Note:

I have covered SEACOR Marine Holdings Inc. or “SEACOR Marine” (NYSE:SMHI) previously, so investors should view this as an update to my earlier articles on the company.

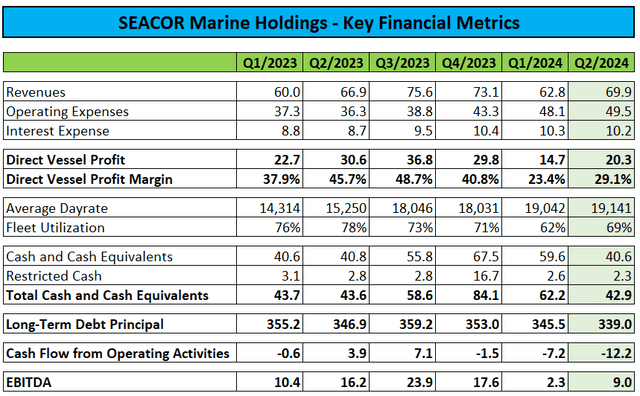

Last week, leading offshore support vessel provider SEACOR Marine Holdings released another disappointing quarterly report, with profitability falling well short of expectations and sizeable cash usage.

Press Releases / Regulatory Filings

While the company’s average dayrate of $19,141 increased to a new multi-year high, year-over-year rate improvement slowed down from 33.0% in Q1 to 25.5% in Q2.

In addition, fleet utilization of 69%, while up meaningfully from Q1, was a far cry of last year’s 78% number.

In the press release, management attributed the issue to drydockings taking longer than expected as shipyards and equipment vendors are dealing with capacity issues:

Our lower utilization was primarily driven by planned drydockings and major repairs as part of a heavier 2024 maintenance schedule, some of which have taken longer than expected as shipyards and vendors continue to address various capacity challenges.

Utilization was also affected by near-term softer demand in the U.S. and longer re-marketing time between jobs internationally.

We observed delays in the project schedules of our customers in the U.S., particularly in decommissioning and offshore wind, as properties with asset removal obligations in the U.S. Gulf of Mexico rotate to new customers and decisions are more generally deferred until after the U.S. election.

In addition, demand in the U.S. market remains soft due to ongoing delays in decommissioning and offshore wind projects.

With results in the domestic market highly dependent on liftboat utilization, revenues and margins have experienced wild swings in recent quarters:

Company Press Releases

With weak market conditions in the United States likely to persist throughout this year, I would expect the segment to remain a drag on the company’s financial performance for at least the next couple of quarters.

Moreover, capacity challenges at shipyards and vendors are not likely to abate anytime soon either, which could further pressure the company’s results in H2/2024 and beyond.

However, management remained optimistic on SEACOR Marine’s prospects:

Despite various capacity challenges, we are well advanced in this year’s maintenance schedule, which should translate into improved utilization for the rest of 2024 and into 2025. Utilization improvement, coupled with the more favorable pricing we are already experiencing, should lead to significant improvements in performance.

Unfortunately, the pace of year-over-year dayrate improvement appears to have slowed during the second quarter.

Given the company’s disappointing H1/2024 performance and persistent near-term headwinds, I have reduced my estimates and price target for a second consecutive quarter:

Author’s Estimates

However, even at the reduced price target of $15.00 (down from $17.50), the stock offers more than 30% upside from current levels:

Author’s Estimates / Value Investor’s Edge

Please note that SEACOR Marine expenses all maintenance and drydocking costs rather than capitalizing parts of them on the balance sheet, which understates the company’s margins and profitability relative to its much larger competitor Tidewater (TDW).

With the majority of 2024 drydockings seemingly behind the company, utilization and profitability should increase meaningfully in the second half of next year and going into 2025, very much as stated by management in the press release. With leading dayrates at decade-highs, overall market conditions remain constructive.

However, at least in my opinion, management should consider putting the company on the block, particularly with domestic competitors Hornbeck Offshore Services and Tidewater still in expansion mode.

In a recent research note, Clarksons Securities AS estimated the company’s net asset value (“NAV”) at up to $25 per share and assigned a price target of $20 to the stock.

Clarksons Securities AS

As a result, my revised $15 price target might prove too conservative in a potential acquisition scenario.

Bottom Line

SEACOR Marine Holdings reported another disappointing set of quarterly results due to persistent weakness in the domestic market and capacity challenges experienced by shipyards and equipment vendors.

In addition, the pace of year-over-year dayrate improvement slowed down considerably.

With these headwinds not likely to abate anytime soon, I have further reduced my estimates and price target for the company.

However, even at the reduced price target of $15.00, the stock offers more than 30% upside from current levels and with the majority of 2024 drydockings seemingly behind the company, financial performance should improve significantly in the second half of the year and going into 2025.

Consequently, I am reiterating my “Buy” rating on the shares.

Read the full article here