Investment thesis

Our current investment thesis is:

- Amdocs is a fantastic business that could represent a low-risk staple in most portfolios. The company has an NTM FCF yield of ~8% and limited margin variability. Its growth will not set the world on fire but there are sufficient tailwinds to ensure above-inflation growth long term.

- From a downside perspective, investors are protected by the long-term relationships the company has developed, its market-leading capabilities, and its consistently high backlog. It’s a critical support function for many leading telecoms/media companies, limiting lost contracts.

Company description

Amdocs (NASDAQ:DOX) is a leading software and services provider to the world’s most successful communications and media companies. With a range of innovative solutions, Amdocs helps service providers deliver a seamless customer experience, enabling them to navigate the challenges of the digital world.

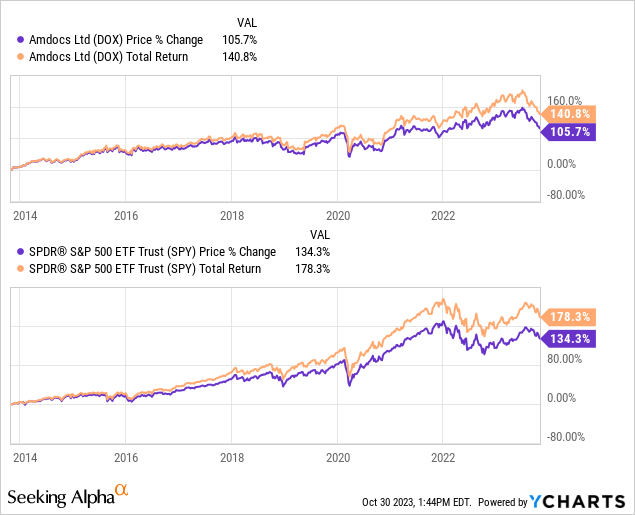

Share price

Amdocs share price performance has been respectable, returning over 100% to shareholders and slightly lagging behind the wider market. This has been generated through positive financial improvement and a moderate development of its valuation/investor sentiment.

Financial analysis

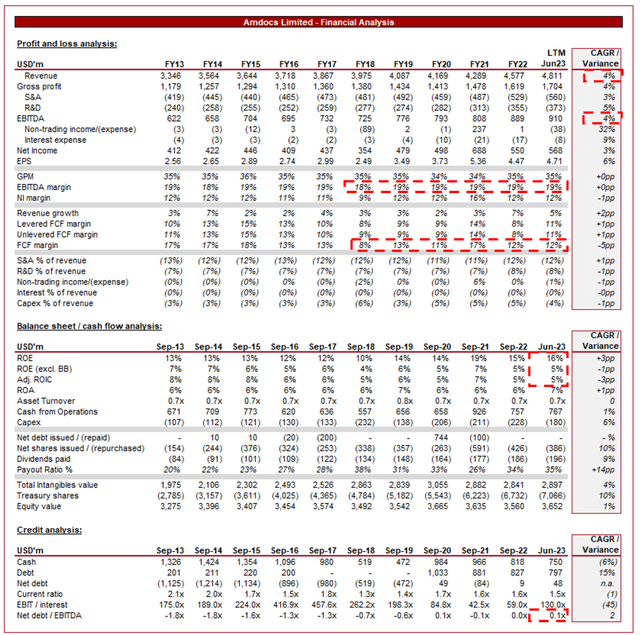

Amdocs financials (Capital IQ)

Presented above are Amdocs’ financial results.

Revenue & Commercial Factors

Amdocs’ revenue has grown moderately well during the last decade, with a CAGR of +4%. This growth has been consistent, fluctuating between 2-7%. EBITDA’s consistency has exceeded even this, with margins between 18-19%.

Business Model

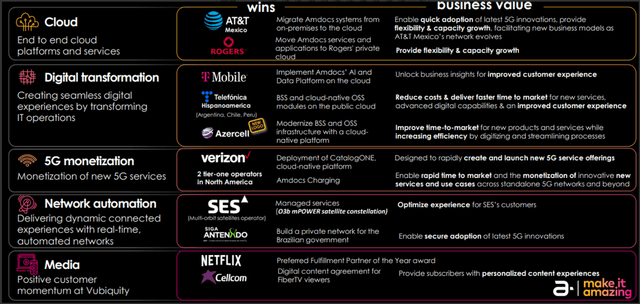

Amdocs offers end-to-end solutions for telecommunications and media companies. Its suite includes customer relationship management, billing, data analytics, digital services, and more. By providing a comprehensive set of services that are constantly expanding, it becomes a one-stop solution for its clients, fostering long-term partnerships. Amdocs has a strong global presence, serving clients in numerous countries.

The following are examples of projects currently progressing with leading firms across a range of services.

Projects (Amdocs)

By specializing in the telecommunications and media sectors, Amdocs tailors its services to the unique challenges and needs of these industries, allowing the company to specialize and hone deep domain expertise. This creates a positive innovation cycle, allowing for an understanding of sector-specific weaknesses and areas of exploitation.

Amdocs invests significantly in R&D, ensuring its technologies remain cutting-edge. Most recently, this development has been in the areas of AI-driven analytics, cloud-based services, 5G, and digital transformation tools. We believe its services in these segments will drive revenue growth in the coming years, particularly if its AI solutions are compelling relative to its alternatives. Amdocs’ relationships with leading providers have fostered trust, allowing it to pitch these new solutions and generate upselling potential.

Amdocs strategically acquires companies that complement its services or provide access to new technologies and markets. These acquisitions broaden its offering and have allowed it to strengthen its competitive position, contributing to consistent growth and margin protection.

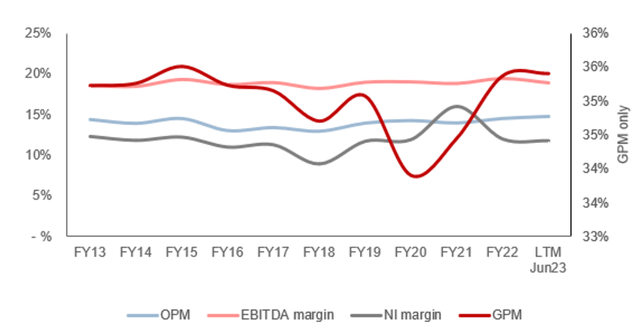

Margins

Margins (Capital IQ)

Amdocs’ margins have been impressively consistent, with minimal volatility during the last decade. This is a reflection of its strong competitive position, allowing the company to maintain progressive pricing at its margin premium without dilution. This said, the company lacks any material economies of scale beyond its existing level, likely due to reinvestment of any gains into customer acquisition to drive revenue.

Quarterly results

Amdocs’ impressive resilience is reflected in its recent performance, with top-line revenue growth of +7.3%, +7.3%, +6.8%, and +6.5% in its last four quarters. In conjunction with this, margins have continued to remain flat.

The company’s strong results are a reflection of the ongoing nature of the services the company provides. It has a ~100% managed service renewal rate, with a number of multi-year relationships with leading companies in the space. This has allowed the company to develop a strong backlog and pipeline, allowing for a de-risked revenue unwind and a focus on future revenue generation.

The broader macroeconomic environment will have an impact on the company, as softening consumer spending and inflationary pressures on supply chains contribute to financial pressure on the communications and media industry. This has contributed to softening backlog growth, although an economic recovery in the next 12-18 months will likely mean the impact on the company is not significant.

Key takeaways from its most recent quarter are:

- Revenue growth in North America is up 5.4% and 28.2% in Europe, reflecting strong growth across key geographies.

- Managed services revenue of $720m, equivalent to ~58% of total revenue, which as we understand has an impressive renewal rate, essentially representing “recurring” revenue.

- Backlog of $4.14b, up ~5% YoY, reflecting a slowdown but still strong growth relative to the wider market.

- Although margins have been broadly flat for an extended period, profitability has stepped up, reflecting a renewed focus on operational excellence.

- Amdocs launched “amAIz”, an enterprise-grade Generative AI framework. Management considers this an impressive offering for its clients, seeking strong uptake.

- Amdocs completed the acquisition of TEOCO’s service assurance business for a net consideration of ~$90m.

Balance sheet & Cash Flows

Management takes a highly conservative capital allocation approach, with no material debt usage. This has allowed for FCF reinvestment in acquisitions, as well as distributions to shareholders through dividends and buybacks.

The company has spent >$1.5b on M&A, none of which have materially diluted ROE or margins. Further, dividends have grown at a 9% rate while buybacks at a 10% rate. We consider this highly attractive for investors.

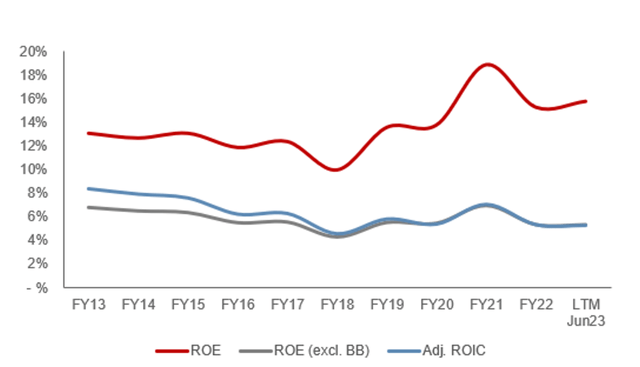

ROE (Capital IQ)

Outlook

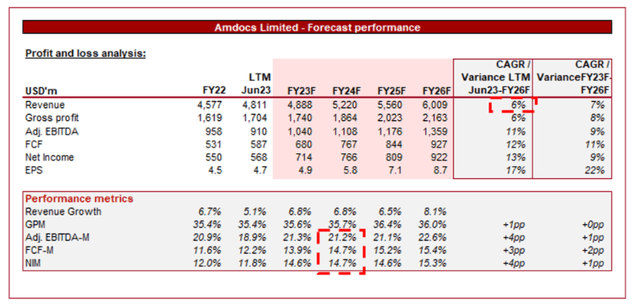

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming years.

Analysts are forecasting a slight improvement in growth alongside flat margins. The improvement in growth is likely a reflection of technological advancements within Amdocs’ sphere of expertise, such as AI and 5G, allowing it to accelerate. Further, its lack of margin improvement is likely to mean future gains are immaterial.

Industry analysis

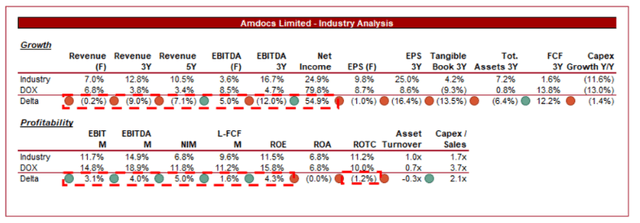

IT Consulting and Other Services Stocks (Seeking Alpha)

Presented above is a comparison of Amdocs’ growth and profitability to the average of its industry, as defined by Seeking Alpha (21 companies).

Amdocs performs well relative to its peers. The company’s margins are superior to its peers and have generally shown better consistency. The company’s commercial position underpins this, with strong industry relationships and deep expertise.

The company is lacking in growth, however. The company’s maturity is likely partially the reason for this but also the growth potential of the industry. Although we see good scope for cross and up-selling, we believe the runway for organic growth is far more limited given its more niche focus.

Valuation

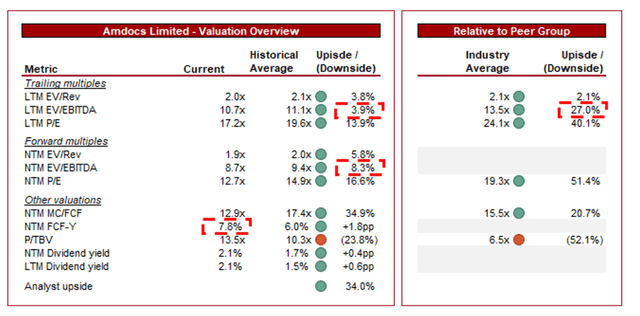

Valuation (Capital IQ)

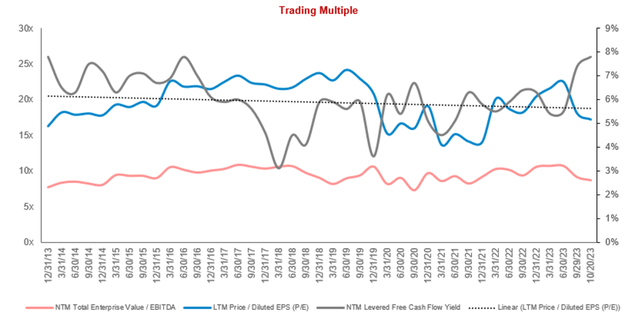

Amdocs is currently trading at 11x LTM EBITDA and 9x NTM EBITDA. This is a discount to its historical average.

We believe there is good justification for a premium to its historical average. With technological development, particularly from AI and 5G, there is reasonable scope for Amdocs to accelerate its growth trajectory and potentially improve its margins through software. From a downside perspective, Amdocs is equivalent to its historical average, which implies upside of 4-8% on an EBITDA basis.

Further, Amdocs is trading at a ~27% discount to its peers on an LTM EBITDA basis and ~51% on a NTM P/E basis. This discount is heavily weighted toward the company’s lack of growth but we feel it does not wholly appreciate its profitability. The company can consistently distribute heavily to shareholders and has shown an ability to generate growth above inflation. Again, this suggests upside in our view.

Confirming our view is its NTM FCF yield. This is currently 1.8ppts above its decade average at ~8%. This is objectively an impressive yield at a time when treasuries are at 5%, particularly given its strong competitive position and limited margin volatility. This is a supremely attractive investment for risk-averse investors.

Valuation evolution (Capital IQ)

Key risks with our thesis

The risks to our current thesis are:

- Market saturation.

- Inability to keep up with technological advancements.

- Increased competition leading to reduced market share.

Final thoughts

Amdocs is a fantastic business in our view and the definition of consistency. We struggle to see anything that can deviate from its current trajectory, owing to the quality of the services it provides, in conjunction with consistent innovation and new tailwinds through technological development.

Although the company’s runway for growth is not substantial, its profitability and FCF generation should allow for strong financial results directly to shareholders. At an FCF yield of ~8%, the stock is on sale in our view.

Read the full article here