Introduction

Those who follow me know I’m a huge fan of Business Development Companies. The main reason is because of the amount of income they typically generate and pay out in the form of dividends. These are often considered riskier investments because of their business structures. Lending to smaller, start-up businesses can have its positives, but comes with disadvantages as well.

One reason being is their heavy use of leverage. Another is because some of these smaller businesses they provide funding to are often distressed, which can lead to financial problems for the BDC down the line. But there are many BDCs I consider to be high-quality and investments to hold for the long-term.

I wrote an article back in November on several that I consider to be quality, ranking them on their chances of navigating an economic downturn like a recession, which you can read here. It’s not out of the norm to see these yielding upwards of 15% because of the business model, but every yield is not created equal. So proceed with caution.

I suggest doing a deep dive into company/business financials before deciding to invest simply because of the enticing yield. In this article, I give reasons why TriplePoint Venture Growth (NYSE:TPVG) may look enticing but too good to be true.

Brief Overview

Similar to Hercules Capital (HTGC) and Trinity Capital (TRIN), TPVG specializes in investments in venture capital-backed companies in the growth stage. They provide debt financing to venture growth space companies looking for loans and/or equipment financing. Within growth capital loans they invest between $5 million to $50 million, equipment loans $5 million to $25 million, and revolving loans $1 million to $25 million.

This is slightly different from peers Ares Capital (ARCC) and Capital Southwest (CSWC) who both target companies with an EBITDA range of $10-250 million and $3-20 million respectively. Blackstone Secure Lending (BXSL) typically targets companies with a weighted-average EBITDA of $183 million. So, TPVG differs from other well-known BDCs in the sector when it comes to this. They are also externally managed, and target returns between 10% and 18%. One way the company does this is through equity kickers in the form of warrants.

The Good

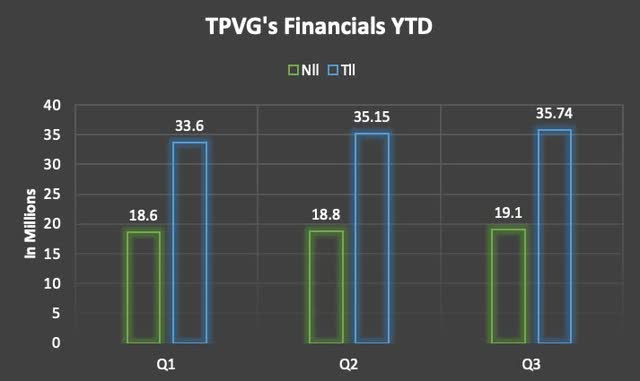

Throughout 2023 TriplePoint has posted some solid financials. In their latest earnings back in November the BDC beat analysts’ estimates on net investment income by $0.04. Total investment income of $35.74 million also beat estimates by $2.03 million. Net investment income of $19.1 million increased by 13% from $16.9 million year-over-year. Total investment income increased by 20% from $29.7 million over the same period. In the chart below you can see TPVG’s Nll & Tll have both increased steadily YTD.

Author creation

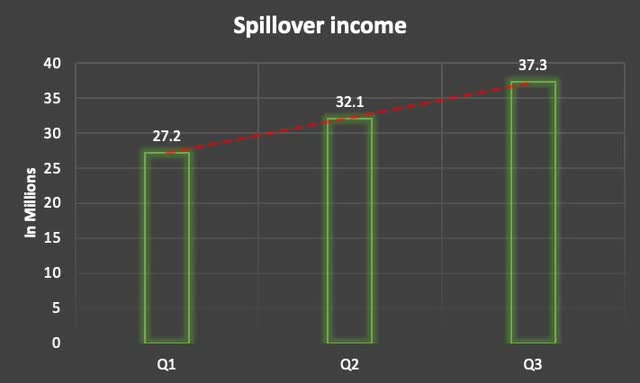

So, investors who’ve held TPVG this year have enjoyed some nice double-digit returns. Another metric the BDC has continued to grow was its spillover income quarter-over-quarter. This is something I like about the company. Like ARCC, they elect to rollover spillover income.

This is important because it gives them an extra financial buffer if they unexpectedly experience some financial hardship. You can see their spillover income increased by more than 37% quarter-over-quarter from $27.2 million to $37.3 million, or $0.77 to $1.03. This is impressive all things considered.

Author creation

The company raised their dividend to $0.40 earlier this year, and has continued to out-earn the dividend with Nll of $0.54 in Q3. This was up from $0.51 in Q3 ’22. While other peers have paid out extra income in specials & supplemental dividends, TPVG has elected not to.

One reason may be due to the externally-managed structure, similar to Ares Capital. They have also elected to keep the dividend at $0.48 this year. Both BDCs last paid out a special in December of 2022. And while investors may enjoy the extra income, I don’t mind some of my holdings preferring to roll it over. I like the balance in my portfolio.

Liquidity & Balance Sheet

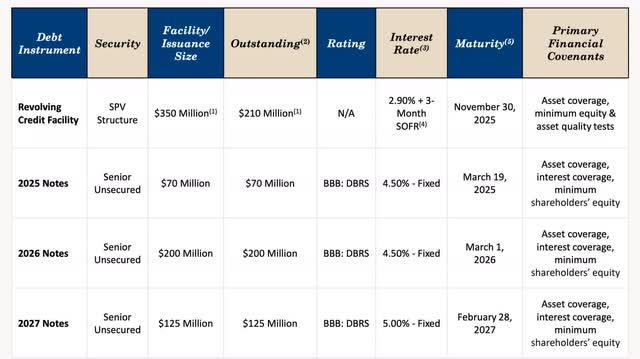

TriplePoint’s balance sheet is also solid. With a credit rating of BBB and well-laddered debt maturities, the BDC doesn’t have to worry about any maturing debt in 2024. They’ve also been focusing on increasing their liquidity and at the end of the quarter had $262.5 million available. This included $122 million in cash and $140 million available under the revolving credit facility. Additionally, they managed to decrease their leverage ratio from Q2 to 1.62x.

TPVG investor presentation

With three rate cuts expected in 2024 and a weighted-average interest rate of 4.70%, TPVG may be able to refinance their debt due in 2025-2027 at lower rates which is good for the company.

The Bad

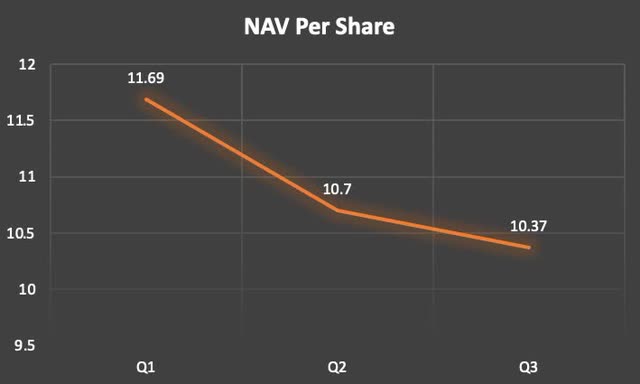

This is where TPVG starts to concern me. Since the start of 2022 the BDC’s NAV has been in a constant decline. In Q1 ’22, TPVG’s NAV was $13.84. And you can see in the chart below that since Q1 of this year this decline has continued. This significant decline is the worst in the sector, and I get into why later in the article.

Author creation

To put this in perspective, both peers in the venture capital space, Trinity Capital & Hercules Capital, both managed to grow their NAVs year-over-year. TRIN’s NAV grew from $13.17 to $13.74 while HTGC’s grew from $10.53 to $10.93. In Q3 of last year, TPVG’s NAV stood at $12.69, representing more than an 18% decrease.

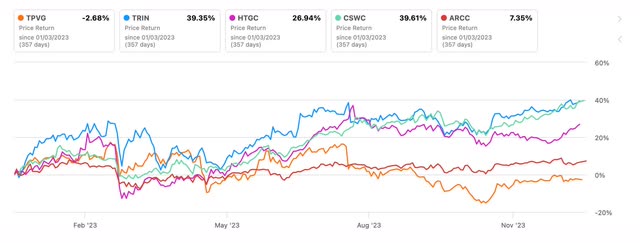

A growth in NAV shows that the value of underlying investments in the portfolio continues to increase over time. And NAV growth usually leads to share price appreciation (over time). YTD you can see how TPVG has lagged some of its peers in price return.

Seeking Alpha

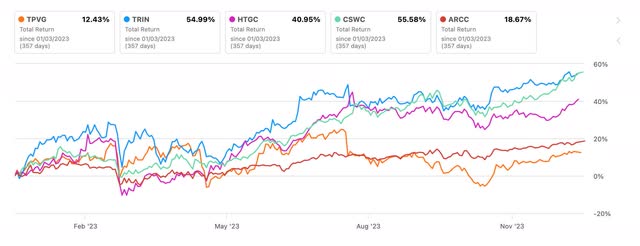

Below you can see the BDC has more than 12% when it comes to total returns, but they still trail the others by a sizable margin.

Seeking Alpha

Investors who enjoy high dividends I’m sure may argue with my thesis about TPVG, but as a buy-and-hold investor, I prefer to focus on quality. Quality over quantity is how I view all my holdings. Yes, collecting a $0.40 dividend on a quarterly basis from a stock trading at less than $11 a share may seem compelling, but I’d rather pay a bit more for a company that I consider to be of higher quality.

Credit quality usually warrants a higher share price and better total returns over a longer period of time. And yes, the company has been out-earning its dividend by a decent amount, but poor credit quality will likely lead to losses in the future.

The Ugly

Another thing that highly concerns me is TPVG’s rapid rise in non-accruals. At the end of the quarter the BDC reported a total of 11.1%, which is extremely high. I understand the high interest rate environment has caused a rise in non-accruals for some, but a double-digit percentage is alarming.

This is in comparison to peers HTGC & TRIN whose non-accrual percentages stood at 2.7% and 2.6% respectively. Furthermore, some peers like ARCC have managed to decrease their non-accruals quarter-over-quarter. At the end of Q3, ’22 TriplePoint’s non-accrual percentage was just 3.3%, or just 1.0% of their total portfolio fair value.

During the quarter the company also downgraded the credit quality of several of their e-commerce & consumer portfolio companies in their debt investment portfolio. Additionally, one company, HealthIQ, filed for bankruptcy.

Over the last few years, the BDC has had $89.7 million in net realized losses which has driven their NAV down. Subsequently, this has driven up their leverage ratio. Although they managed to decrease this quarter-over-quarter, this stood at just 1.15x in Q3 of 2022.

For those who invest in BDCs, you want to see these numbers move in the opposite directions. NAV growth moving upwards while the leverage ratio moves downward over time.

And while credit stress events are expected to ease in Q4 and beyond with rates expected to decline, this is something investors in TPVG should be concerned with going forward.

Risk Factors

TPVG’s biggest risk is their non-accruals. With an alarmingly high rate, investors in the BDC should proceed with caution. A further rise in non-accruals will likely affect the company’s net investment income & total investment income for the foreseeable future. The company does a good job with spillover income to somewhat negate this, but this is still a major concern.

While BDCs typically enjoy interest income from higher rates due to their predominantly floating rate portfolios, loan defaults also affect dividend sustainability going forward. Then there’s the risk of a recession which would likely cause an even higher rate of loan defaults as well. With portfolio companies already feeling the impact from the macro environment, rolling into a recession in the next year could spell disaster for those with a lower credit quality like TPVG.

Valuation

At the time of writing the BDC trades at a small premium to its NAV. The stock currently trades at a price $10. and historically has traded at a higher premium of 8% according to CEFdata. The reasons listed in this article are probably why they now trade at a smaller premium/in-line to their NAV.

At the current price and yield, I think the stock could be considered a buy for short-term dividend investors looking for income. If you have a longer-term outlook I would look to invest in other peers within the sector.

Additionally, the price target of $10.60 offers no upside and with rates expected to decline next year, I suspect the price will fall slightly as investors rotate into BDCs considered higher-quality.

Tipranks

Bottom Line

TriplePoint Venture Growth has grown its net investment income & total investment income steadily quarter-over-quarter in 2023 which is impressive considering the environment and their staggering rises in non-accruals. For investors focused on high-yields, TPVG maintains some solid financial metrics for now.

And with the current environment expected to ease somewhat in 2024, they may continue to pay and increase their dividend for the near term. But for those that prefer quality over quantity and enjoy investing in the sector, there are several other higher-quality options out there. Due to the significant rise in non-accruals, lagging performance in comparison to peers, and a significant NAV price per share decline year-over-year, I rate TPVG a sell.

Read the full article here