Dear readers,

I don’t cover technology stocks often here on Seeking Alpha, and it’s for a good reason – my current exposure to the sector is very low. It’s not that I don’t believe in technology and don’t think that these are great businesses. Believe me, I do, and I had significant exposure to the sector in the first half of this year. But following the AI-fuelled rally, I’m in the camp that valuations have got too expensive in light of the current state of the economy and returns of the sector are not worth it on a risk-adjusted basis.

Let’s take Microsoft Corporation (NASDAQ:MSFT), which is arguably one of the strongest companies in the world, one of only two AAA-rated stocks and one that has substantial AI tailwinds going for it. If any stock deserves a premium, it’s Microsoft.

Last time I covered the stock I tried to get the point across by modelling several potential growth scenarios, neither of which gave particularly exciting return potential. Today, I take a different approach and focus on the spread between the earnings yield and interest rates, while taking into account very strong Q1 2024 results.

Valuation spread to treasury yields

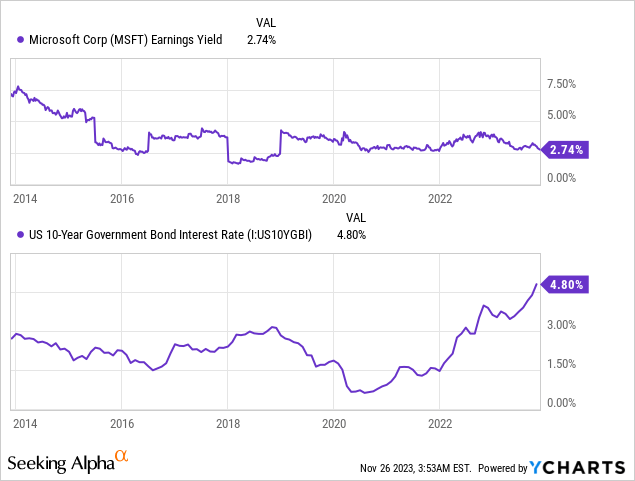

Year-to-date the stock price has rallied by 60%+ and it now trades at a forward P/E of 32x. That’s a forward earnings yield of 3.1%. And looking at actual last 12 months’ numbers gives an even more aggressive earnings yield of 2.74%.

It’s important to consider the earnings yield in light of interest rates (i.e., yields). If we look back, over the past 10 years, the earnings yield has, for the most part, moved with and been above the 10-year treasury yield. In particular, between 2014 and today, MSFT has averaged an earnings yield of 3.7%, while the 10-year treasury yield has averaged about 2.2%, for a spread of around 150 bps.

Today, that spread is negative 210 bps!

Such a negative spread is not sustainable over the long term. Why would anyone invest at 3%, when they can get 5% risk-free? So something has to give. There are three possible outcomes that can restore the imbalance and return the spread to positive territory and closer to the historical average.

Either:

- 10-year yields decline,

- the stock price falls,

- or earnings rise.

Let’s start with the first one – interest rate expectations. I’ve summarized my base case in detail in another article – here.

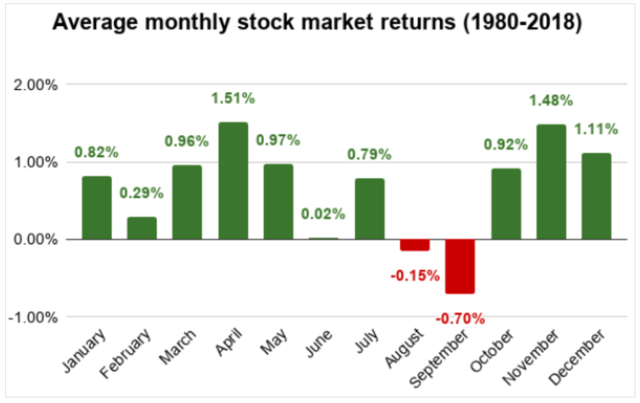

In short, I think it’s quite likely that the rally can continue into the year-end, driven primarily by (1) good October CPI data, (2) a Fed pause and (3) seasonality.

Stock Analysis

Beyond this year, I expect a slight softening of the economy, which is supported by a weakening consumer and an inverted yield curve, followed by some (small, think 50 bps) interest rate cuts as inflation declines closer to the Fed’s 2% target or as the economy slips into a recession.

As a result, I expect 10-year yields to decline somewhat, though nowhere near the level seen over the past 10 years. Going back to Microsoft, a 50 bps drop in yields isn’t nearly enough to normalize the valuation, so other significant tailwinds are needed to justify the valuation.

Growth expectations following recent results

The single most evident tailwind is AI which makes the growth forecast very tricky. Right now, it seems that AI could have vast implications for many businesses and have the potential to increase productivity significantly. But the same was true of the internet in early 2000s, yet it took another 10+ years for the “idea” to actually translate into profits. And those who bought at the top of the bubble suffered significant losses in the meantime.

The truth is that no one knows how big AI could get and how soon it will translate into higher earnings. But when/if it happens, Microsoft is very likely to benefit from the roll-out of AI in a number of ways. Most notably, the fact that most businesses already use Microsoft’s products should make the implementation of AI applications seamless and combined with Microsoft’s hyper scalable cloud service Azure, there aren’t many players that have a better chance of gaining market share.

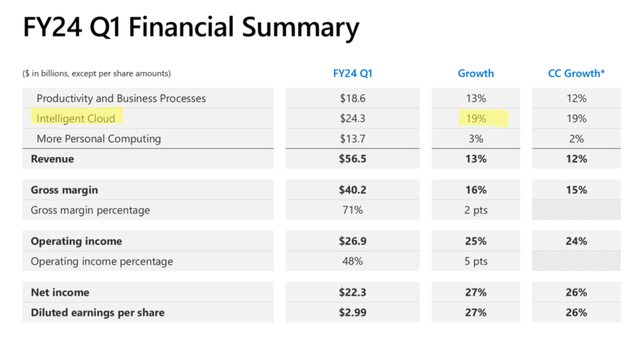

Microsoft has posted great results recently. In the short-term, over fiscal Q1 2024, AI-related momentum has resulted in very strong YoY growth in Cloud and Azure of 24% and 29%, respectively. This has driven overall Cloud revenues up by 19% YoY. Productivity and Business Processes were up 13% YoY, while Personal Computing lagged at just 3% YoY, primarily due to a 22% drop in revenue from Devices.

MSFT Presentation

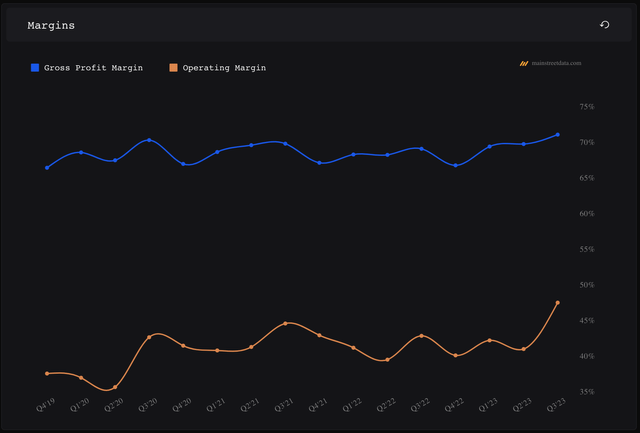

Moreover, Microsoft’s margins have continued to improve with the gross margin increasing by 2 pts and the operating margins by 5 pts, reaching record levels.

Main Street Data

Going forward, it’s likely that growth will continue to be driven by MSFT’s cloud service. The consensus is for annual growth of about 15% until at least 2026. That’s up from about 14% just 6 months ago.

Seeking Alpha

Forward outlook is good, but not good enough

The problem with any newly emerging technology is that we just don’t know how big it will get. So let’s start by reverse engineering the level of growth that’s currently priced in and then decide if this is achievable and something we want to put our money on.

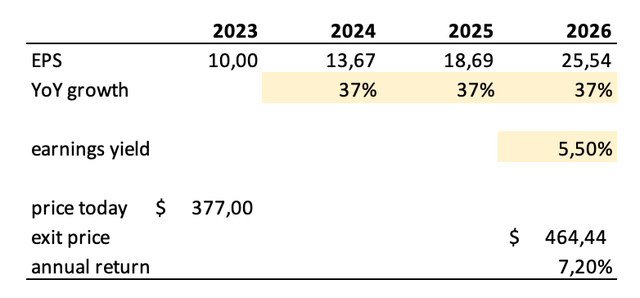

Going back to interest rate expectations, I’m going to assume that the 10-year yield declines to 4% by the end of 2026. Over the long-term, I see no reason why MSFT earnings yield should be below long-term yields, so I will assume that the earnings yield increases 150 bps above long-term yield – i.e. to 5.5%.

With these assumptions, in order to get an 8% annual return (0.8% dividend yield + 7.2% from price appreciation), MSFT would have to grow their EPS by 37% per year for at least the next three years. That’s more than double consensus and recent growth and implies a >5 Trillion market cap by 2026.

Do you think such levels of growth are likely? I don’t.

Author’s calculations

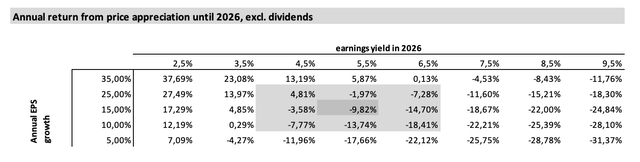

Looking at a number of scenarios in the sensitivity table below, the current valuation really only makes sense if you expect growth significantly above consensus (25%+ per year) and/or an earnings yield <3.5% which is likely to materialize only if long-term treasury yields decline to at least 2.5-3%. That’s the sort of interest rate environment we were in prior to 2022.

Once again, do you think it’s likely that we will return to zero interest rates? I don’t. My base case of an earnings yield of 5.5% by 2026 and 15% growth in line with consensus, results in a negative annual return of -9.8%.

Author’s calculations

Bottom Line

MSFT is currently priced very aggressively and can deliver average 8% returns only under extremely aggressive growth and interest rate assumptions.

Future growth could easily surpass expectations if AI really takes off, though achieving 37% EPS growth three years in a row is very ambitious, and even then the investment only makes sense if yields decline back to where they were prior to 2022.

In that case, there will be a number of interest rate sensitive sectors that deliver significantly higher upside than MSFT.

As a result, I don’t like the risk-reward over the medium to long-term here and rate MSFT a SELL, despite some short-term momentum potential due to seasonality. The valuation is simply too high and there are many interest rate sensitive alternatives that are likely to outperform MSFT if interest rates decline.

Read the full article here