Once the market received news that Realty Income (NYSE:O) will merge with Spirit Realty Capital, Inc. (SRC), I wrote an article elaborating on the key effects from such a transaction.

The overarching positives were mostly associated with a significantly higher market capitalization level that would lead to:

- Enhanced bargaining power with financers for whom the notion of size and diversification play an important role in capital pricing processes.

- Strengthened liquidity of the equity (i.e., shares), which should contribute to a reduced illiquidity premium and in general allow O to rely on more notable additional issuances of equity.

- Improved position in the context of credit rating agencies, where company’s size and business diversification constitute, on average, 10 – 25% (depending on the agency and sector) of the total credit score.

Plus, if we consider management expectations the deal is set to be directly accretive to the adjusted funds from operations, or AFFO (on a per share basis, at around 2.5%). In fact, just recently Wolfe Research upgraded O to buy (outperform) referring to, among other things, that the estimate for accretion from the SRC acquisition is overly conservative.

Provided that the deal receives the necessary approval (e.g., antitrust), O would become the 4th largest REIT and land into a list of Top 200 companies in the S&P 500.

All in all, this would mark a significant change in how O creates value and supports its future dividends.

However, the fact that O is becoming so large and is increasingly venturing into more exotic segments of real estate (e.g., casinos and data centers), has caused a logical debate around O’s prospects to remain a reliable and relatively risk-averse dividend aristocrat.

With the recent Q3, 2023 results in mind on top of becoming the 4th largest REIT, let’s explore some of the most important aspects, which should be taken into account in the context of how O could create value and sustain its dividend on a go forward basis.

Decent entry point

First, by looking at the historical 10-year period, O’s current multiple seems from the first glance rather attractive.

YCharts

On a P/CF basis, O trades very close to the 10-year bottom. Yet, we have to be honest here and factor in the presence of higher SOFR, which was not the case before 2022. Namely, it is only logical that given higher interest rates, valuations are relatively low.

A more relevant approach would be to compare O to its closest peers.

Seeking Alpha

After solid Q3, 2023 earnings, where like-for-like FFO grew by 7.2%, and given the pressure on the share price from notable merger with SRC, almost all of O’s valuation metrics became more balanced and somewhat in line with the sector.

While in P/FFO terms O seems a bit stretched, in the context of its sound capital structure, this seems justified. Furthermore, if we take a look at forward P/FFO for 2024, O actually trades 7% below the sector average (compared to the Free Standing REIT segment).

From a valuation perspective, investors have now a rather attractive entry point to consider entering or adding to their current O position.

Size matters

There has been a lot of talk about O’s ability to continue delivering so solid results as it has done historically. In my view, this kind of concern is fully reasonable because of a couple of reasons:

- O as most REITs puts a strong focus on external growth via M&A to create value in a more rapid pace than what would otherwise be possible from the retained FFO. With a potential market cap over $50 billion, O would have to find very sizeable opportunities in real estate space to move the needle. In so large block trades, the chances of finding very opportunistic deals are inherently more narrow as typically these sellers are large scale and institutional investors, who are very well aware of the right cap rate levels.

- On top of the increased difficulties to capture lucrative cap rates, which typically lie in smaller scale / one-off transactions, the total addressable market of properties, where O wants to play has also, per definition, become smaller against the backdrop of O’s capitalization levels. This means that in order to sustain the external growth strategy, O would have to deviate more and more from its core net lease, retail sectors. In fact, this is what we can already see from the recent years (e.g., entering into office space, casinos, data centers).

- Finally, as O becomes larger and more diversified across many real estate segments, there is a risk of an emergence of a conglomerate discount. This occurs, when due to the complexity of the underlying business and no clear area of focus, the market starts to incorporate additional risk premium, effectively implying that if the business was split (e.g., net lease retail separated from O’s other real estate segments) these different parts would be valued higher.

The key argument is that because of O’s size, investors should not expect very significant gains going forward relative to REITs, which are small-cap and specialized in a certain pocket of the commercial real estate segment.

With that being said, in my view, O is not treated by investors as a vehicle from which huge alpha performance is expected. Instead, O’s investors (at least in my case) expect:

- Stability and steady growth in the monthly dividend.

- Gradual growth in the underlying value.

Now, for the fulfillment of these two aforementioned aspects having gigantic capitalization levels come in handy. Please refer for more details in the introductory section, but the main benefit is cheaper cost of capital (especially debt financing) that is very critical in REIT business.

Lastly, there is an additional positive nuance, which supports the benefit of O’s increased size.

YCharts

In the chart above, I have gathered a set of the largest equity REITs and compared their total return performance to the broader REIT index.

The conclusion is obvious, all of the largest REIT names have delivered better returns than the REIT average. There could be several explanations for this like the level of capital flows that are going into more liquid and larger names, which are more in the top of the largest indexes (e.g., the S&P 500).

Granted, this fact alone should not form a buy thesis, but it should definitely be factored into the overall equation.

Benefit from duration factor

Looking at the prevailing macroeconomic backdrop and how the market is pricing the trajectory of future interest rates, it is clear that in a relatively foreseeable future we should experience first steps towards the normalization of the Fed Fund’s rate.

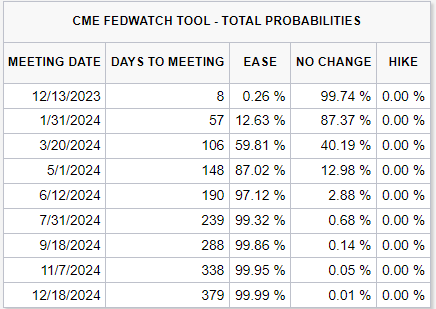

CME Group Inc

The market is currently pricing in a significant probability of rate cuts in 2024. Obviously, the market has previously been wrong and most probably will continue to be wrong on the future path on interest rates, but the overarching element is that it is extremely unlikely that the interest rates will continue to climb higher. Instead, it seems that the odds are clearly stacked in favor of some initial rate cuts in 2024.

The exact timing (month or quarter) is not that important for O as long as the followings things are clear:

- Interests rate will not move higher from here.

- In the foreseeable future, there will be normalization of the Fed Fund’s rate.

For O investors, the fact that interest rates are set to converge back to more accommodative levels should imply very positive news as the underlying characteristics of its business carry quite elevated exposure towards the duration factor.

Realty Income Investor Relations

The key driver of this is the duration of the weighted average lease term, which is close to 10 years. In other words, O has a significant chunk of its leases contracted many years ahead, where the majority of payments are inherently rather back-end loaded. For SRC, the weighted average lease term is even longer, at 10.2 years.

The notion of already binding cash flows that are contracted well ahead into the future makes O exposed to similar dynamics as any other plain vanilla fixed income instrument. And as we all now, fixed income tends to respond very well to any moves in the interest rates.

So, given that the interest rates will highly likely start to go down in 2024, O’s share price should benefit more than an average REIT.

The bottom line

O becoming the 4th largest REIT imposes several challenges for achieving a clear alpha performance such as more constrained access to opportunistic M&A deals and the potential of conglomerate discount.

At the same time, higher market cap level should structurally decrease the cost of financing and add the benefit of getting additional index flows from capital markets that in turn should put an upward pressure on the Stock price.

Given that most of O’s investors have entered their positions with an expectation of receiving reliable dividends and stable growth (not necessarily alpha), bigger size could be deemed as a net positive.

Due to the combination of strong quarterly performance in terms of the FFO per share growth and an additional discount stemming from the recently announced acquisition of SRC, the current multiple presents a compelling entry point.

Finally, if the interest rates start to normalize next year, which seems like a highly likely scenario, O should benefit more than an average REIT due to its long weighted average lease term profile that will become a bit more extended after the consolidation of SRC.

Read the full article here