A Quick Take On Alto Neuroscience, Inc.

Alto Neuroscience, Inc. (ANRO) has filed to raise $100 million in an IPO of its common stock, according to an SEC S-1 registration statement.

The firm is a clinical-stage biopharma developing treatments for serious human brain and central nervous system conditions.

When we learn more details about the IPO from management, I’ll provide a final opinion.

Alto Neuroscience Overview

Los Altos, California-based Alto Neuroscience, Inc. was founded to develop drug candidates for treating various brain disorders, including major depressive disorder [MDD] and post-traumatic stress disorder [PTSD].

Management is headed by founder, Chairman and CEO Amit Etkin, M.D., Ph.D., who has been with the firm since its inception and was previously Professor of Psychiatry and Behavioral Sciences at the Stanford University School of Medicine.

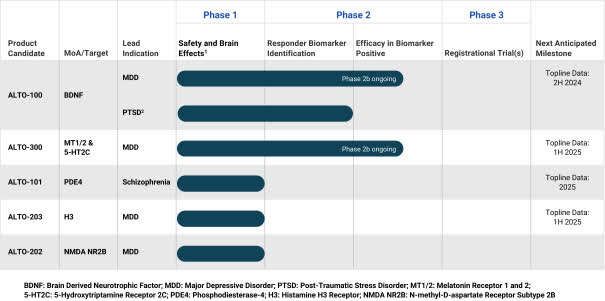

The firm’s lead candidate, ALTO-100, is in Phase 2 trials for the treatment of MDD and PTSD, and management expects top line data available in the second half of 2024.

ALTO-300, which is also in Phase 2 trials for treating MDD, is expected to have top line data in the first half of 2025.

Below is the current status of the company’s drug development pipeline:

SEC

Alto has booked fair market value investment of $101.8 million as of September 30, 2023, from investors, including Alpha Wave Ventures, Lightswitch Capital, IJS Global, Apeiron Investment, InVivium Capital, and others.

Alto’s Market & Competition

Per a 2023 market research report by Future Market Insights, the worldwide market for the treatment of depression was estimated at $10.1 billion in 2022 and is forecasted to rise to $16.8 billion in 2032.

This represents an expected CAGR of 5.2% from 2023 to 2030.

The primary characteristics that are expected to produce this demand growth are an increasing incidence of mental health disorders worldwide, “a 13% increase in mental health conditions and other depressive disorders in the last decade.”

Other aspects affecting the demand for treatments include “demographic changes, environmental conditions and increasing mental stress.”

Major competitive vendors that provide or are developing related treatments include the following companies:

-

Cerevel Therapeutics

-

Sage Therapeutics

-

Karuna Therapeutics

-

Prothena

-

ACADIA Pharmaceuticals

-

Axsome Therapeutics

-

Neurocrine Biosciences

-

Intra-Cellular Therapies.

The firm’s pipeline of drug candidates addresses other large markets, including the treatment for PTSD conditions.

Alto Neuroscience Financial Status

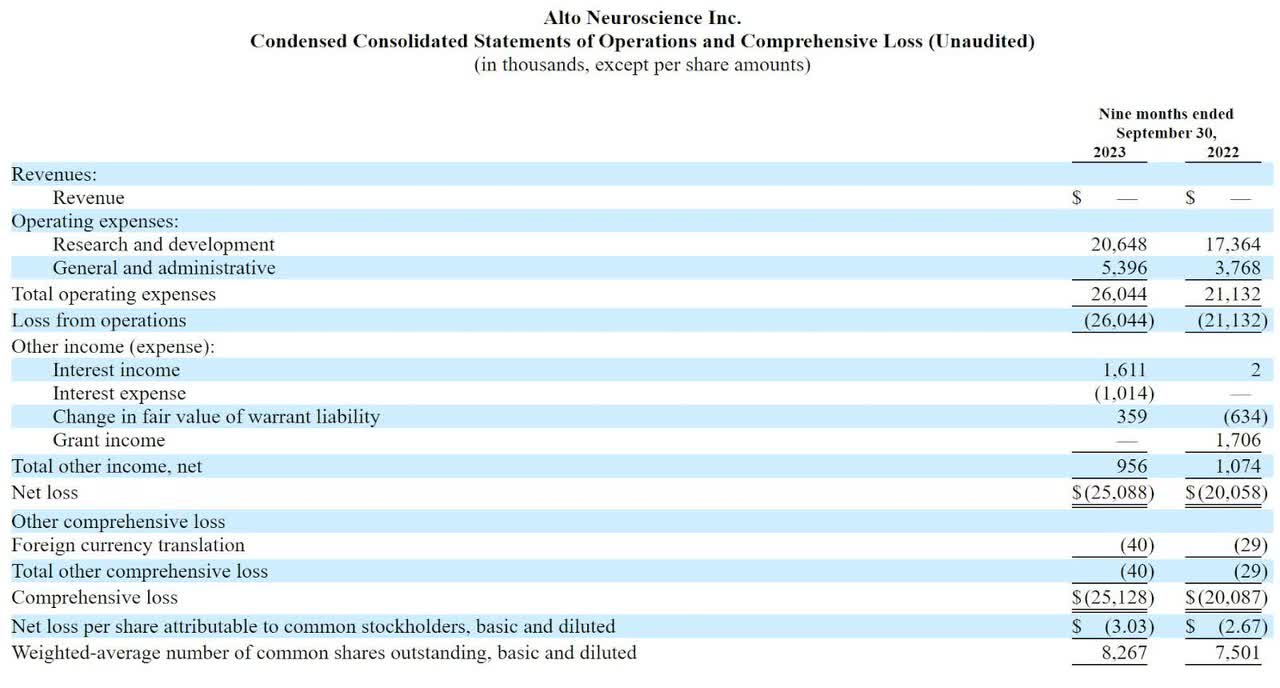

The firm’s recent financial results are typical of a development-stage biopharma firm as they feature no revenue and material R&D and G&A expenses associated with its pipeline development activities.

Below are the company’s financial results for the periods indicated:

SEC

As of September 30, 2023, the company had $51.3 million in cash and $17.3 million in total liabilities.

Alto Neuroscience’s IPO Details

Alto intends to raise $100 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Assuming a successful IPO, the company would be considered both an “emerging growth company” and a “smaller reporting company.” These designations will enable management to disclose substantially less financial information to shareholders.

Management says it will use the net proceeds from the IPO as follows:

to advance the clinical development of ALTO-100

to advance the clinical development of ALTO-300

to advance the clinical development of ALTO-101

to advance the clinical development of ALTO-203

the remainder for general corporate purposes, potential additional clinical development across our pipeline programs, enhancements to our Platform, CMC and preclinical work, and other operating expenses.

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm does not have any pending litigation that would have a material adverse effect on its operations or financial condition.

Listed bookrunners of the IPO are Jefferies, TD Cowen, Stifel, William Blair and Baird.

Commentary About Alto’s IPO

Alto Neuroscience, Inc. is seeking U.S. public capital market investment to fund advancing its pipeline of central nervous system [CNS] drug treatments.

The firm’s lead candidate, ALTO-100, is in Phase 2 trials for the treatment of MDD and PTSD, and management expects top line data available in the second half of 2024.

ALTO-300, which is also in Phase 2 trials for treating MDD, is expected to have top line data in the first half of 2025.

The market opportunity for treating major depressive disorder is large and is expected to grow at a moderate rate of growth in the coming years.

The treatment of PTSD is also a large market that is expected to increase in size, per a report from Future Market Insights.

Management hasn’t disclosed a major pharma firm collaboration but has in-licensed significant portions of its IP portfolio from major research groups and pharma firms.

The company’s investor syndicate includes a number of institutional investors or family offices but does not feature any well-known life science institutional venture capital firms or big pharma strategic investors.

As for valuation expectations, I estimate the market capitalization of the company will range between $100 million to $200 million at IPO based on the stage of development of its candidates and the various market sizes of its addressable markets.

Unfortunately, the Biopharma industry has generally performed quite unevenly post-IPO in recent quarters, with some stocks performing very well and others quite poorly, so there has been a sharp bifurcation in performance.

Also, there were only 18 Biopharma IPOs during all of 2023, a relatively low number indicating low appetite for these cash-hungry firms at a time of sharply higher cost of capital assumptions.

Should the cost of capital drop in 2024, we are likely to see a higher number of Biopharma IPOs than in 2023.

When we learn more IPO details from management, I’ll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Read the full article here