Nvidia Corporation (NASDAQ:NVDA) will be reporting Q2 ’25 earnings on August 28 after market close, bringing analysts to a divide between continued growth based on the H100 demand vs. a slowdown as a result of the delays in Blackwell. Despite the challenges voiced by systems integrators such as Super Micro Computer (SMCI), Nvidia’s performance may not entirely be dependent on the release of the B100 given that demand still outstrips supply of the H100 GPUs. Given these factors, I remain bullish on NVDA shares and reiterate my BUY rating with a price target of $165/share at 19.50x eFY26 price/sales.

Seeking Alpha

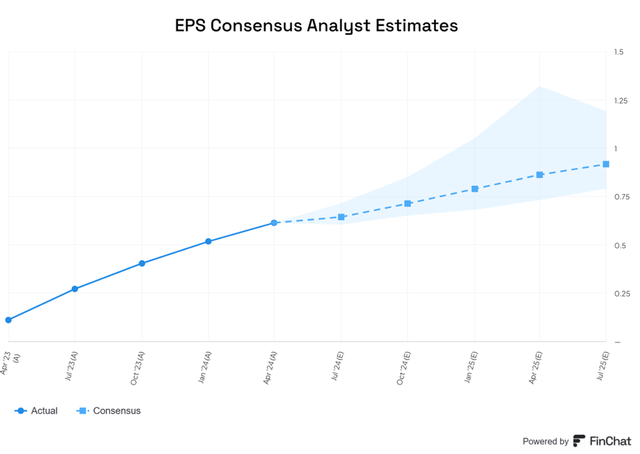

In the last 90 days, analysts have revised their EPS estimates up 19x and down 12x. Analysts are forecasting Nvidia to report revenue in the range of $26.8-30.45b with $28.7b at the midpoint and EPS in the range of $.06-0.71/share with consensus coming to $0.64/share.

FinChat

I’m modeling eq2’25 revenue to come in at $28,733M with an adjusted diluted EPS of $0.68/share.

Bank of America (BAC) VP of Derivatives Research, Gonzalo Asis, is suggesting to hedge the risk of an earnings disappointment. Other analysts, such as Equity Strategist, Scott Rubner, of Goldman Sachs, Dan Ives of Wedbush, Oppenheimer Asset Management, and Blayne Curtis of Jefferies all anticipate a strong performance for Nvidia at their Q2 ’25 earnings. Overall, I side with these analysts as Nvidia continues to realize strength across all segments as enterprises, hyperscalers, and consumers are seeking higher compute speeds across their specific compute needs.

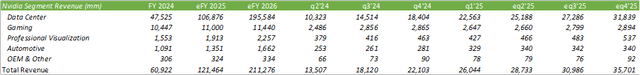

Nvidia Operations

Corporate Reports

Starting with Data Center, Nvidia continues to realize exceptionally strong sequential growth for the segment driven by both hyperscalers and enterprises for their Grace Hopper architecture. Management stated in their q1’25 earnings call that demand for the H100 continues to outstrip the firm’s supply capabilities as more enterprises turn to accelerated computing. Accordingly, 40% of the deployed AI infrastructure in q1’25 was driven by large cloud providers with the remainder being enterprises. This is primarily driven by the need to build out the infrastructure capable of supporting these high-powered, data-driven AI/ML models. The use cases are becoming more and more apparent as large firms such as Tesla (TSLA) are leveraging a massive 35,000 H100 GPU cluster to train their AI platform.

Given the recent hints of Blackwell being delayed into CY25, I believe some investors may be hesitant on Nvidia going into eq2 ’25 earnings. Despite the headwinds, I do not believe it will result in a material impact to revenue growth given the excess demand for the H100 GPUs. I anticipate the H100 to remain as a driving force for Nvidia even after the release of the H200 as enterprises invest in scaling out their AI capabilities to deliver cost-saving/money-making applications, such as those offered through Palantir’s (PLTR) platform. One interesting point management mentioned on the q1 ’25 earnings call was that the Blackwell GPUs are backwards compatible. This suggests that an enterprise or hyperscaler can build out their Grace Hopper system with the H100 or H200 and implement the B100 when released. Given the one-year release cycle, it shouldn’t be expected that end-customers will delay investments for the next-generation release. I believe this will result in enterprises averaging up their infrastructure as they scale out their AI factories.

As for the Blackwell architecture, the B100 is expected to perform 30x faster for inferencing when compared to the H100 with a 25x lower TCO and energy consumption. Management suggested that the Grace Blackwell architecture will include the 5th generation NVLink, a multi-GPU spine, and InfiniBand and Ethernet switches. This versatile architecture will support hyperscalers and enterprises for both training and inferencing.

In addition to this, networking equipment providers Cisco (CSCO) and Arista Networks (ANET) each suggested that the next networking equipment purchasing cycle has begun and that enterprises and hyperscalers are each increasing their investments for higher speed equipment. This trend could drive significant improvement to shipments for Spectrum-X Ethernet and InfiniBand.

For eq2’25, I’m forecasting the Data Center segment to provide $25b in revenue, a 144% year-over-year growth rate.

Turning to the other segments, management anticipates Gaming, Professional Visualization, and Automotive to each generate sequential growth in eq2 ’25. Nvidia is experiencing strong reception to their GeForce RTX GPUs for gamers, creators, and running AI applications. Microsoft (MSFT) recently announced their partnership with Nvidia to optimize AI performance for Windows, which is expected to run LLMs up to 3x faster when using GeForce RTX AI PCs. Though I do not anticipate consumer demand for AI PCs to show material improvement in CY24, enterprises may begin adopting these powerful machines to work in tandem with their AI-enabled data centers.

Nvidia is also progressing their automotive offerings with the Nvidia DRIVE Thor, which will be powered by the Blackwell architecture. Nvidia is currently working with various Chinese electric vehicle makers and is anticipating Thor to go into production vehicles starting in 2025.

Nvidia Financials

Corporate Reports

Looking to the financials, I anticipate total revenue to grow by 113% to $28.7b in eq2’25, primarily driven by the Data Center segment. Management suggested in their Q1 ’25 earnings call that they anticipate each segment will experience sequential growth in eq2 ’25. Given my revenue forecast and management’s margin forecast, Nvidia should generate $19.2b in adjusted operating income and $0.68/share in adjusted EPS.

Risks Involved With Nvidia

Bull Case For Nvidia

Demand for Nvidia’s H100 GPUs remains stronger than what the company is capable of supplying. This suggests that the firm may be minimally impacted by the potential delay in the release of the B100 GPUs. Sequential improvement across segments with a growing interest in AI PCs across enterprises will drive significant revenue growth and potentially lead to stronger year-over-year margin improvement.

Bear Case For Nvidia

Nvidia may experience some headwinds as a result of the delay in the B100 release. This may result in hyperscalers delaying some investments, anticipating the faster and more power-efficient GPUs. The broader economy is also experiencing some durability challenges, as suggested in the recent jobs report revision for 818,000 fewer jobs. Slower employment growth or a higher unemployment rate may lead to lower demand for AI PCs and potentially a smaller AI footprint.

Valuation & Shareholder Value

Corporate Reports

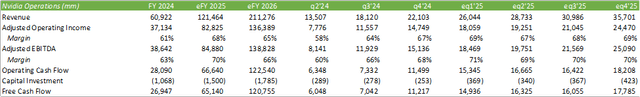

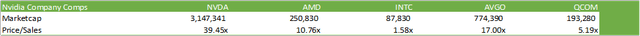

NVDA shares currently trade at 39.45x trailing/price sales, making the shares priced to perfection going into eq2’25 earnings. Given the rich valuation, shares may react with significant volatility in either direction, depending on investors’ sentiment towards the delays in Blackwell and a potential slowdown in revenue growth. Given the strong demand for the H100, I believe NVDA will release another strong earnings report that may drive shares positively.

Seeking Alpha

Despite the high trading multiple when compared to its peers, I believe NVDA’s valuation is justified given the significant growth outlook for the firm in the coming years. If more firms turn to transforming their traditional compute data centers to accelerated AI factories, Nvidia may maintain their higher valuation in tandem with their growth.

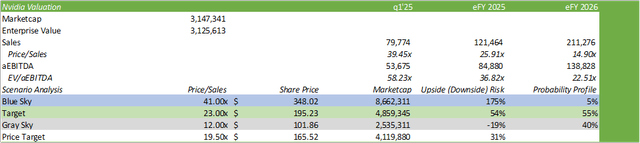

Valuing the company based on their historical trading multiples and my forecast for sales generation, I believe NVDA shares have significant room for more growth going forward. I reiterate my BUY rating for NVDA with a price target of $165/share at 19.50x eFY26 price/sales.

Corporate Reports

Read the full article here