Peter Lynch on “Junk”

Firstly, I am by no means labeling Ares Capital (NASDAQ:ARCC), “junk”. It’s basically what they invest in. Yes, business development companies are a more polite and eloquent way to put it, but the principal business is to invest in a diversified manner into both private and public below investment grade credit. Ares Capital does this better than most and is one of the few “blue chips” when it comes to this unique segment of the stock market.

“You can make a halfway decent case for investing in a junk-bond fund, or in a blended fund that offers a mix of corporate and government paper that produces a better overall yield than you could get from investing in a lone bond. What I can’t figure out is why anybody would want to invest all his money in an intermediate- or long-term government bond fund. A lot of people do. More than $100 billion is invested in government bond funds today.”- Peter Lynch Beating The Street p. 57

Lynch was a fan of junk to an extent, and hired a junk bond fund manager to be a part of the fixed income department for a non-profit he was running at the time, circa the early 1990s. He went on to state that junk can be very profitable, you just don’t want to bet the ranch on it. I agree, several analysts are starting to recommend specialty credit as a part of the fixed-income portion of their investor’s portfolios. Lynch also stated that you’re better off buying this exposure through a fund versus single issues. I couldn’t agree more and Ares Capital fits that bill as one of the best risk managers in the space.

Regarding long-term government debt, Lynch states in both of his popular stock picking books, One Up on Wall Street and Beating The Street, that you must wait for the 10 or 20-year issues to yield at least 6% more than the S&P 500 dividend yield before considering locking your money into single issues of government debt. With The S&P 500 (SPY) yielding 1.56% in dividends, we would need to wait until the 10-year yields at least 7.5% before considering. He hated that fixed income had no element of growth to the yield, so you had better lock in an ultra-high rate to be competitive with stock returns over a decade.

The Howard Marks “Checklist”

Howard Marks has been making the rounds and making the case for specialty credit. I covered his comments from Further Thoughts on Sea Change in my article about Oaktree Specialty Lending (OCSL). Subsequent interviews have added color. Before we visit where Marks thinks the “sweet spot” is for the FED funds rate, let’s revisit his checklist from Mastering The Market Cycle and ask ourselves where we are regarding the specialty lending opportunities:

From the 2006 Howard Marks memo “It Is What It Is”:

| Economy: | Vibrant | Sluggish |

| Outlook: | Positive | Negative |

| Lenders: | Eager | Reticent |

| Capital markets: | Loose | Tight |

| Capital: | Plentiful | Scarce |

| Terms: | Easy | Restrictive |

| Interest rates: | Low | High |

| Yield Spreads: | Narrow | Wide |

| Investors: | Optimistic | Pessimistic |

These are non-scientific measures of the economy. We ask ourselves these questions and according to Marks, if we have more check marks in the left than the right-hand column, hold on to your wallet. The reverse is true, especially for BDCs when you have more marks on the right-hand column.

In my opinion, I have one check on the left, regarding a rather vibrant economy at the moment, and 8 on the right-hand side. With the most risky of credit assets, credit cards hitting APRs in the upper 20s, the yield spread is widening. Business loans and alternative construction loans are well into the 12% range.

The FED funds sweet spot

Marks believes the sweet spot for the Federal Funds rate to where BDCs should be competitive with equity returns is 2-4%. 0% is an emergency measure which he believes we should never return to. With this higher-for-longer narrative in effect, BDCs should do well. Also, these returns are contractual versus implied for the equities market. Marks also believes the returns on a well-diversified and managed BDC should be safer than equities in the next decade with more restrictive covenants in case of default.

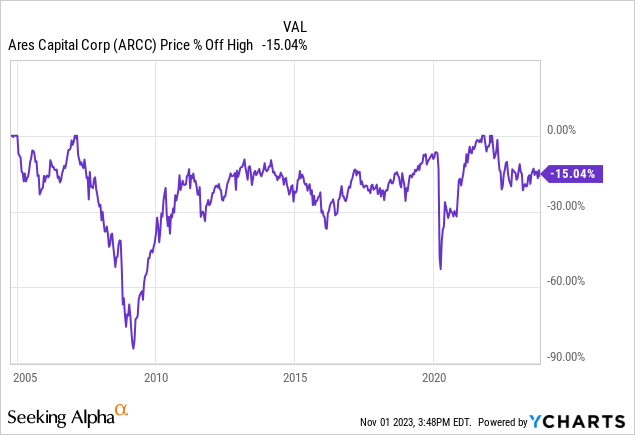

The chart

Back to ARES, this is a well-covered BDC, but we always like to look at the chart versus history to see where we’re at:

At about 15% off the highs, this is most likely a function of the risk-free rate increasing and becoming more competitive with high-yield credit. If the credit market continues to tighten, the yield spreads should continue to widen for ARES as more companies are forced to borrow from alternative lending as traditional bank appetite wanes. This could result in more capital appreciation from these prices should we see more floating rates reset and more new loans being made at higher and higher rates.

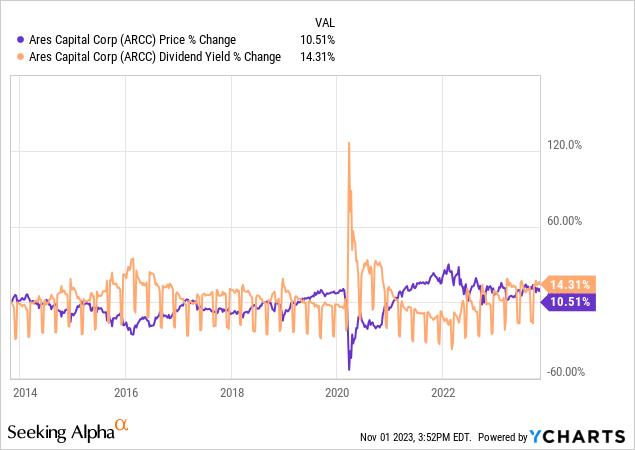

Heat check

A Peter Lynch basic throughout his books is comparing the growth in EPS to the growth in share price. When the growth in share price exceeds the growth in earnings, he stays away from the “hot” segment. As 90% of a BDC’s profit is paid out as a dividend by law, the dividend growth rate is an excellent proxy for earnings growth. Here we can see the 10-year yield growth at 14.3 % versus the share price change of 10.51%. Again, the dividend in this case is the ROI more so than capital appreciation. The stock is not trading at a premium to its dividend growth rate at this time. Positive outlook.

Share price should track dividend growth rate

This is a pretty tight line outside of market crashes where the yield spiked as a function of a sharp drop in a “black swan” event. The COVID-19 dip was an opportunity for many investors as companies were able to access PPP loans to stay current on their debt and operating costs. In normal times, the share price functions quite logically, straddling dividend growth rates .

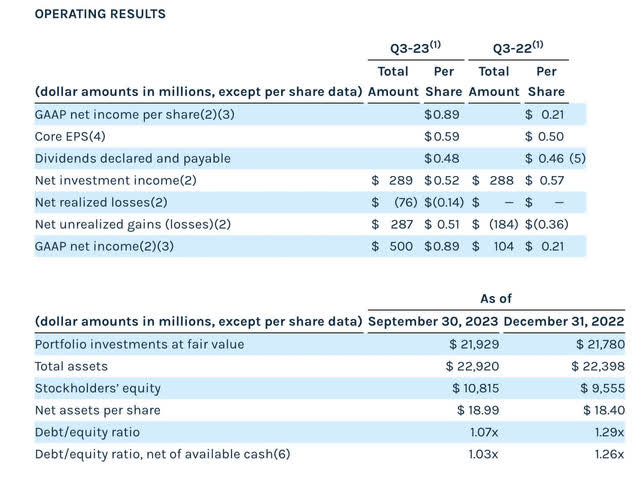

Ares portfolio

ir.arescapitalcorp.com

| GAAP net income per share growth YOY MRQ | 323% |

| Core EPS growth YOY MRQ | 18% |

| Dividend payable growth | 4.34% |

BDCs have had a banner year and ARES MRQ results exemplify that growth. The company has also de-levered and now has debt-to-equity ratio near 1 X.

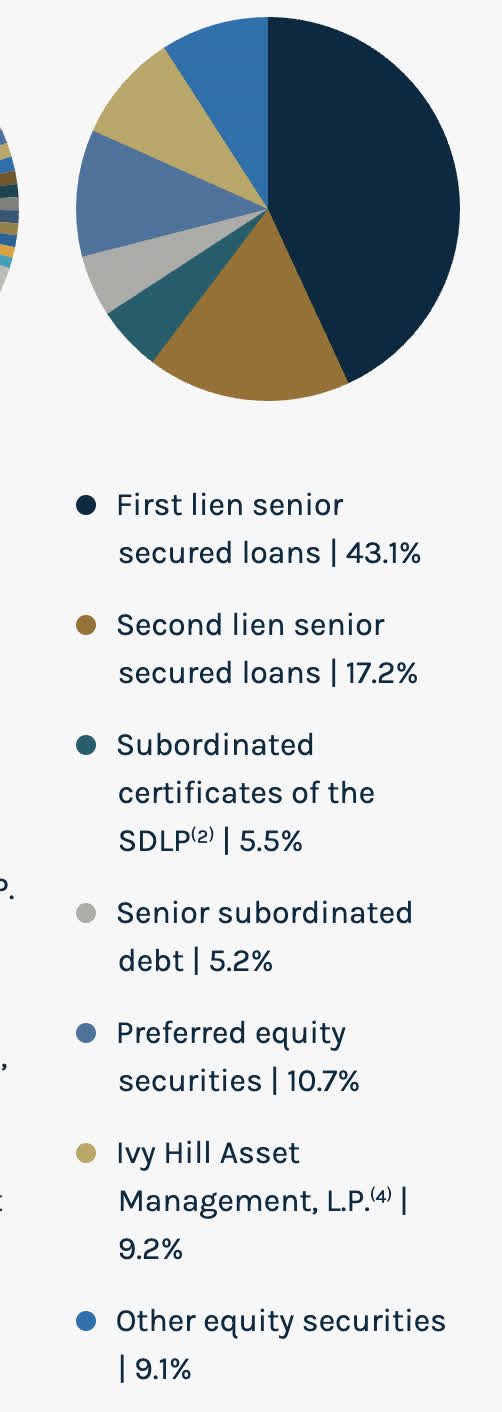

MRQ Portfolio Composition

From ARES Investor Relations:

As of September 30, 2023, Ares Capital Corporation’s (“Ares Capital” or “ARCC”) portfolio had a fair value of approximately $21.9 billion, and consisted of 490 portfolio companies backed by 228 different private equity sponsors. Ares Capital has a diversified portfolio in terms of issuer concentration, asset class, industry sector and geographic representation.

arescapitalcorp.com/portfolio

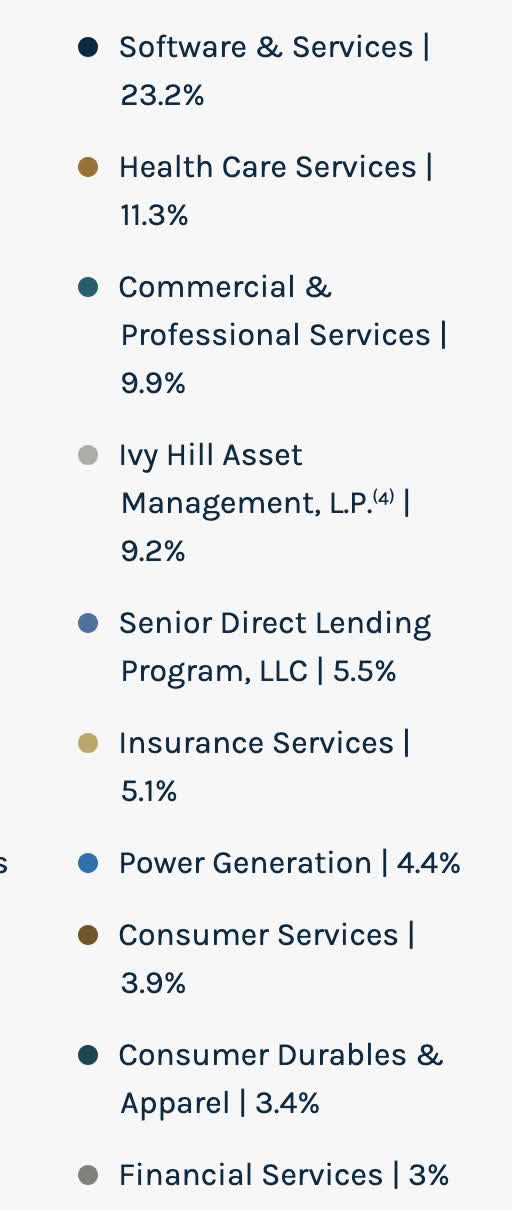

Portfolio loan sector composition

arescapitalcorp.com/portfolio

A similar set up we’re seeing all across the BDC industry is a higher weighted average towards tech. With less tangible assets these companies can have lower operating costs that are obligated, such as property taxes and insurance. They also may have better options to raise equity to make interest payments. As Marks points out, most corporate debt doesn’t get paid off, it just gets rolled over. Making sure you’re both as high as you can get on the capital stack and have a company with fewer obligations ahead of your interest payments is the key.

In the case that these companies default, the tighter credit market is making it easier to secure better rights than previously. These are all positives for specialty credit.

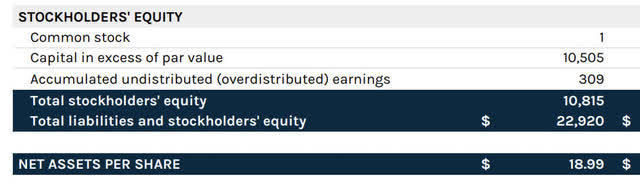

NAV

ir.arescapitalcorp.com

Currently trading at $19.19, a 1.01 X multiple of NAV as of November 1st, 2023. A small premium.

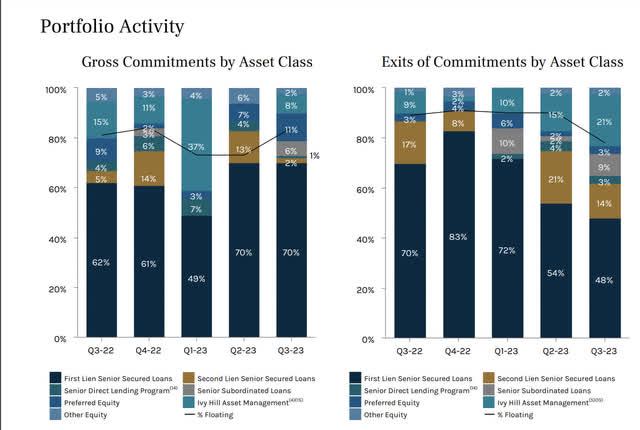

Underneath the surface of alternative credit trends

ir-api.eqs.com

Underneath the surface of the portfolio churn, we can see from ARES as a proxy, for what the direction of specialty credit looks like at the moment. New commitments are trending towards first-lien senior secured with a higher percentage of floating rates. The exits are the opposite trend. This is exactly the trend line that Howard Marks harps on in his memos and books. The credit tightening cycle will force good companies with bad balance sheets into higher rates, optimally floating, with more restrictive terms. These are positive trends in the BDC space.

Risks

As Marks has recently been quoted, specialty credit will do well when the FED rate is at least in the 2-4% range. A quick reduction in interest rates for whatever reason it may be, could at least send the perception to the market that BDCs will soon go back in the direction of less senior, less floating rate, and lower rates. I could envision not the state of the economy leading to stimulative measures by the FED and rate cuts, but rather costly wars either in person or by proxy by the U.S. The FED indirectly affects the 10-year Treasury by lessening demand through the increase in yield on the short end of the yield curve.

The 10-year is the primary instrument the government uses to finance its ongoing business, expansion, and Defense. With rates having nearly quintupled since COVID on the long end of the spectrum, Marks may be underestimating that interest payment expense by the US government may result in an emergency all on its own. Stanley Druckenmiller recently was quoted saying that Janet Yellen’s biggest blunder was not refinancing all of the government debt during COVID at ultra-long durations and ultra-low rates.

As more criticisms over not refinancing government debt at low rates take hold, the more the government will consider taking this route at the first ray of sunshine it gets. There may be some sort of quick cut back to near zero in the future if the demand is there, followed by a huge long-duration Treasury issuance.

Summary

ARES is an exemplary example of a BDC taking advantage of all the right things that alternative credit should be doing at this time. It is following Marks’ philosophies and predictions to a tee. Higher rates, higher capital stack positioning, and floating trends are encouraging in ARES portfolio activity. As Peter Lynch would wonder, if you have a good “junk” manager, why would you settle for a standard bond return unless it was at least 600 basis points higher than the S&P 500 dividend yield?

Only specialty credit funds and junk bonds as a fixed-income asset class can compete with implied equity returns and they are on a contractual basis. If you believe in “higher for longer”, this is a great buy.

Read the full article here