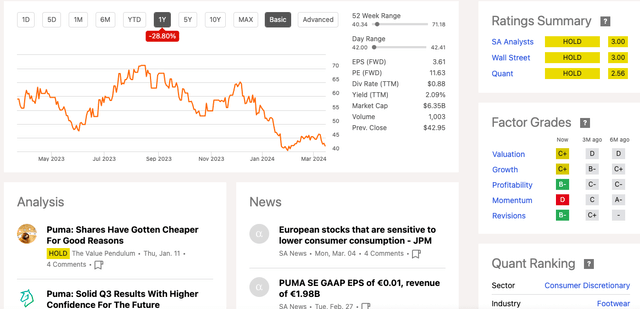

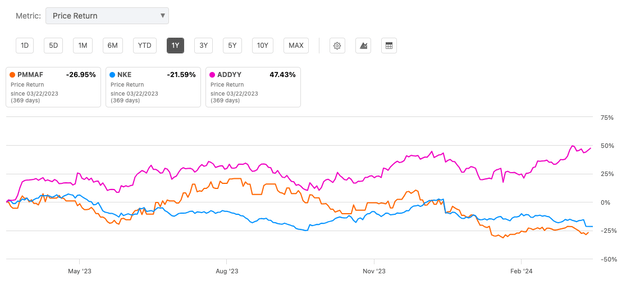

German sportswear giant PUMA SE (OTCPK:PMMAF)’s stock has dropped by 7.83% since releasing its FY2023 earnings results one month ago. Over the last year, there has been a lot of price volatility, and the stock has lost 28.80% in value. Despite headwinds, FY2023 was relatively successful, increasing its top line by 6.6% YoY, significantly improving its levered free cash flow and an increased cash position on the balance sheet. Conversely, the company saw a decline in its bottom line, and normalised diluted EPS reduced YoY by $0.22 to $1.86. Furthermore, the management team has given a cautious tone regarding the outlook for FY2024.

One year stock trend (SeekingAlpha.com)

The company has lost momentum in big markets, particularly the United States. The competition within the sportswear industry is fierce, with many smaller and newer competitors taking a position alongside the giants. While little growth is expected in FY2024, I believe the efforts the company is putting into its global brand strength while building local knowledge through new marketing teams in the US and China are potential indicators of success later down the line. Furthermore, the negative sentiment towards the stock has pushed down the price, and it is trading very cheaply compared to alternatives in the industry. On top of that, the company has a better-paid dividend program than its market share-dominating peers, NIKE, Inc. (NKE) and adidas AG (OTCQX:ADDYY). Therefore, long-term investors may want to take a bullish stance on this stock.

Company overview

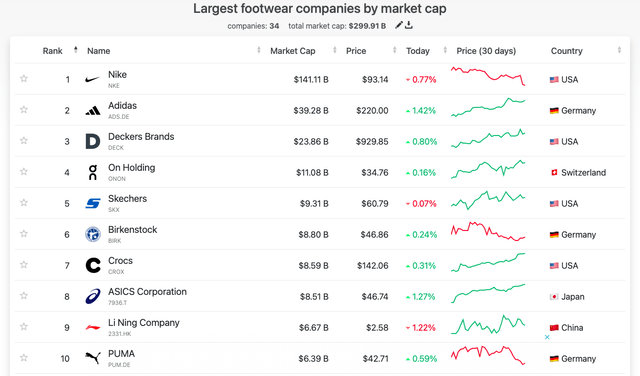

Thanks to two feuding shoemaker brothers, Germany has two of the largest sportswear companies: Adidas and Puma. Puma is the globe’s tenth-largest footwear company and the eleventh-largest sporting goods company by market cap, although it claims its spot as the third-largest sportswear company in terms of revenue. Founded in 1948, the business has seen success through timely innovations, strong distribution channels, and partnerships with sports stars, teams, and celebrities to grow and expand its TAM.

Largest footwear companies by market cap (companiesmarketcap.com)

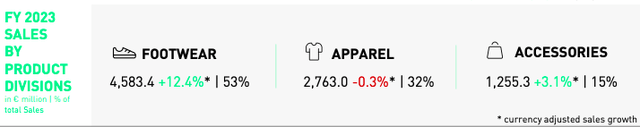

The company generates the majority of its revenue from footwear. In FY2023, 53% of its $9.5 billion revenue came from this product division. Apparel was the second largest division, at 32%, followed by accessories, which comprised 15% of total sales.

Revenue by category (FY2023 Factsheet)

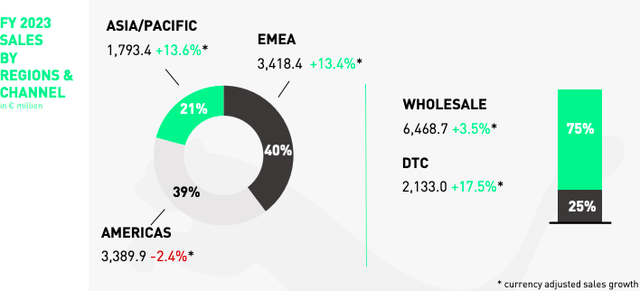

The company divides its revenue into three markets: EMEA, Asia/Pacific, and the Americas. EMEA is its largest market, with 40% of its total revenue in FY2023, followed closely by the Americas. Only the Americas saw a decline, which was impacted by the devaluation of the Argentinian Peso by more than 50%. The company sells most of its products through wholesale channels, although its DTC (direct-to-consumer) channel is growing, with a 17.5% increase YoY.

Sales by revenue and channel (Factsheet FY2023)

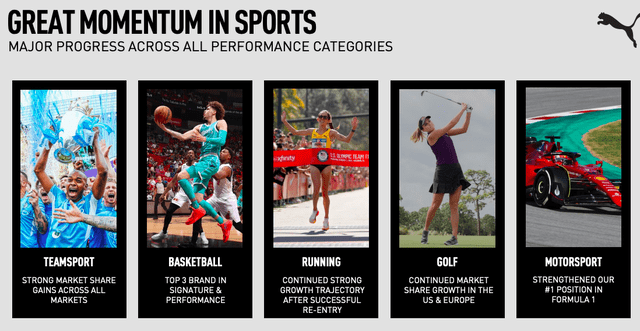

Puma is aware that to grow, it needs to increase the relevancy of its brand across several markets, especially within the US and China. The company has created two new local management teams for both China and the US. It has also invested in popular sports and sports players. Since 2019, the company has significantly grown its position in basketball.

Investing in major sports teams and players (Investor presentation 2024)

To build its brand strength on a broader scale, Puma will run an international global brand campaign, the first of its kind in ten years. Over the last year, the company has revived its partnership with Rihanna; this is part of its strategy to grow the sports-style category.

Partnerships to promote sport style (Investor presentation 2024)

Previously, Rihanna partnered with the company between 2015 and 2018. The partnership was a significant success, positively impacting the top line, creating popular sub-labels such as Fenty Puma, and designing the Creeper sneaker. This gave the company an edge and opened it up to a younger, trendy customer base.

Renewed partnership with Rihanna for one year (Investor presentation 2024)

The company has positioned itself well for the second half of next year with its local marketing efforts and global brand investment, pushing its ‘fastest brand in the world’ message and reducing its inventory to healthy levels amidst challenging market conditions. Furthermore, several new innovations will be released in 2024. The company expects sales to increase by mid-single digits in FY2024 and EBIT results to be between $620 million and $700 million.

Global brand campaign (Puma website)

Financial overview

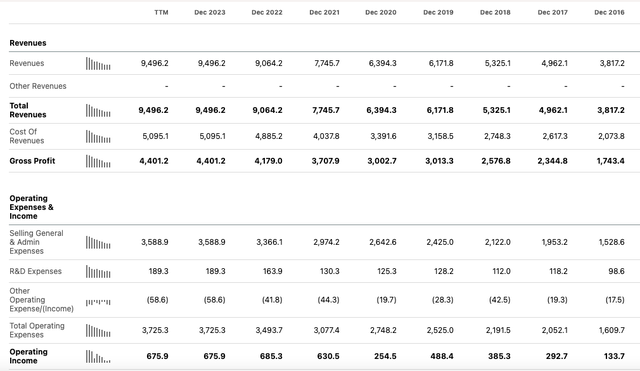

Although Puma reported disappointing results in Q4 2023, if we look at the company’s historical performance, we can see an impressive upward top-line trend alongside a three-year CAGR of 18.01%. The gross profit margin has slightly increased from FY2022. However, operating income has declined. The company’s growth has slowed in FY2023 and expects a similar performance in FY2024.

Annual revenue, gross profit, and operating income (SeekingAlpha.com)

If we look at the net income of $336.6 million, we can see it has slightly decreased from FY2022’s $378.5 million. However, the company has consistently delivered profitable results over the last three financial years.

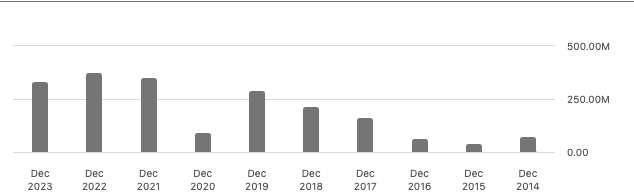

Annual net income (SeekingAlpha.com)

One of the company’s impressive aspects is that it has significantly grown its positive levered free cash flow to $344 million from $37.6 million in FY2022. This allows the company to reinvest in the business, pay off debts, and reward investors.

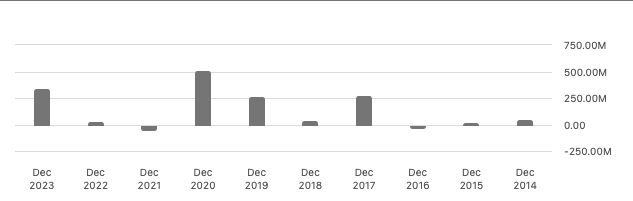

Levered free cash flow (SeekingAlpha.com)

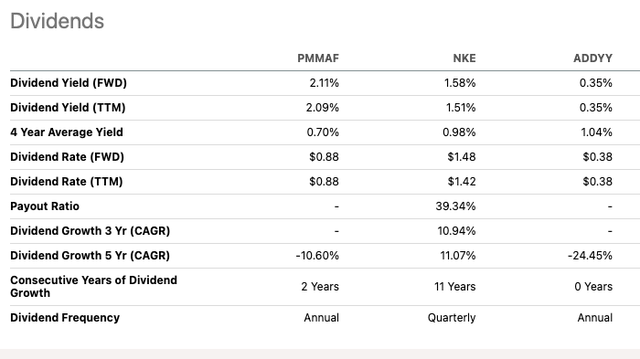

The company’s dividend program has an FWD yield of 2.11%, which is more generous than its larger peers, Nike and Adidas.

Dividend versus peers (SeekingAlpha.com)

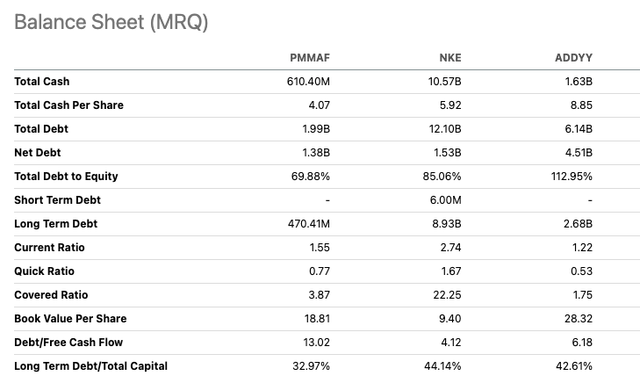

If we look at the company’s balance sheet, we can see that cash has increased from $610.4 million to $495.9 million in FY2022. Its total debt appears large at $1.99 billion. However, if we compare it to peers in the industry, we can see that it is much lower than its larger peers. The company has reduced its inventory level YoY by 20% to $1.99 billion. The company can cover its short-term liabilities with a current ratio of 1.55, although we can see that much of its liquidity is within its inventory, which gives a quick ratio of 0.77. However, it is expected within the consumer goods industry.

Balance sheet versus peers (SeekingAlpha.com)

Valuation

While the company ended FY2023 on relatively strong financial results, given the number of headwinds. Nevertheless, the stock has lost more value than its larger peers in the footwear industry. This negative sentiment could indicate a good moment to buy a profitable stock and invest in growth, and although the next half year is still expected to be hit by similar headwinds of 2023, the company is clearly aiming to stay relevant and competitive within the industry.

Stock trend versus peers (SeekingAlpha.com)

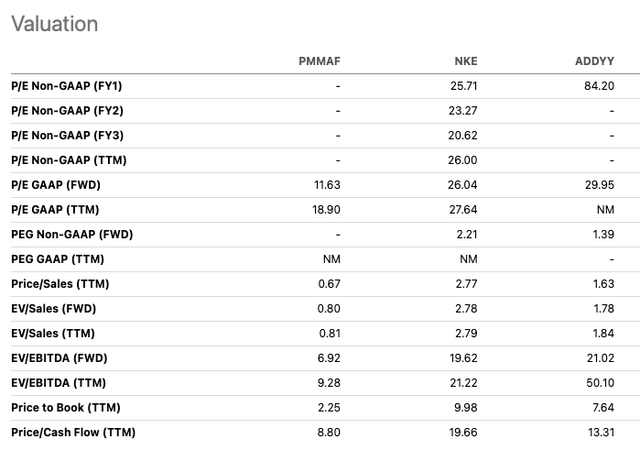

We can see that Puma appears undervalued across every valuation ratio in SeekingAlpha’s Quant valuation table relative to its peers below. The company has an attractive FWD price-to-earnings ratio of 11.63 compared to 26.04 for Nike and 29.95 for Adidas. Further, the ratios are under the company’s five-year average, indicating a potentially good moment to buy if you believe in the company’s long-term growth and profitability. While there have been weaknesses, a recovering China market, a market boost within the US, and price increases in Argentina could allow the company to continue its long-term upward-term growth trajectory.

Valuation versus peers (SeekingAlpha.com)

Risks

Puma competes in a fiercely competitive market in which consumers are quick to change habits and trends. It is significantly smaller than its peers, Nike and Adidas; therefore, it benefits less from the scale opportunities those companies have. This puts more pricing pressure on the company and impacts its market share and profitability. The company is playing across an international scope and is affected by economic conditions and changing market environments, which can hurt the overall performance.

Final thoughts

Puma has delivered strong results in FY2023, irrespective of serious headwinds. At the same time, we have seen the stock lose over 25% in the last year, making it appear attractive relative to its larger peers in the industry. Furthermore, the company has cautioned that the first half of FY2024 will be difficult, but it is also taking on many strategies and efforts that could grow the company in the short and long run, including local marketing teams in the US and China, the release of innovations and its first global branding campaign in ten years which could boost its brand strength. With a solid historic performance, an attractive P/E, and prospects in sight, investors may want to take a bullish stance on this stock. Ensure long-term growth within this competitive market. Furthermore, the company is much cheaper than alternatives in the footwear industry. Therefore, investors may want to take a bullish stance on this stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here