In June, 2023 I revised my bearish thesis and turned bullish on Alexandria Real Estate Equities, Inc. (NYSE:ARE) due to dirt cheap valuations and strong cash flows with no signs of deterioration. The chatter back then by the bears was that ARE should suffer from structural decline for office properties by facing slow and painful increase in its vacancy rates. While this was true and applicable for many if not most office REITs, in ARE’s case the combination of pure play focus on life science / lab clients and trophy like properties were clear mitigants to that risk. Even if ARE was to experience some pressures on the top-line generation, it would still be fine given single digit P/FFO multiple and robust balance sheet.

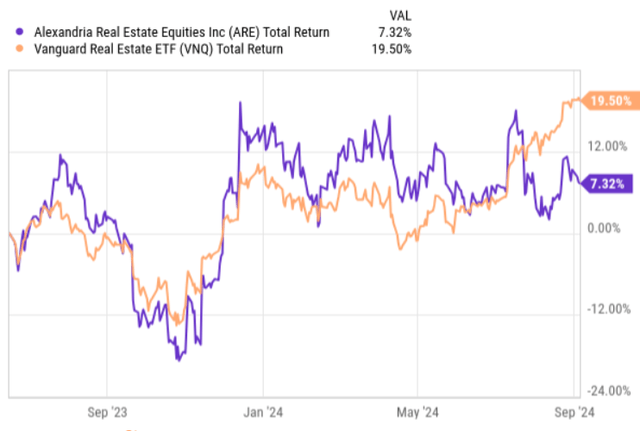

In the chart below we can see how since the publication of my initial bull thesis ARE has performed somewhat in line with the overall REIT market. Yet, starting from July there has been a notable divergence between ARE and the index, which has lead to a negative alpha.

Ycharts

It seems that ARE has not responded that well to the improved interest rate outlook. Let’s now review the recent (Q2) quarterly earnings results to understand whether the bull thesis is still attractive.

Thesis review

Before I dissect the Q2, 2024 earnings data, it is worth starting with underscoring the fact that ARE continues to trade at a depressed multiple of P/FFO of 9.5x. In fact, since the moment when I circulated my bullish investment case on ARE, the multiple has actually improved as the earnings have gone up and the share price remained almost flat (the return we see in the chart above are mostly driven by the dividend component).

If we look at the Q2, 2024 earnings, the most important metric measuring the core cash generation – FFO per share – is clearly up. Compared to Q2, 2023 period, the FFO per share increased by 5.4% or $2.36, which leads to a FFO payout ratio of 55% (on an annualized basis). The Management also reiterated the midpoint of full-year 2024 guidance for FFO per share at $9.47 – i.e., an increase of 5.6% compared to the total result achieved in 2023.

One of the key drivers behind the increased FFO per share generation was the improvement of same store NOI metric, which advanced by 3.9% on a cash basis. Part of the growth was achieved through embedded lease escalators, but bigger part came from positive leasing momentum. For example, the total rental / lease increased for H1, 2024 came in at 15% on a cash basis. The rental increases stemming from releasing activity was also solid at 3.7%.

So, already here we can conclude that the underlying business is growing even despite the single digit multiple and the struggling office sector.

What we have to consider in addition to the positive organic growth is the incremental boost on earnings from organic development activity. For ARE that is able to reinvest ~ 45% of its FFO generation back in the business and source cheap debt due to its strong investment grade credit rating, the project CapEx (and returns) is significant and can really move the needle.

For instance, this quarter ARE delivered ~ 285,000 square feet of new space that was 100% leased (92% of the space was associated with mega campuses). The remaining projects that ARE expects to put online over the remainder of 2024 and 2025 are already 87% leased with an expected NOI stabilization to kick in early 2026. The identified or projected incremental NOI stemming from the new development activity is at $480 million, which in the context of Q2, 2024 annualized NOI of ~ $1.9 billion is massive.

Speaking of this growth, the comment in the recent earnings call by Joel S. Marcus – Executive Chairman and Founder – provides a nice visibility on where ARE’s strategic focus points are:

So, in thinking about our competitive advantages, and what we choose to really emphasize. I think most importantly, our first mover advantage in the top life science clusters, we continue to refine and refocus our footprint, and you see that by our actions quarterly. Our high quality assets aggregated in desirable and well-amenitized mega campuses, we continue this monumental effort really driven to and by our re-development and development efforts in each of our massive mega campuses and our attempt to reduce and hopefully successful strategy our non-mega campus pipeline, future pipeline and obviously the sale of most of our non-core assets over time. That’s going to be critical to our go-forward business plan.

While the current share of rental / lease income from mega campuses stands at already 74% of the total top-line generation, ARE’s objective is to increase that to 90% over the next couple of years, primarily through a targeted organic CapEx activity. This should further de-risk ARE’s business and introduce even higher barriers for competitors to offer comparable supply of property.

Finally and perhaps most importantly, I see no negative impact on the capital structure from the aforementioned investment activity. There are couple of reasons. First, ARE is in the process of divesting its non-core assets, which in Q2, 2024 already generated above $60 million of fresh liquidity. Given the current LOIs that are in place, the total expected proceeds from non-core asset monetization is estimated to produce $807 million. Second, the current form of balance sheet remains in a robust shape, carrying strong investment grade credit rating and well-laddered debt maturity profile with an weighted average term to maturity of 13 years. Third, the new projects themselves will generate incremental EBITDA, which, in turn, will help maintain capital structure (e.g., net debt to EBITDA) in balance.

The bottom line

From the analysis above we can safely conclude that ARE’s business is strong, exhibiting clear patterns of a continued and stable growth. All of the core performance metrics are clearly green (e.g., FFO growth, same store NOI growth, leasing spreads, unchanged occupancy etc.). On top of this, the current growth agenda is set to further de-risk the business and deliver additional cash flow generation.

One of the main reasons why, in my opinion, ARE has not lately responded that well to the positive beta factor from the rising REIT index is its well-laddered debt maturity profile. The key driver that recently pushed the overall REIT space higher was the improved interest rate outlook, where cheaper debt financing would strongly benefit many REITs that currently face elevated financial risks as their balance sheets and debt structures are clearly not that solid as for ARE. Namely, the fact that SOFR goes down a bit does not have any material impact on ARE, hence the immaterial reaction by the share.

The key risk for ARE is the increased vacancy rates. However, given the aforementioned fundamentals and core performance metric dynamics in combination with new growth projects coming online that can be funded in a sustainable fashion (i.e., conservative FFO payout and non-core asset divestitures), this risk, which would ultimately drive down the FFO seems unlikely.

I am maintaining my bullish stance on Alexandria Real Estate Equities.

Read the full article here