Madrigal Pharmaceuticals (NASDAQ:MDGL) is currently transitioning from the clinical trial stage to preparing market-ready solutions primarily aimed at addressing non-alcoholic steatohepatitis (NASH) and liver fibrosis. Their leading candidate, Resmetirom, is now in Phase III clinical trials and is anticipated to enter the market by spring 2024, subject to FDA approval. This progression places Madrigal at a pivotal point where they could address a significant unmet medical need concerning NASH, aiming to become the pioneer in FDA-approved treatment for this condition. While this journey presents numerous challenges, a recent injection of $500 million in equity has significantly bolstered Madrigal’s financial standing and extended its financial runway. The careful synchronization of Madrigal’s clinical advancements and financial strengths, highlighted by the recent capital injection, presents a persuasive argument for considering MDGL a “buy” at the current price points, with a positive outlook on receiving regulatory approval by 2024.

Business Overview

Madrigal is a clinical-stage biopharmaceutical company based in West Conshohocken, Pennsylvania, established in 2011. With a modest team of 92 employees, the company is relatively new to the biotechnology scene. MDGL is dedicated to developing therapeutic solutions, primarily targeting NASH and liver fibrosis, while also extending its focus towards cardiovascular and metabolic disorders. It’s also worth mentioning that the company hasn’t produced any revenues or profits since its inception.

At the forefront of its clinical pipeline is resmetirom, a liver-centric selective thyroid hormone receptor beta agonist. This drug is currently in Phase III clinical trials with a PDUFA (Prescription Drug User Fee Act) date assigned by the FDA in March 2024, aiming to provide a treatment solution for NASH. If successful, resmetirom has the potential to be a pioneering breakthrough in NASH therapy by addressing the root causes of the disease. Alongside resmetirom, MDGL is also developing MGL-3745, thus broadening its therapeutic portfolio with related NASH therapies. The company’s revenue generation at this stage heavily relies on successfully transitioning its clinical candidates from trial phases to market-ready therapies. Thus, MDGL is currently transitioning from trials to market-ready solutions, which is common within the biopharma sector.

In my view, the potential market for MDGl is substantial given the high unmet medical need associated with NASH-a condition lacking FDA-approved treatments. The projected first-to-market positioning of resmetirom could serve as a significant revenue catalyst, albeit contingent on favorable clinical trial outcomes and subsequent regulatory nods. I believe the company’s meticulous focus on a specialized domain like NASH, supplemented by its foray into cardiovascular and metabolic diseases, sketches a promising trajectory, provided the clinical validations are affirmative. MDGL is also developing a backup compound, MGL-3745, which suggests a thoughtful risk-mitigation strategy. This seems prudent for navigating the complex landscape of biopharmaceuticals.

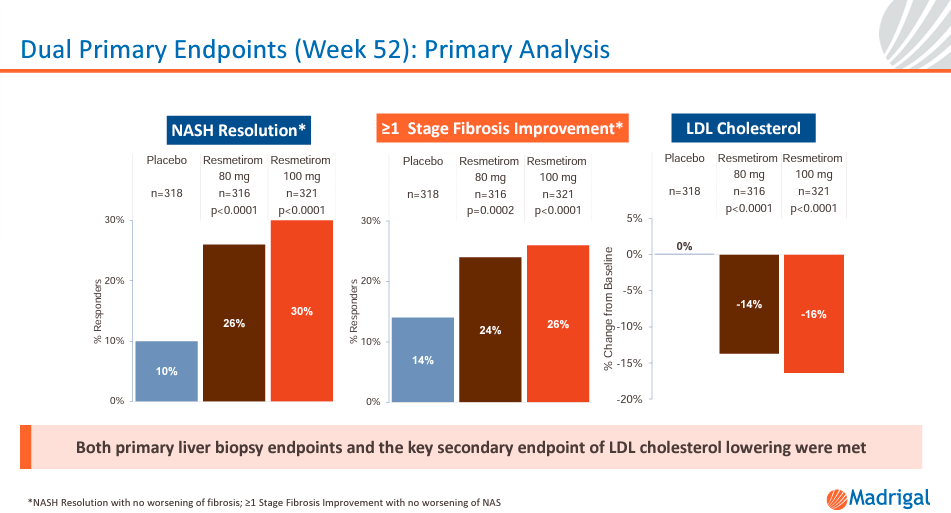

Source: EASL 2023 MAESTRO-NASH Primary Results Presentation

MDGL’s Clinical Progress Despite Challenges

Currently, MDGL is progressing well with its flagship drug, resmetirom, a stride propelled by encouraging trial outcomes. In late June, MDGL initiated a rolling submission for its New Drug Application for resmetirom. The FDA has granted Priority Review and assigned a Prescription Drug User Fee Act date for resmetirom of March 14, 2024.

However, there are challenges on the horizon. The landscape of competition and uncertainties surrounding FDA approval pose risks. There’s also a pressing need for additional capital to cover escalating R&D costs and to offset the reported net loss. External factors, particularly the rise of GLP-1 weight loss drugs, could challenge MDGL’s competitive stance despite their side effects. GLP-1 drugs could infringe on the market share anticipated for resmetirom. The scenario becomes more complex due to a slim positive assessment of resmetirom’s cost-effectiveness by ICER and the potential of GLP-1 drugs to address obesity and directly treat NASH.

Moreover, resmetirom is further in the clinical development than Pfizer’s GLP-1 drug danuglipron. If resmetirom receives FDA approval by its PDUFA date in March 2024, it could be commercialized sooner than danuglipron, which is still preparing to enter Phase 3 trials by the end of 2023. For context, the market for NASH treatment is projected to grow, with the patient population expected to rise to around 11 million by 2030. The sooner Madrigal can capture a share of this growing market, the better it will be to sustain and potentially increase its market share in the long term, especially in the face of competition from drugs like danuglipron and others in the pipeline.

MDGL targets 8 million potential patients with Resmetirom. (Source: Madrigal Pharmaceuticals Investor Presentation 2022)

The recent setback of Akero Therapeutics, where its leading drug efruxifermin (EFX) for NASH failed to meet the primary endpoint in a Phase 2b trial, proved favorable for MDGL. This scenario fostered a positive environment for shares of MDGL and Enanta Pharmaceuticals, as both companies are making headway with their respective NASH candidates. While Enanta is strategizing to out-license its FXR agonist candidates for NASH, MDGL’s candidate, resmetirom, is steadily advancing through Phase 3 trials, showcasing a promising outlook in the competitive landscape of NASH therapeutics.

A recent analysis of clinical trial data for novel NASH treatment drugs and the efficacy of antidiabetic drugs on NASH underscore the necessity for multi-target therapies. The disheartening failure of certain NASH trials suggests that a singular focus on one pathway isn’t sufficient to alleviate NASH. This accentuates the imperative to delve deeper into understanding the progression of NASH and to identify candidates capable of modulating multiple pathways or disease cascades in NASH pathophysiology. Emerging multi-target therapies or synergies between antidiabetic agents with proven clinical efficacy and safety could potentially be promising avenues for NASH treatment, thereby warranting more clinical investigations.

Cash Raised To Secure The Balance Sheet

Luckily, MDGL appears prudent in its funding and has secured new funds to fuel its clinical and commercial endeavors. The company unfurled a $500 million underwritten public offering of its common stock and pre-funded warrants for select investors. Madrigal Pharmaceuticals sought to secure $500 million through a public offering comprising 1.25 million common shares priced at $151.69 each and pre-funded warrants for an additional 2.05 million shares at a marginally lesser price. This move potentially expands the market with up to 3.79 million new shares, which would dilute the value of existing shares. The offering also allowed underwriters to acquire up to 0.49 million more shares, aiding the company in reaching its financial target. While this equity issuance is dilutive, it’s a strategic move to bolster the company’s capital. It is crucial for funding operational expenses such as R&D and clinical trials, especially in their pursuit of novel therapeutics for nonalcoholic steatohepatitis.

The funds from this offering were slated to significantly augment Madrigal’s cash reserves significantly, thereby helping to offset the reported operational losses of $164.8 million in the first half of 2023 and prep for potential product launches. Although this $500 million is not reflected in the 10Q report ending June 30, 2023, due to the later announcement date of September 28, 2023, it’s reasonable to anticipate that these funds would be realized by the company shortly after the offering closure date of October 3, 2023, and hence, should be included in the cash or cash equivalents in the subsequent reporting period. The net amount received may be slightly less than the $500 million due to associated costs like underwriting discounts and commissions, a factor to consider when analyzing the net proceeds from this offering and its impact on Madrigal’s financial stance in the next report.

Cash Runway, Share Dilution, and Valuation Analysis

Madrigal has yet to generate revenue or profits since its establishment, as it is still in the research phase. A critical aspect to consider is the company’s cash burn rate, which can be computed by adding the net CAPEX to the cash from operations. A historical analysis illustrates a rising trend in cash burn, from $1.4 million in 2014 to $277.2 million in the TTM. This increase has not corresponded with a rise in debt, indicating that share issuance has predominantly financed the cash burn, thereby diluting shareholder value over time.

Author’s elaboration.

Notably, diluted shares outstanding have surged from about 1 million in 2014 to 17.7 million in the TTM, translating to a CAGR of 40.6% since 2014. This is concerning as it implies substantial shareholder dilution each year without yielding profits. The recent equity raise of $500 million is included in this analysis. Moreover, the cash runway, calculated by dividing the company’s cash and equivalents by its cash burn, has varied significantly since 2014. For the TTM, MDGL has approximately 1.1 years of cash runway left at the current burn rate. However, post the latest equity raise, the cash reserves bolstered by $500 million, extending the cash runway to 2.9 years.

Author’s elaboration.

On the regulatory front, the FDA decision expected in March 2024 could be a pivotal moment for MDGL. If approved, it could transition from a clinical-stage to a production phase or attract acquisition offers from larger pharmaceutical firms. Although the risk profile of MDGL would notably reduce post-approval, facilitating debt financing, the intrinsic value estimation remains complex due to the inherent uncertainties in biotech ventures.

Author’s elaboration.

In my view, Madrigal’s TAM for its drug Resmetirom, which targets 8 million individuals, can be noteworthy. A report indicates that a daily dose of Resmetirom is cost-effective up to at least $50.35, translating to $18,377 per patient annually. This suggests a yearly TAM of roughly $147 billion. It’s important to mention that these figures are derived from the lowest cost-effective threshold identified for Resmetirom, and higher pricing could potentially enhance its revenue prospects. Additionally, the estimated lifetime cost per patient is around $348,432, which is a crucial factor when evaluating long-term revenue potential. So, I think Resmetirom can be a consistent revenue generator upon successful development and commercialization.

This analysis underlines the promising financial trajectory of Madrigal Pharmaceuticals, centered around the potential revenue from its drug Resmetirom. It’s crucial to highlight that the figures presented are not a definite price target for Madrigal but a gauge of Resmetirom’s revenue scope. The projections hinge on two core factors: the eventual pricing of Resmetirom, still subject to further analysis and stakeholder negotiations, and the competition Madrigal will face from well-capitalized pharma giants like Pfizer. However, Madrigal’s recent capital boost and the promising progress of its Phase-3 trials solidify its current $2.71 billion market capitalization. The successful accrual of half a billion in equity demonstrates strong investor faith, which may signal a higher likelihood of FDA approval. Such approval is a linchpin for unlocking steady revenue in a lucrative market, potentially placing Madrigal at a vantage point as a first-mover. Despite the speculative phase pre-FDA approval, the positive outlook for Madrigal justifies a “buy” rating for MDGL, especially with the anticipated FDA nod in 2024, as forecasted by the management, earmarking Madrigal as a compelling investment prospect.

Investment Thesis Risks

However, investors need to be aware that MDGL’s bullish thesis has a series of risks that necessitate thorough examination by prospective investors. A significant determinant of the company’s success is the approval of its principal drug candidate, resmetirom, under the Prescription Drug User Fee Act (PDUFA). The regulatory process, known for its unpredictability, poses a substantial risk. Any setbacks or rejections in FDA approval for resmetirom could severely impact MDGL’s stock price, as it’s currently pricing in an imminent FDA approval.

Furthermore, the biopharmaceutical realm is fiercely competitive. Emerging alternatives like GLP-1 weight loss drugs and other novel NASH treatments could threaten MDGL’s market dominance and revenue outlook. Since MDGL is in the clinical stage with no revenue influx, financial stability is pivotal. The company’s fiscal well-being largely depends on its capability to garner sufficient funding. However, recent equity-raising initiatives have bolstered its cash reserves, and the escalating cash burn rate, alongside the necessity for additional capital to underpin research, development, and other operational requisites, presents significant financial risks.

Post-approval, the commercial triumph of resmetirom hinges on its market reception, which could be swayed by various factors, including its pricing, relative efficacy, and the prevailing reimbursement rates. Even with a lead from its advanced research phase, it’s improbable for Madrigal to monopolize the market in the long run. A pragmatic approach might be to allocate Madrigal around 10% of the TAM and evaluate its valuation based on this estimation. As a whole, these risks temper my optimism on MDGL.

Conclusion

MDGL hinges on Resmetirom, their spearhead candidate battling NASH and liver fibrosis. As the clock ticks closer to the critical FDA verdict expected in spring 2024, the stakes soar, not merely for Madrigal but for the vast patient demographic yearning for a viable treatment. The fiscal outlook of Madrigal, as delineated in the analysis, largely swings on the market reception and pricing of Resmetirom post-approval. While the specter of competition and market share allocation looms, the recent $500 million equity infusion reverberates robust investor faith in Madrigal’s strategic blueprint. My “buy” rating is largely due to my optimism of an eventual FDA endorsement that could unlock a lucrative market niche for Madrigal. Nonetheless, the broader competitive landscape and market share dynamics necessitate a prudent appraisal of Madrigal’s long-term valuation and market position.

Read the full article here