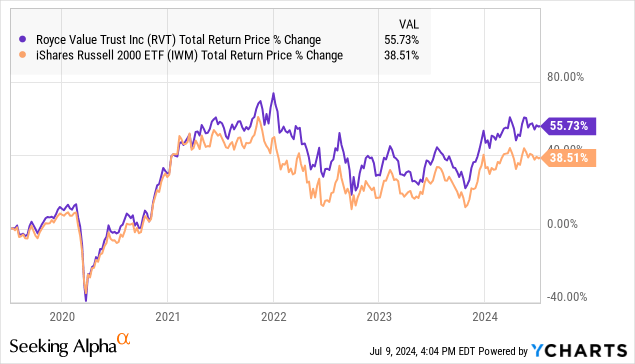

The Royce Small-Cap Trust (NYSE:RVT) takes an actively managed approach to small-cap stock investing through a closed-end fund (CEF) structure. The fund has a long history of not only delivering positive shareholder returns but also outperforming small-cap benchmarks like the iShares Russell 2000 ETF (IWM).

We last covered RVT back in 2019, hailing it as a category reference point within CEFs. Nearly five years later, we can reaffirm our opinion that this is a high-quality fund with a nearly 40-year record that speaks for itself. RVT also offers an 8% distribution yield, making it a compelling option for income-focused investors.

Our update today explores where RVT is headed through the rest of 2024. Small-caps have lagged behind the broader market, still trading below their pandemic-era cycle peaks. Could RVT make a good addition to your portfolio?

What is the RVT CEF?

RVT has been publicly traded since 1986 with its founding portfolio manager Chuck Royce recognized as a pioneer in small-cap investing.

The attraction of this segment is the understanding that small companies are often in an earlier stage of growth, with the potential for significant returns for those that evolve into large caps. There is also a sense that underfollowed small caps can trade at lower valuations, making them compelling opportunities.

On this point, while RVT has always had a small-cap strategy, it was previously known as the “Royce Value Trust” until a name change just this year highlighted the small-cap focus. Officially, the investment policy was updated from investing at least 65% of its assets in small- and micro-cap companies to an amended mandate lifting that to 80%. In practice, the actual exposure to small caps is above 95%.

The key takeaway here is that given the actively managed strategy, all holdings are at the discretion of the investment management team, and not intended to track any particular index.

Going through the current portfolio, RVT includes 445 current holdings which is a large number of stocks, but also less than a quarter of the referenced Russell 2000 Index which works as a performance benchmark.

In this case, RVT has enough diversification where the performance is not necessarily dominated by the returns of a single stock, but more so on the high-level cross-sector trends and themes within small-caps as a whole. The largest single position as of June 30, is Alamost Gold Inc. (AGI) with a small 1.6% weighting, followed by Inpinj, Inc. (PI) and Envos Corp. (ENOV) at 1.3% and 1.2% of the net asset value, respectively.

Overall, there is a good measure of diversification. The ability to generate excess returns or alpha becomes less about overweighting a single stock and more about the positioning in sectors, over- or underweighting corners of the market. Notably, RVT has a tilt towards the Industrial sector which represents 24% of the fund, while Utilities and Consumer Staples are under-represented.

source: Royce Funds

RVT Performance

We mentioned RVT’s impressive performance history. Data from Royce shows that $10,000 invested in RVT at inception would have grown to more than $405k over the past 37 years compared to $265k in the Russell 2000 Index assuming the reinvestment of all distributions.

When thinking about the value of an actively managed strategy, this type of record helps to justify the fund’s 0.97% expense ratio which is elevated compared to IWM at 0.19%, but otherwise comparable to other closed-end funds.

source: Royce Funds

At the same time, it’s clear that the performance spread has narrowed in recent years, reflecting a more volatile period for small-caps compared to its stronger momentum in the early 2000s.

RVT has returned a modest 2.4% year-to-date, above the 0.9% gain in IWM, but significantly trailing the large-cap focused S&P 500 which we track in the chart below through the Vanguard S&P 500 ETF (VOO) with an 18% return thus far in 2024.

One explanation is that mega-cap tech leaders within the theme of artificial intelligence have dominated market returns this year, meaning small-cap strategies like the RVT CEF missing that exposure has lagged. There is also a case to be made that small companies have been more pressured by high interest rates and the cumulative effects of elevated inflation in recent years.

That dynamic has likely contributed to a persistent discount to the net asset value for RVT, which is currently at a -13% spread, below a -10% average over the past 5 years. The interpretation here is that the fund is relatively cheap or undervalued with the opportunity for investors being where the discount narrows, adding an incremental return potential on the upside.

What’s Next For RVT?

A chart that stands out to us is this one, showing 43% of Russell 2000 companies are currently unprofitable, a level that has structurally trended higher from under 20% in the past two decades. This is important as it highlights the value of an actively managed small-cap strategy.

In contrast to the Russell 2000 which passively holds “everything”, the value investors get from RVT is its flexibility to weed out the so-called bad apples by focusing on high-quality companies with generally stronger fundamentals.

source: Royce Funds

RVT looks attractive thinking about the next phase of the equities bull market where inflation normalizes lower and the Fed has room to cut interest rates. This backdrop could be a positive driver for an expansion of valuation multiples from beaten-down small-cap names.

In terms of addressing the secular underperformance of small-caps to large-caps, we believe that the dynamic will eventually reverse, translating to RVT outperforming the S&P 500 either in absolute terms or through reduced volatility on the downside.

The main risk to consider is the possibility of a deterioration in the macro backdrop, defined by the emergence of a recession with sharply higher unemployment. A surprising rebound of inflation forced the Fed to delay rate cuts or even tighten monetary conditions further would also likely result in a new round of market volatility. We would expect small caps and the RVT fund to sell off in such a scenario.

The good news is that RVT should continue to pay out its managed distribution policy, currently at a quarterly rate of $0.27 per share. This amount is typically variable to maintain a policy of an average of a 7% yield on the net asset value over a year.

Final Thoughts

RVT is a high-quality fund and remains a good option for investors as a core portfolio holding for long-term small-caps exposure. The expectation is that the fund should continue outperforming small-cap benchmarks, and is in a good spot into the second half of 2024.

Read the full article here