Thesis

Readers familiar with our articles know that we have been a steadfast bull for Advanced Micro Devices, Inc. (NASDAQ:AMD) in the past. We have been arguing for a bull thesis on the stock since 2022, when the prices went as low as ~$60. Our bullish thesis was built on two main pillars. First, we saw many of the troubles AMD was facing to be temporary (such as the cyclical weakness in the PC sector and its inventory churn). Second, we saw its AI potential underpriced by the market. As a result, we have argued AMD stock offered far better return potential than the overall market in the next few years (see the chart below).

Seeking Alpha

However, over the past few months, we have been reconsidering our thesis. We believe the above catalysts have run their course already (more quickly than we thought). The temporary issues have largely ended in our view, and the price-value gap has largely disappeared. We began to see the opposite in the stock, that is, too much optimism has been baked into the stock prices.

Against this backdrop, the thesis of this article is to explain a downgrade from “buy” to “hold” on the stock. We believe potential investors will face more downward risks than upward risks in the near future. For existing investors, the risk analysis could differ depending on your tax considerations.

The remainder of this article will elaborate on our thought process for this downgrade. Our considerations mostly fall into the following 3 categories. First, we believe the market’s expectation for its new products (especially the MI300) is too and has largely ignored potential setbacks. Second, the high expectation has in turn pushed the stock price to a point that leaves no margin of safety.

AI competition and MI300

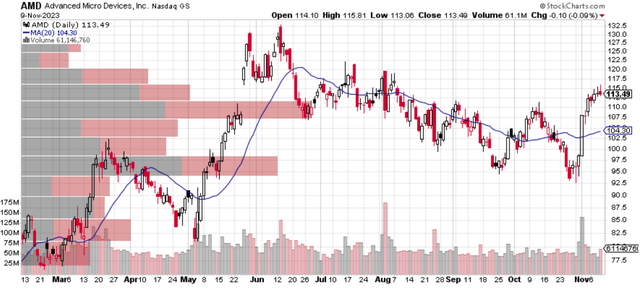

AMD stock prices have risen sharply since its 2023 Q3 earnings report (from about $95 before the ER to the current level of around $117). In my interpretation, a large driver for such a sharp rally is the market expectation for its new AI chips, especially the MI300. The market has high expectations for the chip to shake Nvidia Corporation (NVDA) dominance in the AI space. In a recent call with investors, its CEO Lisa Su made some quite upbeat comments about the chip. She commented that multiple “large customers had committed to using MI300 chips” and gave a 2024 sales forecast of $2 billion for the chip – the first time the company has ever provided a specific guidance number.

Source: Stockcharts.com

We certainly see good reasons for the expectations assigned to MI300. From a technical point of view, we agree that chip offers many of the key capabilities highly desired for AI applications, such as the new GPU architecture that is optimized for AI workloads, the high-bandwidth memory system that is designed to accelerate data movement, and its support for a variety of AI frameworks.

However, we think the market’s enthusiasm has been overblown and ignore the potential downside risks. There could be delays in the production of the chips, which could disappoint investors and customers who are eagerly awaiting the chips. There could be technical glitches. The MI300 chips are based on a new GPU architecture. It is possible that there could be technical glitches with the new architecture that have not surfaced thus far. Its competitors, both NVDA and Intel (INTC), are not sitting still either. For example, I expect Nvidia to launch its next-generation H100 chip soon, which could offer performance advantages over the MI300. Finally, advanced AI chips represent one of the focal issues amid the China-U.S. tension. Export control policies can be fluid and change in the near future, limiting the chips’ access to a key market.

Yet, as to be argued next, the stock’s current valuation is at a point where it allows no margin of error in our mind.

Valuation risks

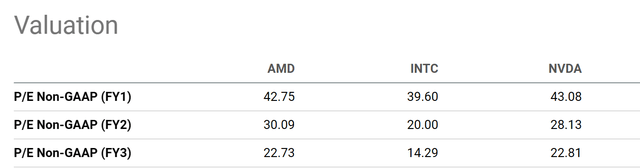

The next chart below shows AMD’s P/E ratios in comparison to those of INTC and NVDA. As seen, AMD’s FY1 P/E ratio of 42.75x is essentially on par with both INTC (39.6x) and NVDA (43x). However, its FY2 P/E ratio is far higher than INTC and also higher than NVDA, reflecting a perfect growth curve from its new chips in our view.

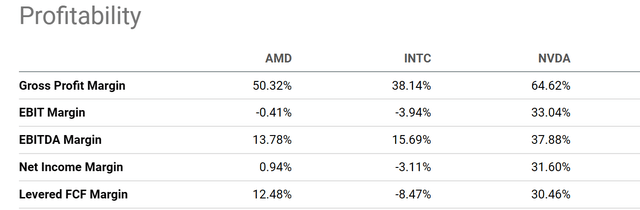

Furthermore, as you can see from the second chart below, we don’t see AMD having an obvious profitability advantage when compared to its peers. Its profitability metrics are far inferior to NVDA across the board and comparable to those of INTC. As such, it is difficult for us to justify its P/E multiple, which is higher than INTC and on par with NVDA.

Seeking Alpha Seeking Alpha

Other risks and final thoughts

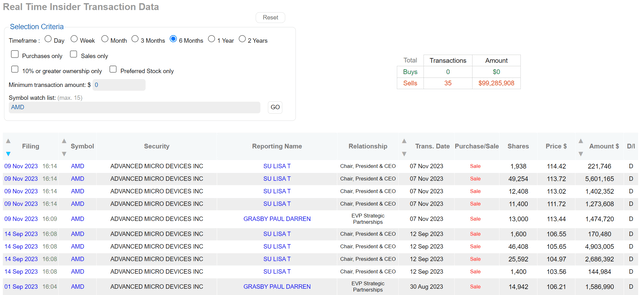

Besides the risks aforementioned, potential investors should also take a look at AMD insider trading activities and include these activities as part of their decision-making. As you can see from the chart below, in the past 6 months, a total of 35 insider activities were reported. All of the activities were selling transactions, with a cumulative total of close to $100M. Since September 2023 alone, its CEO Lisa Su and an EVP have reported a series of sales, with an average price of around $110, pretty close to the current market price. Of course, insider selling does not provide as clear a bearish signal as insider buying provides a bullish signal. However, when the insiders are all selling, we should pay attention.

All told, AMD has been one of our best Bull theses in the past 1~2 years. However, we believe the stock has reached a near-term peak price currently and wrote this article to downgrade our rating from BUY to HOLD. We certainly see good fundamentals behind the stock. We are not arguing its MI300 chips (or other products) are not as good as expected. As aforementioned, we agree that chip offers many of the key capabilities highly desired for AI applications. And we see a variety of addressable markets for the new chip, including large language models, image recognition, machine learning, and also scientific computing. It is just that we believe the upside potential has already been fully priced into current Advanced Micro Devices, Inc. valuation multiples and we cannot see a clear value-price gap anymore.

DataRoma

Read the full article here