as the company will likely struggle with its debt. If it goes away, AAWH will likely soar. For year-end 2024, I think that the market will be looking at estimates for 2025. I project that in the bullish scenario, the stock could trade at an enterprise value to adjusted EBITDA ratio of 8X. I am using 230 million shares, which includes about 7 million options and warrants that will be exercised. I reduce the current net debt of $242 million by these exercises totaling $27 million. This valuation ratio of 8X is far lower than where the stock traded in 2021 and works out to $3.90, substantially higher.

Why I Reduced Exposure

I was very long AAWH in both of my model portfolios when the company pre-announced Q3. Now, I have no position in my Beat the Global Cannabis Stock Index model portfolio. It’s not in that index. I have reduced my exposure from 25% or so to now 6% in the Beat the American Cannabis Operator Index model portfolio. This is less exposure than its weight in the index.

AAWH is not as cheap as it was, though perhaps the company will provide a good reason for its Q3 results being so far ahead of expectations. I noted that the analysts did not raise their 2024 and 2025 projections much, and I saw the price go a little higher while peers were moving lower. MSOs seem cheap to me, especially if 280E goes away, as their cash flow will improve and better position them to deal with their debt.

Conclusion

I still like Ascend, though I don’t include any in my Beat the Global Cannabis Stock Index model portfolio and have just a small position in my Beat the American Cannabis Operator Index model portfolio. The stock was very cheap previously and it is somewhat cheap now. The future performance will be tightly related to whether 280E taxation gets eliminated.

In my main model portfolio, I have MSO investments similar in size to the exposure of the Global Cannabis Stock Index at about 22%. My largest sub-sector exposure is to ancillary stocks, as I think they offer lower risk due to their low valuations and their better balance sheets. I also have big positions in a couple of Canadian LPs, which trade below tangible book value.

Ahead of the upcoming earnings reports, I think that investors can pause on Ascend Wellness and pick other MSOs or stocks from other sub-sectors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here