Founded in 1993, Affiliated Managers Group (NYSE:AMG) stock offers a reasonable entry point for investors that believe in the future of active management. The company benefits from its diversified assets under management through three dozen boutique investment management firms, its solid balance sheet with reasonable leverage, and commands a long history of returning excess capital to investors through stock buybacks, along with low valuation multiples.

I last covered the company in July 2016 and update my analysis in this article.

Company Overview

Affiliated Managers Group is a global asset management firm with $673 billion in assets under management as of December 31, 2023. AMG partners with and often takes equity takes in boutique investment management firms (“Affiliates”) that focus on active management, and in return of asset-based management fees paid by Affiliates, AMG provides Affiliates with strategic, business development, operational, and capital support.

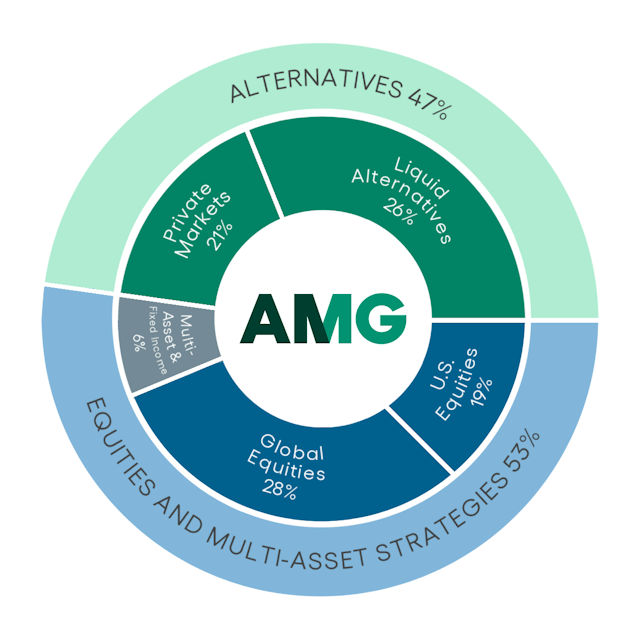

Founded in 1993, and with more than 500 strategies managed by more than 35 Affiliates across liquid alternatives, private markets, multi-asset, and differentiated equity strategies, AMG’s business is diversified by asset class, client type, and geography. The following graph shows the composition of AMG’s assets under management as of December 31, 2023.

AMG Investor Relations

Fundamental Analysis

The following long-term chart presents AMG’s revenue and net income on a trailing-twelve-month basis throughout the last three decades:

My three key takeaways from the above chart are:

- AMG’s revenue and net income trends have shown signs of cyclicality with material declines during previous recessions;

- Even though AMG’s business grew outstandingly in the three decades through 2015, the company’s revenue growth has stalled and in fact declined from 2016 through the most recent period; and

- AMG has generally achieved positive and growing earnings, except for two briefs periods in 2009 and 2019.

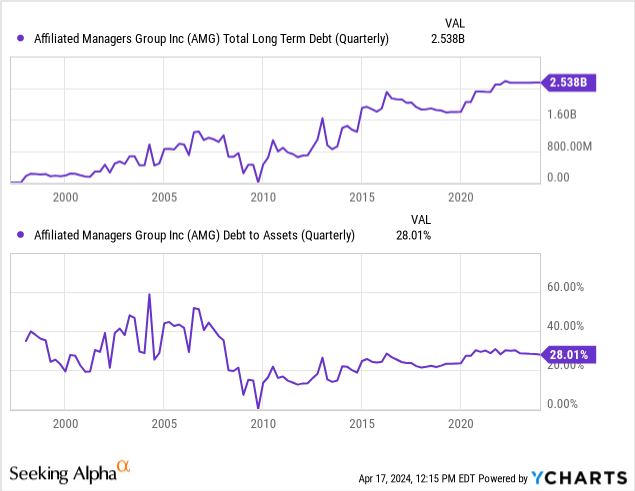

AMG may finance its growth by taking equity stakes in boutique investment management firms by issuing debt. The following graph illustrates AMG’s total debt balance and balance sheet leverage, as measured by total debt to assets ratio, throughout the company’s three-decade publicly traded history:

I note that, although AMG’s total debt balance has continued to increase, the company’s debt to asset ratio has remained relatively unchanged throughout the last decade and is at a reasonable level of 28 percent today.

Comparable Company Analysis

Based on AMG’s business and its size, I selected the following companies for the comparable company analysis: Janus Henderson Group (JHG), Franklin Resources (BEN), Invesco (IVZ), and AllianceBernstein Holding (AB).

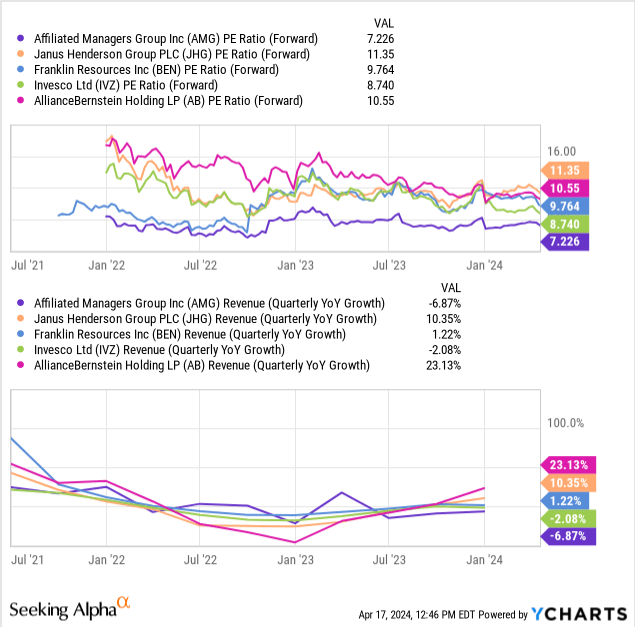

The following chart includes the Peer Group’s price-to-earnings on a forward-looking basis as well as the companies’ quarterly revenue growth on a year-over-year basis:

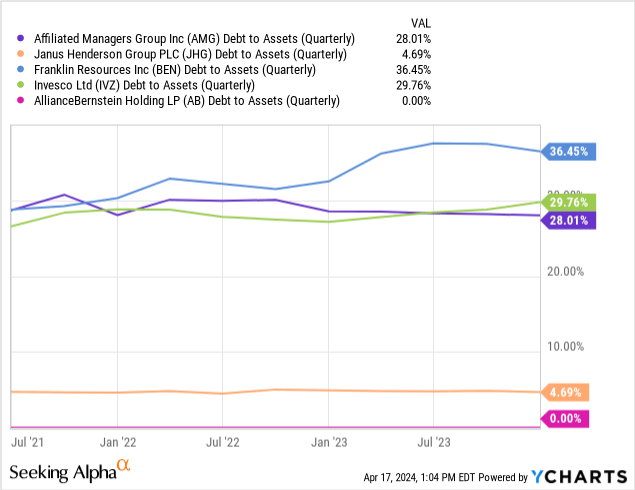

I note that AMG’s valuation multiple of 7.2x represents a 26 percent discount to the median multiple of its peer group, 9.8x. AMG could be trading at a discount to its peer group for a number of reasons, including but not limited to shifting investor preferences, concerns about future growth, underlying affiliate performance, a slowdown in new deal activity, debt levels, or other reasons. Although AMG has experienced declining revenue growth in recent periods, its revenue growth rate has trended generally in-line with its peer group in the last three years. Further, I note that AMG’s balance sheet leverage represents the media of its peer group and remains at a reasonable level of 28 percent, as the following graph shows:

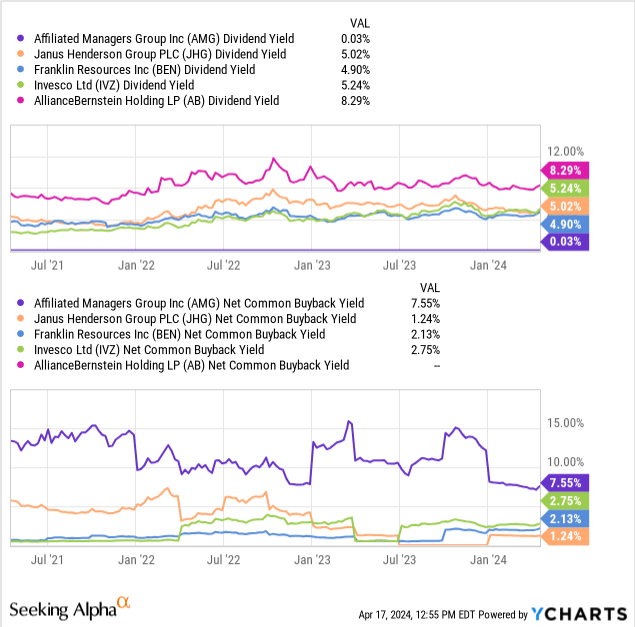

Finally, I note that AMG returns capital to investors through stock buybacks, in contrast to its Peer Group that have returned capital to their investors primarily through dividend payments:

Next, I discuss the company’s fair value and assign my price target.

Fair Value and Price Target

I believe the AMG stock should trade at a price-to-earnings multiple near the median of its peer group for the following reasons:

- Comparable Fundamentals: AMG’s balance sheet and income statement fundamentals align with those of its peers, suggesting similar risk profile and growth potential;

- Revenue Stability: AMG’s asset-based management fees derived from a diverse group of Affiliates provides a level of stability during volatile market conditions;

- Earnings Consistency: Except for brief periods in 2009 and 2019, AMG’s track record of positive earnings highlights its ability to navigate challenging market conditions; and

- Shareholder Focus: AMG demonstrates its shareholder focus through a relatively high and consistent stock buyback yield.

Assumptions and Calculations

- I identified a peer group based on recommendations by the Seeking Alpha Premium Tool and my own experience in the industry;

- I calculated the average and the median of the peer group’s price-to-earnings multiples to be 9.41x and 9.76x, respectively; and

- I selected a price-to-earnings multiple appropriate for AMG, 9.6x, and applied it to AMG’s projected earnings per share of $22.11 for 2024.

Based on AMG’s valuation multiple discount to the peer group’s median price-to-earnings ratio, I assign a BUY rating with a $212 per share price target, which represents 33 percent upside from the current price of $159 per share.

Risks To My Analysis

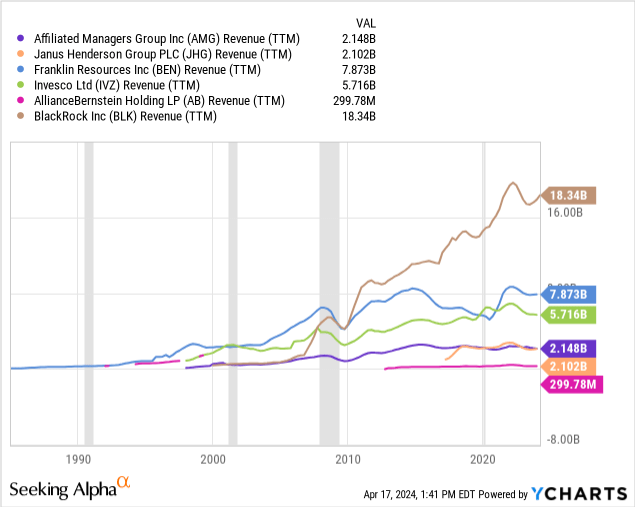

Even though BlackRock (BLK), the global asset management behemoth with $10 trillion in assets under management as of December 31, 2023, is primarily focused on passive management through its iShares suite of ETF products, BlackRock’s tremendous growth since 2008 has coincided with the significant slowdown in the growth of investment management firms focused on active management, including AMG:

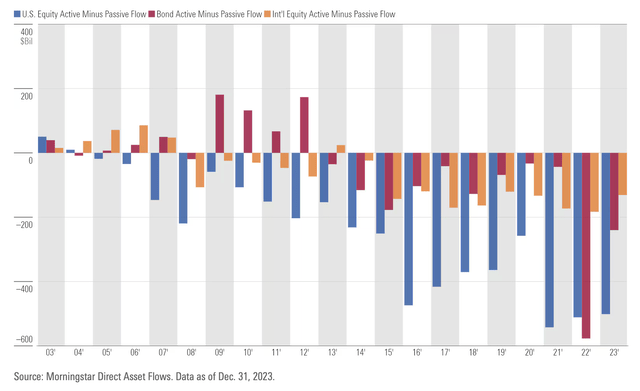

The primary risk to AMG is the continued, rapid growth of passive investment management products, such as ETFs, which has created a challenging business environment for firms such as AMG that focuses on active management. The following chart illustrates the persistent outflows that active management firms overall have experienced since 2007:

Morningstar

Second largest risk to AMG investors is the performance track record of the Affiliates potentially deteriorating and leading to large outflows, but I believe the diversified nature of AMG’s Affiliates and the company’s assets under management materially mitigates this risk.

Conclusion

With its diversified assets under management through three dozen Affiliates, long history of returning excess capital to its investors through stock buybacks, and currently low valuation multiples, AMG stock offers a reasonable entry point for investors that believe in the future of active management. I rate the stock BUY with a $212 per share price target.

Read the full article here