In this monthly article, we try to identify five closed-end funds (“CEFs”) that have a solid historical performance, pay high enough distributions, and offer reasonable valuations at the current time. We also present a more diversified list of the top 10 funds.

Author’s Note: This article is part of our monthly series that tries to discover the five best buys in the CEF arena at that point in time. Certain parts of the introduction, definitions, and sections describing selection criteria/process may have some commonality and repetitiveness with our other articles in this series. This is unavoidable and intentional to keep the entire series consistent and easy to follow for new readers. Regular readers who follow the series from month to month could skip the general introduction and sections describing the selection process (please skip to “Narrowing Down To 50 Funds”). Also, those who need a detailed introduction to our selection process can read our blog post here.

Please note that these are not recommendations to buy but should be considered as a starting point for further research.

We believe a well-diversified CEF portfolio should contain at least 10 CEFs, preferably from different asset classes. It’s also advisable to build the portfolio over a period rather than invest in one lump sum. If you were to invest in one CEF every month for a year, you would have a well-diversified CEF portfolio by the year’s end. What we provide here every month is a list of five probable candidates for further research. A CEF portfolio can be an important component of the overall portfolio strategy. One should preferably have a DGI portfolio as the foundation, and the CEF portfolio could be used to boost the income level to the desired level. How much should one allocate to CEFs? Each investor needs to answer this question himself/herself based on their personal situation and factors like the size of the portfolio, income needs, risk appetite, or risk tolerance.

Criteria to Shortlist:

|

Criteria |

Brings down the number of funds to… |

Reason for the Criteria |

|

Baseline expense < 2.5% and Avg. Daily Volume > 10,000 |

Approx. 435 Funds |

We do not want funds that charge excessive fees. Also, we want funds that have fair liquidity. |

|

Market capitalization> 100 Million |

Approx. 400 Funds |

We do not want funds that are too small. |

|

Track record/ History longer than five years (inception date 2016 or earlier) |

Approx. 375 Funds |

We want funds that have a reasonably long track record. |

|

Discount/Premium < +7% |

Approx. 350 Funds |

We do not want to pay too high a premium; we want bigger discounts. |

|

Distribution (dividend) Rate > 5% |

Approx. 250-290 Funds |

The current distribution (income) is reasonably high. |

|

5-Year Annualized Return on NAV > 0% AND/ OR 3-Year Annualized Return on NAV >0% |

Approx. 200-250 Funds |

We want funds with a reasonably good past track record in maintaining their NAVs. |

After we applied the above criteria this month, we are generally left with around 250 funds (plus or minus 5%) on our list. From here on, we apply our other criteria to narrow the list.

Note: All tables in this article have been created by the author (unless explicitly specified). Most of the data in this article are sourced from Cefconnect.com, Cefa.com, and Morningstar.com.

Narrowing Down To 50 Funds

To narrow down the number of funds to a more manageable count, we will shortlist ten funds based on each of the following criteria. Thereafter, we will apply certain qualitative criteria to each fund and rank them to select the top five.

At this stage, we also eliminate certain funds with substantially negative NAV returns for both three-year and five-year periods.

Seven Broad Criteria:

- Excess discount/premium (explained below).

- Distribution rate.

- Return on NAV, last three years (medium-term).

- Return on NAV, last five years (long term).

- Coverage ratio.

- Excess return over distributions.

- The total weight (calculated up to this point).

Excess Discount/Premium:

We certainly like funds that are offering large discounts (not premiums) to their NAVs. But occasionally, we may consider paying near zero or a small premium if the fund is otherwise great. So, what’s important is to look at the “excess discount/premium” and not the absolute value. We want to see the discount (or premium) relative to their record, say 52-week average.

Subtracting the 52-week average discount/premium from the current discount/premium will give us the excess discount/premium. For example, if the fund has the current discount of -5%, but the 52-week average was +1.5% (premium), the excess discount/premium would be 6.5%.

Excess Discount/Premium = Current Discount/Premium (Minus) 52-Wk Avg. Discount/ Premium.

So, what’s the difference between the 12-month Z-score and this Excess Discount/Premium measurement? The two measurements are quite similar, maybe with a subtle difference. The 12-month Z-score would indicate how expensive (or cheap) the CEF is in comparison to the 12 months. The Z-score also considers the standard deviation of the discount/premium. Our measurement (excess discount/premium) compares the current valuation with the last 12-month average.

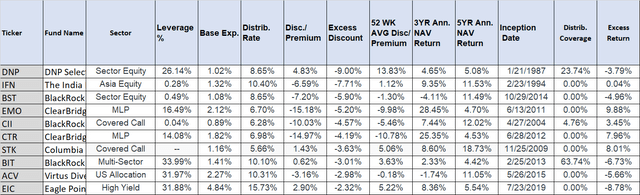

We sort our list (of 250 funds) on the “excess discount/premium” in descending order. For this criterion, the lower the value, the better it is. So, we select the top 10 funds (most negative values) from this sorted list.

(All data as of 08/16/2024.)

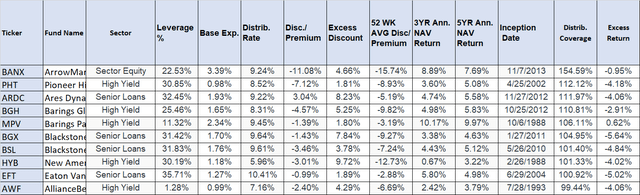

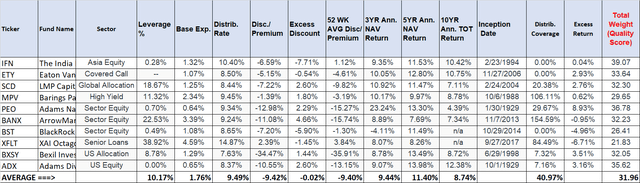

Table 1:

Author

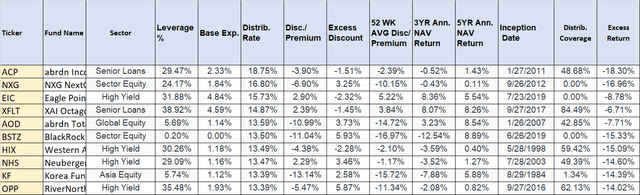

High Current Distribution Rate:

After all, most investors invest in CEF funds for their juicy distributions. Even though we should not chase yield, at this stage, we want to give them a fair representation in our list and subject them to a more rigorous criterion later on. We sorted our list on the current distribution rate (descending order, highest at the top) and selected the top 10 funds from this sorted list.

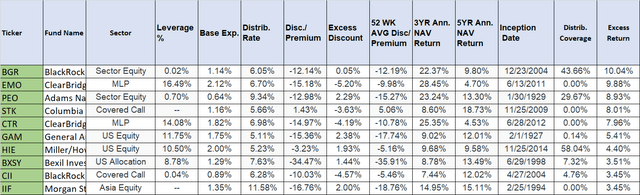

Table 2:

Author

Medium-Term Return on NAV (last three years):

We then sort our list on a three-year return on NAV (in descending order, highest at the top) and select the top 10 funds. Please note that too many MLP and energy funds have been topping this list for the past several months due to the oil crash in 2020 and the subsequent recovery. For this reason, we make a shortlist based on the total score and keep only a few of them on this list.

Table 3:

Author

Five-Year Annualized Return on NAV:

We then sorted our list on the five-year return on NAV (in descending order, highest at the top) and selected the top 10 funds.

Table 4:

Author

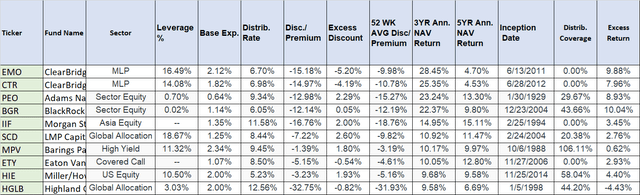

Coverage Ratio (Distributions Vs. Earnings):

The coverage ratio is derived by dividing the earnings per share by the distribution amount for a specific period. Please note that in some cases, the coverage ratio may be a bit inaccurate since the “earnings per share” may be three to six months old. But in most cases, it’s fairly accurate. Furthermore, the coverage ratio is not critical for pure equity funds as they generate very little dividend income, and they cover most of their distributions from capital gains. However, we sorted our list on the coverage ratio and selected the top 10 funds.

Table 5:

Author

Excess Return Over Distribution:

If a fund provides a very high distribution but low returns over 3, 5, or 10-year periods, it does not help the long-term interests of the investor. In simple terms, the fund is just overpaying the distributions and hurting the NAV in the long term. That is why we calculate a factor we like to call “excess return.” This excess return is what is provided by the fund over and above the distribution rate over a specified period. We calculate it by subtracting the distribution rate from the three-year NAV return. In this list, we included the top 10 funds.

Table 6:

Author

Total Weight (Quality Score) Calculated Up to This Point:

Note: The Total Weight calculation is not fully completed at this point, since we have not considered the 10-year NAV return. Furthermore, we will need to adjust the weight for the coverage ratio at a later stage. However, we select the top 15 names based on current calculations.

Table 7:

Author

From the above selections, we now have 75 funds in total (tables 1-7).

We will need to see if there are any duplicates among them. In our current list of 75 funds, there were 29 duplicates, meaning there are funds that appeared more than once. The following names appear twice (or more):

Appeared twice: ADX, BANX, BXSY, EIC, ETY, HIE, IFN, MPV, SCD (9 duplicates).

Appeared three times: BGR, CII, GAM, STK (8 duplicates).

Appeared four times: CTR, EMO, IIF, PEO (12 duplicates)

So, once we remove 30 duplicate rows, we are left with 46 (75–29) funds.

Note: It may be worthwhile to mention here that just because a fund has appeared multiple times does not necessarily make it an attractive candidate. Sometimes, a fund may appear multiple times simply for the wrong reasons, like a high current discount, high excess discount, or a very high distribution rate that may not be sustainable. However, during the second filtering stage, it may not score well on the overall quality score due to other factors like poor track record. That said, if a fund has appeared four times or more, it may be worth a second look.

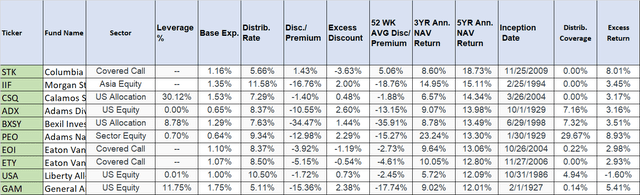

Narrowing Down to Just 10 Funds

In our list of funds, we already may have some of the best probable candidates. However, so far, they have been selected based on one (or two) criteria that each may be good at. That’s not nearly enough. So, we will apply a combination of criteria by applying weights to eight factors to calculate the total quality score and filter out the best ones.

We will apply weights to each of the eight criteria:

- Baseline expense (Max weight 5)

- Current distribution rate (Max weight 7.5)

- Excess discount/premium (Max weight 5)

- 3-YR NAV return (Max weight 5)

- 5-YR NAV return (Max weight 5)

- 10-YR NAV return or 10-YR Total return (Max weight 5, if less than ten years history, an average of three and five-year returns)

- Excess NAV return over distribution rate (Max weight 5)

- Adjusted Coverage Ratio (Max weight 7.5): Before we apply the weight for the coverage ratio, we like to adjust it for certain factors. The adjustment is performed based on the type of fund to provide fair treatment to certain types, like equity and sector funds.

Once we have calculated the weights, we combine them to calculate the “Total Combined Weight,” also called the “Quality Score.”

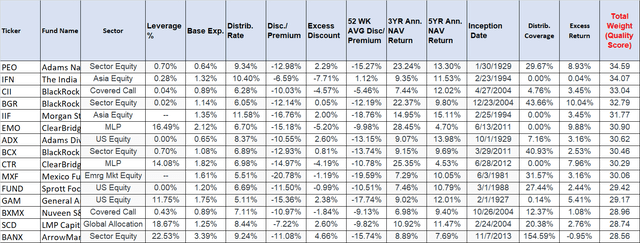

The sorted list (spreadsheet) of 46 funds on the “combined total weight or quality score” is attached here.

File-for-export_-_5_Best_CEFs_-_Aug_2024.xlsx

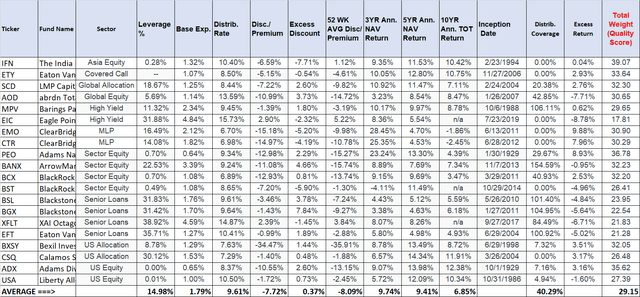

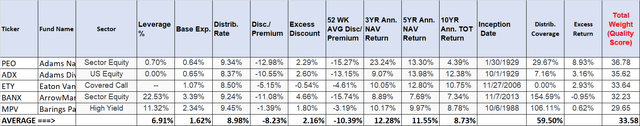

10-Positions Portfolio of The Month

Before we get to the final five, we will narrow down our list from 46 names to 20. So, we sorted our table based on the sector and then the quality score. Furthermore, in this round of selections, we mostly pick one or two top funds from each sector (based on quality score). There is a bit of subjective judgment, as we tend to prioritize funds that pay regular and consistent distributions on a monthly or quarterly basis. We also weed out any fund that may have a poor track record in terms of NAV performance. Funds that may have inconsistent dividends (even if they are high) generally do not make it to our top list. Furthermore, be aware that many times, single-country funds score high in our rankings, but most of them pay variable dividends on an annual or semi-annual basis. In addition, being single-country funds, they can be inherently riskier since their future returns are tied to just one country, be it economic, regulatory, or geopolitical factors. For these reasons, they generally do not make it to our top 5 lists, but they do appear on our list of 20. Individual investors could consider them based on their goals.

Here’s the list of the top 20 selections (from different asset classes):

Table 8:

Author

From here on, we will have to perform some subjective judgment and narrow the list to 10 names. Here’s the list of the top 10 selections this month (in order of sector):

(IFN), (ETY), (SCD), (MPV), (PEO), (BANX), (BST), (XFLT), (BXSY), and (ADX).

Table-8B:

Author

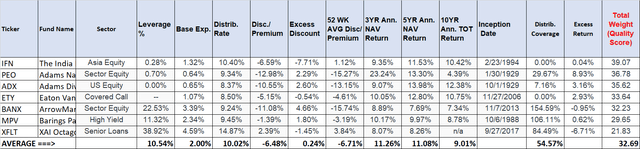

Final Selection: Our List Of Final Top 5

5-Positions Portfolio of the Month:

So far, we have followed our filtering criteria to a large extent. However, in the end, if we only want to select five funds, we will need to apply our subjective judgment. As such, for new CEF investors, our list of top 10 selections (table-8B) is quite compelling and makes a more diversified list. While we narrow down this list to five, we should be mindful to keep the list as diversified as possible in terms of asset classes. Since this step is mostly subjective, the choice would differ from person to person. Nonetheless, here are the selections for this month, based on our perspective (in order of Quality Score):

Current month selections:

- Adams Natural Resources Fund (PEO)

- Adams Diversified Equity Fund (ADX)

- Eaton Vance Tax-Managed Equity Income Fund (ETY)

- ArrowMark Financial Corp (BANX).

- Barings Participation Invs (MPV).

Table: The Final 5 Funds:

Table 9:

Author

Some information about the selections:

We recommend that readers look at the top 10 and 5 lists. The top-10 list offers much more of a diversified lot compared to the top 5.

- (PEO) Adams Natural Resources Fund

If you are an income investor and believe in the long-term viability and continued strong demand for fossil fuels (irrespective of climate change concerns), then PEO is a good way of investing in some of the largest and most recognized names in the oil industry at a large discount. PEO currently offers nearly a -13% discount on its NAV and over 9% of its income. The fund was not a favorite of the income investors until recently, as it used to provide an uneven and variable distribution, mostly at the year’s end. For example, in 2023, the distribution was only about 6.2%, out of which 78% of the total amount was paid in December 2023. However, in May this year, ADAMS group changed the distribution policy for both PEO and ADX (discussed later) and will distribute a minimum 8% annual rate of the Fund’s average net asset value (“NAV”) to shareholders. This policy has come into effect starting with the third quarter. This will make the distribution nearly even, predictable, and regular, as it will be paid on a quarterly basis.

Some top holdings of the fund are well-known names such as Exxon Mobil (XOM), Chevron (CVX), ConocoPhillips (COP), Marathon (MRO), Linde (LIN), and EOG Resources (EOG). The two oil majors, XOM and CVX, together represent over 30% of the total assets. Sure, you can build your own portfolio of oil stocks and earn a decent dividend yield in the range of 3% without incurring any ongoing fees, but the income level will not be high enough and may not suit everyone.

With 0.64% annual fees, this fund will provide roughly 8% predictable income (2% each quarter) and similar growth from the underlying holdings (minus the distributions and fees).

You could also invest in the Energy Select Sector SPDR ETF (XLE) for similar (or slightly better) total returns with a 3.2% dividend yield and very low fees (0.09%).

- (ADX) Adams Diversified Equity Fund

Under the US equity category, in the past, we have often selected Liberty All-Star Equity (USA) over funds like ADX, mainly because ADX’s yield used to be subpar for most income investors. In addition, it used to pay 90% of the distributions at the year’s end. One of the reasons income investors come to CEFs is the high level of income at regular intervals, so an income yield in the range of 6% (that too mostly annually) did not fit the bill. However, in May this year, ADX changed its distribution policy altogether. Under the new policy, the fund commits to distribute a minimum 8% annual rate of the Fund’s average net asset value (“NAV”) to shareholders beginning with the third quarter distribution in August 2024. Furthermore, it will be paid on a quarterly basis, just like other regular funds.

So, now the yield is 8% plus. It does not make it a better or worse fund just by raising the distribution, but it fills the need for regular income for CEF investors. However, since the announcement of that policy, the discount (on NAV) has narrowed down from -14% (3-year average) to the current -10%.

The fund is internally managed, with reasonable fees (lower than peers). Its core philosophy is to invest in a broadly diversified, sector-neutral, large-cap equity portfolio. In addition, the fund has a very long and excellent performance history. In the past 3, 5, and 10-year periods, it has returned 9.07%, 13.98%, and 12.38%, respectively, on an annualized basis.

Some top holdings of the fund are similar to that of the S&P500, with many of the Magnificent Seven among them, such as Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), Amazon (AMZN), Alphabet (GOOGL), Meta (META), JPMorgan Chase (JPM), and Eli Lilly (LLY).

- (ETY) Eaton Vance Tax-Managed Equity Income Fund:

Similar to the last few months, we had many covered-call funds appear in our top 50; however, we selected ETY to keep in our top-10 and top-5 lists. This month, we had to decide between the BlackRock Enhanced Capital and Income (CII), Columbia Seligman Premium Technology Fund (STK), and Eaton Vance Tax-Managed Equity Income Fund (ETY). We finally selected ETY as the yield for the other two funds is quite low, even though their growth record is excellent.

ETY invests in S&P500 stocks with an emphasis on dividend-paying stocks and writes call options on roughly 50% of the portfolio value. Just like the S&P500, it is overweighted in technology stocks. The fund is rather concentrated as it only has under 60 holdings. The fund uses zero leverage. ETY utilizes the call options on the index instead of using the individual stock holdings. It writes call options for a rather short period of less than a month and at a strike price near the money. The premium generated by the call options helps the fund pay for expenses as well as pay monthly distributions. The fund has a very decent long-term record of performance. Investors can enjoy 8.5% monthly distributions while making some capital appreciation. The fund currently offers a reasonable discount of -5%, which is slightly better than its one-year average.

- (BANX) ArrowMark Financial Corp:

This fund has been appearing on our list for the last many months. It is included this month as well. During the last few months, the price has appreciated somewhat, and the discount has come down from -13% to -11%. Even then, we would consider it attractive enough at current levels. As a result of the tightening discount, the yield has come down somewhat but is still at a very attractive level of 9.25%, excluding any special distributions. The fund invests to a large extent in regulatory capital relief securities (87% of the total) but also in preferred equity, subordinated debt, convertible securities, and common equity. The primary objective is to provide a steady high income and, more or less, a stable NAV. It offers investors exposure to floating rate instruments that have been benefiting from the rise in interest rates. This should also appeal to investors who like the distribution to be well covered by their investment income. However, please keep in mind that with 9% plus distribution income, there is not much scope left for capital gains. Furthermore, a relatively high discount to its NAV provides some margin of safety.

The fund raised its quarterly dividend from $0.39 to $0.45 a share in October 2023. The fund had an NII (Net Investment Income) of $18.7 million in the year 2023, while the total distributions, including the special distributions of $0.52 a share, amounted to $15.6 million. The NII covered the distributions (excluding the specials) to the extent of 1.56x (including the specials, 1.20x).

There is some concern that with rates starting to decline in 2024 and 2025, the fund’s investment income may go down (due to exposure to floating-rate instruments), but those issues may be overblown. Even though the rates are likely to come down, they are not going back to zero (barring some black swan events). Furthermore, since it uses a modest level of leverage, lower rates also reduce its interest expense. Further, the management appears to be confident they will be able to manage the investment income over and above the distribution level even when the rates do go down, as it did okay during the 2020-21 zero rates environment. It appears likely that they would be able to cover the regular distribution even when rates fall substantially from current levels; however, there may not be much left for any specials at that point.

Two Bonus Candidates for the month: The India Fund (IFN) and XAI Octagon FR & Alternative Inc Trust (XFLT)

IFN: This fund appeared last month as well as a bonus candidate, and the same will apply this month. The fund is in a similar situation to last month. This fund has been appearing for quite some time in our top 20 (or top 10), but we have never included it in our top-5 list for the simple reason that it is a country-specific fund, so there are always some additional risks. These risks include currency risks and the trajectory of the growth or lack of growth of a specific country’s economy. So, we would not recommend this for everyone. Please always do your own due diligence.

We include this as a bonus candidate as the fund is quite appealing at this time. It pays high income (yield over 10%), paid on a quarterly basis, even though the dividend payout can vary to some extent from year to year. The growth has been quite decent as well due to the growing Indian economy, despite the subpar performance of other emerging markets. The fund is currently being traded discounted by roughly -7%, which has come down from -10% last month. The fund had either traded at a premium or near zero discount over the last 52 weeks. However, the 5-year average discount has been around -7%. So, it appears to be of a reasonable value at this time.

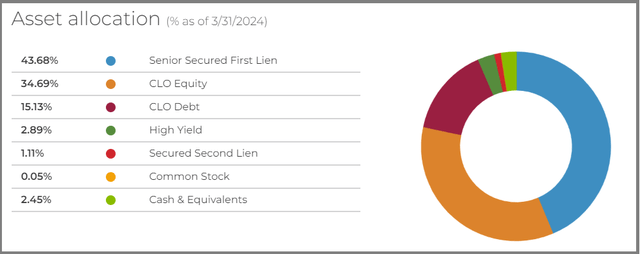

XFLT: This fund should be of interest to those who like high distributions. In some ways, it is a retiree’s dream fund in terms of income, as it provides nearly 15% of income that is fully covered at this time. But sure, there are some risks, as nothing comes for free. A fund like this can have a very high volatility in times of crisis. For instance, during the peak of the pandemic in 2020, this fund had a drawdown of 40% compared to 24% for the S&P500. However, in hindsight, that was probably the best time to accumulate this fund.

This is how the fund describes itself:

“The Trust invests in a dynamically managed portfolio of floating-rate credit instruments and other structured credit investments within the private markets. Under normal market conditions, the Trust will invest at least 80% of managed assets in senior secured loans, CLO debt, and CLO equity.”

Below is the slide on investment allocation from the fund’s website:

Chart-1:

Source: XFLT website

As we can see, the fund is invested to the extent of 43% in Senior First-Lien Loans, which are considered relatively safer. However, it also invests nearly 50% of its assets in CLOs (Collateralized Loan Obligations) and nearly 2/3rd of those in CLO equity tranches, which is considered the riskier part of CLOs. Its closest competitor fund in its space is Eagle Point Credit (ECC). In the last month or so, the fund’s premium has narrowed down somewhat to the 2% range and lower than its 3-year and 5-year average of 4.60%. If we look at its longer-term history of discount/premium, it has traded mostly at a premium.

In some ways, XFLT is a rather complex fund to understand, and we cannot go into all the details and technicalities of the fund here, as the format of this article does not allow it. However, we will encourage our readers to research further. There are plenty of good articles on this fund from SA authors.

Table 9A: The Final 5 Plus the Two Bonus Candidates:

Author

CEF-Specific Investment Risks

It goes without saying that CEFs generally have some additional risks. This section is specifically relevant for investors who are new to CEF investing, but in general, all CEF investors should be aware of it.

They generally use some amount of leverage, which adds to the risk. The leverage can be hugely beneficial in good times but detrimental during tough times. The leverage also causes higher fees because of the interest expense in addition to the baseline expense.

Due to leverage, the market prices of CEFs can be more volatile, as they can go from premium to discount pricing (and vice versa) relatively quickly. Especially during corrections, the market prices can drop much faster than the NAV (the underlying assets). Investors who do not have an appetite for higher volatility should generally stay away from CEFs or at least avoid the leveraged CEFs.

CEFs have market prices that differ from their NAVs (net asset values). They can trade either at discounts or at premiums to their NAVs. Generally, we should avoid paying any significant premiums over the NAV prices unless there are some compelling reasons.

Another risk factor may come from asset concentration risk. Many funds may hold similar underlying assets. However, this is easy to mitigate by diversifying into different types of CEFs ranging from equity, equity-covered calls, preferred stocks, mortgage bonds, government and corporate bonds, energy MLPs, utilities, and municipal income.

Concluding Thoughts

We use our screening process to highlight five likely best closed-end funds for investment each month. At the same time, we also provide a larger list of ten CEFs from many asset classes. Our filtering process demands that our selections have an above-average long-term performance record, offer an average of roughly 8% distributions, and are relatively cheaper with reasonable discounts.

The selected five CEFs this month, as a group, are offering an average distribution rate of nearly 9% (as of 08/16/2024). If you were to add the bonus candidates, the yield goes up to 10% plus. Besides excellent distributions, these funds have a proven record over the short and the long term and collectively returned 12.28%, 11.55%, and 8.73% in the last three, five, and ten years, annualized. The leverage for the group, on average, is very low, at 6.9%. The current average discount (to NAV) is also very attractive, roughly at nearly -8.25%. Since this is a monthly series, some selections may overlap from month to month.

Please note that these selections are based on our proprietary rating system and are dynamic in nature. So, they can change from month to month (or even week to week). At the same time, some funds can repeat from one month to the next if they remain attractive over an extended period. Furthermore, note that if a fund has not made it to our list, it does not mean it is not good. It could be because they may not be attractively priced at this time or trading at a premium while running our filtering process.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here