Co-authored by Treading Softly

Picking the right partner for any task is essential.

If you’re going to be working on a vehicle, you want someone with some level of mechanical aptitude or at least the ability to readily listen to instructions. If you’re going to bake, you want someone who has the ability to understand how to measure accurately and follow the steps of baking effectively. If you’re going to go hunting, you want someone who has some firearms proficiency but also understands how to be quiet and exceptionally safe in that practice.

When it comes to life, many people choose to get married to somebody, picking them as a “Life Partner.” Sadly, like many aspects of life, marriages do not last as long anymore. According to data from the U.S. Census, 50% of first marriages, 67% of second marriages, and more than 70% of third marriages end in divorce.

Looking towards the market, average holding timeframes for investors have collapsed from multiple years to days. As an income investor, I am laser-focused on buying quality – but not quality as others determine it. Quality income investments that pay me to be a shareholder and pay me that quality income I’m looking for. Just like any task in life, I am looking for the right partners to put in my portfolio to work alongside me.

Today, I want to present one partner that I think is extremely valuable for an income portfolio in the current environment we live in.

Let’s dive in!

Pick The Right Partner

XAI Octagon Floating Rate & Alternative Income Term Trust (NYSE:XFLT), yielding 15.4%, is a CEF (Closed-End Fund) that invests in floating-rate corporate loans. It does this with a combination of direct investments in senior secured corporate loans and through Collateralized Loan Obligations. CLOs also invest in senior secured corporate loans made to companies with credit ratings in the B range.

What makes a CLO investment different is that it is a portfolio of loans that is actively managed. Funds that invest in CLOs can take on a debt position, where they are owed an amount of principal and are paid at a predetermined (floating) interest rate, or they can own a portion of the equity – the portion that gets to keep whatever profits are made.

I’ve discussed other funds that own primarily equity tranches in CLOs, which provide the highest yield and highest return potential – but also take on the highest risk. Equity tranches can provide very high returns, but debt is first in line to get paid.

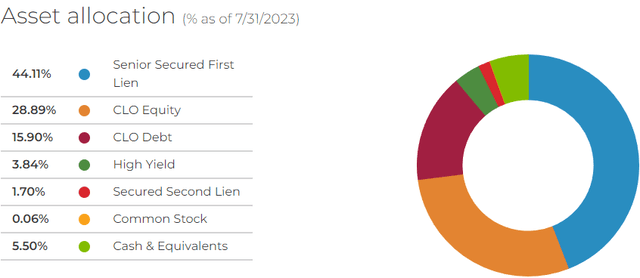

XFLT maintains a roughly equal allocation invested in senior loans and CLOs. For its CLO investments, it holds both debt and equity tranches. Source

XFLT Website

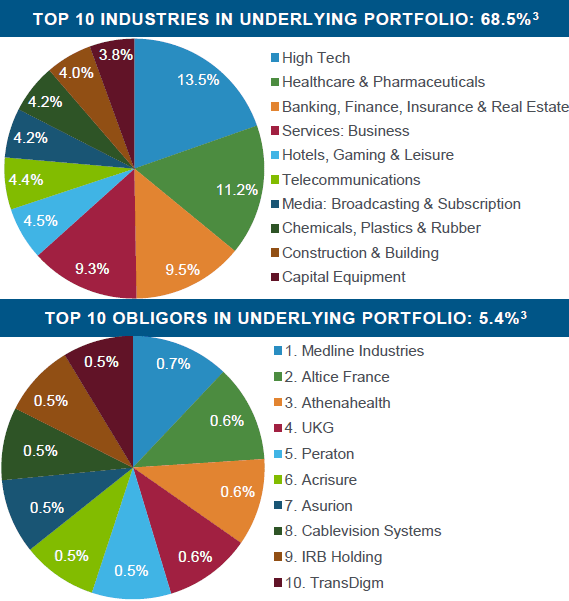

XFLT is extremely diversified, with the largest single borrower accounting for only 0.7% of its portfolio. Source

XFLT Q2 2023 Presentation

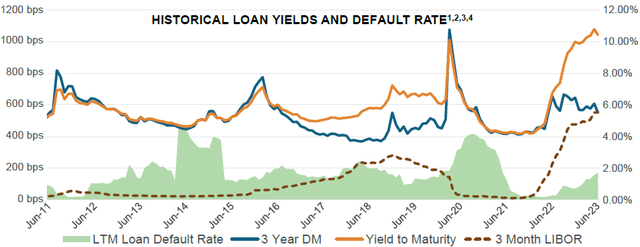

Since these are floating-rate loans, they have generally held up better than fixed-rate loans in the face of rising interest rates. However, they have not been immune to the headwinds. The yield to maturity for loan yields is now over 10%, higher than it was during the COVID panic.

XFLT Q2 2023 Presentation

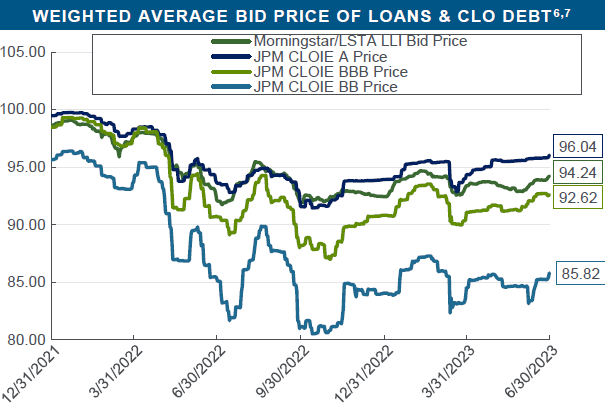

The 3-Year DM (Discount Margin) is a value measurement that takes into account the current risk-free rate that has been trading at an elevated level for over a year. We can also see the low prices for loans reflected in the average discount to par for loans and for CLO debt tranches:

XFLT Q2 2023 Presentation

Note that the BB CLO tranches are trading in the mid-80s, 10% lower than they were in 2021, even though they are collecting much higher interest since they pay a floating rate.

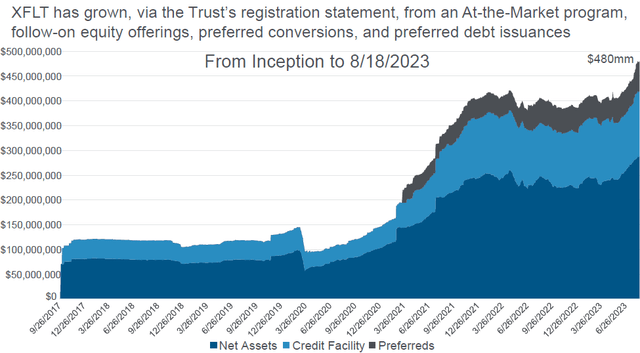

XFLT has taken advantage of low loan prices and low CLO prices by increasing its assets under management.

XFLT Q2 2023 Presentation

Note that XFLT grew rapidly following COVID until the middle of 2021 and then held steady through 2022. In the first half of 2023, XFLT increased its assets by about 20% – this is something shareholders should welcome because:

- It makes XFLT more efficient. The costs of managing a $500 million portfolio are not much higher than managing a $400 million portfolio.

- Buying when prices are low is usually good for the buyer. “Buy low, sell high” is one of the most basic pieces of investment advice that many people can’t follow. The reason is that when prices are low, “everybody knows” that it is a bad time to buy for this reason or that reason. History has proven time and again that investors who are willing to buy when others are selling make more money – loan yields are high, and prices are low. While it is perfectly possible that prices can decline more, the prices today are attractive. XFLT bought a lot in late 2020/early 2021, and investors are being rewarded today for that good decision with a dividend that is 16% higher than it was pre-COVID. I believe buying today is an equally good decision.

The interest rate shock created by the Fed is reverberating throughout the market and the economy. This is a unique time we are living in, with the opportunity to invest in debt at low prices and high yields relative to what we have seen over the past 20+ years. XFLT is one of many options I am investing in to take advantage of this opportunity.

Conclusion

With the Federal Reserve having tossed the proverbial toaster into the economic bathtub, XFLT, in its 15% yield, offers an opportunity to work alongside management to massively benefit from the current environment. Many different credit products or fixed-income investments are trading at large discounts to their par values, simply because of the rapid rate heights the Federal Reserve conducted. These investments are collateral damage in the Federal Reserve’s war against inflation. As the economy is buffeted again and again by these interest rate hikes, and as the impact of that damage continues to be felt and understood more fully, the collateral damage within the fixed-income market is clearly seen.

The management team of XFLT is actually working to benefit from the extremely high yields available within the credit markets, which then they turn around and provide us as income into your portfolio through your investment. Every month, outstanding income pours out from XFLT and arrives directly into my account as an irrevocable return that cannot be taken away from me on the whim of someone else – it’s cash in hand.

When it comes to retirement, cash in your hand is what it takes to pay your bills, buy your groceries, and fill your gas tank. I want you to have big, powerful paychecks from the market to be able to buy and afford things like groceries, your bills, and your lifestyle. Financial security should be the bedrock on which your entire retirement is built. Our unique Income Method can help make that financial security possible.

That’s the beauty of my Income Method. That’s the beauty of income investing.

Read the full article here