This article series aims at evaluating ETFs (exchange-traded funds) regarding past performance and portfolio metrics. Reviews with updated data are posted when necessary.

USMV strategy

iShares MSCI USA Min Vol Factor ETF (BATS:USMV) was launched on 10/18/2011 and tracks the MSCI USA Minimum Volatility (USD) Index. It has a portfolio of 170 stocks, a 30-day SEC yield of 1.72% and a total expense ratio of 0.15%. Distributions are paid quarterly. The fund’s objective is a lower volatility relative to the broad U.S. equity market. USMV doesn’t focus on low-vol stocks like most low-volatility ETFs, but it uses sophisticated mathematical tools to optimize a portfolio with a low aggregate volatility.

As described by MSCI, the underlying index is optimized from the MSCI USA Index to obtain a lower beta, volatility and capitalization bias, with a preference for stocks with low idiosyncratic risk. This process makes use of Barra Optimizer software library to “produce an index that has the lowest absolute volatility for a given set of constraints,” based on an estimated security co-variance matrix. Among the constraints, constituent weights are capped at 1.5% and sector weights must not deviate more than 5% from the parent index. The underlying index is reconstituted twice a year at the end of May and November. The portfolio turnover rate in the most recent fiscal year was 23%. This article will use as a benchmark the Russell 1000 index, represented by iShares Russell 1000 ETF (IWB).

Portfolio

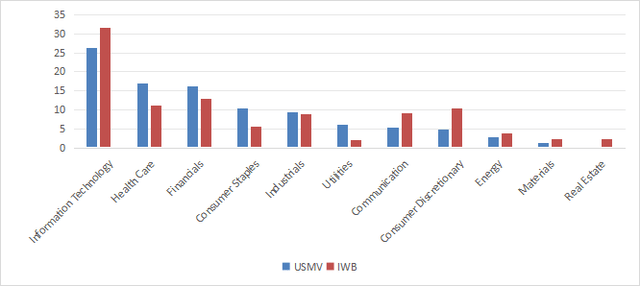

The fund has about 68% of asset value in large and mega cap companies, and the rest in mid-caps. The heaviest sector is technology (26.3%), although it is less overweight than in the benchmark (31.6%). It is followed by healthcare (17%), financials (16.3%) and consumer staples (10.3%). Compared to the Russell 1000, USMV overweights financials and traditional defensive sectors: utilities, consumer staples and healthcare. It underweights mostly consumer discretionary, communication, materials and ignores real estate.

USMV sector breakdown in % of assets (Chart: author; data: iShares)

The top 10 holdings, listed below with some fundamental ratios, represent 15.7% of asset value and the heaviest position weighs 1.67%. Therefore, the portfolio is well-diversified and risks related to individual companies are low.

|

Ticker |

Name |

Weight% |

EPS growth% |

P/E TTM |

P/E fwd |

Yield |

|

LLY |

Eli Lilly and Co. |

1.67 |

7.89 |

136.97 |

66.88 |

0.57 |

|

TMUS |

T-Mobile US, Inc. |

1.62 |

138.15 |

24.39 |

19.62 |

1.45 |

|

WCN |

Waste Connections, Inc. |

1.61 |

-7.14 |

57.58 |

37.16 |

0.64 |

|

MSFT |

Microsoft Corp. |

1.60 |

25.11 |

40.51 |

39.73 |

0.64 |

|

MSI |

Motorola Solutions, Inc. |

1.56 |

1.11 |

47.84 |

29.57 |

1.01 |

|

RSG |

Republic Services, Inc. |

1.55 |

18.81 |

34.23 |

32.20 |

1.10 |

|

WMT |

Walmart Inc. |

1.53 |

69.24 |

29.92 |

28.72 |

1.19 |

|

IBM |

International Business Machines Corp. |

1.51 |

349.87 |

19.93 |

17.71 |

3.80 |

|

WM |

Waste Management, Inc. |

1.51 |

11.86 |

34.39 |

28.66 |

1.43 |

|

PGR |

Progressive Corp. |

1.50 |

594.86 |

21.51 |

18.76 |

0.19 |

Fundamentals

USMV is cheaper than the Russell 1000 regarding valuation ratios, and it has significantly lower earnings and cash flow growth rates.

|

USMV |

IWB |

|

|

P/E TTM |

22.7 |

25.18 |

|

Price/Book |

3.65 |

4.26 |

|

Price/Sales |

1.96 |

2.75 |

|

Price/Cash Flow |

14.62 |

17.11 |

|

Earnings growth |

17.56% |

22.31% |

|

Sales growth |

9.11% |

8.64% |

|

Cash Flow growth |

5.70% |

8.49% |

Data: Fidelity

In my ETF reviews, risky stocks are companies with at least 2 red flags among: bad Piotroski score, negative ROA, unsustainable payout ratio, bad or dubious Altman Z-score, excluding financials and real estate where these metrics are unreliable. With this assumption, 18 stocks out of 170 are risky, and they weight only 8% of asset value, which is a good point. Moreover, according to my calculation of aggregate quality metrics, reported in the next table, portfolio quality is superior to the benchmark.

|

USMV |

IWB |

|

|

Altman Z-score |

4.71 |

3.84 |

|

Piotroski F-score |

5.99 |

5.85 |

|

ROA % TTM |

9.04 |

6.28 |

Performance

Since inception, USMV has underperformed the Russell 1000 by 2.5% in annualized return. As expected, volatility is lower (measured in the next table as standard deviation of monthly returns) and USMV has a beta of 0.71 (also based on monthly returns). The gap in risk-adjusted performance (Sharpe ratio) is insignificant.

|

Total Return |

Annual Return |

Drawdown |

Sharpe ratio |

Volatility |

|

|

USMV |

320.14% |

11.96% |

-33.10% |

0.93 |

11.45% |

|

IWB |

454.73% |

14.44% |

-34.60% |

0.91 |

14.45% |

Calculation with Portfolio123

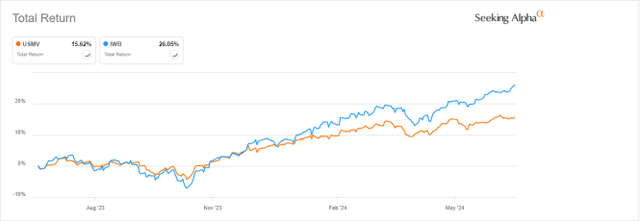

Over the last 12 months, the fund has lagged the benchmark by 10.4%:

USMV vs Russell 1000, 12-month total return (Seeking Alpha)

USMV vs. competitors

The next table compares characteristics of USMV and four low-volatility ETFs in U.S. equities:

- Invesco S&P 500 Low Volatility ETF (SPLV)

- Fidelity Low Volatility Factor ETF (FDLO)

- SPDR SSGA US Large Cap Low Volatility Index ETF (LGLV)

- SPDR Russell 1000 Low Volatility Focus ETF (ONEV)

|

USMV |

SPLV |

FDLO |

LGLV |

ONEV |

|

|

Inception |

10/18/2011 |

5/5/2011 |

9/12/2016 |

2/20/2013 |

12/1/2015 |

|

Expense Ratio |

0.15% |

0.25% |

0.15% |

0.12% |

0.20% |

|

AUM |

$24.12B |

$6.91B |

$1.11B |

$683.29M |

$624.27M |

|

Avg Daily Volume |

$163.41M |

$105.02M |

$4.93M |

$2.72M |

$1.06M |

|

Holdings |

170 |

103 |

130 |

163 |

434 |

|

Top 10 |

15.66% |

12.90% |

35.11% |

11.82% |

9.31% |

|

Turnover |

23.00% |

55.00% |

46.00% |

27.00% |

30.00% |

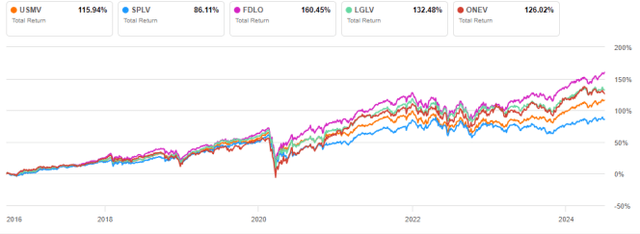

USMV is the largest and most liquid of these funds, and it has the lowest turnover rate. The next chart compares total returns, starting on 9/19/2016 to match all inception dates. USMV is second to last, beating only SPLV. The best performer is FDLO.

USMV vs competitors since 9/19/2016 (Seeking Alpha)

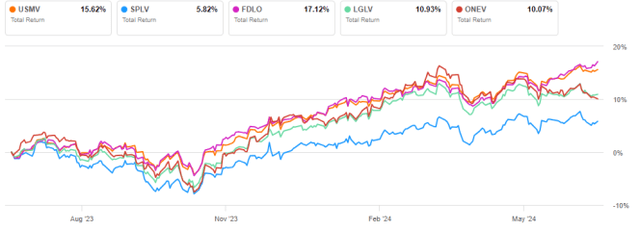

However, it comes in second position over the last 12 months, shortly behind FDLO:

USMV vs competitors, 12-month return (Seeking Alpha)

Takeaway

iShares MSCI USA Min Vol Factor ETF implements a low-volatility strategy picking stocks based on an optimized covariance matrix, whereas other low-vol funds screen stocks based on their beta or price standard deviation. Nonetheless, this methodology also results in overweighting traditional defensive sectors relative to the benchmark. The current portfolio looks superior to the Russell 1000 index regarding value and quality, but inferior in growth. USMV has lagged the benchmark in total return since inception, but it is marginally better in risk-adjusted performance. It has also lagged several low-vol ETFs over the last 8 years, especially Fidelity Low Volatility Factor ETF, whose low-volatility approach includes earnings in addition to price. I have reviewed FDLO in May.

Read the full article here