Opportunity Summary

Amid a time of geopolitical uncertainty, international rate hikes and a slowing global economy Alibaba (NYSE:BABA) is trading at depressed levels. At the same time the Chinese government is doing their best to support the local tech-industry. The plan is to increase computing power by more than a third in less than three years and this will surely benefit Alibaba who is the largest e-commerce player in China, holding a 45% market share. However, that would be icing on the cake for Alibaba that we argue has a solid foundation already with its strong growth prospects, especially within international retail.

For instance, AliExpress, Alibaba’s key player in international retail e-commerce, is continuously becoming more cost efficient by working on supply chain optimization and parcel consolidation, and they are using these efforts to improve price competitiveness, increase transacting users and enhance consumer experience. As a result, AliExpress has increased user retention rate and purchase frequency among consumers significantly, and is now a true catalyst to revenue growth within international retail. We expect this trend to continue.

Catalysts

Alibaba’s international retail business show tremendous momentum

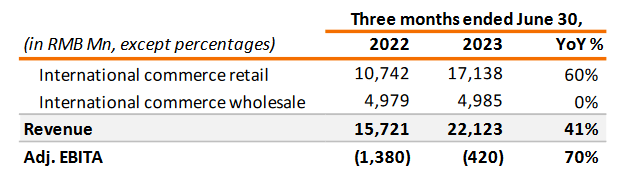

The International Digital Commerce division (IDC) posted a massive 41% June quarter YoY growth in revenues and like that wasn’t enough, after taking a closer look, we see that IDCs retail business, led by AliExpress, Lazada and Trendyol, delivered 60% in revenue growth in its June quarter 2023.

Alibaba, Q3 2023 report

A 60% revenue growth is massive and the international retail segment is becoming an ever more important key player for Alibaba’s overall growth. IDC currently constitutes almost 10% of total revenue streams for the company but with its current growth rate it won’t take long until it constitutes 30-40% of total revenue. As such, we expect international retail to play a key role in Alibaba’s future growth as we move forward. We believe it’s only a matter of time before IDC delivers positive EBITDA numbers, and we expect IDCs EBITDA to turn positive already by year-end.

Valuation

What’s even more interesting is the paradox path of the share price. The shares are down at a five-year low at this moment.

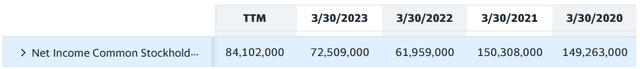

Yahoo Finance

One of our theories is that the market may be focusing too much on the sharp decline in net income for Alibaba which occurred back in 2022, when net income declined by 60% YoY. But this decline was not due to a decline in either revenues or operating profit, but caused by a loss in non-operating interest income. It shouldn’t be that relevant.

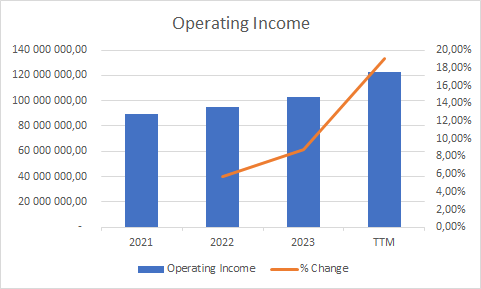

HedgeMix

Fact is, operating profits have increased steadily over the last few years and the growth rate for the last twelve months vs FY2023, reached an astonishing 19%.

Our take on the PEG Ratio

With 2.55 billion in outstanding shares, Alibaba has forward-looking annualized Earnings Per Share of $7.34 which yields a Forward P/E ratio of 11.54 as of October 17, 2023. With this said shares with a PEG ratio of below 1 are usually considered undervalued. In our case, Alibaba would need to yield an annual growth rate of above 11.54% to be undervalued. Is this realistic? We believe Alibaba has a major retail opportunity to embark on. With revenue growth rates of 60% in international retail, our view is that it’s highly plausible for Alibaba to touch on 15% in annual earnings growth. Assuming, Alibaba manages to maintain a 15% earnings growth rate for the next 5 years, that would yield a target price of $170, keeping the P/E-ratio constant.

Our DCF Model

However, if Alibaba manage to maintain 15% percent earnings growth, it will most likely reach a P/E-ratio closer to its peers, and then we’ll be looking at Alibaba shares moving closer to their all-time highs.

For this reason, we find it relevant to estimate the target price of Alibaba, using our DCF Model and anticipating a 10% CAGR for free cash flow, considering some of the earnings will be invested into R&D etc. We assume a perpetual growth rate of 2% and use a discount factor of 8% representing the cost of capital. To account for the bumpy road of Alibaba’s free cash flow the last few years we use the last four years average as starting point.

HedgeMix

As seen from the above model illustration, our five-year DCF Model yields a Fair Value of $248 for the Alibaba stock. This poses a major upside for Alibaba and we are remain bullish on the stock.

Take-Away Message

Market consensus seems to overlook the fact that operating income has been increasing steadily over the last years. The world is still in the midst of the e-commerce boom and we expect Alibaba to leverage on it. With a 60% growth YoY in international retail sales, they are surely on the road.

And as it often is with good ideas – you’re not alone. Citi Bank recently maintained its buy rating for Alibaba, and we’re not surprised. Now’s the time to buy!

Read the full article here