I have not failed. I’ve just found 10,000 ways that won’t work.”― Thomas A. Edison

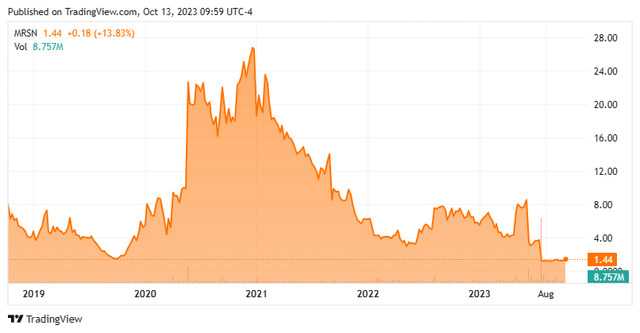

Today, we are putting Mersana Therapeutics, Inc. (NASDAQ:MRSN) in the spotlight. It has been over a year and a half since we last looked at this small clinical-stage biotech concern. We concluded that article noting that while the company had a potentially intriguing developmental platform, the company/stock was in ‘show me‘ territory given some recent setbacks at the time. The company recently got a new CEO. This followed a huge plunge in the stock after a major trial failure in late July of this year.

Today, we circle back on Mersana Therapeutics. An updated analysis follows in the paragraphs below.

Seeking Alpha

Company Overview:

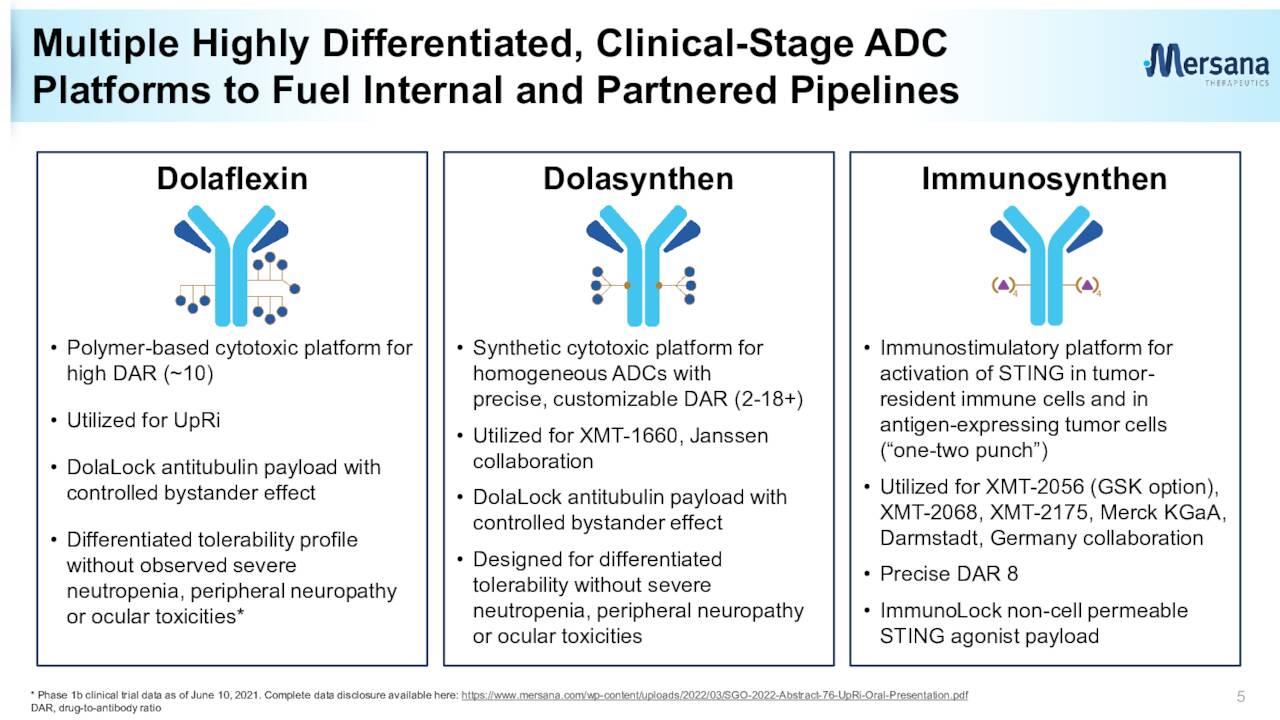

This clinical stage biopharmaceutical company is focused on developing antibody drug conjugates [ADC] for cancer patients with unmet needs. The company is headquartered just outside of Boston in Cambridge, MA. Mersana’s two ADC developmental platforms incorporate additional features designed to minimize off-target toxicity and increase efficacy within their ADC candidates. The stock trades around $1.50 a share and sports an approximate market capitalization of $175 million.

March Company Presentation

Recent Developments:

On July 27th, Mersana Therapeutics disclosed that it had suffered a major blow to its key developmental program. The company divulged that its pivotal trial for its lead candidate upifitamab rilsodotin (UpRi) that was being evaluated to treat ovarian cancer missed its primary endpoint. As a result, the equity plunged by approximately three quarters following the news. This followed a partial clinical hold on the candidate in June of this year.

The trial failure triggered some severe actions by management. First, it laid off half of its staff to cut costs. It also discontinued all development around UpRi, which was its primary focus up to that point. This concluded a disastrous journey for UpRi. The last time we covered the company the candidate had a significant percentage of adverse effects for the participants in an earlier staged study.

A change in leadership soon followed this developmental setback as well. In addition, to a new CEO (who was previously head of R&D and prior to that Chief Medical Officer at the company), the company also appointed a new Chief Operating Officer and Chief Development Officer.

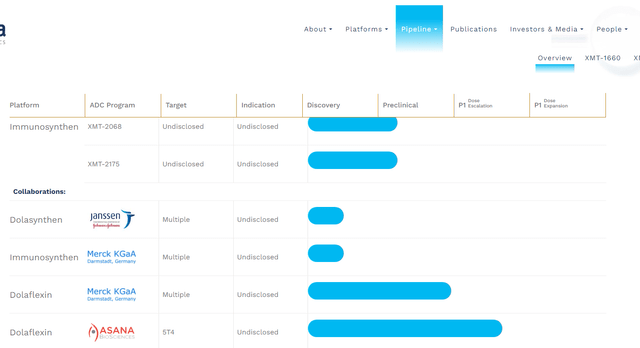

Company Website

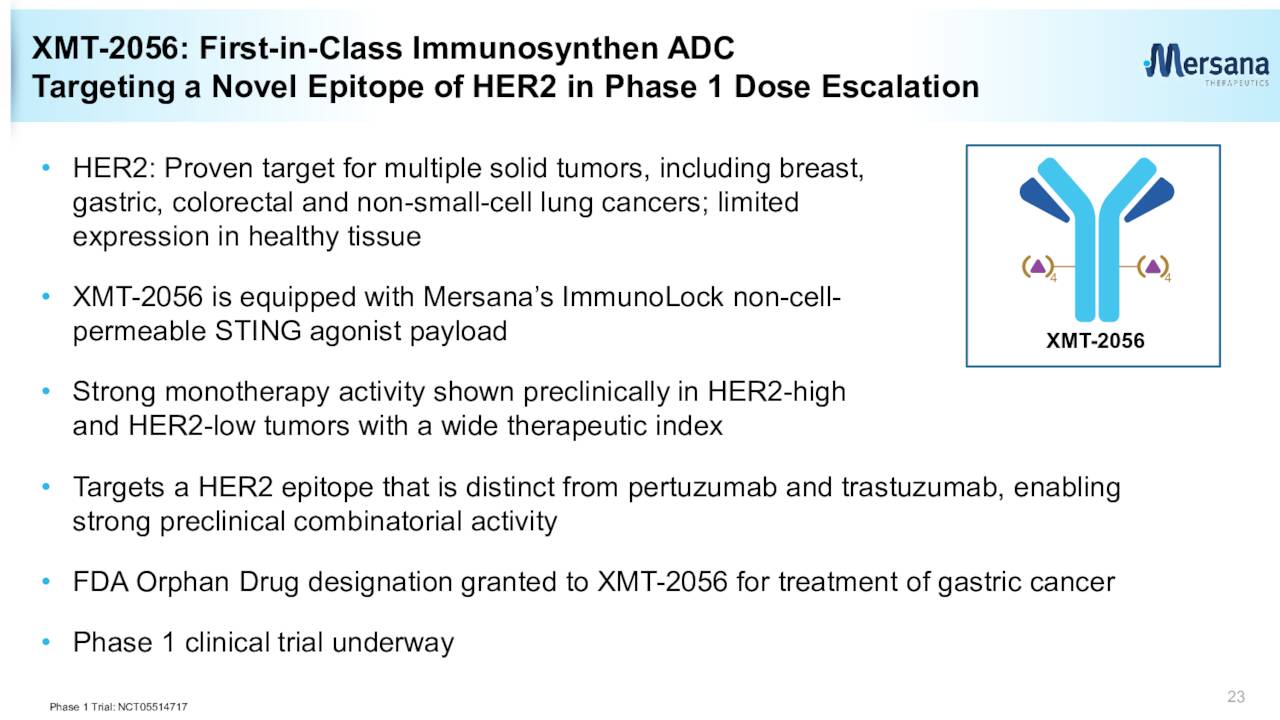

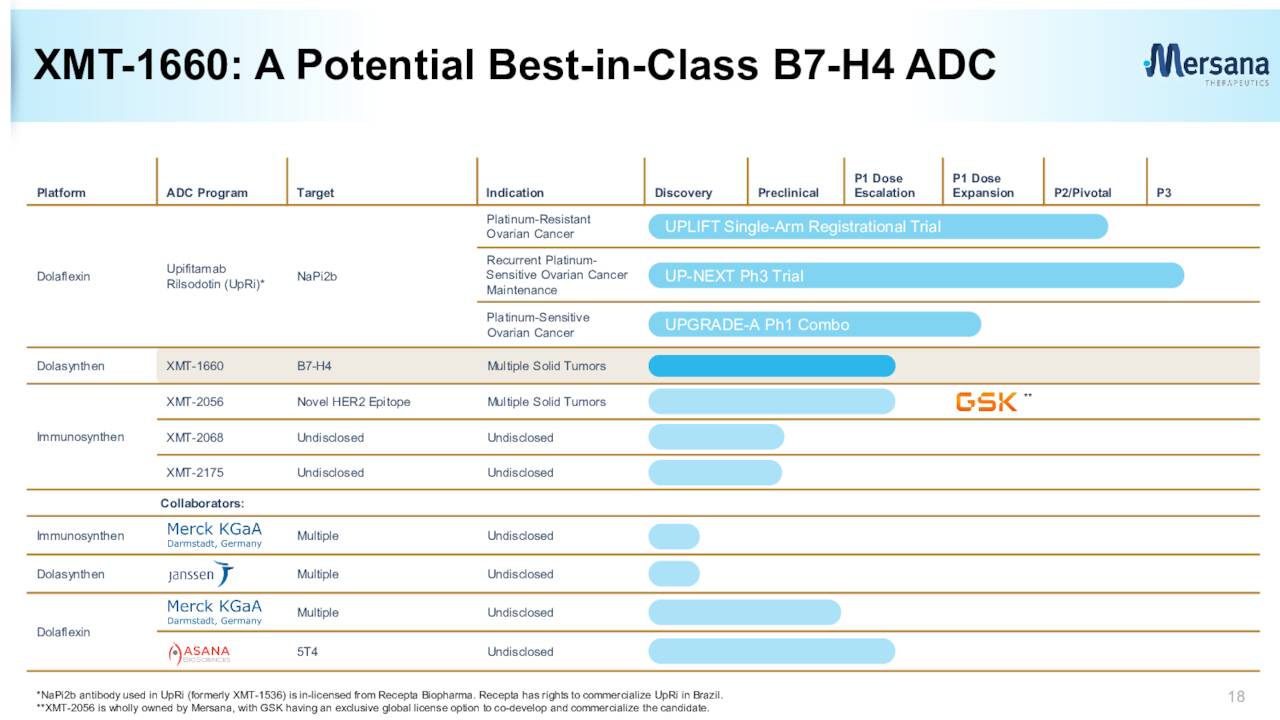

The jettisoning of the UpRi leaves Mersana with a collective of very early-stage candidates as can be seen above. Concentrating on the positives since our last piece on Mersana, in May of last year, the company did win orphan drug designation for its ADC candidate XMT-2056 as a treatment for gastric cancer.

March Company Presentation

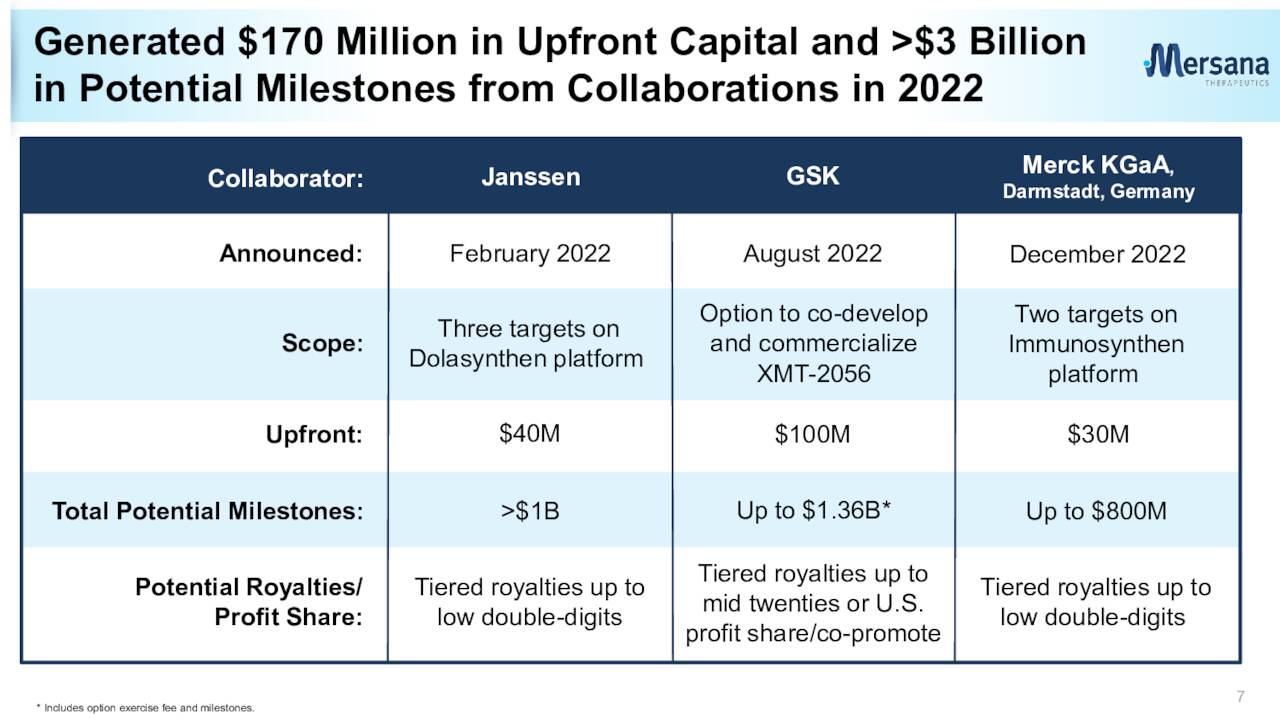

Last summer, Mersana also signed a significant collaboration agreement with GSK (GSK) around the development of XMT-2056. This agreement brought Mersana a $100 million upfront option fee payment if GSK exercises the option. Mersana can also earn north of $1.3 billion in developmental, sales, and regulatory milestones as well as royalties on any eventual commercialized sales.

Late last year, Mersana inked a smaller collaboration and licensing agreement with Merck KGaA to develop antibody-drug conjugates against up to two targets. This brought in a $30 million upfront payment into Mersana’s coffers and the company can also garner a potential $800 million in various milestone payments around this agreement as well as royalties on any eventual commercialized sales that come from this agreement.

March Company Presentation

The company also recently initiated the dose escalation portion of a phase 1 trial for its candidate XMT-1660 for solid tumors this year. It plans to initiate the dose expansion portion of this study in 2024.

March Company Presentation

Analyst Commentary & Balance Sheet:

The analyst firm community is universally bearish on Mersana Therapeutics’ prospects. Since the company’s major pipeline setback in late July, seven analyst firms including JPMorgan and Citigroup and have either reissued or downgraded the shares to Hold/Neutral/Sell ratings.

Approximately 15% of the overall outstanding float in the shares is currently held short. Despite the significant fall in the stock price since the last time we looked at Mersana, insiders are not stepping up to buy the dip. There has been no insider purchases in the stock in 2023. Collectively, several insiders have disposed of approximately $225,000 worth of equity so far this year. The company ended the first half of 2023 with just over $285 million in cash and marketable securities (significantly higher than its current market capitalization) after burning through just over $60 million of cash in the second quarter to support operations. The company has negligible long-term debt.

Verdict:

If Mersana Therapeutics was in ‘show me‘ status the last time we posted research on the name, it is now in super ‘show me‘ status given its recent massive setback in its primary developmental program. The company does have cash on hand to fund all operations into 2026, some nice collaboration programs, and several early stage ‘shots on goal‘. The stock also trades substantially under the net cash on its balance sheet.

However, until the company can successfully advance one of more candidates to mid and late-stage development, the stock is an avoid. New insider purchases would be a positive as would positive analyst firm coverage. Both of those entities also seem to have a wait and see attitude on the stock at current trading levels.

Success is stumbling from failure to failure with no loss of enthusiasm.”― Winston S. Churchill

Read the full article here