November 1 was a day to forget for Paycom Software (NYSE:PAYC) investors with its stock price plummeting from around $240 to $150 following the third-quarter earnings report which showcased Beti’s revenue cannibalization. Several Wall Street analysts rushed to downgrade Paycom on the back of a hit to their long-term revenue per user assumptions. This hit, as many of you are now aware, comes from the belief that the success of Beti, the company’s flagship automated software, will eliminate certain billable items in the future. We will discuss more about Beti, its success, and the challenges posed by its success later in this analysis.

Paycom stock’s post-earnings crash gave me flashbacks of the DocuSign (DOCU) stock crash in late 2021 following an earnings report the market interpreted as lackluster. From November to December of 2021, DOCU stock crashed by more than 50% after its earnings failed to impress Mr. Market. At the time, when the stock tumbled to $135 from highs of over $300, I published an article discussing the reasons why I was not tempted to jump on board at those seemingly attractive prices. DOCU stock has declined another 70% since that article. When DocuSign stock reached $55 late last year, I struck a bullish stance, but sadly, the stock has lost another 27% of its value since then.

In my opinion, there are a few similarities between DocuSign’s crash in 2021 and Paycom’s crash.

- Paycom is substantially cheaper than it used to be just a few months ago, but even then, its valuation remains rich.

- Despite having a long runway to grow, Paycom is likely to enter a phase of decelerating revenue and earnings growth. This phase may last a couple of years in the worst-case scenario.

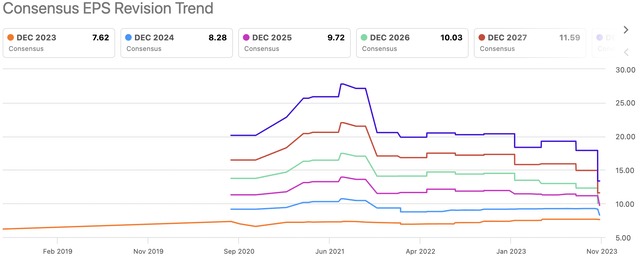

- Earnings revisions are headed lower – big time – and I do not see any catalyst driving PAYC stock higher in the foreseeable future.

On that note, let’s dive deeper to understand Paycom’s recent earnings and the challenges the company is facing today.

Third-Quarter Earnings Are Not Disappointing

Paycom Software is an established American online payroll and human resource tech provider that has played a pioneering role in the world of fully online payroll services. Its software caters to businesses of all sizes, streamlining their HR and payroll operations. This comprehensive software encompasses payroll processing, time and attendance tracking, benefits administration, talent acquisition, talent management, and HR management. Paycom’s versatile software serves a diverse clientele, spanning Fortune 500 giants to small and medium-sized enterprises, nonprofit organizations, and government agencies.

In the third quarter, Paycom demonstrated strong financial performance, albeit with certain challenges and a tempered outlook for the future. The company reported revenue of $406 million, showcasing a commendable 22% year-over-year growth. It is important to note that while this growth is robust, it fell slightly short of the previously provided guidance of $411 million because of lower-than-expected service revenues and unscheduled payroll runs.

Paycom’s revenue profile comprises recurring and implementation revenues. Recurring revenues, the primary source, arise from talent acquisition, time and labor management, payroll, talent management, HR management, and Global HCM applications. These fees are recognized at the conclusion of each client’s payroll period, with a month-to-month contract structure. Implementation revenues include nonrefundable upfront fees for new client setup and sales of time clocks integrated with the Time and Attendance application. The upfront fees provide clients with a material right for contract renewal and are recognized ratably over the estimated renewal period. Time clock sales are recognized upon delivery, with standalone prices determined using observable inputs.

Paycom maintained its status as a highly profitable entity, with adjusted EBITDA of $165.6 million, reflecting a substantial 31% YoY growth, and non-GAAP net income of $102.4 million, an impressive 39.5% YoY increase. Despite the growth in sales during Q3, Paycom’s overall business performance seemed to underperform expectations. This performance raised concerns about potential headwinds in the future.

New Challenges Are Looming On The Horizon Amid Expansion Efforts

The rapid growth of automated payroll, exemplified by Paycom’s Beti platform, can be attributed to its compelling advantages in the modern business landscape. Automation in payroll processing, as recognized by the American Payroll Association, offers the potential to significantly reduce costs by as much as 80%. This cost reduction is crucial for any business, particularly in an era where operational efficiency is paramount.

Moreover, the inherent accuracy of automated payroll systems minimizes the risk of errors, a critical factor considering the potential financial repercussions of mistakes. A notable instance is Citigroup’s $900 million blunder resulting from a simple arithmetic mistake, underscoring the high-stakes nature of manual payroll processing.

The growth of automated payroll is further substantiated by market trends. ReportLinker predicts a substantial expansion in the Global Payroll & HR Solutions and Services Market, with an expected value of $50.4 billion by 2030 growing at a CAGR of more than 8%. This projection demonstrates the increasing demand for streamlined payroll solutions. As businesses worldwide seek cost efficiency, error reduction, and streamlined processes, the rapid adoption of automated payroll solutions will become a trend.

Paycom’s strategic decision to extend its payroll solution into Mexico signifies a major step in the company’s expansion efforts. This expansion, which includes the introduction of Beti, represents Paycom’s second North American venture, building upon its earlier entry into the Canadian market.

The introduction of Paycom’s services in Mexico, particularly its comprehensive payroll and tax management solutions, is poised to create a notable differentiation in the local payroll software landscape. By offering these services, Paycom addresses a critical need in the Mexican business ecosystem, potentially elevating its market presence.

A study conducted by Forrester Consulting in June 2023 highlights the tangible benefits of Paycom’s Beti platform. The study indicates that organizations implementing Beti experienced a substantial reduction in the time required for payroll processing, with a remarkable 90% improvement. This evidence underscores the potential efficiency gains and cost savings that Paycom’s solutions can bring to businesses, further bolstering the company’s value proposition as it expands into the Mexican market.

While this might hint at potential pricing power in the future, it contrasts with the subdued guidance for the upcoming year.

Paycom’s core business relies on its Beti platform for payroll services, which is generally well-regarded for its efficiency. However, an intriguing dynamic has emerged. The success of Beti, the automated software, has inadvertently caused certain challenges. Beti allows employees to initiate payrolls independently, and its remarkable accuracy has reduced the need for additional Paycom software to correct payrolls. During the earnings call, management highlighted that nearly two-thirds of its clients have shifted to Beti. This, in turn, has eliminated certain billable items for Paycom. For instance, one customer significantly reduced the number of payrolls from 19 to 13 within a quarter due to Beti’s effectiveness.

Craig Boelte, Chief Financial Officer of Paycom, said during the earnings call:

Now that more clients are achieving the ROI that Beti has to offer, it has eliminated certain billable items, which is cannibalizing a portion of our services and unscheduled revenues.

Fellow Seeking Alpha analyst From Growth to Value discusses in detail why Beti will cannibalize revenue in the short term as it eliminates the need for rectifying payroll management errors for which Paycom charges fees. I highly recommend you read the linked article to understand how Beti’s success is posing a risk to Paycom.

In contrast to many SA analysts who are bullish on Paycom after the crash, I believe investors need to be cautious for a few reasons. First, Paycom was priced for growth – for good reason – and I believe the market is not fully pricing in the expected deceleration of growth in the next few quarters. Since June 2021, Paycom’s topline has grown at an average of close to 30% in each quarter, but in the next few quarters, the company is likely to grow at a seemingly meager rate of between 10%-15% at best. Management’s unofficial guidance for FY 2024 confirms this. This suggests a massive, meaningful fall from the recent highs, and even more concerningly, this fall is abrupt. Mr. Market, as many of you will agree, has a tendency to punish growth companies that fail to live up to expectations in the short term.

I am a long-term-oriented investor, and I see how Paycom’s strategy of giving up short-term gains to ensure the sustainability of its long-term earnings can pay off handsomely in the long run if the company successfully disrupts the global payroll management market. That being said, there’s a big if, and I believe PAYC stock will find it difficult to get going from here in the foreseeable future before we see any recovery.

Second, Paycom’s earnings expectations have fallen off a cliff in the last few weeks and will continue to do so in the foreseeable future until we have more clarity about how Beti will help Paycom gain competitive advantages on a global level.

Seeking Alpha

In the absence of a reversal of this trend, I doubt PAYC will make a U-turn any time soon.

Third, I failed to identify any catalysts that could drive PAYC stock higher. At a forward P/E of 21, PAYC is not ridiculously expensive but is not a bargain either given that the company is expected to hit a roadblock in the coming quarters. Positive earnings revisions can turn out to be a catalyst, but I don’t see analysts turning bullish on earnings expectations for the next few quarters. Paycom’s strategy of disrupting the market through Beti and other automated solutions will take time to materialize, if at all, and I do not believe we will see any major progress on this front in the foreseeable future. Not to forget, corporate spending may hit roadblocks in the coming months too, meaning Paycom may fail to attract new customers for the time being despite Beti being a top-of-the-line solution that is likely to improve the efficiency of a business of any scale and size.

Hampered by these challenges, I believe PAYC stock will remain pressured in the foreseeable future. Given that Paycom’s strategy can help the company emerge as an innovative leader in a growing market – especially outside of North America – I rate PAYC stock a hold today. I am not comfortable initiating a new long position at the current valuation.

Takeaway

Paycom stock’s crash reminds me of the time when DocuSign stock crashed, attracting a lot of bulls but only to disappoint investors ever since. I am not suggesting that Paycom has a bleak future. Far from that, I believe the company is well-positioned to grow albeit at a slower pace than we are used to. Even more importantly, I believe the company is doing the right thing by focusing on long-term growth opportunities by allowing Beti to cannibalize short-term revenue in the hopes of capturing market share and building durable competitive advantages. However, in the absence of an identifiable catalyst at a time when earnings revisions are trending lower, I feel more comfortable monitoring the progress from the sidelines than jumping on board Paycom’s story today.

Read the full article here