Taiwan Semiconductor Manufacturing (TSMC) (NYSE:TSM) is a semiconductor foundry, which means it manufactures chips for other companies like Advanced Micro Devices (AMD) and Nvidia (NVDA). AMD and Nvidia, on the other hand, are fabless semiconductor companies that design and sell their own chips but outsource the manufacturing to foundry TSMC.

Because TSMC’s revenue is derived from manufacturing services for various companies, including AMD and Nvidia, its revenue growth may not directly correlate with the revenue growth of its customers. Factors such as overall semiconductor market demand, TSMC’s manufacturing capacity, and the competitiveness of its technology nodes can all impact TSMC’s revenue performance relative to its customers.

Indeed, in 2023 during the downturn in the consumer electronics market, which incidentally decimated memory companies such as Micron Technology (MU) and Samsung Electronics (OTCPK:SSNLF), TSMC’s revenues dropped 4.4% YoY in 1H 2023 but recovered to grow 18.5% HoH in H2 2023.

Chart 1 shows total quarterly revenue (NT$ billion) for TSMC between Q1 2018 and Q4 2023, as well as QoQ revenue growth.

The Information Network

Chart 1

TSMC HPC versus Nvidia Data Center Revenues

To assess whether TSMC’s revenue is underperforming compared to AMD and Nvidia, one would need to compare the revenue growth rates of these companies over a specific period, taking into account their respective business models and market conditions.

To do an accurate comparison, in Chart 2 I plot TSMC’s High Performance Computing (HPC) revenues against Nvidia’s Data Center revenues from Q1 2021 to Q4 2023. To ensure visual compatibility, I scaled TSMC’s HPC revenues in NT$billion by a factor of 15, while Nvidia’s revenues are presented in $million.

This supports the argument that there is a close relationship between TSMC’s HPC and Nvidia’s Data Center revenues up until Q2 2023 when Nvidia’s data center revenues started skyrocketing.

To be clear, TSMC’s HPC products include personal computer central processing units (“CPUs”), graphics processor units (“GPUs”), field programmable gate arrays (“FPGAs”), server processors, accelerators, and high-speed networking chips.

The Information Network

Chart 2

In Chart 3, I add AMD’s Data Center revenues for the same period. Fourth quarter business results have Datacenter segment revenue, of $2.28 billion up 37.9% year-over-year, and up 42.8% sequentially. The strong growth was due to AMD launching its MI300 accelerator family in December with strong partner and ecosystem support from multiple large cloud providers, all the major OEMs and many leading AI developers, according to the company. Data Center guidance for Q1 2024 was vague, as the company only noted it will grow QoQ in Q1 2024 and exceed $3.5B in 2024.

Chart 3 shows that, trendlines (blue and green dotted lines) for TSMC and AMD are comparable, and it remains to be seen if AMD can duplicate Q4 growth as I suspect it is preparing for the launch of its Mi400 with HBM3 in 2025 to compete against Nvidia’s B100.

The Information Network

Chart 3

Ratio Comparison of Revenues

I show in graphical form in Chart 4 the ratio of Nvidia/TSMC revenues (orange bars) and AMD/TSMC revenues (gray bars). These are actual Data Center revenues for Nvidia and AMD, and HPC revenues for TSMC.

The AMD/TSMC ratio has been flat except for a Q4 2023 spurt which caused the trend line (dotted gray line) to show a positive slope. The same is true for the Nvidia/TSMC trendline (dotted orange line) until the ramp in Q2 2023.

Clearly, AI GPUs from Nvidia and AMD are causing a divergence of revenues even though these chips are made by TSMC.

Mi300 ASPs are estimated at between $10,000 and $15,000 (depending on customer and quantity). Nvidia’s H100 processors are priced between $25,000 and $40,000.

The Information Network

Chart 5

TSMC’s Price Increase

TSMC was planning on increasing the prices of its chips in mid-2023, but the slowdown in the chip market and its revenues forced the company to recant. Chart 6 shows TSMC revenues and ASPs between Q1 2018 and Q4 2023.

It is important to recognize on Chart 6 that the ASPs are not only correlated with price increases, but on product mix as smaller node wafers are priced higher. In Q4 2023, a notable portion of TSMC’s wafer revenue stemmed from its more advanced process nodes. Specifically, 15% of the revenue was attributed to wafers processed with N3 technology, while N5 and N7 technologies contributed 39% and 17%, respectively. In terms of monetary value, N3 technology accounted for $2.943 billion, N5 for $6.867 billion, and N7 for $3.3354 billion.

Overall, TSMC’s advanced technology nodes, encompassing N7, N5, and N3, collectively represented 67% of its total wafer revenue. Furthermore, a broader category inclusive of all FinFET-based process technologies comprised 75% of the company’s wafer sales.

The Information Network

Chart 6

Table 1 shows TSMC’s price structure as of January, 2023, according to The Information Network’s report Global Semiconductor Equipment: Markets, Market Shares and Market Forecasts.

The Information Network

In late 2023, TSMC increased wafer prices and intends to increase them again in 2024. Chart 7 shows the new pricing structure for wafers calculated through 2024 and estimated for 2025. On aggregate, TSMC will raise prices by 8.7% compared to prices listed in Table 1.

Importantly, TSMC’s 2nm wafer price in 2025 will reach nearly $30,000. By way of comparison, based on a chip size of 814 mm2, TSMC can fabricate 87 H100 chips for Nvidia, based on 100% yield. At an ASP of $30,000, as stated above, it means that Nvidia can generate revenues 87x greater than what it pays TSMC for each wafer.

The Information Network

Chart 7

Investor Takeaway

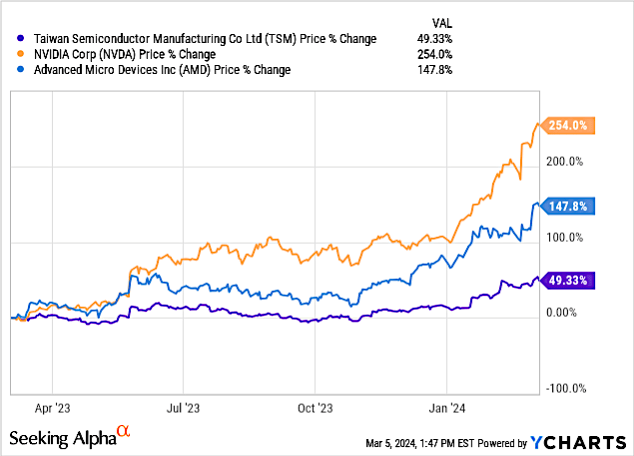

Chart 8 shows share price change performance for the past year for TSM, NVDA, and AMD. It shows the disproportionate growth in NVDA compared to the others.

YCharts

Chart 8

Chart 9 shows days of inventory for TSMC, including customers NVDA and AMD for the past 3-year period. Days of inventory for NVDA and AMD had increased in 1H 2023 as chip demand softened, and subsequently dropped to 123 days for AMD and 86 days for NVDA. TSMC inventory has remained flat during this period.

YCharts

Chart 9

There has been concern that TSMC doesn’t have the capacity to meet demand from AMD. However, this is not the case at the fabrication foundry, but is the case for TSMC’s packaging foundry. I discussed this in a February 13, 2024 Seeking Alpha article entitled “Intel’s Secret Weapon.”

What has happened at the fabrication foundry is that TSMC has adjusted capacity utilization, due to the semiconductor slowdown in 2023. In Q3 2022, TSMC’s capacity utilization was at 111%, meaning demand was 11% greater than supply. In Q4 2022, utilization started dropping until it reached a low of 73% in Q3 2023 before increasing to 76% in Q4 2023. This means that currently, supply is outpacing demand by 24%, and in principle, in Q4, 24% of fabs were idle.

This oversupply was in trailing-edge chips (>20nm), which dropped to 37% of revenues in Q4 2023 from 41% in Q3 2023. This is the key for the company, as it continues to spend for leading-edge technology – the move to 3nm and 2nm technology.

In response, TSMC cut capex towards the lower end of the 32% to 36% range for 2023 because of the overhang of slow sales to PC and Smartphones. In addition, TSMC has a strategy so that some of its N3 capacity can be supported by N5 tools, enabling higher capital efficiency without WFE spend.

Leading-edge technology accounts for between 70% to 80% of its total CapEx in the year, mature specialty technology between 10% to 20%, and the remaining are split between advanced packaging and its e-beam operation.

In fact, CEO C.C. Wei noted:

- “N3 successfully entered volume production and enjoy a strong ramp in second half ’23, accounting for 6% of our total wafer revenue in 2023.

- N3E has already into volume production in the fourth quarter of 2023.

- N2 technology development is progressing well and on track for volume production in 2025.”

TSMC is undervalued. Without the company making the chips, Nvidia and AMD would not be in the position they now enjoy, which is a catalyst for Nvidia’s outstanding Q2-Q4 guidance. I rate TSM stock a Buy.

Read the full article here