Investment Thesis

Trane Technologies (NYSE:TT) is poised to benefit from strong order bookings and healthy backlog levels which offer good visibility for its near-term revenue growth. While the company is seeing some normalization in its residential and transport refrigeration businesses, the sales growth should benefit from favorable demand trends in its commercial end-market which accounts for 80% of its revenues. This business has secular growth drivers like the recent reshoring trend fueled by government funding from the Inflation Reduction Act (IRA) and the CHIPS and Science Act which should contribute to its revenue growth in the coming quarters. In addition, the revenue growth should also benefit from the company’s good execution with it quickly pivoting focus to higher-growth verticals like data centers, education, etc., and market share gains in the transport refrigeration business. In the medium to long term, once the interest rate cycle starts reversing, the residential end-market should see a sharp recovery given the tight supply-demand dynamics which should accelerate the company’s revenue growth. Besides organic growth, the company has a healthy balance sheet to support its M&A strategy which bodes well for the company’s inorganic growth prospects moving forward.

On the margin front, the company’s margin growth should see benefits from operating leverage, carryover impact of past price increases and further price increases, and increased higher-margin aftermarket mix. Moreover, the valuation is lower than its historical averages. So, the good revenue and margin growth prospects coupled with reasonable valuations make TT’s stock a buy.

Revenue Analysis and Outlook

In my previous article, I talked about the solid underlying demand drivers for the company helping its revenue growth. The company has reported its third quarter results since then where it reported better than expected revenue and earnings which drove the stock outperformance.

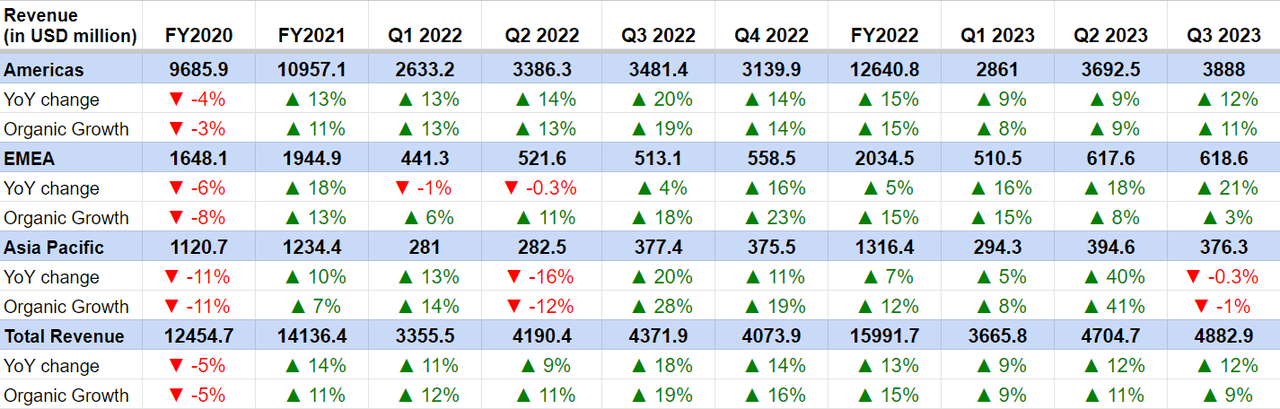

In the third quarter of 2023, TT reported revenues of $4.88 billion, up 12% Y/Y or 9% organically benefiting from robust end-customer demand, particularly across its commercial HVAC businesses in the Americas, Asia Pacific, and Europe, Middle East, and Africa (EMEA) segments.

In the Americas segment, revenue grew 12% Y/Y on a reported basis and 11% Y/Y organically led by strong growth in the commercial HVAC business (up low 20s) with revenues up ~30% in equipment and up low-teens in services. Further, the residential business was up low single-digit which also benefited the segment’s revenues. These positive factors effectively offset the revenue decline in the Americas transport refrigeration business.

The EMEA segment’s revenue grew 21% Y/Y and 3% Y/Y on an organic basis driven by mid-single-digit growth in commercial HVAC and low single-digit growth in transport refrigeration businesses.

In the Asia Pacific segment, revenues were flat Y/Y on a reported basis and declined 1% Y/Y organically due to tough comparisons versus the 28% Y/Y organic order growth in Q3 FY22. This was a result of the strong recovery in volumes following the ending of COVID-19-related lockdowns in China. However, organic revenue was up ~30% on a three-year stack basis.

TT’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, the company’s revenue outlook remains solid. The company posted ~10% Y/Y growth in orders last quarter which is the strongest level in the last two years and its enterprise backlog ended the quarter at $6.9 bn which provides good visibility on the potential growth in the coming quarters.

The company’s U.S order bookings were driven by 14% Y/Y organic bookings growth within the commercial HVAC business in the Americas segment. The company also achieved Y/Y growth in order bookings internationally with bookings up 29% Y/Y or 12% Y/Y organically in its Asia Pacific segment and up 12% Y/Y organically in the EMEA segment.

TT’s Historical Orders Growth (Company Data, GS Analytics Research)

While the company’s residential and transport refrigeration end-market is seeing some normalization, its commercial end-market, which is ~80% of its revenues, is doing very well. There are secular growth drivers in this business like incentives from the Inflation Reduction Act (IRA) for higher efficiency HVAC equipment and the recent reshoring trend helped by stimulus from the CHIPS and Science Act and IRA which is resulting in good demand from heavy non-residential construction.

The company is also executing well and its sales quickly pivoted to focusing on growth verticals like data centers, high tech, and education as the residential and transportation market slowed.

Also, I believe the residential market is near a bottom. There have been some positive data points on the inflation front of late and once the interest rate cycle starts turning, this market can quickly return to growth given the tight supply-demand conditions fueled by over a decade of underbuilding of new homes after the great housing recession of 2008.

On the transportation side, the company has a good history of posting above-market growth and even if the market sees some decline due to tough macros, I expect the company to continue gaining market share.

Outperformance in Trane Technologies’ Thermo King (transportation) business (Company’s Q3 Investor Presentation)

The company also has a healthy balance sheet with net leverage (net debt to TTM EBITDA) of less than 1.3x. It has deployed or committed ~$900 mn year to date for bolt-on technology acquisition and equity investment, and I expect the inorganic growth to continue moving forward as well. Hence, I am optimistic about the company’s revenue growth prospects.

Margin Analysis and Outlook

In Q3 2023, the company saw a 100 bps Y/Y increase in adjusted EBITDA margin to 19.5% driven by strong volume growth, higher price realization, and productivity gains which more than offset the adverse impact of cost inflation and continued business reinvestment. Segment wise, the Americas segment’s adjusted EBITDA margin improved by 80 bps Y/Y while the EMEA and Asia Pacific margins expanded by 260 bps Y/Y and 160 bps Y/Y, respectively.

TT’s Adjusted EBITDA margin (Company Data, GS Analytics Research)

TT’s Segment Wise Adjusted EBITDA margin (Company Data, GS Analytics Research)

Looking forward, I am optimistic about the company’s margin expansion prospects.

The company is set to benefit from operating leverage from increasing sales. It has guided for 30% plus incremental margins for Q4 and I believe longer-term incremental margins could be in the range of 25% to 30% for the company.

The company has also done a good job in terms of pricing and last quarter, the company saw 4 percentage points of pricing improvement. The carryforward impact of recent price increases as well as future price increases should continue to help margins.

Further, the company is also focusing on growing its aftermarket business mix in the long run. The aftermarket business has higher margins and should help lift the company’s overall margins.

Valuation and Conclusion

TT is currently trading at 22.22x FY24 consensus EPS estimates of $10.02 and 19.98x FY25 consensus EPS estimates of $11.15, which is at a discount versus the company’s 5-year average forward P/E of 24.19x.

The company has solid growth prospects supported by a strong backlog and order bookings, secular demand trends in its commercial end-market, good execution with quickly pivoting focus to higher growth verticals, market share gains in the transportation refrigeration business, and inorganic growth from M&As. Once the interest rate cycle starts reversing, a recovery in the residential end-market should accelerate revenue growth in the medium to long term given the tight supply-demand dynamics in this market. The margin outlook also looks attractive with benefits from operating leverage, price increases, and increased higher-margin aftermarket mix. The valuation is also lower than historical. This, combined with solid revenue growth prospects and margin improvement potential makes TT’s stock a buy.

Read the full article here