Thesis

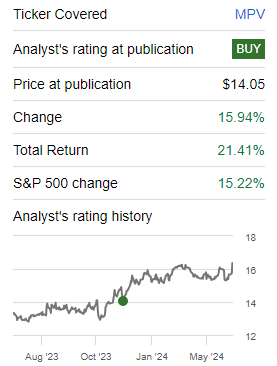

Roughly seven months ago, we started covering the MassMutual Participation Investors (NYSE:MPV) fixed income CEF with a ‘Buy’ designation. The fund has outperformed since our rating, up over 20% on a total return basis:

Rating (SA)

The initial thesis revolved around the manager’s experience in the sector, the wide credit spreads as of the writing of the article, and the robustness of private credit. The thesis has delivered and then some. It is highly unusual to see 20% plus total returns in such a short time span, and retail investors need to understand that unlike equity, credit cannot go up indefinitely. There is no ‘AI revolution’ in private credit that would propel valuations much higher from here.

In fact, we think valuations are stretched currently, and we are going to articulate in this article why we are placing this name on ‘Hold’, since the price point is no longer attractive for a buy rating.

Private credit is opaque

Firstly, we need to make sure we are on the same page regarding the pricing of private credit. By its nature, private credit is opaque. Private credit references tailored, negotiated transactions which are not widely syndicated. Therefore, pricing is specific, and generally done off observable market curves. For example, a private credit that is deemed to have a BB internal rating and is secured via a first lien, might price off a BB leveraged loan curve. A ‘BB curve’ simply represents an aggregate spread level for a certain tenor for liquid credits in that rating band.

Opaque pricing can lead to leading or lagging issues in markets, with managers having more flexibility than usual in assigning specific spreads to their portfolios:

Pricing (Bloomberg)

The above series of charts, courtesy of Bloomberg, show us how for the same issuer, private marks can vary substantially from public ones, but more importantly highlight the flexibility the private markets have. Due to the tailoring aspect, private credit managers can argue for marks which are different from what we see in the public markets.

As stated above, a 20% total return in a short period of time is a massive achievement, and we are not going to annualize that for you because the numbers would be eye watering. While widely syndicated credits have tightened, we are not seeing that type of move even in leveraged liquid high yield.

Buy when spreads are wide, hold or sell when they are tight

When dealing with any type of credit instrument, be it widely syndicated or private, the rule of thumb is to buy credit when spreads are wide, and hold or sell when they are tight. Low credit spreads simply means that you might not get compensated enough for the risk you are taking by buying a fixed income instrument.

Observable credit spreads are now at levels not seen since the 2017-2019 period:

Credit Spreads (The Fed)

This simply means the market is pricing a soft landing with no margin for error. Any deviation from this scenario would result in a move up in spreads, which in turn would decrease prices on private credit securities and inherently MPV’s pricing.

As discussed above, many private credits use spreads against observable curves, so it is safe to assume they will move in sync, even if they might lag the exact move (i.e. managers have some latitude in pricing).

Private credit is rapidly becoming a market of its own

To note that private credit is no longer a ‘niche’ market in fixed income. In fact, it has morphed into an asset class of its own:

Private Credit (Cobalt)

Private credit has seen an astounding growth, and the total size of the market is now very similar to high yield or leveraged loans. What we have not yet seen in private credit though is a ‘market shakeout’. When new asset classes form, they tend to morph into quasi-bubbles, and for them to actually mature they need to go through a period of stress or ‘shakeout’. Only market stress scenarios bring to fore issues with the underwriting process and with marks.

Think about the significant improvements in the securitization market after the 2008/2009 CDO market implosion. The asset class has thrived since, but has weeded out bad structures, bad management and bad practices.

MPV portfolio – dominated by private credit

MPV continues to be a CEF focused on private credit:

Portfolio (Fund Website)

Over 84% of the holdings are in private credits, with the rest being made up of cash or equity. Equity is present in some portfolios as a result of restructurings or as a side-incentive during deal underwriting.

The fund is generally granular, but its top holding is quite concentrated at above 6% of the fund:

Holdings (Fund Website)

As an investor, one wants to see 2% limits for individual issuers, which is the case here for most of the names outside Madison IAQ.

The fund is now trading with a premium to NAV

The significant rally in spreads has seen the CEF move above flat to NAV:

The current 8% premium to NAV is highly unusual for MPV, with the CEF last seen at similar levels prior to Covid. We do not like to see fixed income CEFs at large premiums to NAV in today’s environment where credit spreads are tight because it simply means they will see a high volatility in their discount/premium.

We are of the opinion the fund will see its premium go back to 0% during the next risk-off event. MPV is not a buy at today’s premium levels.

Conclusion

MPV is a fixed income CEF focused on private credit. The fund comes from a very well regarded platform, and has outperformed in 2024. Its significant rally has been driven by both fundamentals, as well as an increase in its premium to NAV. With spreads very tight and the CEF at very high premium levels historically, the pricing does not look attractive anymore. We are moving our rating to ‘Hold’ on the name currently, waiting for a risk-off move and a decrease in the premium to NAV to make pricing levels attractive again.

Read the full article here