Introduction

As a value investor, the March 2023 banking crisis – triggered by the collapse of Silicon Valley Bank (OTCPK:SIVBQ) – naturally piqued my interest. Specifically, I looked for banks with comparatively large unrealized losses on their balance sheets, but where I was convinced that a forced liquidation of these underwater securities was unlikely. U.S. Bancorp (NYSE:USB), the fifth-largest bank in the U.S. by total assets, falls into this category, and I began covering the stock soon after it crashed in early April. Recently, I published an earnings preview in which I discussed deposit trends, loan portfolio quality, and an often overlooked risk indicator – the significant and still growing utilization of the Bank Term Funding Program (BTFP).

I started building a position in USB shortly after the crash and remain very confident about the bank’s prospects given its astute management, diversified loan portfolio, good scale and high profitability. Of course, the dividend (current yield 5.55%) played a role in my decision to add USB stock to my income-oriented portfolio. However, I recently considered increasing my yield by taking a position in U.S. Bancorp’s Series B preferred stock (USB.PR.H). After all, the last quarterly dividend declared on September 12, 2023 represents an annualized yield of 8.4% currently.

However, I ultimately decided against this maneuver and am sticking with U.S. Bancorp common stock – despite the significantly higher dividend yield and potentially higher dividend safety of Series B preferred stock. Read on to find out why…

What Is USB.PR.H?

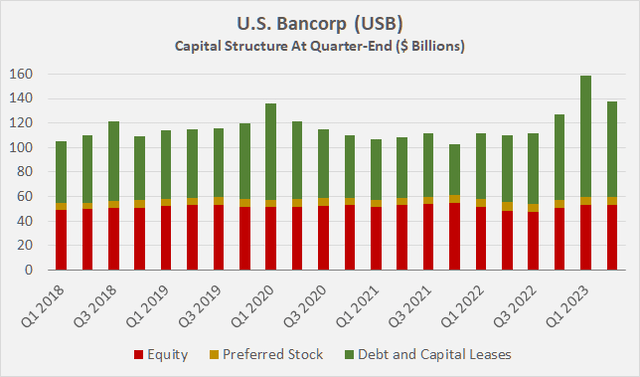

USB.PR.H (the official ticker symbol is USB PrH and can be found on Yahoo Finance under USB-PH) are depositary shares representing a 1/1000th interest in a share of U.S. Bancorp’s Series B preferred stock. Like many banks, U.S. Bancorp finances its operations through a more or less fixed percentage of preferred stock (typically 5% of the total capital structure), which of course is subordinated to the company’s debt (green) and senior to its common stock (red):

Figure 1: U.S. Bancorp (USB): Capital structure at quarter-end (own work, based on company filings)

The stock was issued on March 27, 2006 (see original prospectus), is non-cumulative, perpetual, and has a liquidation preference of $25 per depositary share. This means that the stock is currently trading at a significant discount to its liquidation preference. However, given past performance (Figure 2), our highly leveraged financial system, and long-term uncertainties, I would not expect the stock to return to par anytime soon.

Figure 2: U.S. Bancorp Series B preferred stock (USB.PR.H): Premium/discount to the liquidation preference of $25 per depositary share (own work, based on the weekly closing price of USB.PR.H)

From a total return perspective, I prefer the common stock (USB) because of the currently higher perceived risk and therefore comparatively greater discount to fair value. This is underlined, for example, by the currently quite low USB/USB.PR.H spread. In Figure 3, a spread of 100% means that USB common shares cost twice the dollar amount as the 1/1000 Series B preferred shares. The lower the spread, the cheaper the common stock is compared to the preferred stock. However, there is still the enticing 8% dividend on the preferred shares – let’s take a closer look.

Figure 3: U.S. Bancorp Series B preferred stock (USB.PR.H) vs. common stock (USB): Relative share price premium (own work, based on the weekly closing prices of USB.PR.H and USB)

What Can Income-Seeking Investors Expect From USB.PR.H And What Are The Risks?

USB’s Series B preferred stock entitles the holder to a quarterly dividend paid in arrears on January 15, April, July and October of each year. In principle, the dividend is variable, adjusting for 3-month LIBOR (likely already replaced by SOFR) plus a 60 basis point premium, but subject to a floor of 3.50%. This is the main reason why the share price is quite sensitive to the prevailing interest rate environment. Figure 4 shows the inverse correlation (r = -0.87) between USB.PR.H’s stock price and 3-month LIBOR.

Figure 4: U.S. Bancorp Series B preferred stock (USB.PR.H): 3-Month LIBOR compared with the share price (own work, based on the daily closing price of USB.PR.H and 3-Month LIBOR)

If we annualize the quarterly declared dividend and divide it by the share price on the day of declaration, we get a fairly good approximation of the actual dividend yield of the stock. A comparison with the 3-Month Daily Treasury Par Yield (Figure 5) shows a positive correlation (r = +0.65) between USB.PR.H’s forward dividend yield (blue line) and short-term interest rates (gray line), at least in a “normal” market environment. Of course, this is not a big surprise knowing how USB’s Series B preferred stock dividend is calculated. Looking at the spread (dashed red line), an investment in USB.PR.H currently appears at least somewhat attractive from a historical perspective.

Figure 5: U.S. Bancorp Series B preferred stock (USB.PR.H): Implied forward dividend yield vs 3-Month Daily Treasury Par Yield (own work, based on the daily closing price of USB.PR.H and 3-Month LIBOR)

While the stock looks quite attractive today from a yield spread perspective, investors need to keep in mind the variable dividend rate. Market data (e.g., the recent sharp rise in long-term Treasury yields) suggests that rates will remain higher for longer, but eventually, they will decline again, putting pressure on USB.PR.H’s payout. Moreover, when the yield curve eventually returns to a normal shape, USB.PR.H’s yield will follow the now-low interest rates at the short end of the curve.

However, I think it is problematic that an equity-like investment (which requires a long-term horizon – USB.PR.H has a market-like beta) has a dividend yield that is closely tied to short-term interest rates. Worse, in a deep and prolonged economic crisis, the Federal Reserve typically lowers interest rates, leaving an investor in USB.PR.H with a yield of only 3.5%. Of course, the common stock dividend could be canceled in a severe economic downturn, but that’s a risk that aligns well with the long-term mindset of an equity investor.

In addition to the preferred share’s close link to short-term interest rates and comparatively weak (and limited) capital appreciation potential, which in my view make it an unconvincing investment, there are other risks to consider.

In a deep crisis, a suspension of the preferred stock dividend is also to be expected. However, U.S. Bancorp has declared and paid every single dividend on its Series B preferred stock to date – even during the Great Recession and at the height of the COVID-19 pandemic, so this risk should not be overstated. However, as with other non-cumulative preferred stock, USB.PR.H investors are not entitled to a subsequent payment if the dividend is temporarily suspended.

In theory, the risk of total loss in the event of bankruptcy is lower for preferred shares than for common shares. In the event of a bailout (remember that USB is the fifth largest bank in the U.S.), I can actually imagine only common shareholders walking away empty-handed. However, if U.S. Bancorp were to fall (or be allowed to fall), I highly doubt that preferred stockholders would be better off than holders of common stock.

Finally, those interested in investing in USB.PR.H should consider the typically rather low trading volume. While typically more than 12 million shares of USB common stock change hands daily on the New York Stock Exchange, only about 120,000 shares of USB 1/1000 Series B preferred stock do. That equates to a daily turnover of only about $2.2 million, while the daily turnover for USB common stock is about $400 million. As a result, the bid-ask spread on USB’s preferred stock is comparatively wide, making opening or exiting a position in USB.PR.H at a fair price a difficult proposition.

Conclusion

I believe that the March 2023 banking crisis, triggered by the collapse of Silicon Valley Bank, offers long-term investors an excellent opportunity to add attractively valued stocks of high-quality financials to their portfolios. U.S. Bancorp is definitely in that category, despite a slightly weaker earnings outlook than a year ago.

However, with a dividend yield of 5.5% – only slightly higher than long-term Treasuries (e.g., 5.3% on the 20-Year Treasury), but with significantly higher risk – it is worth considering higher-yielding alternatives with similar or even lower risk than USB common stock.

U.S. Bancorp’s Series B preferred stock – or, more specifically, its 1/1000 depositary shares – currently looks very attractive because of its 8.4% dividend yield. Of course, since it is a non-cumulative preferred stock, investors may miss out on the dividend in a deep crisis, but I think it is generally very safe, considering that U.S. Bancorp has not failed to declare (and pay) a single dividend on USB.PR.H since it began trading in 2006.

It is the combination of an equity-like asset with a dividend that is closely linked to short-term interest rates that makes USB.PR.H a rather risky investment in my opinion. An equity-like asset should only be held with a very long-term horizon in order to be able to ride out recurring bear markets, but it is during such times that USB.PR.H’s dividend payout declines – namely, when the Federal Reserve lowers interest rates to spur economic growth. As a result, the poor yield during an economic downturn could tempt investors to sell their low-yielding preferred shares. The 3.5% floor is small consolation in a downturn, but that alone doesn’t qualify USB.PR.H as a good investment. I would only consider investing during a time of peak pessimism when USB.PR.H’s forward yield is very high despite low interest rates.

Moreover, the comparatively weaker return prospects – due in part to the fact that preferred shares rank senior to common shares in the event of bankruptcy – have led me to stick with my investment in USB. I am confident that in the event of a bankruptcy of U.S. Bancorp in a severe economic crisis (which would likely be accompanied by other, much more serious problems), preferred shareholders would likely be no better off than common shareholders. The only case in which I can imagine that only the common shareholders would walk away empty-handed would be in a bailout. However, given its astute management, diversified and high-quality loan portfolio, good scale and high profitability, I doubt that the fifth largest bank in the U.S. is at risk of needing to be bailed out in an economic downturn – let’s not forget how well the bank weathered the Great Financial Crisis of 2007 to 2009.

Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your own due diligence.

Read the full article here