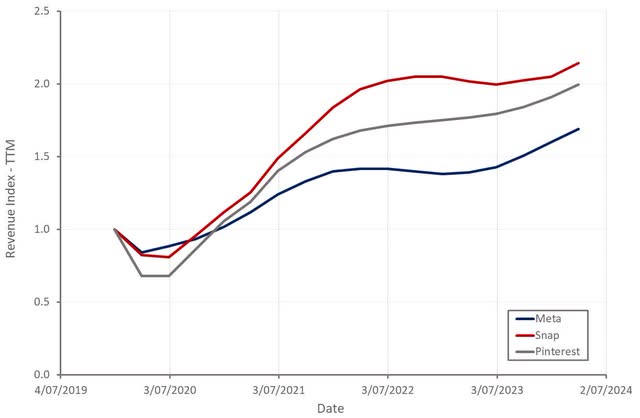

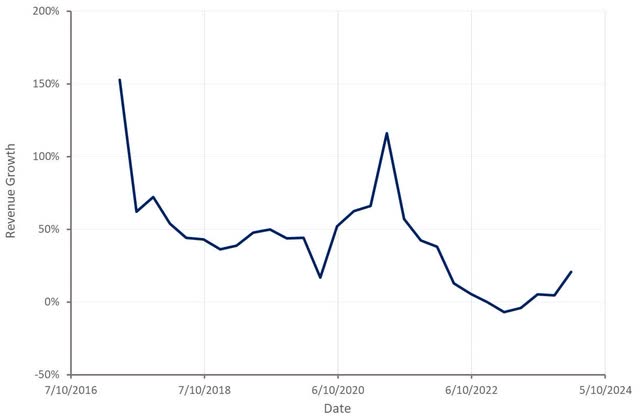

Snap’s (NYSE:SNAP) financial performance continues to rebound after a difficult 2-year period which has been driven by a combination of macro headwinds and privacy initiatives impacting digital advertising. While Snap’s near-term future is highly dependent on macro conditions remaining stable, the company should continue to generate solid growth with improving margins over a longer time frame.

The last time I wrote about Snap in December, I suggested that while its fundamentals were improving, the company’s valuation would probably limit near-term upside. Despite the recent jump, Snap’s share price is still down since then. While I feel that the company has been unfairly maligned, Snap also has genuine issues, and as a result, I find it difficult to get excited about the stock outside periods of excessive investor pessimism.

Market Conditions

A post-pandemic hangover, tighter financial conditions and difficulties wrought by privacy initiatives have caused significant difficulties for many digital advertising companies in recent years. There has a broad-based reacceleration in recent quarters, though, which is somewhat surprising given that macro uncertainty remains elevated and retail sales are weak. Much of this is likely to be a result of the ecosystem adjusting to privacy changes. Some companies have recovered targeting and attribution faster than others, though, and Snap has been a laggard in this regard. As a result, it could continue to see relatively strong performance in coming quarters.

Snap has stated that the improvement in market conditions in Q1 was broad-based, with verticals like CPG, ecommerce, restaurants, and travel performing particularly well. Demand for brand advertising picked up, and Snap’s direct response business accelerated on the back of improved ad performance. The direct response business is expected to continue improving in Q2, but there will be some seasonality headwinds.

Figure 1: Social Media Company Revenue (source: Created by author using data from company reports)

It is worth noting that social media could continue to face headwinds in coming years as its impact on society becomes more widely recognized. For example, a UK regulator has proposed social media rules which aim to protect children from harmful content, which appears to be targeted at recommendation algorithms. The Australian Prime Minister has called for a social media age limit to protect the mental health of children, with Labor pledging 6.5 million AUD towards an age verification trial and also launching an inquiry into social media platforms. The South Australian government is also pushing for an outright ban on social media for children, although it is not clear yet whether this is even feasible. Under the proposal, children aged 14 and 15 would require parental consent to access a social media account. This could be particularly harmful for Snap, as its user base skews towards younger people.

Snap Business Updates

Snap currently has 3 strategic priorities:

- Diversifying revenue and accelerating growth

- User growth and engagement

- Augmented reality

Stronger revenue growth in the first quarter was attributed to improvements to the advertising platform and increased demand. Snap has been trying to increase ROAS on its platform through product innovation. This is largely based around introducing privacy safe signals and investing in larger models. For example, Snap is now investing around 100 million USD per quarter in machine learning.

There are aspects of Snap’s platform that are likely to be appealing to advertisers (user demographics, differentiated products) but the company still needs to further improve ad performance. It is questionable whether Snap has access to the first-party data necessary to replicate the success of Meta, though.

Snap also continues to attract demand to its platform. The company’s self-serve SMB product contributed to an 85% YoY increase in the number of SMB advertisers on the platform. Snap is also benefitting from the introduction of third-party demand. Snap has an ad partnership with Amazon, which aims to bring relevant products to Amazon shoppers inside the Snapchat experience.

Snapchat+ now has approximately 9 million subscribers and continues to provide an incremental source of high margin revenue. Snapchat+ provides subscribers access to exclusive, experimental, and pre-release features, with generative AI potentially increasing its appeal.

Financial Analysis

Snap’s revenue increased 21% YoY in the first quarter to 1.195 billion USD. Direct response advertising revenue increased 17% YoY, driven by improving ROAS for advertising partners. Brand advertising revenue grew 12% YoY on the back of a stronger demand environment. Other revenue increased 194% YoY to 87 million USD, primarily due to Snapchat+ subscription revenue.

Snap expects 431 million DAUs and 1.225-1.255 billion USD revenue in the second quarter, implying 15-18% YoY revenue growth.

Figure 2: Snap Revenue Growth (source: Created by author using data from Snap)

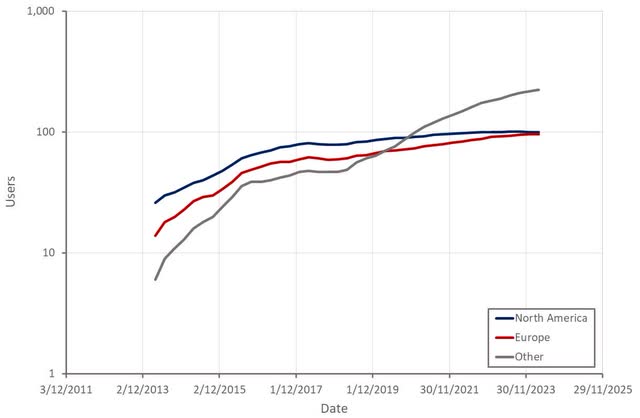

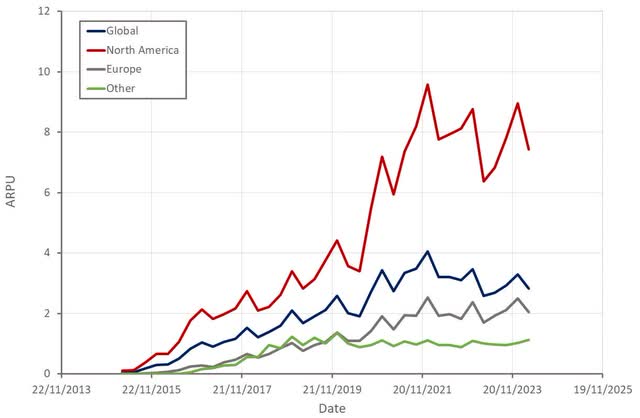

Snap’s DAUs increased 10% YoY to 422 million in the first quarter. This growth is mainly coming from outside of North America and Europe, meaning its impact on revenue growth is currently muted. Snap also continues to drive increased engagement, with the number of viewers and total content consumption time increasing versus the prior year period. The company is particularly focused on engagement in North America and Europe. I have previously suggested that Snap could be approaching saturation in its more mature markets, but that engagement still provides a large opportunity, as the platform has over 750 million monthly active users.

Figure 3: Snap DAUs (source: Created by author using data from Snap) Figure 4: Snap ARPU (source: Created by author using data from Snap)

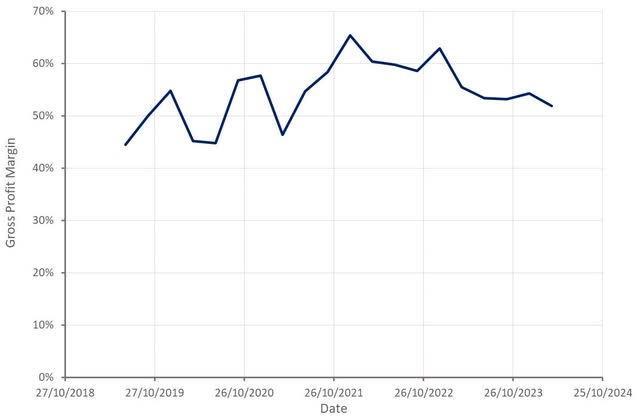

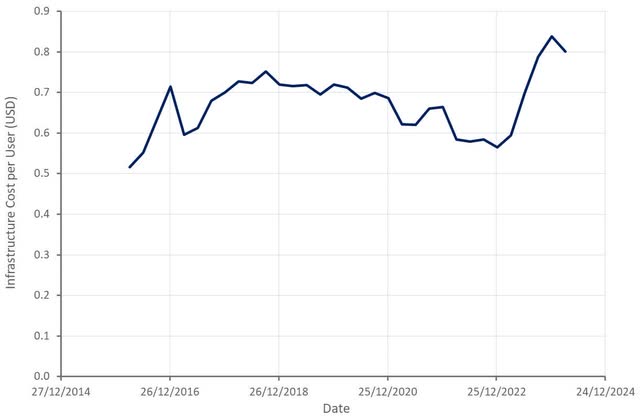

Snap’s gross profit margin continued its recent slide in the first quarter, which was largely due to rising infrastructure costs. Snap has suggested that this is due to investments in machine learning to support its direct response ad business. Snap is also facing margin headwinds from the growth of users in lower ARPU regions.

Figure 5: Snap Gross Profit Margin (source: Created by author using data from Snap) Figure 6: Snap Infrastructure Cost per User (source: Created by author using data from Snap)

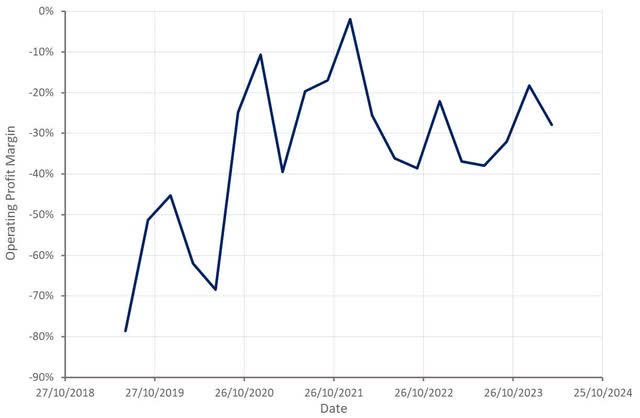

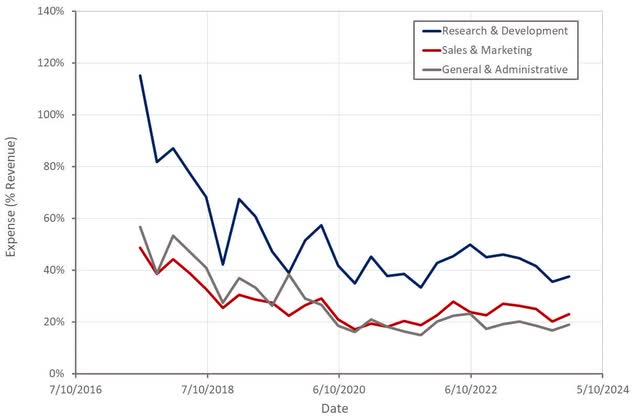

Adjusted operating expenses increased 5% YoY to 579 million USD, supported by cost-cutting initiatives. Headcount was down 7% YoY at the end of the first quarter, although this was offset by 70 million USD of costs related to restructuring initiatives. Operating expenses continue to be driven by R&D.

Snap continues to generate modest free cash flow, but this is somewhat meaningless given the amount of stock-based compensation. SBC was down 60 million USD YoY in the first quarter, but the company’s share count increased 3.8% YoY. Snap is anticipating 1.13-.12 billion USD stock-based compensation in 2024, putting SBC per employee at around 240,000 USD. The distribution of SBC is likely to be highly skewed, but Snap’s costs still appear to be excessive.

Figure 7: Snap Operating Profit Margin (source: Created by author using data from Snap) Figure 8: Snap Operating Expenses (source: Created by author using data from Snap)

Snap repurchased 100 million USD of its 2025 convertible notes and 351 million USD of its 2026 convertible notes in the first quarter. This was done at prices below par value.

Snap recently announced a planned issuance of 650 million USD of convertible senior notes due 2030. The initial purchasers will also have an option to buy up to an additional 100 million USD notes. The notes will accrue 0.5% interest payable semi-annually in arrears. Proceeds will be directed towards general corporate purposes and repurchasing previously issued convertible notes.

Figure 9: Snap Outstanding Convertible Notes (source: Snap)

Conclusion

While Snap has large losses and continues to dilute existing shareholders through SBC, the company has a large cash balance which it has been using to repurchase shares. Since Q3 2022, Snap has repurchased 145 million shares at an average price of 9.86 USD per share (total cost of approximately 1.4 billion USD). While this is largely just an attempt to neutralize the impact of SBC, these repurchases should end up working out fairly well.

Snap also still has approximately 2.9 billion USD in cash and marketable securities, providing the company with flexibility going forward. This cash balance is likely to be viewed more favorably given that Snap is now cash flow positive.

After the recent increase in share price, Snap’s valuation is now less forgiving. Despite this, the stock can move higher provided that the company’s fundamentals continue to improve. Increasing ad ROAS and a more stable demand environment should be supportive of growth going forward. Snap’s losses remain large, though, and there is little evidence that the company is becoming more disciplined.

Figure 10: Snap EV/S Ratio (source: Seeking Alpha)

Read the full article here