Medpace (NASDAQ:MEDP) is a fast-growing clinical research organization led by the entrepreneurial spirit of CEO and founder August Troendle since 1992. In my last article in May, I took a closer look at the company, focusing on its business model and competitive landscape. The conclusion was: Medpace’s focus on excellent execution in a fast-growing segment that also benefits from secular growth makes it a high-quality investment going forward. However, I also pointed out that this industry environment was beginning to slow down as small biotech companies in particular were facing more frequent financing issues.

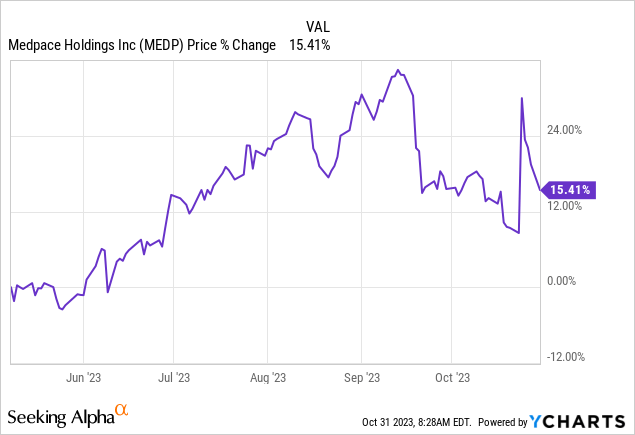

Since then, Medpace released two quarterly filings that both showed strong results and a back-to-back guidance increase! Accordingly, the share price rose in the following time, resulting in a 15% higher price per share than at the time of the last update. Particularly, the Q3 results released last week pushed the stock almost 20% during the day, indicating that Wall Street was quiet pleased.

It seems like the company withstand the current environment pretty well and therefore further strengths my conviction on a compelling investment. And I’m aware of the unpopularity of writing an update about a company that just delivers, but as Lynch already said:

Selling your winners and holding your losers is like cutting the flowers and watering the weeds.

So let’s see if the flower is worth watering!

Operating Performance

During the earnings call last week, Troendle commented on the current environment as follows:

Yes, the environment is kind of hard to comment on because it’s pretty variable. I mean, we’re still seeing quite a bit of funding challenges by clients. And we’ve been through a period of a lot of clients in distress and a number of bankruptcies and challenges. I think that actually derisked our backlog quite a bit of those that are going to have a problem, I think, most of them have. And on the other side, we’re seeing very strong business environment. Just surprisingly to see the disparity is amazing. We have a very strong RFP flow. I think our RFPs – the total RFPs pending is the second highest we’ve ever had. And to fill the pipeline, the new awards, initial awards, as we’ve talked about, that were awarded in Q3 were a record highest we’ve ever had. So we’re seeing great business environment and a horrible business environment. So I don’t know. It’s just kind of schizophrenic.

The disparity between the overall industry environment and the particular situation of Medpace is indeed exciting as the company just kept delivering.

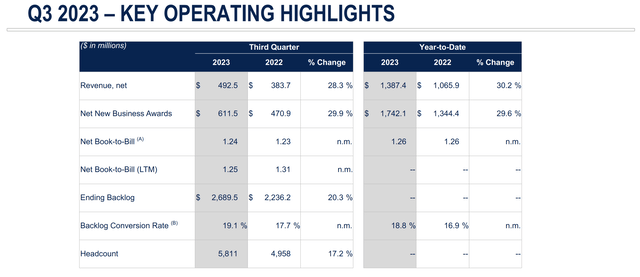

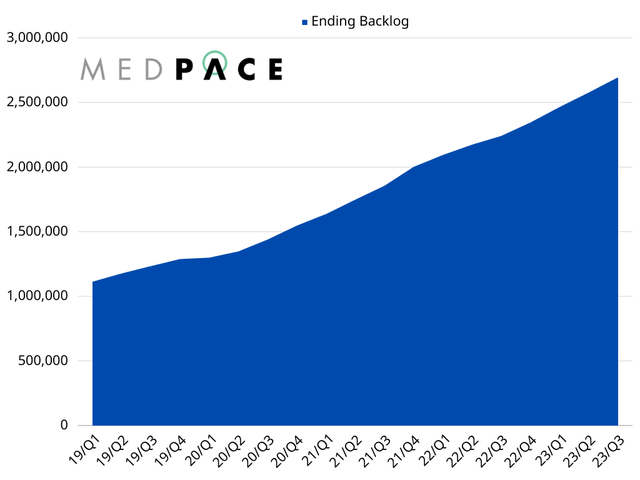

In recent months, Medpace has continued to build on its strong backlog, increasing net new business awards by nearly 30% to a new all-time high of $611.5 million in the third quarter. In total, backlog increased by another 20% to a total of $2,689.5 million, while the company converted a very strong 19.1% of backlog into revenue during the quarter.

Operating Performance, Q3 2023 (Quarterly Presentation)

This led to a top-line revenue growth of 28% and 30% YoY on a Q3 and YTD basis, respectively, showing indeed no signs of slowing or the often-cited normalization to pre-pandemic levels. However, one exception to this is the companies’ performance in profitability as the EBITDA of Medpace only grew high-single digits, resulting in a significantly lower margin of 18.6% compared to 21.8% in the prior year. The key driver to this decrease can be found in the companies’ COGS, particularly the reimbursed out-of-pocket expenses, which are these expenses that incurred in relation to participation in the clinical trial, e.g. travel expenses, accommodation. During the quarter, these expenses grew 52% YoY, therefore, explaining the margin decline. However, these costs are maybe the most fluctuating ones for the company, especially on a quarterly basis as they’re highly dependent on the timing of program initiation and closeout. Regarding the expectation for the coming year, CFO Kevin Brady does not hold out the prospect of any significant improvement, stating:

I mean it’s going to be somewhat contingent on what happens with the reimburse activities, right? Just given the impact that, that has on margin percentage. But if that levels off, and kind of remains elevated, consistent to where we were in the past couple of quarters here. I don’t expect there to be a margin expansion. We still have some longwall pressure from wage and benefit ratio. So I don’t see 2024 as being a huge margin expansion opportunity.

And with that I want to move on to the company’s outlook regarding the expected performance for 2023 and beyond.

Outlook

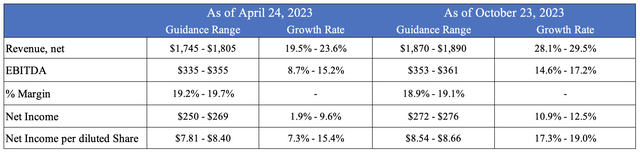

I already stated during the beginning of this article that one key factor for Medpace latest share price appreciation was a positive guidance update. More specifically, the company raised the outlook for ’23 two consecutive times after my last article. Here’s an overview of the changes since then:

Full-Year Guidance 2023, in $ million (Own Illustration)

As shown, Medpace forecasts a significantly higher revenue growth of around 29% for 2023 instead of the previous average of 21.5%. Additionally, we can obtain that the earlier discussed margin pressure through higher reimbursed out-of-pocket expenses and higher personnel costs seem to materialize, however, not as strong as expected at the beginning of the year. According to the current outlook, Medpace is expected to end the year with an EBITDA margin of 19% on average, which is lower than ’22, but still above pre-pandemic levels.

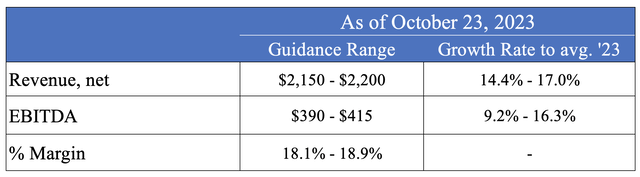

Additionally, the company presented its first outlook for 2024, considering revenue and EBITDA.

Full-Year Guidance 2024, in $ million (Own Illustration)

With expected revenue growth of 14% to 17%, we can clearly see that growth rates are finally returning to pre-pandemic levels, while the operating margin is expected to remain largely in the high teens, if companies’ direct costs remain elevated as discussed.

All in all, we have to be aware that these forecasts are made from today’s point of view in a fragile industry environment and are therefore only a first idea. Shareholders of other companies in the biotech industry, for example, are already familiar with reduced guidance and negative surprises. Nevertheless, I really liked the honest and comprehensive way in which the management answered questions during the earnings call and the more conservative guidance, both of which give me confidence for the future. The guidance for ’24 is also helpful to get an idea of the medium-term growth potential of the company and later on for the valuation.

Big Picture

So before reevaluating my investment thesis, let us zoom out a bit to put the numbers into perspective.

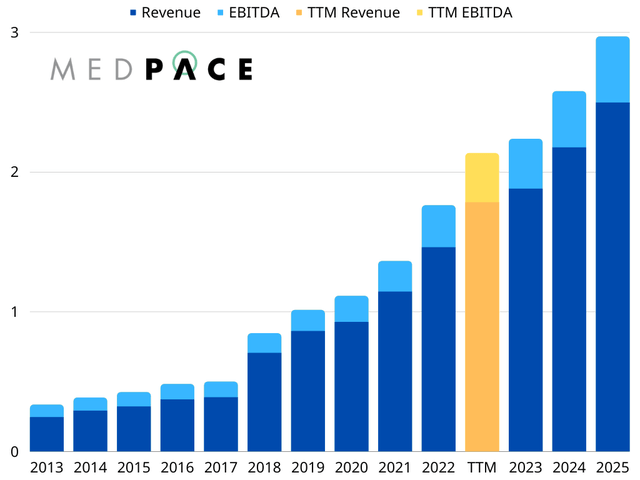

Revenue and EBITDA, 2013-2025e, in $ billion (Own Illustration)

Over the past 10 years, Medpace has compounded revenue at an impressive 22% CAGR, while EBITDA has grown at 14.4%, but both have accelerated significantly in recent years. I really like these long-term charts because they reinforce my conviction to be a long-term shareholder in quality compounders. And as we can see, Medpace is definitely in that group, showing impressive growth rates and solid margins. Going forward, we can expect the company’s momentum to continue, but to slow down to the mid-to-high teens. If we take the current guidance and the analyst estimates for 2025, we obtain a solid growth rate of 19.6% for the coming years. That said, margins seem to have somewhat reached their potential and will probably remain at high teens.

Backlog, 2019-2023, in $ thousand (Own Illustration)

Overall, these assumptions still imply that Medpace will continue to gain market share in the CRO industry, as the underlying projected growth rate is perhaps closer to 8% as stated in one of the most recent industry reports. Therefore, we should be cautious when projecting these expectations into the future, as the current environment continues to pose significant challenges, particularly for small biotechs, which account for 78% of revenue. On the flip side, if the company maintains its level of service in this scenario, it is likely to benefit from a strengthened reputation and increased market share. In my opinion, there is presently no cause to question Medpace’s ability to remain successful, as the company seems to be very well positioned.

Cash Flows

Having put Medpace’s current situation into perspective, we can now proceed with an updated analysis of its ability to generate cash flow.

To analyze a company’s ability to generate cash flow, I focus primarily on its free cash flow. Despite the usual calculation (OCF – CapEx = FCF), I adjust the operating cash flow for changes in net working capital and the expenses for stock-based compensation.

In case of Medpace, the calculation for the trailing-twelve-months looks like this:

| in $ million | |

| Operating Cash Flow | 413.66 |

| – Stock-based Compensation | 20.94 |

| – Changes in NWC | 108.3 |

| Adj. Operating Cash Flow | 284.42 |

| – Capital Expenditures | 15.45 |

| Free Cash Flow | 268.97 |

During the previous 12-month period, Medpace produced approximately $269 million in free cash flow, which, although strong, was significantly lower than the initial operating cash flow. As evidenced by the table above, my adjustments to the changes in the company’s net working capital accounted for the majority of this variance. And although these changes may be insignificant for numerous companies, the order-based business model at Medpace results in considerable fluctuations in both operating receivables and payables.

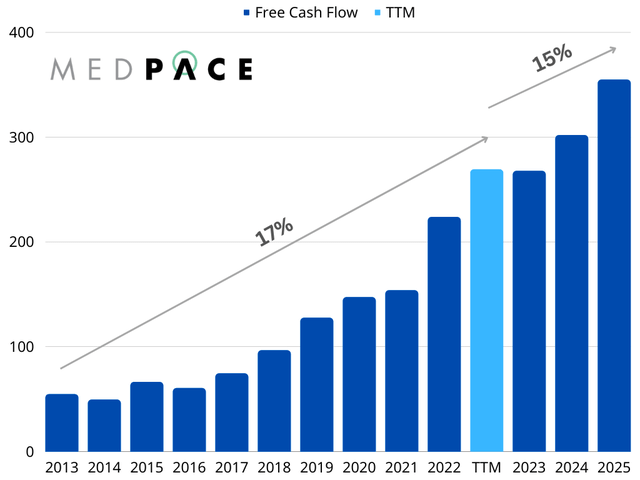

Free Cash Flow, 2013-2025e, in $ million (Own Illustration)

Over the past 10 years, the analysis reveals that Medpace has increased its free cash flow at a CAGR of approximately 17%, which is higher than the historical growth rate of the company’s EBITDA, indicating that the company has significantly improved its cash conversion. Currently, Medpace achieves a remarkable conversion rate of 77% of its EBITDA into free cash flow. This is impressive considering that we exclude cash received from customers in advance of services performed or revenues recognized.

Throughout the years, we have seen conversion rates fluctuate similarly to changes in net working capital, so I have used a more conservative average to calculate forecasts based on EBITDA estimates. Based on a free cash flow conversion of 75%, we derive an expected CAGR of 15% for 2023-2025, further highlighting the resilient yet lower growth.

Valuation

So, having reconsidered the underlying cash generation of the business from the perspective of its owners, we can finally reconsider the current valuation.

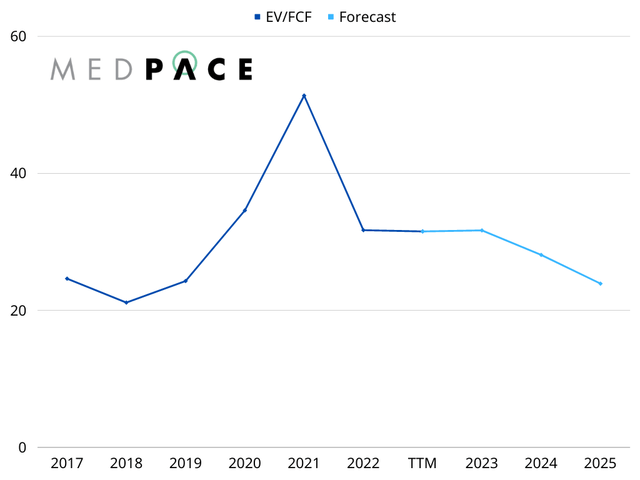

EV/FCF Multiple, 2017-2025e (Own Illustration)

At its current stock price of $264.64, Medpace is valued at a market capitalization of $8.41 billion and an enterprise value of $8.48 billion. In addition, with a reported free cash flow of $0.27 billion, the company is currently trading at an EV/FCF multiple of 31.5.

Therefore, the current valuation is close to ’22, but higher than when I last wrote about the company in May. Of course, this becomes reasonable when we consider the 15% price appreciation the stock has experienced since then.

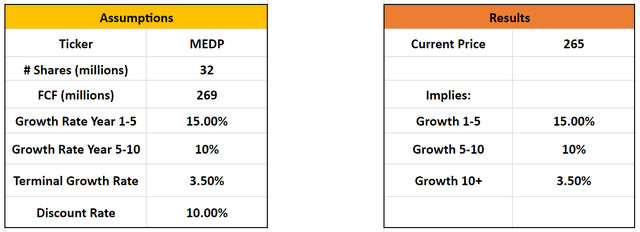

Inverse DCF (Own Illustration)

Additionally, I entered Medpace’s current numbers into an inverse DCF model, which gives us the ability to model future growth rates that are currently priced into the stock. For the initial years of the model, a growth rate of 15% was applied, as per the forecast calculated above. Subsequently, a growth rate of 10% is projected for the following period to arrive at the current valuation.

In conclusion, the current increase in Medpace’s share price is pricing in an increasing amount of realistic growth. However, I believe that both the inverse DCF model and the current multiple are close to the “fair value” of the company, as Medpace is likely to continue to deliver on an operational level based on solid secular growth drivers and increasing market share, resulting in compelling cash flow generation.

Takeaway

Since my last article in May, Medpace has performed as resilient and strong as I expected, which has been appreciated by Mr. Market, who is currently offering the company at a higher price, giving the impression that the company has become too expensive. And indeed, the company’s multiple has now increased to >30x FCF, which is also higher than the multiple in May.

On the other hand, Medpace also demonstrated a resilient backlog and strong operational performance in this uncertain environment, resulting in further market share gains and enhanced reputation in the industry. Going forward, the biotech environment should normalize and continue to drive future growth for the business. However, as Medpace remains a pure-play CRO in a highly competitive industry, it will continue to be important to monitor the company’s key performance indicators to identify any risks that may arise.

In conclusion, I would still consider Medpace a compelling high-quality company to buy at this point in time, as the current valuation still seems reasonable given the resilient backlog and the capital-efficient business model run by a true owner-operator, August Troendle, who still holds 24.7% of the share capital.

Read the full article here