The pricing environment for energy producers like Occidental Petroleum (NYSE:OXY) has strengthened in recent months, in part because OPEC+ member countries like Saudi Arabia and Russia have extended significant oil production cuts until the end of the year. Higher petroleum prices are obviously a favorable development that is set to benefit Occidental Petroleum as well… and the company is growing its production aggressively in the Rockies, the Permian and the Gulf of Mexico. Shares of Occidental Petroleum are more attractively valued compared to the beginning of the year and the company has a high level of profitability. Considering that the risk profile has changed (improved) lately, I am rating shares of Occidental Petroleum a buy!

Previous rating

I rated Occidental Petroleum as a sell in November 2022 due to pressure stemming from lower petroleum prices. Recently, OPEC+ countries have announced deep supply cuts that have supported petroleum prices and improved the pricing situation for the entire industry. Besides price support, I see Occidental Petroleum generating production upside in key shale basins in the U.S. The risk/reward profile has improved, in my opinion.

OPEC+ supply cuts

Saudi Arabia and Russia recently announced that they have extended their voluntary supply cuts to the end of the year. At the beginning of November, Saudi Arabia sent an important message to energy markets and made clear that it will stick to its production cuts in the amount of 1M barrels of oil equivalent per day while Russia confirmed that stand by its 300k barrel of oil equivalent per day reduction. The supply cuts have instilled new fears in petroleum markets as the winter season nears and supported pricing. Price cuts were already announced in the third-quarter and Occidental Petroleum has seen a favorable impact on average prices as a result.

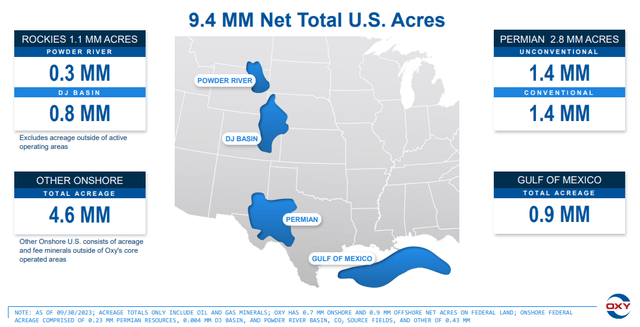

Occidental Petroleum is a U.S.-focused energy producer that also owns midstream assets as well as productive energy assets outside of the U.S. (Algeria, Middle East). The company’s largest production play is the Permian which generated 588 Mboed of net production in the third-quarter.

Since Occidental Petroleum produced a total of 1,220 Mboed in Q3’23, Permian remains by far the most important production source with a total share of 48%. Other key production assets are located in the Rockies (263 Mboed) and the Gulf of Mexico (146 Mboed) which together represented another 34 of Q3’23 production. Permian, by acreage size, is by far the largest investment for the company.

Source: Occidental Petroleum

Production in these key areas is growing rapidly… which of course helps Occidental Petroleum’s earnings picture in a higher-price market. The biggest increase in production, based off of Mboed addition, was in the Rockies, followed by the Gulf of Mexico and the Permian.

Source: Occidental Petroleum

Higher petroleum prices have already had a positive effect on Occidental Petroleum’s third-quarter results: average oil prices increased to $80.70 per-barrel, showing 10% Q/Q growth.

Source: Occidental Petroleum

Occidental Petroleum also maintained a high level of profitability in the third-quarter as well, in part boosted by higher average prices. The company generated $7.40B in total revenues which translated to $1.16B in earnings… and a profit margin of 16%. In the year-earlier period, Occidental Petroleum generated earnings of $2.55B and a net income margin of 27%. Although the firm’s profitability has declined, year over year, Occidental Petroleum still runs a widely profitable operation.

Source: Occidental Petroleum

Forward expectations

Occidental Petroleum has the backing of Warren Buffett and has done acquisitions in the past to grow its portfolio. I believe that Occidental Petroleum may do other acquisitions in the future, potentially to either strengthen its existing core portfolio or add new acreage in other operating areas.

At the very least I expect Occidental Petroleum to invest more money into its existing core operations — Permian, Rockies and Gulf of Mexico — in order to grow its net production. As long as petroleum prices are high, there is obviously an incentive for Occidental Petroleum to drill as much as possible. Net production in its core operations is set to continue to grow which should, at current prices, lead to incremental revenue and earnings growth.

With earnings and free cash flows remaining high, I can also see Occidental Petroleum spend more cash on stock buybacks. Occidental Petroleum repurchased $600M of stock in Q3’23 and exhausted 60% of its $3.0B buyback so far this year. Therefore, it is not unreasonable to expect that the firm will authorize a new stock buyback in the first half of next year.

Occidental Petroleum’s valuation vs. rivals

Occidental Petroleum’s earnings situation as broadly improved… as has the earnings situation of practically all companies operating large production businesses in the U.S., thanks to OPEC+ members intervening in markets. Occidental Petroleum is expected to see a 28% increase in earnings per-share in FY 2024 (to $5.25) which implies that the energy firm’s price potential is valued at a P/E ratio of 11.6X.

Exxon Mobil (XOM) and Chevron (CVX), two large energy companies, with equally attractive EPS growth potential in a high-price world, trade at P/E ratios of 11.2X and 10.2X. I believe Occidental Petroleum could reasonably trade at a P/E ratio of 13-14X which is about the average multiplier OXY traded at in the last year. With an earnings multiplier of 13-14X and EPS of $5.25, shares of Occidental Petroleum may have a fair value between $68-74, implying 11-21% revaluation potential.

Risks with Occidental Petroleum

Occidental Petroleum is an energy producer and as such subjected to uncontrollable price movements in the petroleum and gas markets. Factors outside of the company’s control can and will affect, indirectly, Occidental Petroleum’s earnings trajectory. Besides lower average petroleum and gas prices, the biggest risk for OXY, as I see it, would be a slowdown in production growth in key production areas like the Permian basin.

Final thoughts

Occidental Petroleum is a promising energy company that has a lot more potential for earnings growth than I thought and it maintained a high level of profitability in Q3’23. Occidental Petroleum is increasing its production in key areas such as the Permian and the Rockies, and higher average prices are providing earnings tailwinds. Recent OPEC+ supply cuts have given more support to petroleum prices and instilled new supply fears into the market. Since Occidental Petroleum is growing its production in shale areas and the valuation is cheap, I believe the risk profile is skewed to the upside!

Read the full article here