Oracle reports their fiscal Q2 ’24 quarter after the close tonight, with sell-side consensus expecting $1.32 in earnings per share on $13.0 billion in revenue and operating income of $5.57 billion for expected y.y growth of 9%, 6% and 9% respectively.

The last (August ’23) quarter, the stock was hit hard after the software giant reduced this fiscal Q2’s guidance below what the sell-side was expecting, even though operating margin rose about 150 bps y.y.

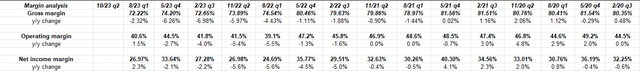

Here’s Oracle’s margin history since Covid:

Valuation spreadsheet from earnings reports

The $30 billion Cerner acquisition closed during the August ’21 quarter.

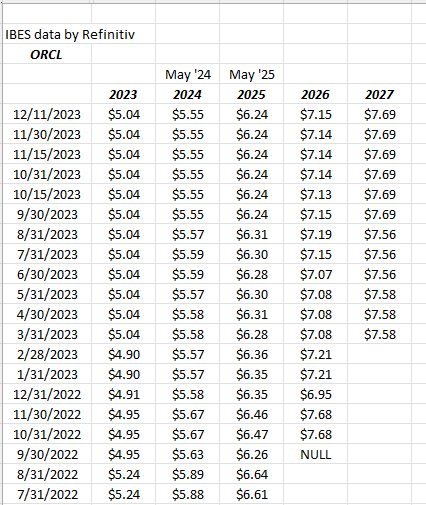

IBES data by Refinitiv

This history of Oracle’s EPS revisions shows that with the closure of the Cerner deal (August ’22), EPS estimates started to get ratcheted lower, which is understandable since Oracle has a history of doing these very dilutive deals, and the dilution causes “fully-diluted shares outstanding” to increase, thus reducing EPS.

There is nothing really out of the ordinary happening around Oracle’s stock price, other than the usual pressure of incorporating or consolidating another big acquisition, which always takes time.

Valuation: When Oracle reported their August ’23 quarter last September, the fiscal ’24 cloud growth of 30% was affirmed by management, but it wasn’t clear how much was organic. Trading at 18x EPS for an expected “average” EPS growth rate over the next 3 years of 12%, the stock is not at the upper end of its valuation range, and technically it’s been below its old high pre the Sept ’23 earnings of $125 – $127, for the last 4 months.

At 6x revenue and 17x cash flow, it’s in line with other large-cap tech and software stocks, but as readers would expect, Oracle never really looks truly cheap.

The stock sports a 1.4% dividend yield. If you’re looking for dividend stocks, Oracle is probably not your best candidate. Years ago, I thought as the stock matured it would eventually sport a bigger dollar dividend and yield, but the large acquisitions Oracle’s business model requires, the current debt load, and the fact that free cash flow is typically negative after these big acquisitions means the dividend will never really be a reason to buy the stock, but it certainly doesn’t hurt.

Morningstar, like a number of sell-side analysts, thinks the cloud gap between Oracle and AWS is too big, and is a negative to the Oracle moat. This blog has a fair value for Oracle between $115 – $120, or right around where it’s trading, thus, if we split the difference, Oracle might be worth owning if it falls below $100 per share.

Summary / conclusion: This blog has written about Oracle’s perceived quality issues, most recently last September ’23, but the fact is like the September ’23 article states, the long-term performance of the stock, at least relative to the S&P 500 and what’s probably considered the mega-cap quality standard in Microsoft, over the last 23 years, and this includes the nuclear winter for large-cap technology of 2000 to 2009, Oracle’s long-term performance relative to the S&P 500 is downright envious.

Tonight, after the Q2 ’24 earnings report, the stock could be +/- $10 per share. Trying to game stock direction after earnings reports is far harder than playing the longer game of buy-and-hold. The point is, I have no clue how the stock will respond to tonight’s earnings. No doubt fiscal ’24 guidance will be updated, and maybe more importantly, as an analyst that adds acquisitions to capex when calculating free cash flow, the huge hit to free cash flow from the Cerner acquisition in August ’22 will now fall off, and investors will get a better read on Oracle’s true free cash flow. (Readers might ask why include acquisitions in capex for free cash flow purposes, but for Oracle it’s especially important: as was noted in the above-linked Sept ’23 earnings preview, Oracle’s free cash flow doesn’t always equal net income, which is somewhat unusual for a software stock, and that to me has always spoken to quality of earnings for Oracle, but again, as the performance chart from YCharts show in the Sept ’23 earnings, it’s never really impacted the stock price.)

Prior to the September ’23 earnings report, Oracle saw a number of upgrades to the stock, and it set investors up for disappointment post earnings, particularly with the lowering of guidance for the Nov ’23 quarter. Some of the sell-side analysts are worried about the tough compare versus the November ’22 quarter, too. The sentiment is far more favorable to an upside move after tonight’s earnings given the September quarter’s slide, but take that with a healthy dose of salt.

The fundamental aspect of Oracle’s story is watching what Morningstar says about the gap between Oracle and AWS (and presumably Azure) over time.

None of this is advice or a recommendation, and past performance is no guarantee of future results.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here