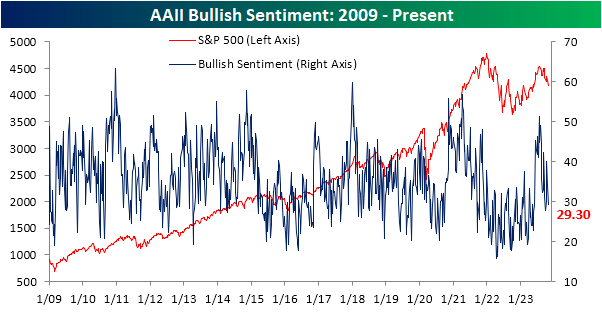

The S&P 500 having made fresh lows in the past week has justified a continued decline in bullish sentiment per the latest AAII survey.

As shown below, only 29.3% of respondents reported as bullish this week compared to 34.1% last week. Although sentiment has quickly reversed, the last week of September actually saw an even lower bullish reading of 27.8%.

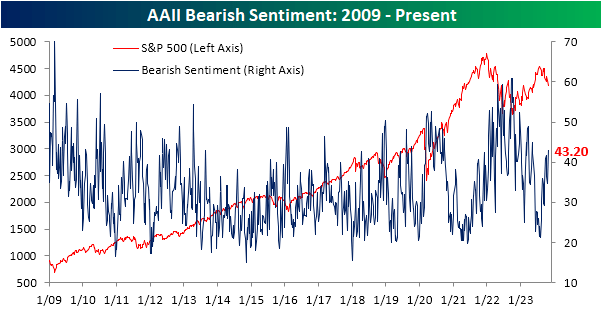

Bearish sentiment, on the other hand, rose up to 43.2% which was the highest reading since the first week of May. Bearish sentiment rose 8.6 percentage points week over week, which was the largest single-week increase since February.

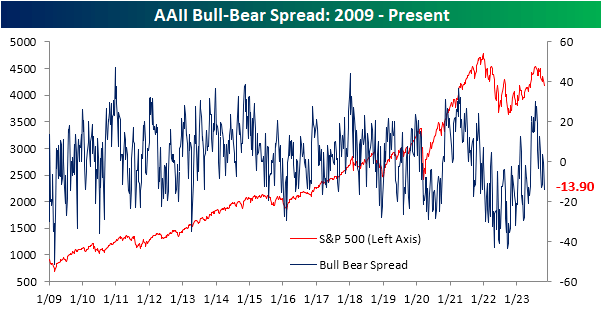

Given the new high in bearish sentiment and drop in bulls, the bull-bear spread tipped deeper into negative territory. Bears now outnumber bulls by 13.9 percentage points. That is the widest margin since May.

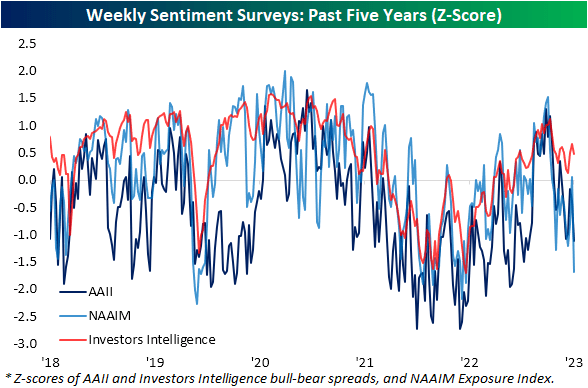

While the AAII survey has shown an expressly negative turn, other sentiment surveys are more mixed. For starters, the NAAIM Exposure Index echoed the AAII results.

The index tracking equity exposure of fund managers echoed the pessimistic tones of the AAII survey as it dropped to the lowest level since the week of October 12th last year.

Meanwhile, the Investors Intelligence survey of newsletter writers has managed to hold onto a more bullish tone.

That survey’s bull-bear spread has been more steadily above its historical average over the course of the past couple of months.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here