Ring Energy (NYSE:REI) is currently projected to generate $67 million in free cash flow in 2024 at low-$80s WTI oil strip prices. Ring has hedged approximately 45% of its 2024 oil production (at guidance midpoint) and those oil hedges reduce its free cash flow by around $19 million (while its natural gas hedges have $4 million in positive value).

Ring’s Q4 2023 performance was largely in-line with my expectations, with production slightly above guidance midpoint and adjusted free cash flow within a couple percent of my projections.

Ring’s 2024 production guidance is a couple percent lower than what I had previously modeled at $155 million in capital expenditures though. This contributes to a slight $0.10 per share reduction in my estimate of Ring’s value, which I now estimate at $2.60 per share at long-term (after 2024) $75 WTI oil. The current WTI oil strip for 2025 is around $75.

Q4 2023 Results

Ring’s Q4 2023 results were solid. It reported 19,397 BOEPD in Q4 2023 sales volumes, including 13,637 barrels per day in oil sales volumes. This was around 1% higher than the midpoint of its Q4 2023 guidance for total sales volumes. Ring’s oil sales volumes were 3% above guidance midpoint as its oil cut ended up being 70% during the quarter compared to its expectations for 69% oil.

I had projected Ring’s Q4 2023 free cash flow at $16 million, while it reported $16.3 million in adjusted free cash flow during the quarter. Thus Ring’s Q4 2023 performance was largely in-line with my expectations (with slight outperformance).

Notes On 2024 Production Levels

Ring’s expectations for 2024 production appear to involve modest declines from Q4 2023 levels. I am using Q4 2023 as a comparison rather than full-year 2023 since Q4 2023 was Ring’s first full quarter after its Founders acquisition closed.

The midpoint of Ring’s 2024 guidance calls for both oil and total volumes to go down approximately -5% from Q4 2023 levels. Ring’s early 2024 production was affected by severe winter weather, but the full-year impact from that is under 1%.

Thus Ring’s $155 million capital expenditure budget for 2024 appears to be a bit below a maintenance budget. Around $175 million to $180 million would likely be enough to keep Ring’s production relatively flat to Q4 2023 levels.

Ring’s Q4 2023 production also slightly exceeded prior expectations, so perhaps around $165 million to $170 million in 2024 capex would have been enough to keep its 2024 production flat compared to its original expectations for Q4 2023.

Updated 2024 Outlook

At the midpoint of its 2024 guidance, Ring expects to produce an average of 18,500 BOEPD during 2024, including 12,950 barrels per day in oil production.

At current strip prices (around $81 to $82 WTI oil) for 2024, Ring is projected to generate around $393 million in oil and gas revenues before its hedges. Ring’s natural gas may fetch a slightly negative realized price (before hedges) as it realized only $0.05 per Mcf for its natural gas in 2023 and 2024 prices appear to be tracking a bit lower.

Ring’s 2024 hedges have around negative $15 million in estimated value. It has around 43% of its natural gas production hedged and around 45% of its oil production hedged. The oil hedges have around negative $19 million in estimated value at current strip, while its natural gas hedges have around $4 million in positive value.

| Barrels/Mcf | $ Per Barrel/Mcf (Realized) | $ Million | |

| Oil | 4,726,750 | $80.50 | $381 |

| NGLs | 991,618 | $13.00 | $13 |

| Natural Gas | 6,198,775 | -$0.10 | -$1 |

| Hedge Value | -$15 | ||

| Total Revenue | $378 |

Ring is currently projected to generate $67 million in 2024 free cash flow. It started 2024 with $425 million in net debt, so this would reduce its net debt to $358 million at the end of 2024. Ring’s leverage at the end of 2024 would be approximately 1.4x in this scenario.

| $ Million | |

| Production Expenses | $74 |

| Production and Ad Valorem Taxes | $27 |

| Cash G&A | $20 |

| Capital Expenditures | $155 |

| Cash Interest Expense | $35 |

| Total Cash Expenditures | $311 |

Notes On Valuation

I have trimmed my estimate of Ring’s value to approximately $2.60 per share at long-term $75 WTI oil. This is a slight $0.10 reduction (compared to my previous valuation estimate), reflecting Ring’s slightly lower than expected production guidance in 2024 with a $155 million capital expenditure budget.

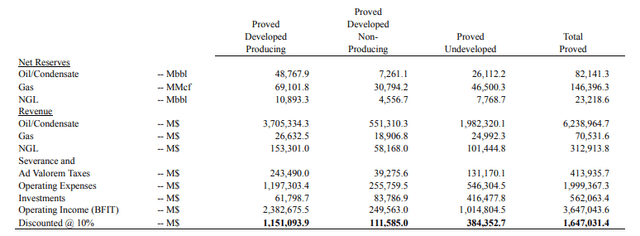

At $2.60 per share and $358 million in net debt (Ring’s projected year-end 2024 net debt), this would value Ring at around 0.76x PDP PV-10 and 0.69x proved developed PV-10 based on its year-end 2023 reserves.

Ring’s Reserves (ringenergy.com (2023 10-K))

Ring’s reserve calculations were based on $74.70 WTI oil and $2.637 Henry Hub natural gas. That oil price is roughly in-line with my long-term commodity price estimates. The natural gas price is lower than my $3.75 long-term estimate, but natural gas only makes up 16% of Ring’s PDP reserves and 19% of its proved developed reserves, so the impact of stronger natural gas prices is relatively modest. Ring’s 2024 capex budget also appears to be slightly below maintenance levels, so its year-end 2024 reserve values at $75 WTI oil and $3.75 Henry Hub gas would probably be unchanged from its 2023 reserve values at SEC pricing.

Conclusion

Since I last looked at Ring in January, its share price has gone up over 40%. Ring is helped by stronger oil prices, although it is roughly 45% hedged on oil so it is also projected to have some hedging losses in 2024.

I believe that Ring may still have some upside based on long-term $75 WTI oil prices, and estimate that it is worth $2.60 per share in that scenario. Although near-term oil prices are in the $80s, the current 2025 strip is still around $75.

Ring remains fairly risky due to its debt, although that should be quite manageable in a mid-$70s oil scenario. Due to its debt making up a significant portion of its enterprise value, Ring’s share price has a lot of torque to oil prices. This has helped it over the last couple months, but its debt also remains a risk if oil prices go down a decent amount.

Read the full article here