Will Rogers once said, “don’t wait to buy real estate, buy real estate and wait.” It is a great quote that highlights the importance of diligence in long term investing. Life rarely presents an opportunity to buy the highest quality assets at a reasonable price. However, 2024 is poised to be a rebound year for real estate as tailwinds continue to mount for the sector. Today, there is significant value across the real estate sector and investors have bountiful opportunity to capitalize. We are going to explore a simple but effective way to take advantage of opportunities in the commercial real estate sector.

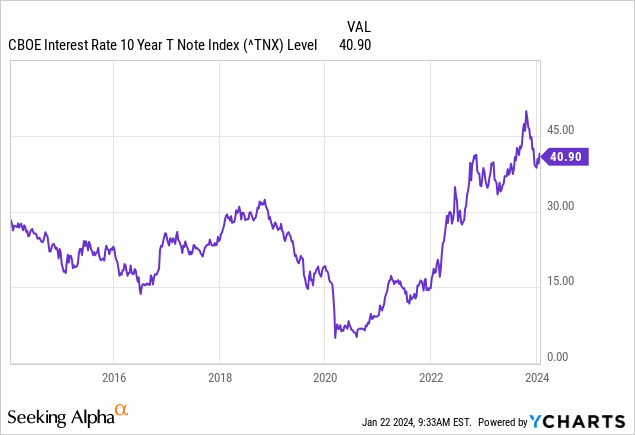

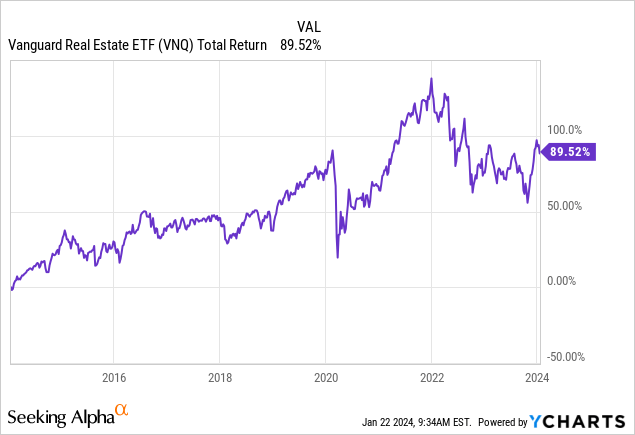

REITs have been beaten down by rising interest rates and a flight to income producing alternatives such as bonds. For more than a decade coming out of the financial crisis, REITs benefitted from a low interest rate environment which facilitated a long-term decline in capitalization rates. The decline in initial yield was accelerated by low costs of capital for landlords and developers, incentivizing aggressive growth across the sector. Additionally, low rates drew attention to REITs as an income producing alternative where investors could access yield supported by strong assets and corporate credit. As a result, REITs performed well over that period.

The “Goldilocks” environment came to a screeching halt in 2022 as rapid increases in interest rates shaped a series of headwinds for real estate. Increasing borrowing costs halted acquisitions and new development. Inflation injected uncertainty around labor and material costs which added to the risk factors. Investors reallocated capital as bond yields surged and offered an opportunity for a higher return with less risk. The REIT market rapidly adjusted in a chaotic fashion creating pricing discrepancies, which we will explore.

The Opportunity

Chaos breeds opportunity. The real estate turmoil over the past two years has caused real estate investors and asset managers to diverge from their traditional playbooks. Low interest rates had the market in agreement regarding pricing because ample transactions across the world supported harmony between public and private valuations. This important connection was one of the first to deteriorate as interest rates rose. Transaction volume decreased significantly as interest rates increased, leaving little support for valuations.

Publicly traded REITs saw worse performance during the initial turmoil due to their liquidity. Private funds have limitations outlined in their prospectus which specify a maximum amount of NAV that can be redeemed within a quarter. In contrast, public REITs trade independently of NAV causing their implied capitalization rates to move freely. As investors sold REITs to pursue other assets, public REITs were heavily impacted while private real estate funds were able to protect their assets by limiting redemptions. Reality is beginning to set in as funds continue to dispose of assets to cover mounting redemption requests. For example, Blackstone’s (BX) flagship real estate fund recently posted its worst annual performance since inception. Redemptions in the fund remain high as Blackstone indicates an additional $1.1 billion in requested redemptions in December.

NAREIT

Currently, the difference between appraisal valuation of private funds and the implied capitalization rates of their publicly traded competitors remains significant. In the fourth quarter of 2021, the spread between public and private REITs was 0.83%. In the third quarter of 2023, this spread had more than doubled to 2.16%. NAREIT further specified that in the third quarter, the spread between implied capitalization rates and private transactions was 1.70%. The difference in valuations implies a discrepancy of approximately 30% at the property level. The consensus suggests a convergence of these valuations as investors capitalize on the arbitrage opportunity.

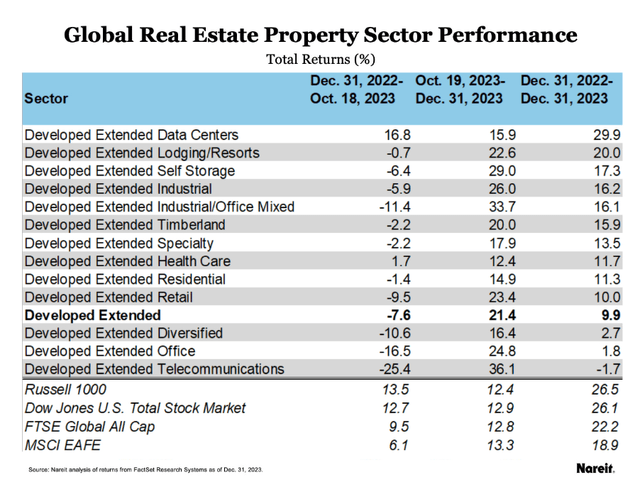

If the Federal Reserve lowers interest rates, REIT valuations will expand, and public REITs will offer a vehicle to capitalize on the opportunity. Sector performance accelerated significantly in the fourth quarter as investors concluded that interest rates have at least leveled off. NAREIT’s annual report was thoroughly optimistic that 2024 will be a rebound year for the REIT sector.

As we look ahead to 2024, the high interest rate environment will likely continue to broadly impact both commercial real estate and REITs. The rapidly emerging consensus is that the Federal Reserve is entering a new, more accommodative period that increases the prospects for stabilizing and even declining interest rates.

Even in this new phase of monetary policy, the current high level of interest rates will continue to affect CRE. Nevertheless, we are cautiously optimistic that despite those challenges, the REIT recovery could begin next year. The impressive performance of REITs during late October and November may be a signal that, as in previous periods of monetary policy adjustments, the end of the rate-rising cycle will herald a period of REIT outperformance.

Source: NAREIT

NAREIT

NAREIT appears to have been correct as REITs pummeled the Russell 1000 between October 19th and year-end. Sector performance should continue to hold if the optimistic thesis around interest rate movements pans out. One of the best ways to capitalize on sector tailwinds is a broad market exchange traded fund. We have covered the Vanguard Real Estate Index Fund ETF (NYSEARCA:VNQ) before, exploring how the fund is one of the most cost efficient options to access REITs. So let’s dive in once again and explore why VNQ is a superior REIT ETF.

Why VNQ?

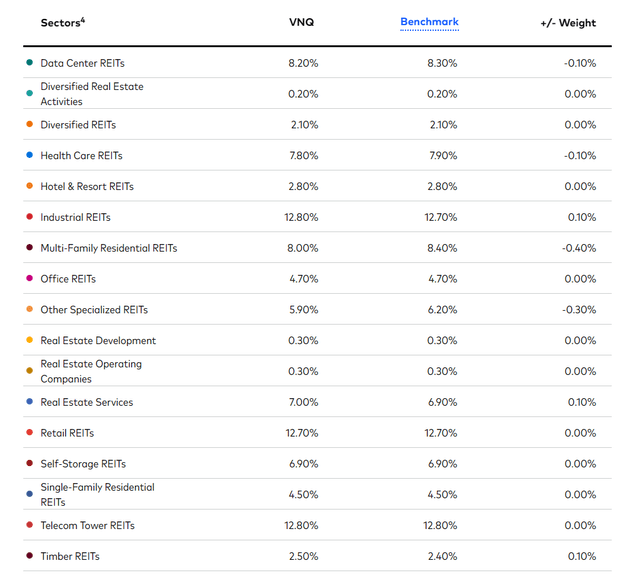

VNQ is one of the oldest REIT ETFs and is managed by one of the largest asset managers. There are a variety of REIT ETFs available from both Vanguard and other options such as BlackRock (BLK). The nuance between funds usually lies in their underlying index. VNQ’s index encompasses the widest approach of all competing funds, including most of the real estate market in its entirety. VNQ follows the MSCI US Investable Market Real Estate 20/50 Index

The MSCI US IMI Real Estate 25/50 Index is designed to capture the large, mid and small cap segments of the U.S. equity universe. All securities in the index are classified in the Real Estate sector as per the Global Industry Classification Standard (GICS®). The index also applies certain investment limits to help ensure diversification–limits that are imposed on regulated investment companies, or RICs, under the current US Internal Revenue Code.

Source: MSCI

Vanguard

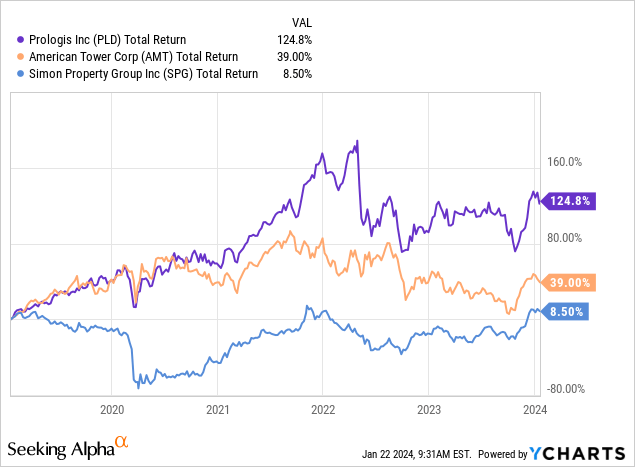

The fund is widely diversified across REIT subsectors, encompassing most public REITs. Additionally, as an index fund, VNQ follows its benchmark closely with little deviation. The largest subsectors of VNQ are industrial REITs, led by Prologis (PLD), telecom tower REITs, led by American Tower Corporation (AMT), and retail REITs, led by Simon Property Group (SPG). The top investments in VNQ’s portfolio are the largest and most established public landlords.

There are a variety of reasons to love VNQ such as the fund’s liquidity. VNQ remains one of the most traded real estate ETFs, outpacing other competitors by a significant margin. While immaterial for some investors, liquidity in a fund remains important especially during tumultuous times where price action can vary more significantly. Additionally, VNQ offers options trading, giving investors an additional opportunity to speculate against macroeconomic trends impacting the real estate market. Shareholders can generate additional yield by writing covered calls against VNQ to supplement the quarterly dividend generated by the fund.

While investing in individual REITs offers an opportunity to outperform the index, many long term investors want to remove the guesswork from the equation. VNQ’s cost efficient approach offers a low-risk vehicle to invest in a diversified portfolio of high quality real estate assets. For investors seeking to “buy real estate and wait”, as Will Rogers suggested, VNQ is a perfect investment to buy and never look back. The fund is well supported by healthy trading volume, a heavily diversified portfolio, and a world class asset manager.

Conclusion

REIT tailwinds are mounting in 2024. Falling interest rates, shrinking valuation gaps, and accelerating transaction volume lay the foundation for a continued rally through the year. Time is of the essence as macroeconomic trends begin to align and support a real estate rebound. VNQ presents an opportunity to take the guesswork out of real estate and diversify your investment across the market. When capitalizing on a macroeconomic opportunity such as valuation discrepancies and interest rate movements, accessing the market is generally a wise decision.

Read the full article here