Investment thesis

Our current investment thesis is:

- PRFT is a high-quality business with good scope to achieve MSD/HSD growth in the coming years, as trends such as AI and Cloud computing contribute to consistent corporate spending.

- The company clearly has unique qualities, owing to its superior revenue growth, development of a high-ticket client base, and outsized margins. We have serious reservations as to whether this is sufficient to allow margins to remain flat.

- Given the risks, we would prefer to see clear evidence of the company being undervalued, which does not appear to be the case.

Company description

Perficient, Inc. (NASDAQ:PRFT) is a leading digital consulting firm that provides services to clients seeking digital transformation and technology solutions. The company is headquartered in St. Louis, Missouri, and operates in North America, Europe, Asia, and other regions.

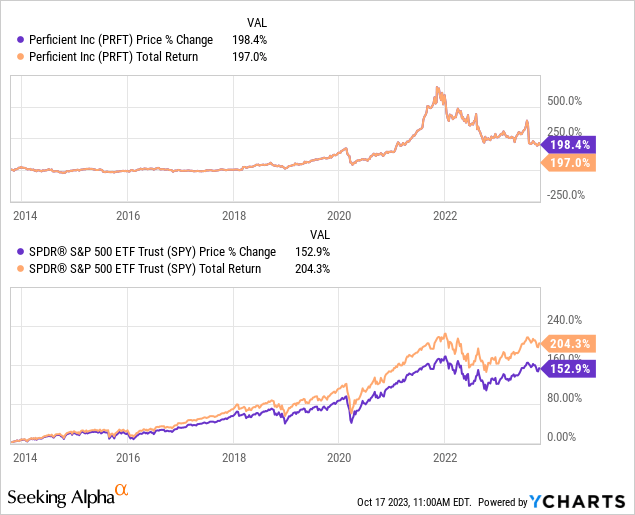

Share price

PRFT’s share price performance has been volatile in recent years, although has broadly moved positively, outperforming the wider market. This has been driven by rapid financial improvement and a consolidation of its market position.

Financial analysis

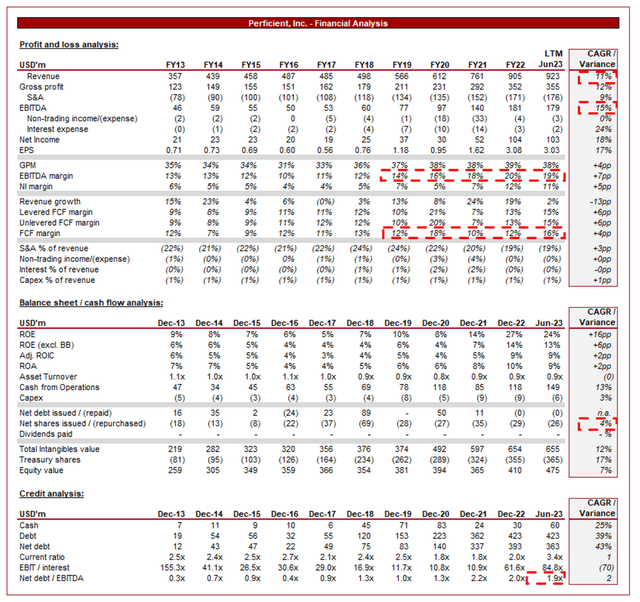

Perficient Financials (Capital IQ)

Presented above are PRFT’s financial results.

Revenue & Commercial Factors

PRFT’s revenue has grown at an impressive 11% CAGR during the last decade, with broadly consistent YoY gains as the business has executed an aggressive go-to-market strategy. Margins have exceeded this, with EBITDA growing at 15%, meaning incrementally accretive returns.

Business Model

PRFT is a consulting firm specializing in digital transformation. It provides a wide range of services to help businesses leverage technology and data to enhance customer experiences, streamline operations, and drive growth. The company boasts an end-to-end suite of services, ensuring that it can both support any transformational exercises, while also being positioned to support a business throughout its operational journey.

PRFT’s services fall under 6 primary segments (see below), which positions the company to support the “modernization” of its clients’ operations, be it front or back office. PRFT continues to “keep its ears to the streets”, discovering and exploiting new technologies to further expand the below services offering. An example of this is AI, with PRFT investing heavily in its expertise in the segment. From a review of its personnel, it appears PRFT is active in poaching staff from comparable or larger peers.

Services (Perficient)

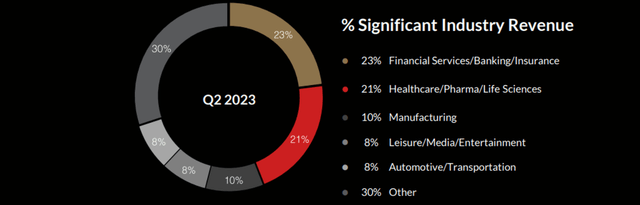

PRFT has deep industry knowledge and focuses on specific sectors, including healthcare, financial services, retail, and manufacturing. This industry specialization allows them to understand unique challenges and deliver tailored solutions. Further, clients are more willing to choose a service provider where they are perceived as a specialist, incentivizing PRFT to deepen its expertise through recruitment. Despite this, PRFT maintains a diversified revenue profile, ensuring it is not susceptible to industry trends.

Industry revenue (Perficient)

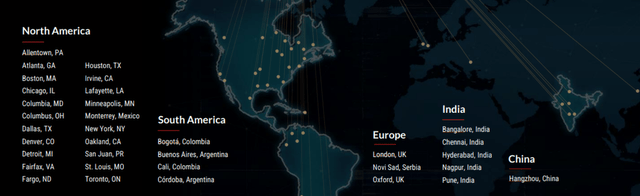

PRFT is a global business, with front-line teams across the Americas, Europe and Asia, as well as delivery teams in India, and the Americas. The company operates in a similar manner to its peers, with many of the simplistic tasks outsourced to low-cost locations (such as India), while client relations, decision-making, etc. made by the front-line team.

Geographical reach (Perficient)

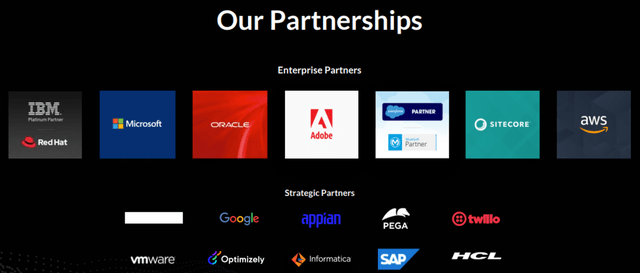

PRFT maintains strategic partnerships with technology leaders such as IBM (IBM), Microsoft (MSFT), Adobe (ADBE), Salesforce (CRM), and AWS (AMZN). These partnerships provide access to market-leading tools and resources, enhancing the services the company can provide. Further, this provides PRFT with greater credibility, improving its value proposition when pitching for new projects.

Partnerships (Perficient)

Finally, PRFT will utilize M&A to expand its expertise or further grow the business inorganically. During this last decade, there has been a trend toward consolidation in the consulting industry, as small boutiques that specialize have been seen as an attractive target to acquire clients. During the last decade, PRFT has spent close to $500m of cash to acquire businesses.

M&A (Perficient)

Digital Consulting Industry

PRFT faces competition from other consulting firms, both large global firms like Accenture (ACN), Deloitte (and the other B4), and IBM, as well as smaller, specialized firms that focus on specific industries or technologies.

The Digital Consulting industry has seen a consistent upward trajectory during the last 2 decades, with an acceleration during the last one. We believe the following trends are key value drivers going forward:

- Technological revolution – The rapid digitalization of all things in society has contributed to a strong demand for digital capabilities, as businesses seek to exploit specific technologies to improve their performance. This is a broad trend underpinning many of the factors we will subsequently discuss. This is a trend that we do not see slowing down given the creation of new technologies regularly that have significant potential. Spending on technological improvements has consistently grown at double-digits in recent years (Source: Management).

- AI – The hype around AI is astronomical and in our view, rightly so. Gen AI in particular has the potential to be revolutionary, mainly because it takes very little to generate improvement. We expect businesses to increasingly demand support with AI integration in the coming years.

- Big data – The emphasis on data-driven decision-making has led organizations to seek expertise in data analytics and business intelligence, areas where Perficient excels. Data has developed from a “nice to have” to critical for all companies, both internally and from their commercial segments.

- Cloud solutions – The cloud has been a revolutionary proposition for companies, with a decline in costs allowing it to go “mainstream”. This trend allows for a rapid deceleration in costs, while supporting the big data trend. We consider this the biggest trend in the last decade, with growth still remaining given the uptake globally leaves sufficient upside.

- Core UX and CMS – Perficient offers services related to digital experience, including website and application development, user experience (UX) design, and content management system (CMS) implementation. These services continue to grow well despite their relative maturity, as content and e-commerce encourage a transition of consumer time to digital services.

- CRM – Similarly to the UX/CMS point, a “standard” service provided that continues to grow well is CRM implementation, driven by efficiency and commercial benefits.

- Talent Pool – Attracting and retaining top talent in the consulting fields is critical to consistently achieving growth, as this is a relationship-driven industry where individuals have direct connections with corporates. PRFT recruitment has been consistent, even during the economic weakness of recent years.

As the following trends suggest, the industry is highly lucrative. There are numerous segments growing well, with PRFT well established within all. With spending in the low double-digits and the industry comfortably over 20%, the long-term value is substantial. This biggest issue, and the reason the consulting industry is not at this growth rate, is competition. It is extremely difficult to differentiate and even more so to create a tangible moat. The fact PRFT can offshore much of the work illustrates the replicability of the work provided. For this reason, the advantages firms can generate are relationships within the industry, reputation, and investment in personnel (both service providers and sales individuals). For this reason, we stress that PRFT’s performance has been good and the future does look bright but it is not guaranteed that the company can maintain its trajectory.

Commercial KPIs

PRFT is doing a good job of improving its foundational position, so as to ensure it can enjoy a proportionate share of the industry growth in the years to come.

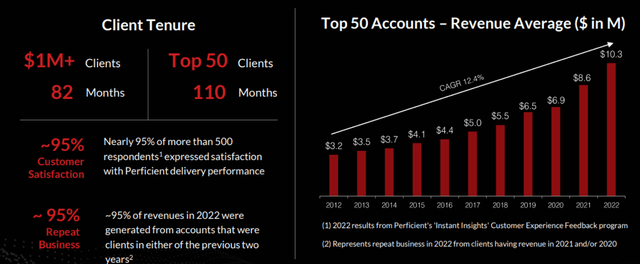

The company’s average revenue has grown at an impressive CAGR of 12.4%, higher than its top-line revenue, implying higher ticket wins. Further, customer satisfaction and repeat business are at an impressive ~95%, underpinning its recurring revenue potential and scope for cross-selling. This is a reflection of its broad service offering and quality of personnel.

Clients (Perficient)

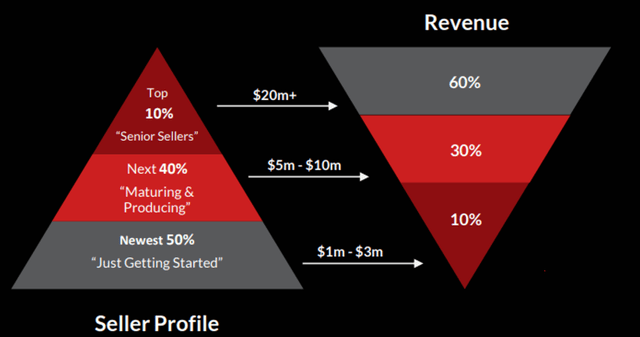

The scope for future customer wins also looks positive, with 50% of its seller profile “just getting started”. Many of these will inevitably be average or underwhelm, but the expectation is that improved recruitment and a bigger brand should allow for more individuals to widen the top bracket’s revenue contribution.

Seller funnel (Perficient)

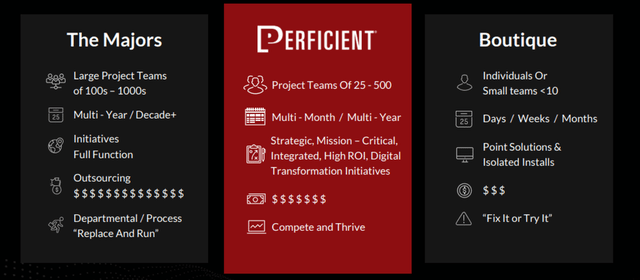

Finally, PRFT believes its go-to-market approach differentiates it from its competition. With more focused teams, flexibility, and a commercially-minded approach, PRFT believes it offers a compelling, differentiated offering.

Competitors (Perficient)

Margins

PRFT’s margins are impressive, with an EBITDA-M of 19% and an impressive upward trajectory. This is a reflection of the company’s focus on high-value services, as well as a quality marketing approach. Although this is extremely good, it does make us nervous that these levels are unsustainable, primarily due to the level of competition within the market. It is unrealistic to expect margins to remain high when the business is providing a (partially) generic service.

PRFT’s strong margins are directly translated for FCF, which means with scale, direct shareholder returns will be substantial.

Quarterly results

Current economic conditions are likely weighing on the business, with reduced corporate spending in response to a reduced demand environment. In the company’s last 2 quarters, growth has declined from double-digits to +3.1% and +4.9%. Further, margins have slightly declined.

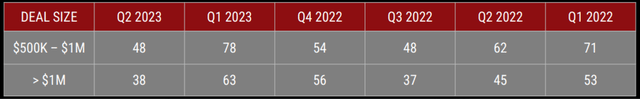

As the following illustrates, the number of deals has declined YoY and QoQ. Our view is that the business will continue to experience soft demand, although an improvement from Q2-24 onwards should be a target.

Deal size (Perficient)

Outlook

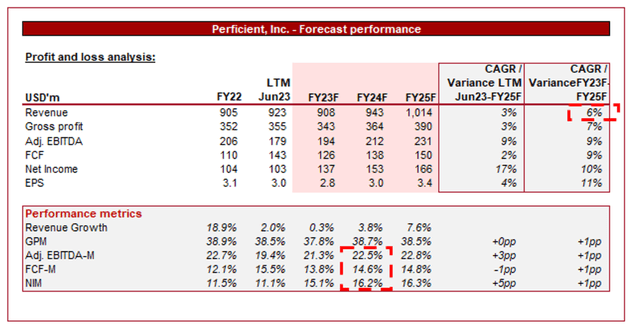

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting a decline in the company’s growth rate, alongside flat margins. Interestingly, we disagree on both counts. We expect growth to remain strong, although slightly dip below its 10Y given the smaller base from which the company has grown. This suggests an MSD/HSD rate. Further, we expect margins to trend down incrementally, wholly due to competition.

Industry analysis

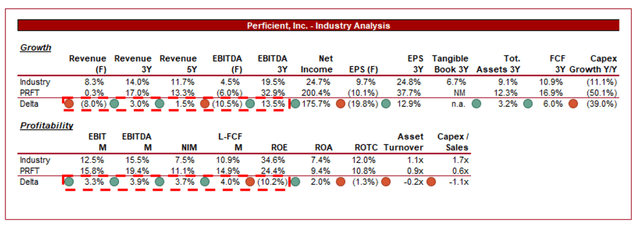

IT Consulting and Other Services Stocks (Capital IQ)

Presented above is a comparison of PRFT’s growth and profitability to the average of its industry, as defined by Seeking Alpha (20 companies).

PRFT performance relative to its peers is strong. The company has achieved impressive growth across both revenue and profitability, regardless of the time frame. This is due in part to acquisitions and its smaller size, but also a successful approach with the industry. Its focus on complex transformational projects, as well as its strong partnerships have supported growth.

Further, PRFT has noticeably better margins than the industry average, despite being a smaller business. This reiterates our concerns around margin erosion over the coming years, as the majority of these peers could easily expand/enter PRFT’s key segments and contribute to a laddering down of prices.

Valuation

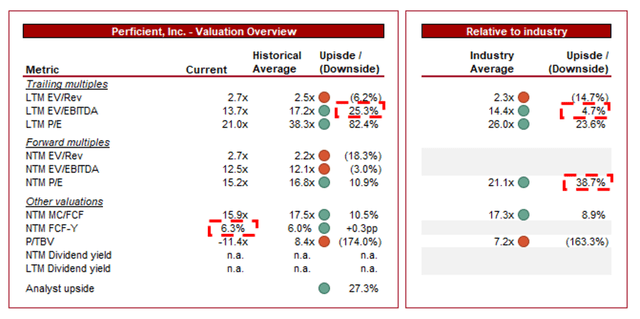

Valuation (Capital IQ)

PRFT is currently trading at 14x LTM EBITDA and 13x NTM EBITDA. This is a discount to its historical average on an LTM basis. Interestingly, the LTM/NTM average differs directionally relative to historicals, illustrating the unexpected slowdown the company has faced.

Our view is that parity with its historical average is justifiable, owing to the continued industry tailwinds driving revenue growth and sufficient coverage of the risks associated with margin erosion. If we were to adjust PRFT’s EBITDA-M down to the industry average EBITDA-M, its multiple rises to 17.5x, implying it is trading at fair value.

Further, PRFT is trading at a small discount to its peer group. We would expect this discount to be larger, owing to the risk of margins and growth declining further.

Final thoughts

PRFT is a high-quality business, owing to its attractive industry exposure, strong go-to-market strategy, deep expertise, and successful marketing approach. We suspect good growth can continue in the coming years, particularly driven by AI and Cloud computing. Strong competition will restrict the ability to achieve materially outsized returns but the market is sufficiently large for all to benefit.

Our concern, although appreciating that there is limited evidence to suggest this will occur, is margin erosion. We do not see sufficient evidence to suggest PRFT has a moat or competitive advantage that will protect its margins in the medium to long term. We suspect competition will consistently erode this. Nevertheless, PRFT has the potential to be an attractive investment, particularly if you believe Wall St. analysts. We would suggest the company is trading around its fair value, supported by a NTM FCF yield in line with the average.

Read the full article here