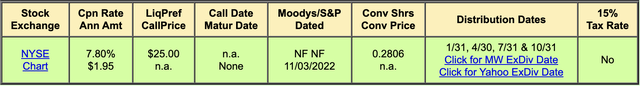

Investing in preferreds shares is in many ways one of the stock market’s most underrated ways of building income and RLJ Lodging Trust’s (NYSE:RLJ) Series A Convertible Preferred Shares (NYSE:RLJ.PR.A) offers a compelling investment proposition for defensively minded yield-seeking investors. There’s a lot to like here with the preferreds paying out a fixed $1.95 annual coupon for what’s currently an 8.2% yield on cost. The coupon is distributed in quarterly installments and with the preferreds currently trading for $23.62 per share, investors can pick them up for a small 5.5% discount to their $25 per share par value. The most distinctive feature of these is they’re essentially perpetual due to a busted convertible feature.

QuantumOnline

RLJ has the option to convert these to 0.2806 shares of common stock at an initial conversion price of $89.09 per common share if the price of the common stock equals or exceeds the conversion price for 20 of any 30 consecutive trading days. RLJ’s commons are currently trading at $9.50 per share, roughly $79.59 below its conversion price. The commons would have to move up 837% for the conversion to be activated and is likely to never trade at this level or close to this level. Digging into the 2017 prospectus issued when RLJ proposed to merge with FelCor Lodging Trust confirms a few more relevant items. The series A ranks senior to the commons and is also cumulative.

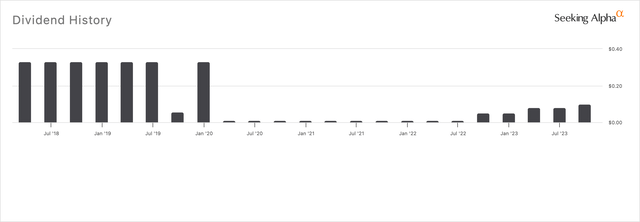

Dividends, RevPAR, And Adjusted FFO

The higher ranking means its holders are prioritized for dividend payments and that any unpaid dividend accrues as a liability to be repaid at a later date. This clause is what makes preferreds special as their dividends tend to be sticky even in times of intense economic discombobulation. RLJ was forced to essentially suspend its common share dividends during the pandemic with the payouts falling to $0.0100 per share from $0.3300 per share pre-pandemic. The REIT last declared a quarterly cash dividend for its common shareholders of $0.10 per common share, a 2 cents per share raise from the prior distribution for what’s a 4.2% annualized forward dividend yield.

Seeking Alpha (RLJ Common Share Dividends 5-Year)

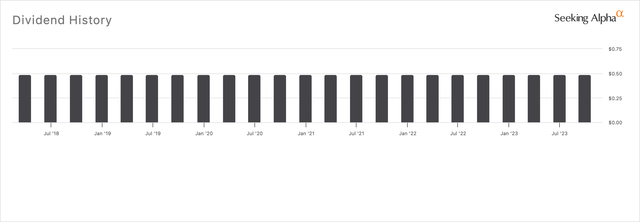

The preferreds, whose yield is 400 basis points ahead of the commons, saw all their distributions met through this period. Hence, the question as to whether to go with the commons or preferreds is not a hard one if you’re an investor orientated towards income. The 25% hike in the common share dividends is welcome but the yield is still half of the preferreds and significantly below their pre-pandemic level. The greatest risk to these non-redeemable securities is whether the underlying business is able to keep generating healthy funds from operations in an era recently described by JP Morgan’s Jamie Dimon as the most dangerous time the world has faced in decades.

RLJ Series A Preferred Stock Dividends 5-Year

RLJ last reported revenue of $357 million, up 8% over its year-ago comp and also beating analyst consensus by $1.38 million. Comparable RevPAR came in at $152.89, an increase of 4.5% from the year-ago period with the REIT also seeing comparable occupancy come in at 75.1%. This was a 50 basis points increase from its year-ago comp with adjusted FFO per share at $0.56, an increase of roughly 7 cents over $0.49 in the year-ago period. RLJ’s property portfolio as of the end of the second quarter consisted of 96 properties spread across 21,239 hotel rooms.

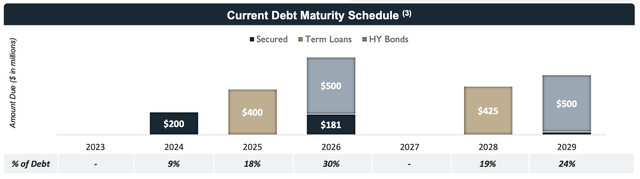

Debt, Maturities, And Dividend Coverage

RLJ Lodging Trust Fiscal 2023 Second Quarter Earnings Supplemental

RLJ held $2.2 billion in total debt at the end of the second quarter with a maturity profile that will see roughly $1.28 billion come due by the end of 2026. The backdrop for refinancing these is tough but not impossible. Further, the Fed is widely expected to pause base rates at their current level of 5.25% to 5.50% when they meet for the next Federal Open Market Committee on 1 November 2023 and the market is currently pricing a 99.9% chance that the Fed will keep rates unchanged. Hence, the current period of disruption caused by still-rising rates could stop with a conclusive end of the hiking cycle early next year.

RLJ is currently covering its common shares dividends by 560% with there being no current risk from FFO posed to the preferreds. To be clear, with the preferreds dividends being maintained through stay-at-home orders during the pandemic, it’s hard to see a situation where they will be challenged despite the current tough inflationary and interest rate environment. Higher for longer aggregated with a recession could see the price of the preferreds dip but the income is safe enough to lodge in. The commons are a hold with the preferreds forming a buy.

Read the full article here