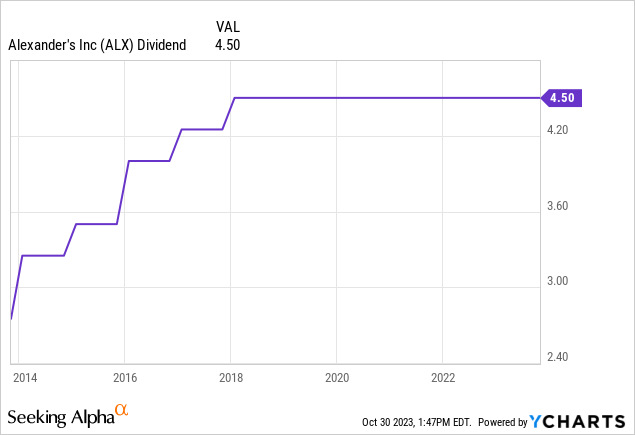

Alexander’s, Inc. (NYSE:ALX) is perhaps one of the most interesting commercial real estate companies in the stock market. The REIT owns just 5 buildings in New York with roughly 56% of its revenue from a single tenant, Bloomberg. ALX last declared a quarterly cash dividend of $4.50 per share, unchanged from its prior distribution for a 9.8% annualized forward yield. The REIT’s quarterly distributions have remained stable at their current level since the first quarter of 2018 with the distribution never being cut once over the last decade. Stability is the key here but fiscal 2023 third-quarter earnings, which saw funds from operations come in at $18.6 million, or around $3.63 per share, have heightened the specter of a near-term dividend volatility. This meant just 81% coverage, a 124% payout ratio.

REIT investors are currently going through some of the most brutal conditions seen by the sector in well over a decade with the current drawdown eclipsing the broad market dip seen during the early 2023 March banking crisis. The Fed’s higher for longer mantra has become a rallying cry for bears who have now built up a near-6% short interest in ALX. This is high for an asset class that simply buys and holds properties, collects rent, and pays out a dividend after taking out operating expenses.

Seeking Alpha

Critically, whilst ALX offers a compelling double-digit yield, its highly concentrated portfolio and FFO generation that’s currently surpassed by its quarterly payout has created a unique specter of risk. ALX’s portfolio, around 2,455,000 square feet, had a commercial occupancy rate of 87.3% and a residential occupancy rate of 93.6%. Commercial occupancy was up 40 basis points from 86.9% in the second quarter.

FFO, Dividend Risk, And Large Cash Position

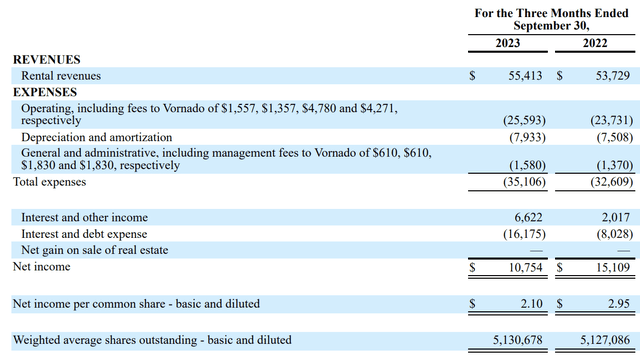

Alexander’s Fiscal 2023 Third Quarter Form 10-Q

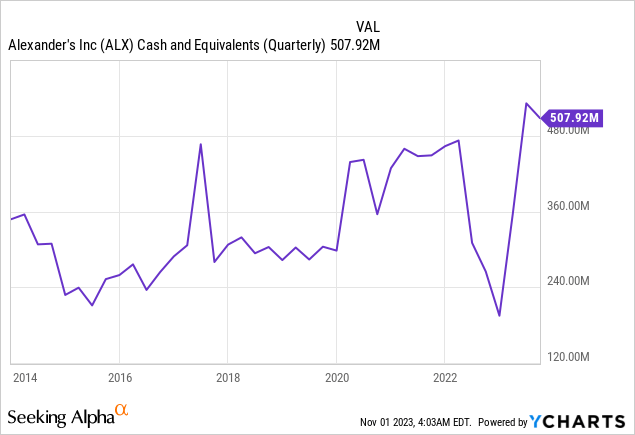

ALX reported revenue of $55.41 million, up 3.1% over its year-ago comp and a beat by $1.71 million on consensus estimates. Total expenses were up by $2.5 million during the period with fees to its external manager Vornado Realty Trust (VNO) included within this line item and forming its largest expense component. This drove net income of $10.75 million, down from $15.11 million in the year-ago period as interest expenses more than doubled to $16.17 million from $8 million. This led to marked weakness with funds from operations which came in at $18.6 million, around $3.63 per share and down from $4.40 per share in the year-ago comp. The FFO weakness is not ideal because this is a REIT where stability has formed a core part of its investment pitch. It means that FFO does not cover the current quarterly dividend payment and that ALX was dependent on a cash and equivalents position of $507.9 million as of the end of the third quarter to maintain the dividend payment.

ALX’s cash position currently sits at its highest level in a decade with the REIT flush with cash from moving its investments in debt and equity securities to cash as well as the March 2023 disposal of its Rego Park III land parcel for $71 million. The current status quo of paying out dividends from its cash position can essentially be maintained for years as ALX waits for interest rates to potentially fall back down to levels that would be more conducive to growth. The REIT is paying out roughly $23.08 million per quarter in dividends, hence, it will only have to cover around $4.46 million of this from its cash position. This creates a long runway for the continuation of the current dividend even against current interest rate headwinds in my view.

Debt And Maturities

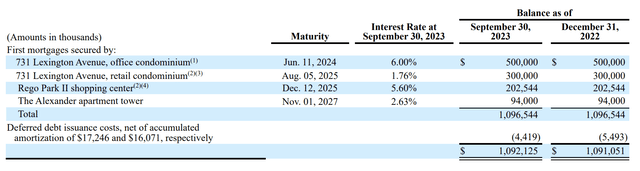

Alexander’s Fiscal 2023 Third Quarter Form 10-Q

The REIT’s debt maturities are not great with the bulk of its maturities on $1.09 billion of mortgages coming up over the next two fiscal years. There is around $500 million in debt coming due in 2024 on its 731 Lexington Avenue office condominium. However, this is at a 6% interest rate, the highest on its debt stack. The REIT would have to chase refinancing ahead of maturity with this set to be at a higher interest rate than its current 6%. This rate was due to an interest rate cap over what would have been a Prime Rate of 8.5% as of the end of the third quarter.

With the Federal Open Market Committee likely set to pause rates in November and December, the overall pressure of rising rates will abate in my view. The next headwind will come from just how long higher for longer will be. I don’t think we’ll see a dividend cut due to the REIT’s large cash position, but the risk of a cut is materially ramped up if 731 Lexington is unable to be properly refinanced. The ticker is a hold against this.

Read the full article here